Like the 20th Century transformation of NCNB into Bank of America, First Citizens’ Frank Holding Jr. is building another North Carolina super regional with grand national ambitions.

North Carolina’s First Citizens Bank doubled its size with the stroke of a pen in the early hours of Monday morning with its landmark FDIC-assisted acquisition of Silicon Valley Bank, and nobody will reap the rewards more than the family that has orchestrated its growth for the last century.

Chairman and CEO Frank Holding Jr. and his four sisters Olivia Holding, Hope Bryant, Carson Brice and Claire Bristow collectively own about 20% of First Citizens’ stock and have close to 50% voting power in the company, according to SEC filings, for a cumulative stake worth $2.7 billion thanks to Monday’s 54% stock gain following the deal. The surge erased all of the stock’s year-to-date losses in the regional bank selloff stemming from SVB’s failure and contagion fears.

Raleigh-based First Citizens and the Holding family have kept a low profile for decades, but the family-owned bank has been on a mission to expand nationwide via opportunistic acquisitions. Its growth has accelerated since the 2008 financial crisis thanks in part to a series of more than 20 FDIC-assisted acquisitions of small failed banks, including California’s $1.8 billion (assets) First Regional Bank, $1.1 billion Temecula Valley Bank, also based in Southern California, and $1.8-billion Denver-based United Western Bank. At the end of 2008, First Citizens had assets of $16.7 billion. Prior to this weekend’s SVB deal, the bank’s assets stood at $109 billion.

“It developed a bit of a specialty in that area,” says Peter Gwaltney, CEO of the North Carolina Bankers Association, referring to First Citizens’ purchases of failing banks. “They’re practiced at this, they’re disciplined and they’re trusted by the FDIC.”

In January 2022, its $2.2 billion acquisition of New York-based CIT Group was its biggest purchase prior to SVB. CIT is a 115-year old middle market commercial and consumer lender with a nationwide footprint. It went bankrupt during the financial crisis in 2008, and emerged in 2010 under the leadership of former Goldman Sachs executive and Merrill Lynch CEO John Thain, who retired in 2016.

Related

First Citizens is taking on $110 billion in assets, $56 billion in deposits and $72 billion in loans from SVB, becoming one of the 20 largest banks in America now with $219 billion in assets. It has more than 500 branches in 21 states, heavily concentrated in the fast-growing Southeast and California.

The $72 billion loan portfolio was acquired at a $16.5 billion discount, the FDIC said in its press release, and an SEC filing said First Citizens received a $35 billion five-year loan from the FDIC at a 3.5% fixed rate to finance the deal. In early March, SVB experienced a bank run as its tech startup customers rushed to withdraw more than $40 billion in deposits. The ailing bank had more than 85% of its $175 billion in deposits uninsured. According to regulatory filings, First Citizens had 32% of its $91 billion in deposits uninsured as of the end of 2022.

“Frank Holding is one of the most opportunistic bank buyers out there,” says Brady Gailey, a managing director at KBW. “He’s creating an enormous amount of shareholder value, and the math on this acquisition is just eye-popping. Tangible book value per share could double with this deal.”

