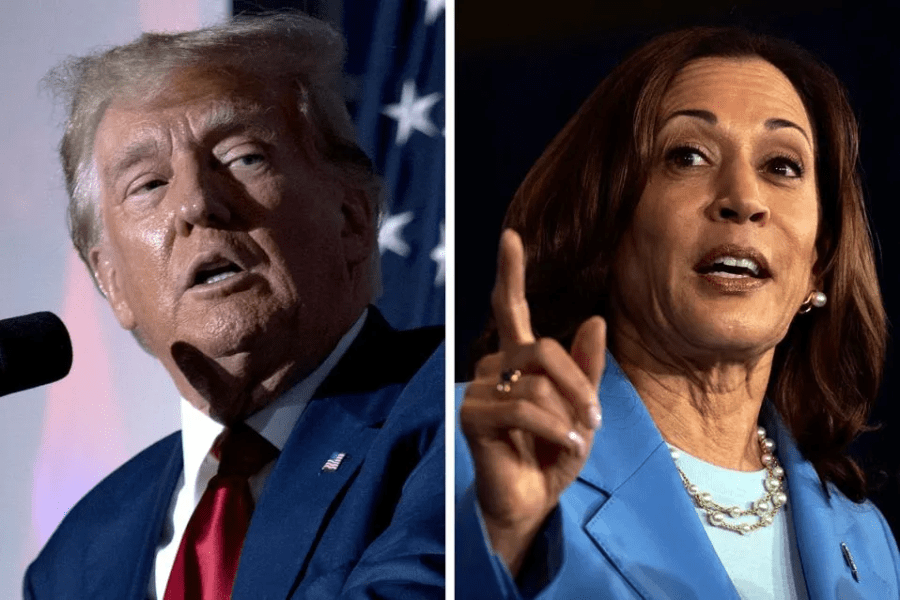

Shares for Trump Media on Wednesday dropped more than 15%, falling to what would be a new record low for the stock, after Vice President Kamala Harris became the betting favourite to win the election after a debate with former President Donald Trump, the majority stakeholder in the Truth Social parent.

Key Facts

- Trump Media and Technology Group shares fell below $15.75 as of around 9:50 a.m. EDT, pacing the stock’s record low price of $16.70 set on Sept. 4.

- Trump faced off in his second debate of the 2024 election and his first against Harris on Tuesday, and several bookmakers favoured Harris’ performance: The Election Betting Odds tracker, which consolidates odds from four separate markets, suggests Harris has a 51.8% chance of winning and the crypto platform Polymarket—which previously favoured Trump—has both candidates with a 49% chance.

- The value of Trump’s roughly 60% stake—totalling 78.75 million shares—dropped to $1.2 billion from $1.4 billion.

What To Watch For

Whether Trump offloads shares in Trump Media. Since going public in March through a reverse merger with a special-purpose company, some shareholders—those who own 5% or more of shares or who serve in high-level management positions—have been unable to sell their shares in a lock-up period. The earliest possible date for the lock-up period to end is Sept. 19, if Trump Media shares remain above $12.

Big Number

79%. That’s how much the value of Trump Media shares has decreased since hitting a record-high of $79.38 on March 25.

Key Background

Trump Media shares have remained volatile in recent weeks despite declining steadily as the lock-up period nears and Trump returned to X. The Truth Social parent’s market value has fallen from a near $10 billion peak in May to over $3 billion on Tuesday, though some analysts believe the company is overvalued after recording a $16 million loss in its recent quarter. The stock dropped and surged amid Trump’s campaign, and previously jumped as high as 13% after Trump debated with President Joe Biden, whose performance led to calls for him to drop out of the race. Shares increased by about 32% on July 15, days after an assassination attempt on Trump during a campaign rally in Pennsylvania.

This article was originally published on forbes.com.

Don’t miss the opportunity to gain exclusive insights that could shape your financial future. Join us at the Forbes Australia Icons & Investors Summit to hear directly from Australia’s top business and wealth experts. Tap here to secure your ticket.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.