Six experts weigh in on this year’s complexities, dangers and opportunities and peek over the horizon to what we may face in 2025.

On the surface, it’s all looking good, mostly. But like everything in life – it’s not as simple as it seems.

The S&P/ASX 200 is on track to end the year about 9% higher after, admittedly, a rocky start. It’s been pretty much heading north since February. This follows a similar gain across 2023. The S&P 500 is up almost 28% on the year and staring at the possibility of a third year of consecutive plus-20% gains.

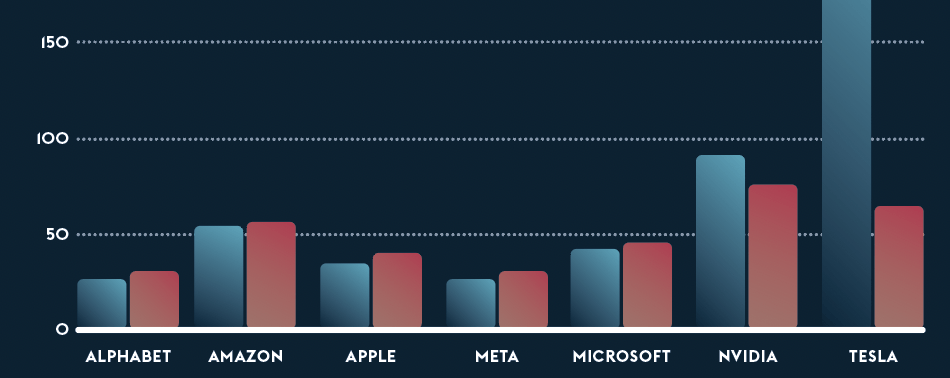

The FTSE 100 is up about 7.5%, the DAX more than 22% and the Nikkei 225 around 19%. So far so, relatively, rosy. However, valuations in some tech stocks – particularly those associated with AI – are eye-wateringly high, but on the other hand technical Relative Strength Index analyses* of the S&P 500 and the S&P/ASX 200 show the former sitting round the middle ground and the latter getting close to “oversold” territory, taking a sharp decline in December. Adding to the complexity, at around 30 times price to earnings ratio, Australian stocks are expensive if you look at the 10-year average of 23.8.**

In the property market Australia’s total value of dwelling stock ticked above $11 trillion in September, median house prices have held their ground and even increased slightly despite rate uncertainty.

In commodities, Brent is trading around US$74 a barrel – not terrible given it tipped $90 back in April. Iron ore is hovering around 100 bucks a ton.

Annual Australian inflation is at 2.8%, according to the last write – broadly compatible with the Reserve Bank’s target range. Gold, however, – a traditional haven asset – is sitting at around $4,000 after starting the year around $3,000.

