The AI chip boom saved this tiny startup. Now worth $2.8 billion, it’s taking on Nvidia

Now worth $2.8 billion, Groq thinks it can challenge one of the world’s most valuable companies with a purpose-built chip designed for AI from scratch.

Now worth $2.8 billion, Groq thinks it can challenge one of the world’s most valuable companies with a purpose-built chip designed for AI from scratch.

Apple shares opened down 8%, Microsoft 5%, Nvidia 14%, Google parent Alphabet 6%, Amazon 8%, Facebook parent Meta 7% and Tesla 11%.

Large technology stocks flails as lower interest rates appear on deck and investors view a Trump presidency as increasingly likely.

The AI boom undoubtedly resembles the dot-com bubble but with a difference. Back then, most startups carried the risks, while now, giant AI pioneers are unlikely to go broke. Rather, investors will suffer.

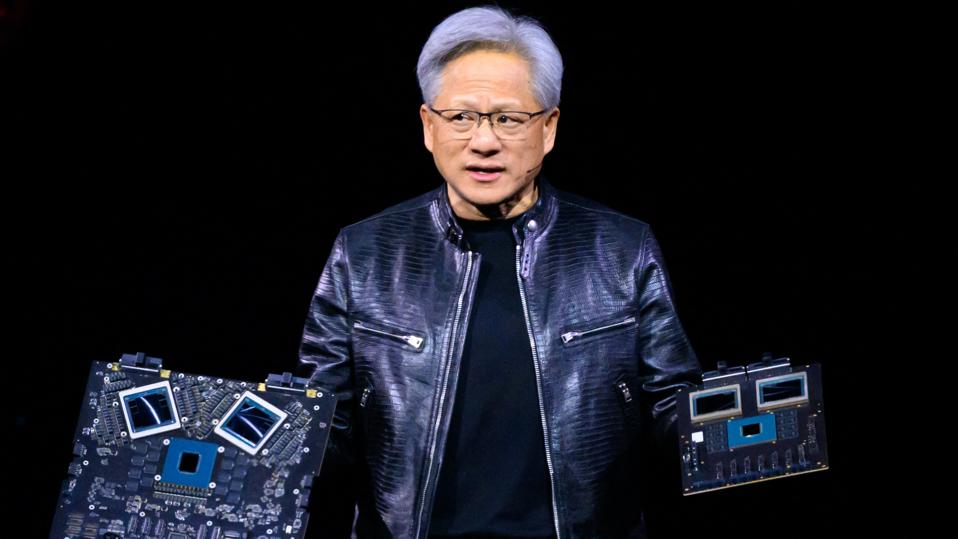

The buzzy chip firm’s CEO Jensen Huang isn’t the only one scoring big, thanks to Nvidia’s soaring shares.

Nvidia was valued at less than 2% of Apple just ten years ago.

If you believe Nvidia’s CEO that we’re amidst a “new industrial revolution,” then an investment in Nvidia is akin to an investment in the steam engine in the 1700s.

The “godfather of AI” is a much richer man thanks to Nvidia stock’s more than 20,000% increase over the last decade.

Tech stocks on Wall Street defied sticky inflation Friday to post their biggest gain in more than two months—easing market anxiety about a slowdown in economic activities—after blockbuster first-quarter earnings and continued betting on artificial intelligence fired up the valuations of major companies.

Shares of artificial intelligence leader Nvidia are up more than 400% since the beginning of last year, adding about $1.5 trillion to its market capitalization.