Spotify stock pops 14% to 3-year high—races to first profitable year

The stock is on pace for its second-best day on Wall Street ever.

The stock is on pace for its second-best day on Wall Street ever.

Large technology stocks flails as lower interest rates appear on deck and investors view a Trump presidency as increasingly likely.

Tesla stock, viewed by analysts as a beneficiary of a Trump Administration, gained 5% in the first day of trading after its CEO Elon Musk endorsed Trump following the attempt on Trump’s life.

The lawsuit was brought by a software engineer who alleged he was not hired by the tech giant because he was a U.S. citizen.

Amazon is a $2 trillion company for first time ever

As he looks towards a possible 2025 IPO, CEO Chris Britt opens up about his own history and Chime’s current business and future. Could Washington stomp on his plans?

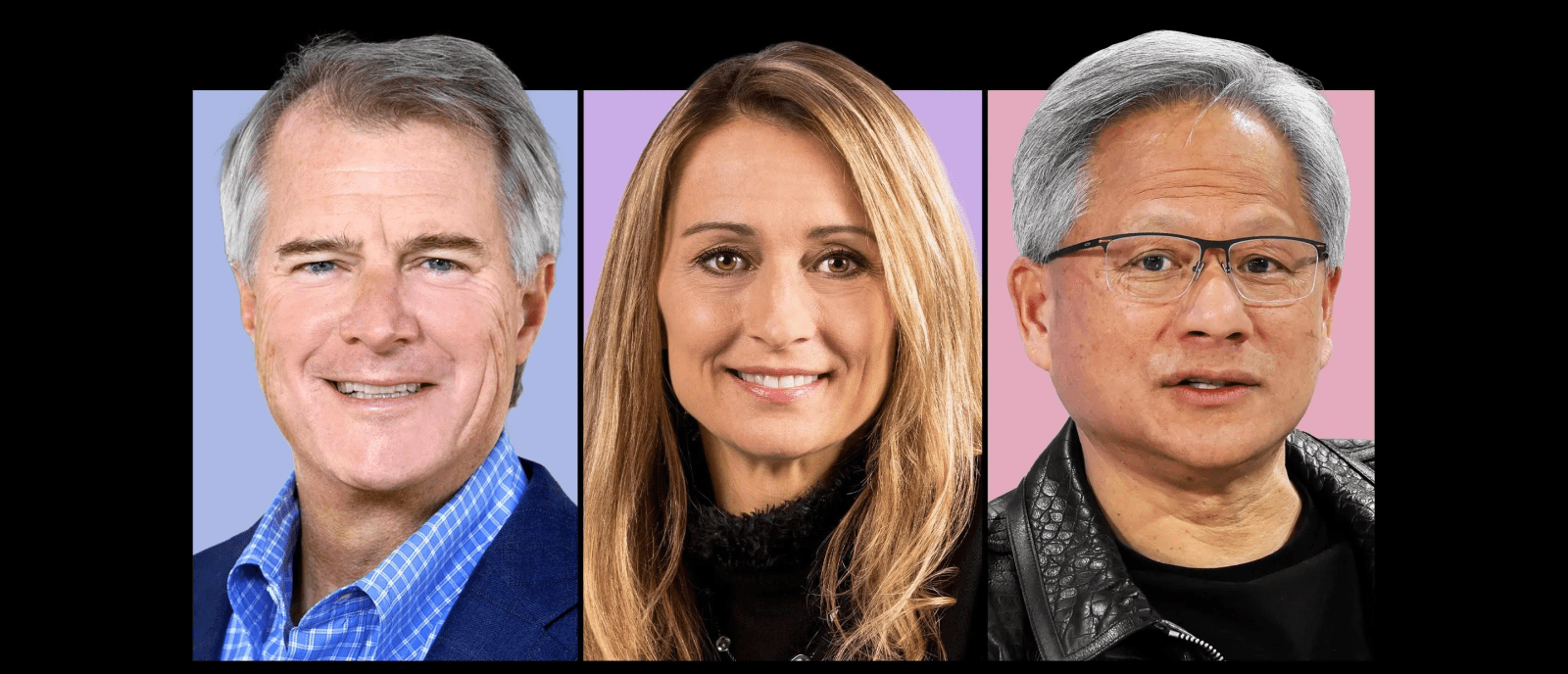

The buzzy chip firm’s CEO Jensen Huang isn’t the only one scoring big, thanks to Nvidia’s soaring shares.

