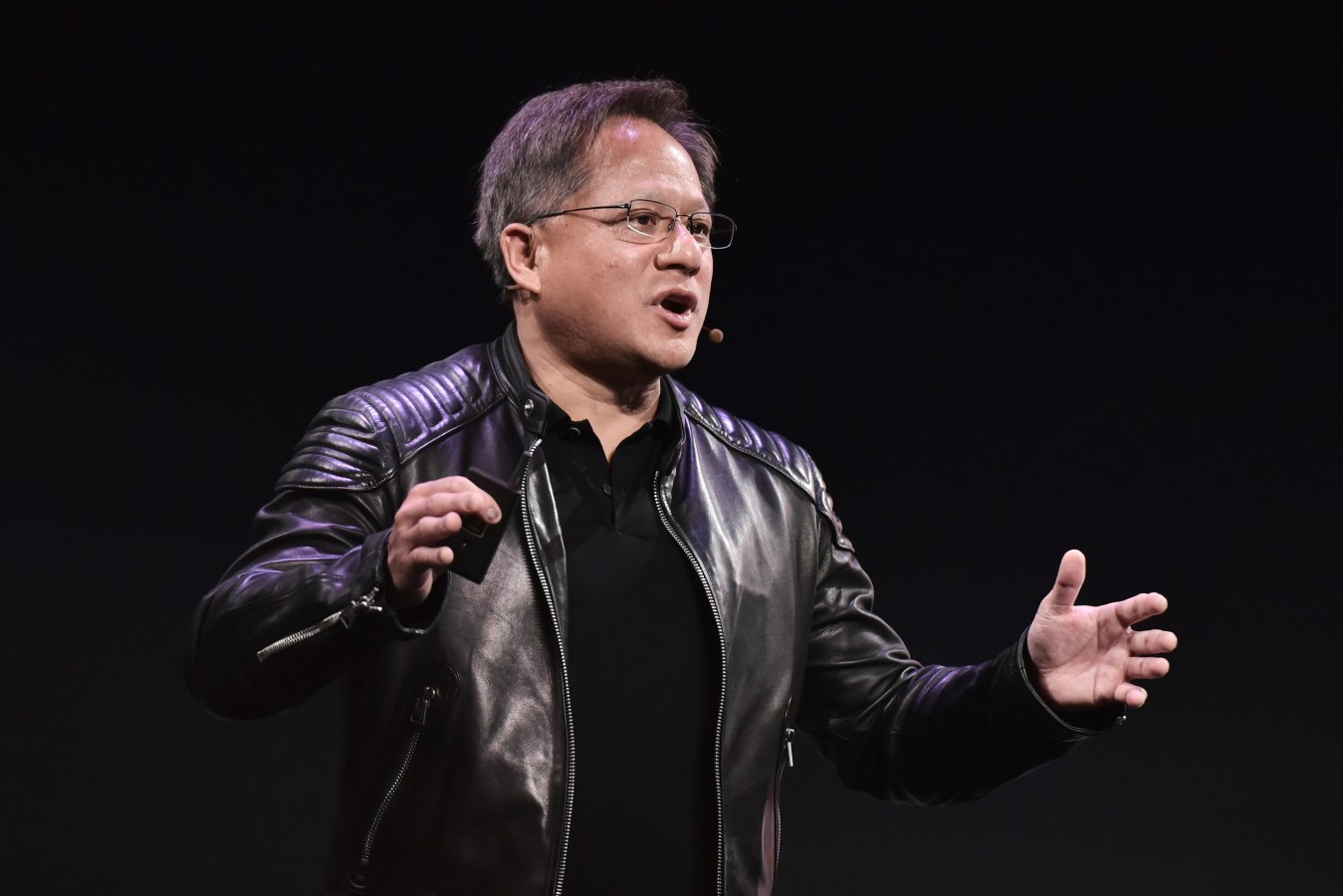

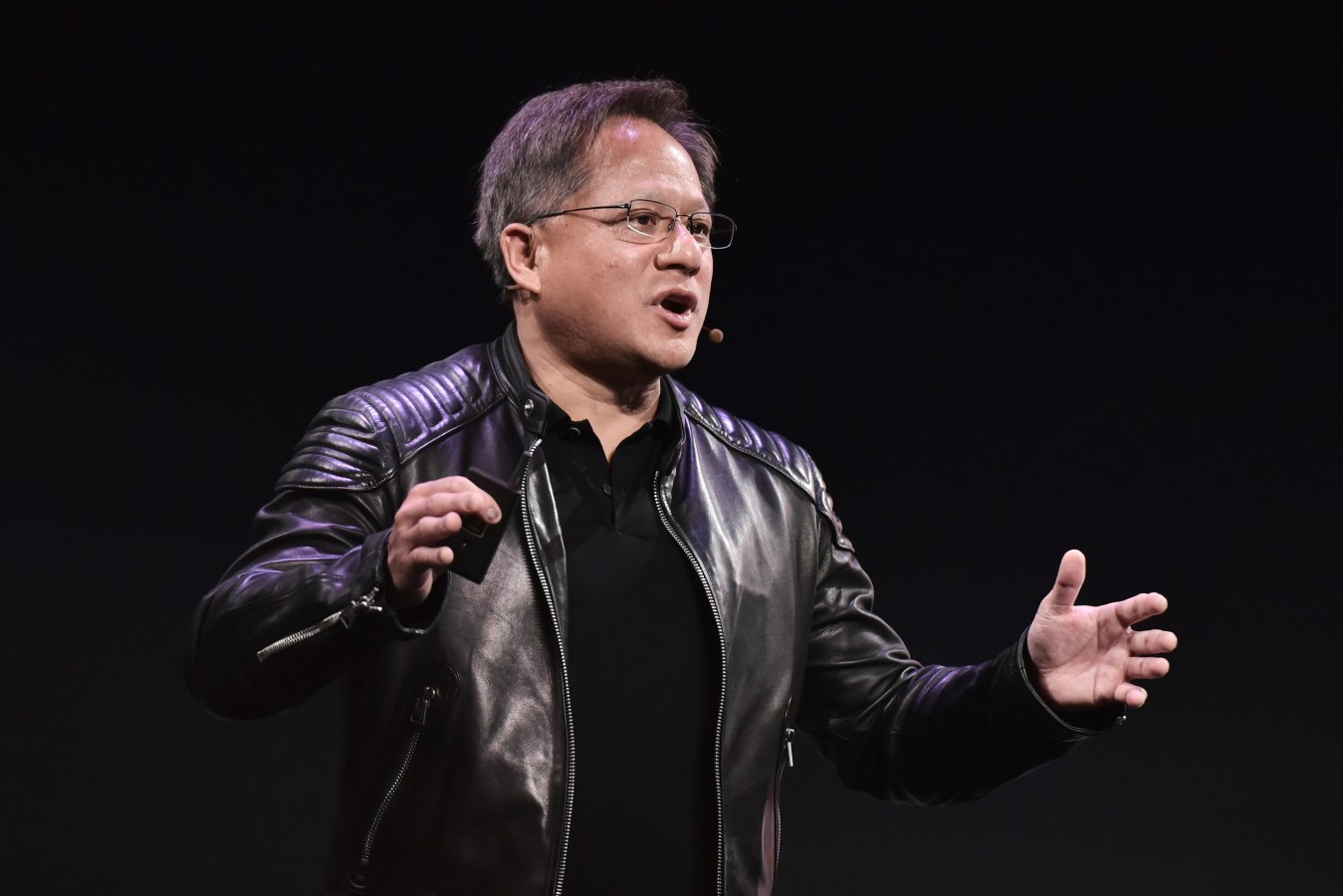

Nvidia joins exclusive club after hitting US$1 trillion market value

Nvidia joins Apple, Saudi Aramco, Microsoft, Alphabet and Amazon in the exclusive club.

Nvidia joins Apple, Saudi Aramco, Microsoft, Alphabet and Amazon in the exclusive club.

The agreement, which raises the debt ceiling for two years, still needs congressional approval.

Investors should consider Silicon Valley chipmaker Marvell a “safer way to gain exposure to the AI wave,” one analyst said.

Netflix could add as much as nine million paid subscribers thanks to the password crackdown, according to analysts.

ESPN plans to maintain its cable channel even with its streaming service, according to anonymous sources.

Senators and industry leaders went back-and-forth about what artificial intelligence governance and dangers may look like—questioning whether the technology is more like the “printing press” or the “atom bomb.”.

Yaccarino was a seasoned executive at NBCUniversal who worked on a Covid vaccine campaign and had ties to the World Economic Forum.

It’s unclear where the reductions will be made, but executives said there won’t be layoffs.

Google cofounders Larry Page and Sergey Brin surged back into the ranks of the 10 richest people in the world Thursday.

The entertainment conglomerate lost four million subscribers for Disney+ last quarter while raking in $2 billion in profits from its theme parks.