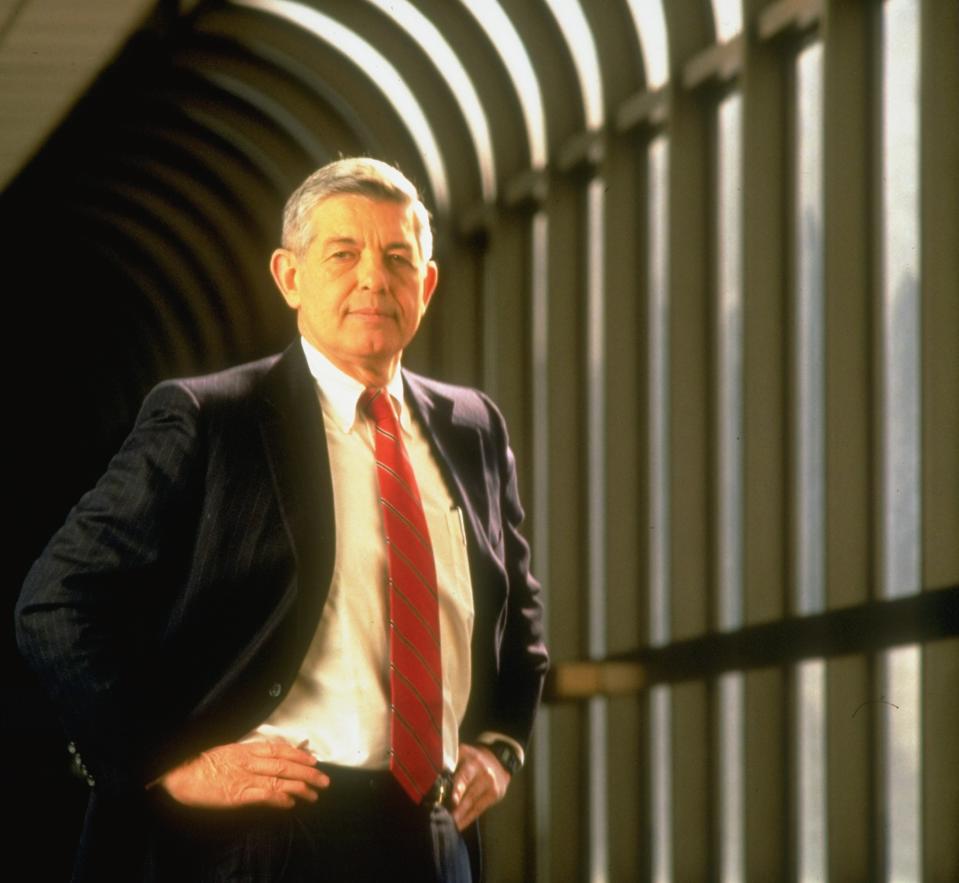

The Holding family’s expansion in banking is reminiscent of the rise of another “super” regional bank out of North Carolina, NCNB, under the leadership of Hugh McColl Jr., a former marine who made hundreds of acquisitions in the 1980s and 1990s. NCNB was renamed Nationsbank in 1991 and ultimately acquired San Francisco’s Bank of America, growing assets from $12 billion in 1983 to more than $640 billion by the end of McColl’s tenure in 2000.

Hugh McColl Jr. turned North Carolina’s NCNB into a banking giant in the late 20th century that merged with Bank of America.

Getty Images

“The Holdings have been very smart people for 100 years,” says McColl, 87, now the retired cofounder and chairman emeritus of private equity firm Falfurrias Capital. “They first made their very good investments during the Depression and right after the Depression, and they’ve always been smart about picking up things in hard times.”

First Citizens was founded in 1898 as the Bank of Smithfield serving farmers in Johnston County, North Carolina. Frank Jr.’s grandfather Robert Powell Holding arrived as an employee in 1918 and became president in 1935. His son Lewis Holding became CEO for a half-century after the patriarch died in 1957, with Frank Holding Sr. serving as an executive alongside his brother. Frank Holding Jr., 61, who went to school at the University of North Carolina at Chapel Hill and earned an MBA from the University of Pennsylvania’s Wharton School, has spent his whole professional career at the bank, became its president in 1994 and took over as CEO from his uncle Lewis in 2008.

Holding’s sister Hope Bryant is the vice chairwoman of First Citizens, and his brother-in-law Peter Bristow is its president. Bryant also serves on the board of Mount Olive’s $4.8 billion (assets) Southern Bancshares and $4 billion (assets) Fidelity Bancshares of Fuquay Varina, two other North Carolina banks that count the Holding family as controlling shareholders. As of the end of 2022, 54% of Southern’s deposits and 35% of Fidelity’s deposits were uninsured.

The Holding family’s influence in North Carolina extends beyond banking. Frank is the chairman of the board of Blue Cross and Blue Shield of North Carolina, the state’s largest health insurer, and is also on the board of the Mount Olive Pickle Company, the largest independent pickle company in the U.S., based in the town of Mount Olive an hour southeast of Raleigh. His cousin George Holding was a four-term Republican congressman from 2013 to 2021, and his sisters Hope Bryant and Olivia Holding are listed as directors or principal owners of North Carolina companies including Twin States Farming and E&F Properties, which own thousands of acres of land.

First Citizens’ growth has been bolstered by its location in one of America’s fastest growing regions. Research Triangle Park between Raleigh and Durham is home to more than 300 companies. Google recently opened a large Durham office, and Apple is building a new billion-dollar campus in the Triangle area. In an investor call Monday morning, Holding cited Raleigh’s status as a growing hub for tech startups and his desire to make First Citizens their bank of choice.

“This transaction builds on our capabilities in the innovation and technology sectors,” Holding said on the call. “We believe there are long term secular tailwinds supporting technology and healthcare businesses that will continue to drive growth in the future.”

First Citizens has also established a large footprint in California and in the Northeast in recent years, and acquiring SVB will accelerate that growth. Many of SVB’s associates with experience in banking the technology industry will join the combined bank.

“Capital call lending, which is lending mostly to private equity companies, is a big piece of what they’re acquiring here. That’s roughly $40 billion of the $110 billion that they’re acquiring. That’s a perfect fit for what they’re already doing there in Raleigh,” Gailey says. “I think as more investors see the merits of this deal, this stock is still headed a lot higher.”

This article was first published on forbes.com and all figures are in $USD.