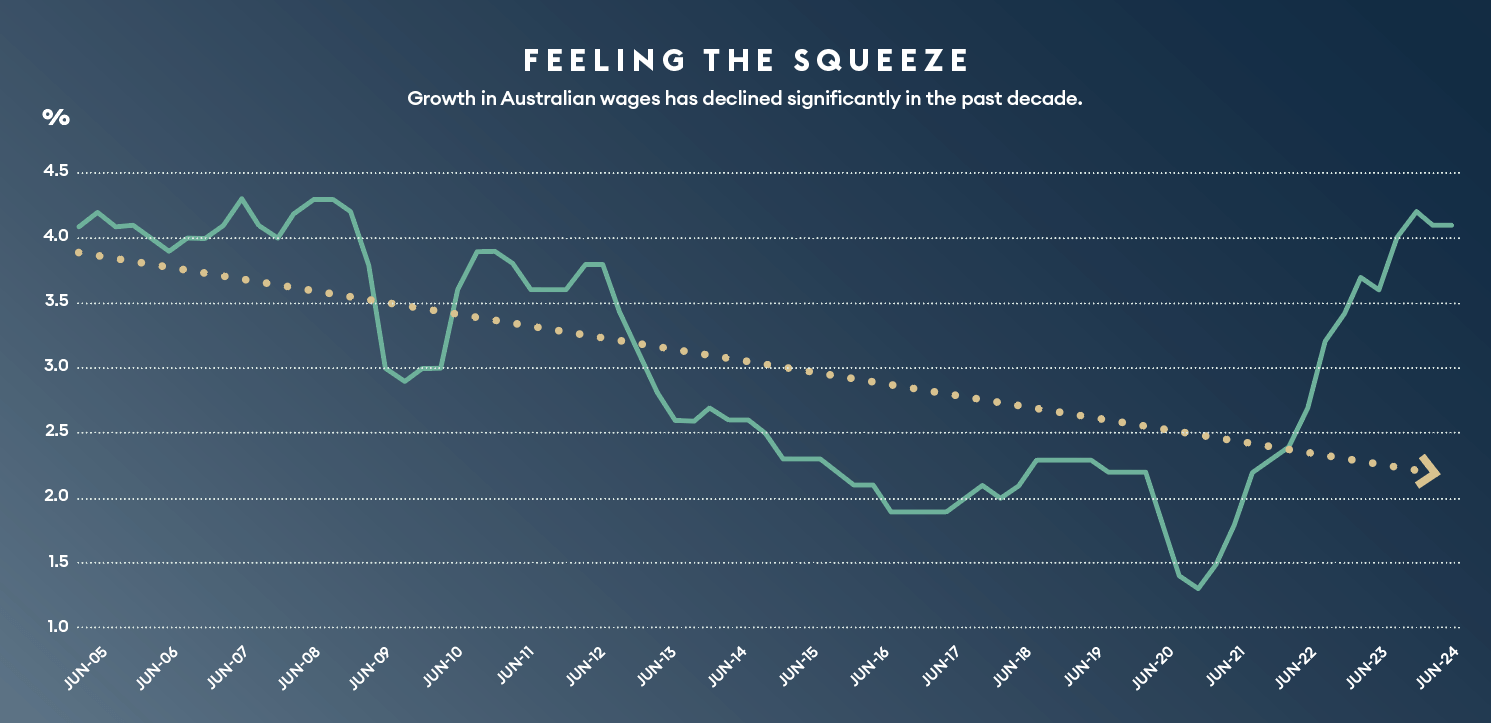

We are still in what many are describing as “cost-of-living” and “housing affordability” crises. Geo-politically we haven’t seen this much risk since the end of the cold war, but CNN’s Fear & Greed index**** – is sitting at a neutral: 50.

To help navigate this financial minefield, in each issue of Forbes Magazine, we speak with an investment expert in diverse asset classes from equities, through listed infrastructure, debt, tech, property and alternative real estate.

As the year comes to an end, we take a look back at what they had to say for each edition of Where I’m Putting the Money.

Philip King

Philip King co-founded fund management powerhouse Regal in 2004. He is now CIO of the firm and is recognised as one of the “pioneers of the Australian alternative investment industry”. He explains his surprising outlook for resource stocks, how water became a better investment than land and why the AI sector is currently only a watching brief.

Warryn Robertson

Lazard Asset Management Pacific’s portfolio manager and analyst, Warryn Robertson, has worked in the investment field for more than 30 years and specialises in global listed infrastructure and equities. He explains the advantages of being heavily weighted offshore, when to be brave and when to be cautious (particularly with tech) and ultimately, why boring can be quite beautiful.

Jun Bei Liu

Jun Bei Liu took over Tribeca’s Alpha Plus Fund in 2019. Since taking on sole responsibility for the portfolio, she has quadrupled assets under management. She talks about, the dangers of “thematic” investing, why tech stocks are too expensive and argues China will still need Australian iron ore for a surprising reason.

Michael Every

Rabobank global strategist Michael Every is known for his often contrary, frank and sometimes flippant, but always exhaustively researched, opinions. He tells why he’s bearish on Australia’s property “obsession”, the economic danger of intergenerational inequity, the continuing threat from China and bemoans the way we constantly do “stupid things cleverly and clever things stupidly.”

Julian Biggins

MA Financial Group’s joint CEO and one of the company’s founders, Julian Biggins, argues we’re looking at a “once in a cycle” opportunity in terms of investing in commercial real estate and alternative assets. In an environment with rates uncertainty, a cost-of-living crisis, and shaky geo-politics, he explains the logic behind his seemingly contrarian position.

Chris Tynan

Blackstone acquired Crown Resorts for $8.9 billion in 2022, taking the private equity behemoth’s investment in Australia to $25 billion. Chris Tynan, Blackstone’s head of real estate in Australia, discusses the three pillars where he sees opportunity: hospitality; logistics; and housing.

*Relative Strength Indicator or RSI is a technical indicator of momentum measuring the magnitude and speed of price changes. It is displayed on a scale of 1-100. An asset is considered “overbought” when the line crosses 70 and “oversold” when it dips below 30.

***Data Source: https://simplywall.st/markets/au

****Data source: CNN “The Fear & Greed Index is a compilation of seven different indicators… They are market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand. The index tracks how much these individual indicators deviate from their averages compared to how much they normally diverge. The index gives each indicator equal weighting in calculating a score from 0 to 100, with 100 representing maximum greediness and 0 signaling maximum fear.”

Data updated 09:00 Dec, 16.

This article represents the views only of the subject and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent Financial and tax advice before making any decision based on this information, the views or information expressed in this article.