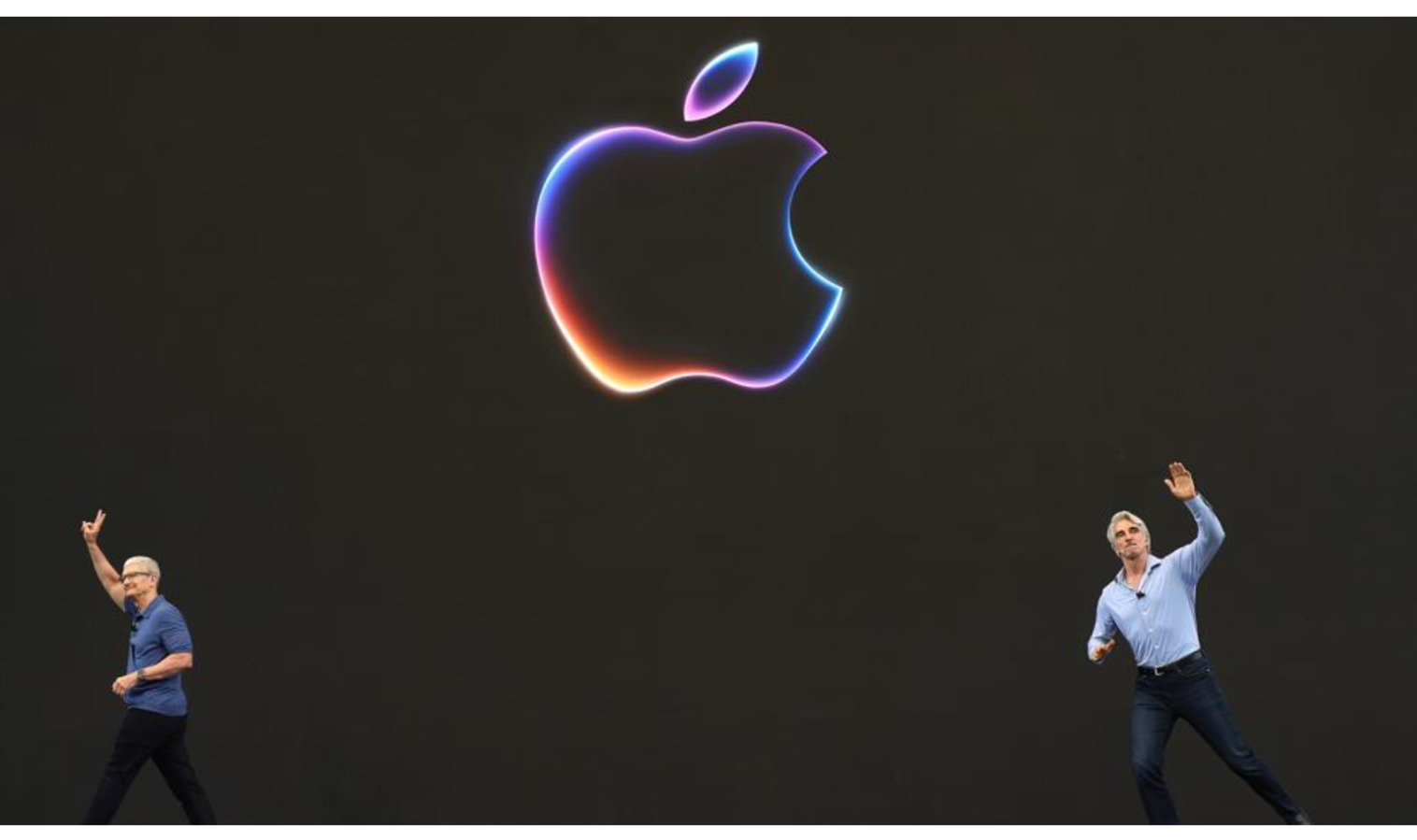

Hours after Apple announced “Apple Intelligence” — its new generative artificial intelligence initiatives — billionaire Elon Musk blasted the announcement in a series of tweets. If Apple “integrates OpenAI at the OS level,” all Apple devices will be banned at his companies, Musk says.

Apple CEO Tim Cook unveiled the company’s “profound new intelligence capabilities” Monday.

Nvidia was valued at less than 2% of Apple just ten years ago.