The Reserve Bank of Australia announced a rate cut for the first time since 2020. So what now?

Australia has been one of the only countries to hold interest rates at post-pandemic levels, keeping cost of living expenses high in the hope inflation will be stamped out long term.

The RBA’s announcement on Tuesday to cut rates by a quarter per cent signals belief that the Australian economy is stable and can withstand lower prices.

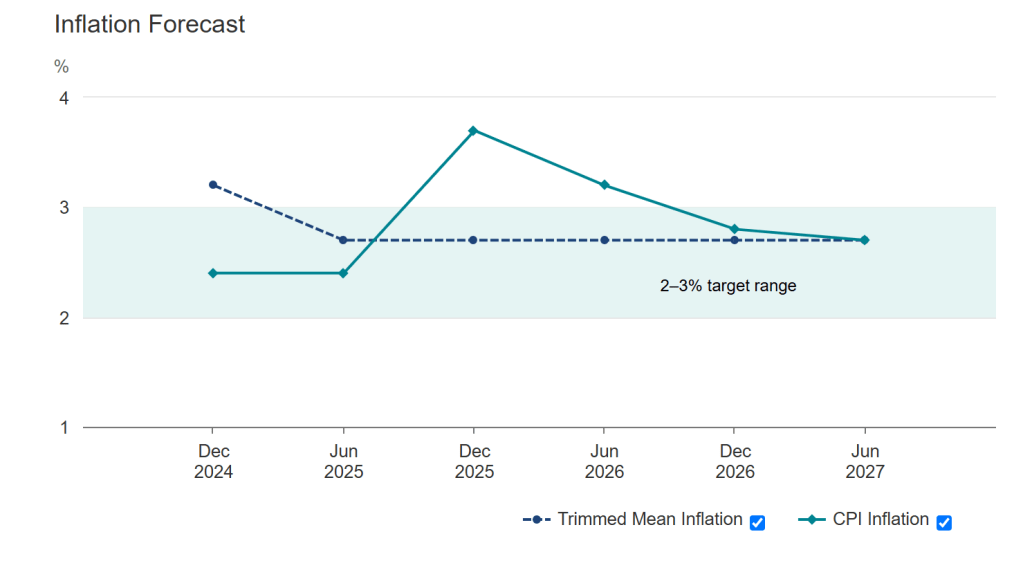

“Inflation has continued to ease, and underlying inflation is expected to return to the 2–3 per cent range a little sooner than we thought,” the RBA said in a statement. “The labour market has been surprisingly strong.”

As such, a much-anticipated change to the cash rate was announced on Tuesday afternoon.

“At its February meeting, the Board decided to lower the cash rate target to 4.10 per cent. There has been good progress on inflation but the Board remains cautious,” the nation’s central bank states.

A part of that caution relates to the inconsistency of economic conditions abroad.

“The global economic outlook is uncertain due to new trade policies and international tensions,” the RBA statement reads.

Those trade policies include tariffs imposed by the US on Mexico, Canada, as well as steel and aluminium. Just this week, US data revealed that inflation has increased since the Federal Reserve started cutting interest rates.

“The recent spike in U.S. inflation raises questions about the potential risks of easing monetary policy too soon,” says Matt Sek, VP for ANZ at Australian-founded unicorn Airwallex. “The U.S. Federal Reserve has faced renewed inflationary pressures since it began considering rate cuts.”

Today’s cut in Australia is based on local economic conditions, however, says Sek.

“The RBA is focused on domestic inflation trends, employment data, and consumer confidence when weighing its decision,” says Sek.

What impact will a rate cut have?

AMP chief economist and head of investment Shane Oliver says while an RBA rate cut signals a gradual downward trajectory of elevated prices, it will take time to be felt broadly by consumers.

“A 0.25% rate cut will cut $100 off monthly mortgage payments on a $600,000 mortgage freeing up some spending power. However, the impact is likely to be minor at least initially: as it takes a while for interest rate moves to start impacting spending as we saw with the initial hikes in 2022,” says Oliver.

AMP has projected there will be three rate cuts this year, and they will be spread out between now and December.

“Rate cuts this year are expected to reverse only 3 of the 13 hikes (or 0.75% of the 4.25% rise); and rate cuts will be gradual, particularly compared to the rapid-fire rate hikes back in 2022 which may dampen expectations,” says Oliver.

The head of investment strategy for AMP says the second rate cut will likely take place in May after the federal election. Once the RBA has initiated three rate reversals, gains can be expected in stocks and across real estate markets.

“Our forecasts for the ASX 200 to rise to around 8800 and for residential property prices to rise 3% this year were predicated on three rate cuts this year,” says Oliver.

A slow and steady approach will encourage inflation to remain low, he notes.

“We expect the start of an RBA rate-cutting cycle to support a modest uptick in economic growth over the year ahead. But not enough to reignite inflation and to drive an uptick in property prices,” says Oliver.

Forbes Women is mobilising a network of female business owners, entrepreneurs and changemakers who support and empower each other. Become a member here.