After a record surge brought the price of bitcoin above $90,000 for the first time and pushed the total value of all digital assets past $3.2 trillion, crypto’s wealthiest are seeing their net worth soar.

Crypto billionaires are seeing their fortunes soar on the back bitcoin passing $90,000 this week.

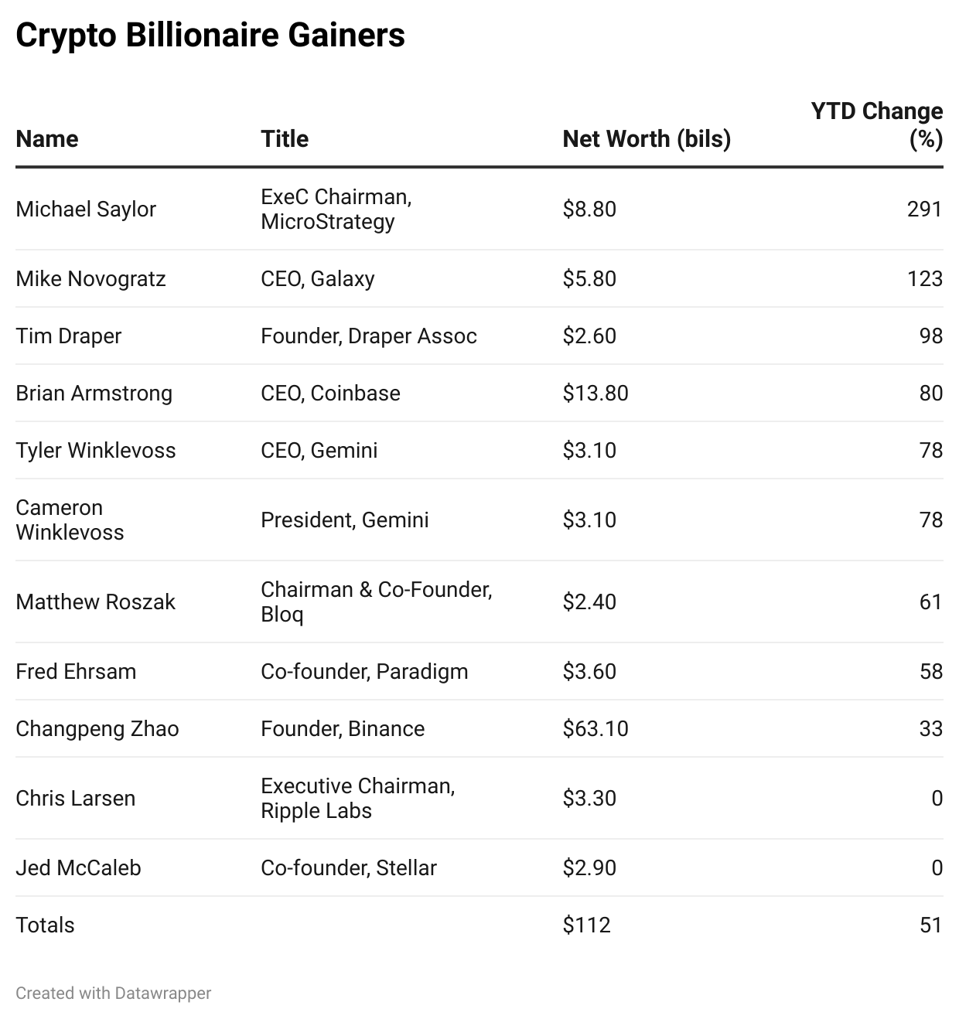

Forbes estimates that 11 top crypto billionaires, whose holdings largely consist of liquid tokens and stocks, have collectively added $38 billion to their fortunes in 2024. Some $24 billion, or 63% of the total increase, occurred after September 1 as the industry became increasingly bullish on Donald Trump’s ultimate victory in the presidential election on November 5.

Michael Saylor, CEO of MicroStrategy, photographed in January 2021 by Jamel Toppin for Forbes. Jamel Toppin/The Forbes Collection

Jamel Toppin/The Forbes Collection

Regarding percentage gains, the biggest winners were the leaders of publicly traded companies whose stocks trade as high beta plays on bitcoin itself. The biggest gainer in percentage change by far was bitcoin enthusiast and MicroStrategy chairman Michael Saylor. His company’s stock, which has the world’s largest corporate stash of bitcoin, worth $25.6 billion, is up 464% year to date. Bitcoin, by comparison, is up 110%. Saylor’s net worth, which largely consists of bitcoin, and his stake in the company grew by 291% to reach $8.8 billion. Next comes Galaxy Digital CEO Mike Novogratz, who rode his company’s 150% surge in stock price year to date to a 123% gain in net worth, from $3.2 billion to $5.9 billion.

Coinbase CEO Brian Armstrong also saw a massive increase. His net worth surged 80%, jumping from $7.6 billion at the start of the year to $13.8 billion, making him the second-richest person in crypto. The vast majority of Armstrong’s increase came in the past two months, when he rode Coinbase’s 74% stock gain over that period to $5.7 billion in additional riches.

The biggest gainer in terms of overall dollars is Changpeng Zhao, the former Binance CEO and convicted felon who just spent four months in federal prison as part of a plea agreement with the Department of Justice in which he pled guilty to anti-money laundering and sanctions violations. His wealth consists of a $33 billion stake in Binance even though he no longer has an operational role at the company. He also has a stockpile of 94 million BNB tokens that Forbes uncovered in a 2023 investigation. Once you add CZ’s stake in BNB, which is a digital asset created by Binance that is used on its blockchain and gives trading discounts to customers, his net worth jumped from $47.3 billion at the start of the year to $63.1 billion. Regarding percentage increases, however, Zhao is near the bottom of our “Crypto Billionaire Gainers” table (see below), with just a 33% gain. BNB is only up 89% in 2024.

The only two crypto billionaires who did not see any appreciation were Ripple co-founders Chris Larsen and Jed McCaleb. Larsen’s net worth, half of which is tied up in XRP tokens, a digital asset used in the XRP Ledger designed to facilitate cheap global payments, stayed flat in the year at around $3.3 billion. McCaleb, who owns 1 billion tokens from a similar blockchain called Stellar (XLM), is also roughly flat, at $2.9 billion. XRP is up less than 1% this year, while XLM has fallen by 11%.

In March, Forbes identified both the XRP Ledger and Stellar network as two prominent billion-dollar crypto zombies because, despite their respective $38 billion and $3.9 billion market capitalizations, they have little utility and serve mostly as vehicles for trading and speculation.

Crypto rich have added $38 billion to their fortunes in 2024.

Forbes