Microsoft delivered strong earnings, but it wasn’t enough to satisfy Wall Street during an unusually tense time for investors in big tech companies, as worse-than-forecasted results in its artificial intelligence business sent Microsoft shares spiralling.

Microsoft CEO Satya Nadella speaks at a May conference.

AFP via Getty Images

Key Takeaways

- The headlines were strong for Microsoft, which beat forecasts on the top and bottom line: Microsoft reported $2.95 diluted earnings per share in the three-month period ending June 30, checking in just above consensus analyst forecasts of $2.94, up 10% year-over-year, while its $64.7 billion in quarterly sales beat estimates of $64.4 billion, up 15% year-over-year.

- Yet, shares of Microsoft cratered about 7% following the earnings announcement, already nursing a more than 8% decline over the last three weeks.

- The slide came as growth in Microsoft’s crucial AI businesses was worse than expected, as its 29% growth in its Azure cloud computing unit fell short of projections of 31%, and sales in its AI-heavy intelligent cloud division was $28.5 billion, below estimates of $28.7 billion.

- Microsoft’s after hours share price of below $400 would be its lowest intraday level since May 2, while its 7% slide would be its worst day since October 2022, though after hours trading tends to bring more volatility.

Tangent

Last quarter was easily Microsoft’s highest-grossing one yet, trouncing the prior record of $62.02 billion set in the quarter ending last December and closing out Microsoft’s fiscal year with a bang. Microsoft’s $88.1 billion net income ($11.80 earnings per share) in its fiscal year stretching from July 2023 to June 2024 shattered last year’s previous record of $72.4 billion, while its $245.1 billion of revenue dwarfed 2023’s record $211.9 billion. The market’s reaction to Microsoft’s overall strong earnings is similar to that of Google parent Alphabet’s announcement last week, when its shares fell 5% despite a double beat.

Surprising Fact

Microsoft’s revenue during its 2024 fiscal year is roughly on par with the entire economies of Greece and New Zealand last year, according to gross domestic product, which measures the total value of all goods and services produced in a single country, quite the achievement for a company which traces its origins back to a 1960s high school computer club.

Key Background

A leader in all things technology for decades, the profitable but often plain Microsoft received a jolt over the last two years as analysts declared Microsoft the immediate winner in the artificial intelligence rave. Microsoft’s immediate profit boost from its cloud computing offerings—operating profits in its AI-heavy cloud unit rose about 40% from its quarter ending in June 2022 compared to last quarter—and broader positioning thanks to its equity investment in generative AI startup OpenAI helped send its stock soaring. Shares of the Washington-based firm are up more than 50% over the last two years, trouncing the S&P 500’s roughly 30% gain, sending Microsoft to a record market capitalization of over $3 trillion. Microsoft’s profits and sales both roughly doubled from its 2019 to 2024 fiscal years as the legacy technology company leaned heavily into the artificial intelligence wave, and it was none other than its AI-heavy intelligent cloud division, growing operating profits from $13.9 billion to about $50 billion in the five-year span, which drove that growth.

What To Watch For

Microsoft is a part of a flurry of technology giants reporting earnings this week, joined by Facebook parent Meta on Wednesday afternoon and Amazon and Apple on Thursday.

Tangent

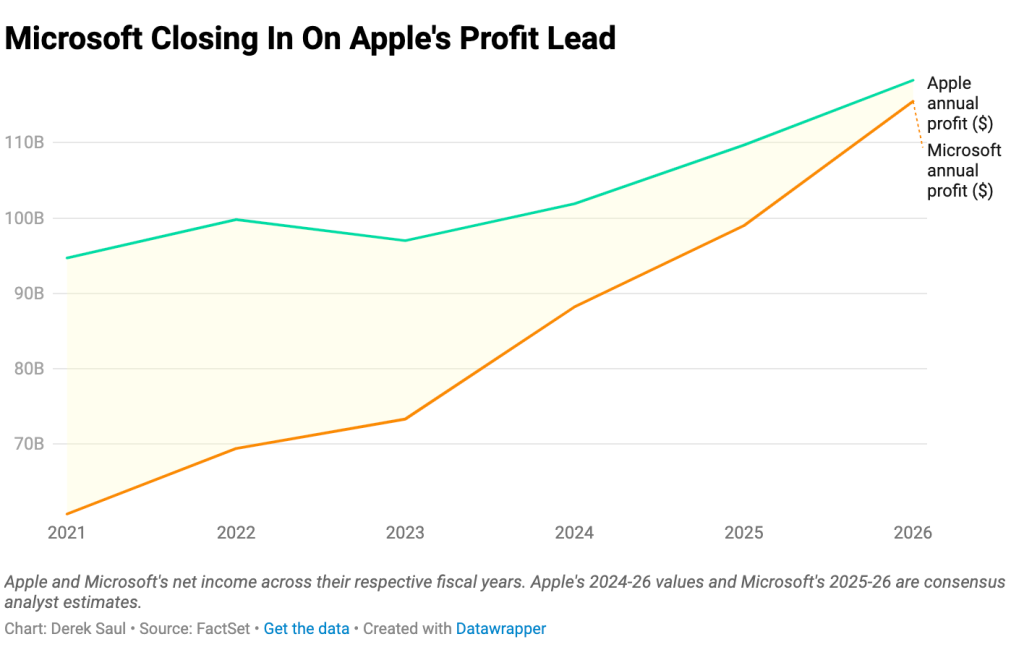

Microsoft is closing in on Apple as the U.S.’ most profitable company. Rivals dating back to the days of Apple co-founder Steve Jobs and Microsoft co-founder Bill Gates leading their respective companies as chief executives, Microsoft’s sub-$90 billion in profit during its 2024 fiscal year is well shy of Apple’s $102 billion projected profit during its fiscal year, but analysts project Apple and Microsoft to be roughly on the same footing by 2026, forecasting a $118 billion net income for Apple and $116 billion for Microsoft, according to consensus estimates compiled by Factset, a far cry from the more than $30 billion gap that separated the pair in 2022. Microsoft was last more profitable than Apple in 2010.

Are you – or is someone you know –creating the next Afterpay or Canva? Nominations are open for Forbes Australia’s first 30 under 30 list. Entries close midnight, July 31, 2024.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter hereor become a member here.