Stocks roared back to life Wednesday afternoon after President Donald Trump announced a 90-day delay on the most significant of his tariffs, just hours after the levies went into effect, sparking extensive carnage across financial markets.

A trader works on the floor of the New York Stock Exchange on Wednesday.

AFP via Getty Images

Key Takeaways

- The S&P 500, which follows 500 of the largest public American companies across industries, jumped almost 10% on the day, while the tech-concentrated Nasdaq soared 12% and the blue chip Dow Jones Industrial Average shot up 8%, or about 3,000 points.

- Wednesday was a historically great day for stocks, as it marked the best percentage gain for the Dow since March 24, 2020, the S&P since Oct. 28, 2008 and for the Nasdaq since Jan. 3, 2001, according to FactSet data.

- It was by far the largest point gain for all three indexes in their five-decade-plus histories.

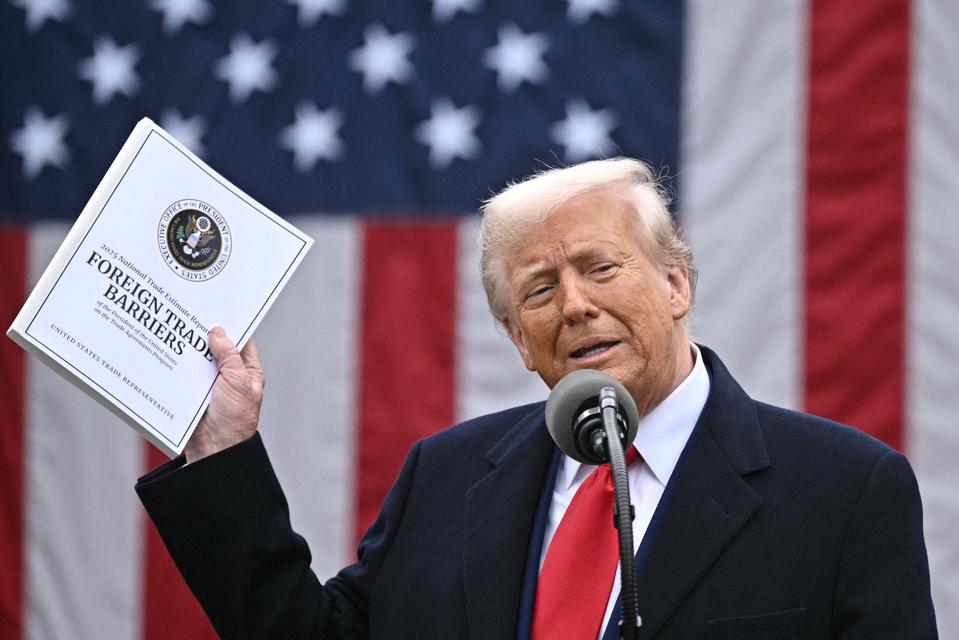

- Trump said Wednesday afternoon he signed a 90-day pause on implementing the more than 10% tariffs on 75-plus countries, sending stocks badly battered by this trade policy soaring.

- “BE COOL! Everything is going to work out well,” Trump posted to his Truth Social site shortly after market open, adding “THIS IS A GREAT TIME TO BUY!”

- Trump had shown no sign he’d reverse course on the tariffs, encouraging companies to simply move all operations to the U.S. in a morning social media post, and China dug in further in its resistance to Trump’s more than 100% tariffs on Chinese imports, slapping an 84% levy on U.S. imports to the Asian country.

What Stocks Surged The Most In The Tariff Pause Rebound?

Nearly every stock surged on the tariff relief, as 484 of the S&P’s 500 constituents were in the green, according to FactSet data. Companies considered most vulnerable in a recession benefited the most, as the S&P’s information technology and consumer discretionary sectors jumped 11% and 12%, respectively.

The most notable risers included tech giants, as shares of Amazon, Apple, Nvidia, Mera and Tesla all enjoyed more than 10% gains Wednesday. Delta Airlines, Expedia and United Airlines all ranked among the top 30 biggest gainers in the rally as the travel industry received a jolt.

Contra

Tariffs have still wreaked havoc on equity valuations. The Dow is down 10%, or more than 4,000 points, from its December peak, the Nasdaq has lost 15% from its December high and the S&P has fallen 11% from its February high.

Chief Critic

“The tariff clouds parted for the first time today, but it’s too soon to know how sunny the skies will be tomorrow—or 90 days from now,” Daniel Skelly, Morgan Stanley Wealth Management’s head of market research and strategy, wrote in emailed comments.

What’s Happening In The Bond Market?

After strengthening immediately after Trump’s announcement last week as investors fled stocks for assets perceived to be safer, U.S. government bonds joined in on the selloff. Yields for the benchmark 10-year U.S. Treasury note shot up 40 basis points from Monday to Wednesday afternoon, at 4.4%, reversing the initially lower yields celebrated by Trump and Treasury Secretary Scott Bessent as a sign of cheaper borrowing costs to come. It was a “perfect storm of bad news” for U.S. bonds, remarked Lawrence Gillum, LPL Financial’s chief fixed income strategist.

“Sticky inflation, a patient Fed, potential foreign buyer boycotts, hedge fund deleveraging, rebalancing out of bonds into cash, and an illiquid Treasury market are all reasons why Treasury yields continue to move higher,” Gillum explained. Higher yields mean less valuable bonds, as fixed income investors demand higher annual payouts to hold onto federal government debt. Yields were little changed amid the equity rally.

JPMorgan Boss Jamie Dimon Warned Of Recession

A recession is the most “likely outcome” for the U.S., JPMorgan Chase CEO Jamie Dimon said in a Wednesday interview with Fox Business. “Markets aren’t always right, but sometimes they’re right,” Dimon remarked about the pain seen across asset classes in recent days. “And I think this time they’re right because they’re pricing uncertainty at the macro level, uncertainty at the micro level, at the actual company level, and then how it affects consumer sentiment,” Dimon continued. In that interview, Dimon encouraged the Trump administration to lean into strengthening trade with allies in Europe and Asia: “I think the goal of this trade stuff should be to make Europe and our trading partners, Japan, Korea, Philippines, stronger, not weaker. Bring them closer.”