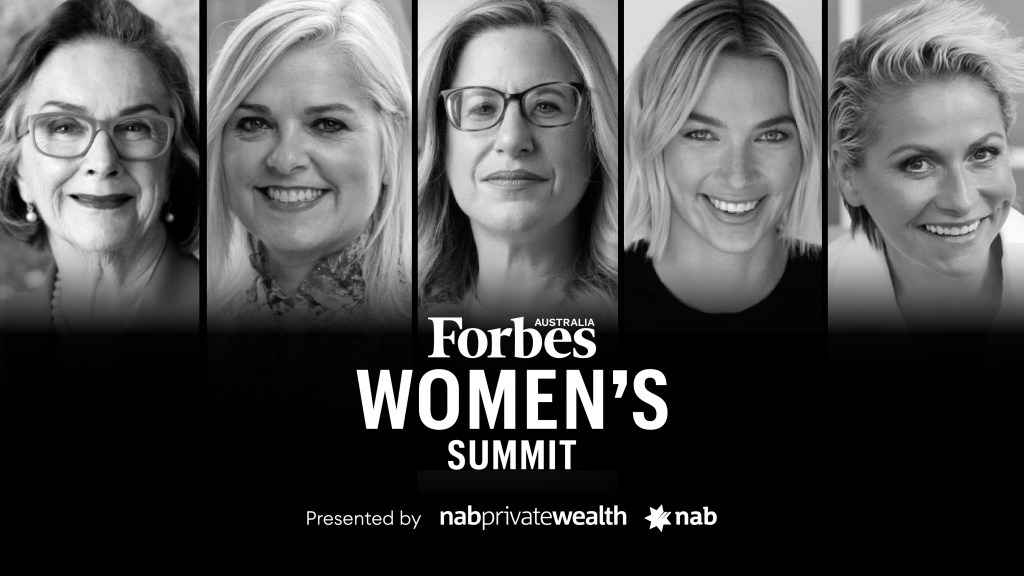

Five women who will speak at the Forbes Women’s Summit on 22 March in Sydney share the best piece of wealth or business advice they’ve received.

For many Australians, rising interest rates and inflation pressures have hit household budgets hard – but women tend to feel the pinch the hardest. In fact, the NAB Wellbeing Survey (Q3 2022) found 52% of women rate living costs as their biggest stressor in the 3 months to November 2022, compared to 43% of men.

But we are in a time of pivotal change and more women are investing than ever before. During the pandemic lockdowns of 2020, women made up 45% of all new investors in Australia. It’s a trend that looks set to continue and as more women start investing, their distinctive investment approach will shape the markets of the future.

Furthermore, studies show that women often make better investors than men. A 2021 study by Fidelity found women outperform men by 0.4% on average. According to various studies, this is because women tend to spend more time researching their investment choices. They tend to avoid trending stocks in favour of long-term, steady investments.

Below, five women who will speak at the Forbes Women’s Summit on 22 March in Sydney share the best piece of wealth or business advice they’ve received.

Sam White, founder of Freedom Services Group and Stella Insurance Australia

I’ve received some great advice throughout my entrepreneurial ups and downs. Arm yourself with as much ammo as you can, and by ammo I do mean knowledge. Knowledge in this world is key and will take anyone a long way – if you know how to use it effectively. With knowledge comes a clearer mindset, as businesswomen our mindset is the single most important factor for everything in life. When it comes to challenges and failures, remember it’s never as bad as you think it is. Nobody’s watching, so don’t assume that other people are judging what you are doing and be as confident as you can.

Maria Lykouras, Executive, JBWere

The best piece of wealth advice I’ve received is the real value of having your own financial adviser. We are inherently emotionally attached to our own money, which means it can be difficult to make rational and objective decisions. This is why it’s important to have the guidance of a financial adviser to help put in place a plan that is tailored to the specific goals that we set for ourselves, our businesses and our family. Great advisers hold us accountable throughout market condition fluctuations, major life or financial changes, with the goal of protecting and growing wealth.

Wendy McArthy AO, businesswoman, activist and former Chancellor of the University of Canberra

Probably the best advice I ever got was to be a homeowner. It was my mother’s instinctive advice. It fulfils a primal need and will be your base capital for the rest of your life if you manage it well. It provides security which can enable you to take risks when families change shape and shift. For me that was in my sixties when children had finished education and I had some disposable money. I became a cautious investor in businesses I understood. I invested in some of our cattle and began developing a balanced portfolio which as a widow now stands me in good stead.

Martina Crowley, Private Clients National Leader, PwC

The best time to start investing was 20 years ago, the second-best time is today. The advice was based on the Chinese proverb that “The best time to plant a tree was 20 years, the second-best time is now”. Building wealth is quite similar.

Michelle Battersby, co-founder and chief marketing officer, Sunroom

Jay Z’s famous line, “If you can’t buy something twice you can’t afford it,” lives in my head rent free and serves as a reminder to not live beyond my means. Of course, I don’t feel this applies to something like buying a home (and easy for Jay Z to say!) but it’s worthy of consideration in most other situations.

A mentor recently said to me “if you want advice ask for money, if you want money ask for advice”. The land of venture capital is such an interesting one. It feels a lot like dating at times and this piece of advice really stuck with me. The pressure is off when you’re asking someone for advice and you have a solid opportunity to give them an insight into your wins/challenges at the same time, which can be a really good building block for future investment.

These women will be speaking at Forbes Australia’s inaugural Women’s Summit event on the 22nd of March, presented by Nab Private Wealth. They’ll be joined by other influential women including; Miranda Kerr, Christine Holgate, Natasha Oakley and more, and will discuss how to break barriers in business, build wealth and make industry connections. You can see the full line-up and get your tickets here.