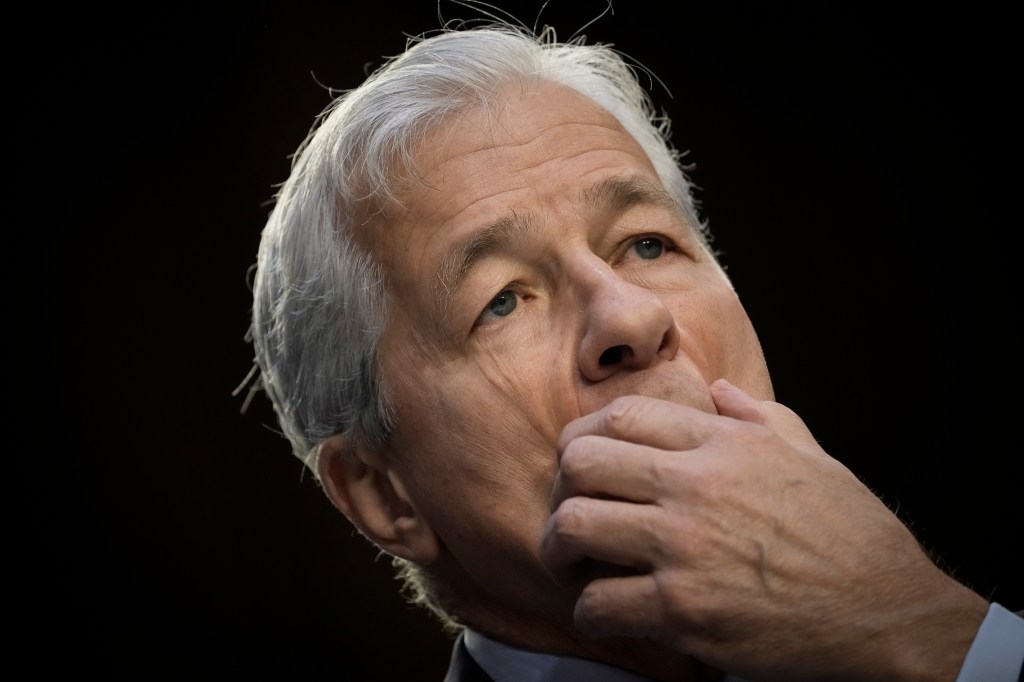

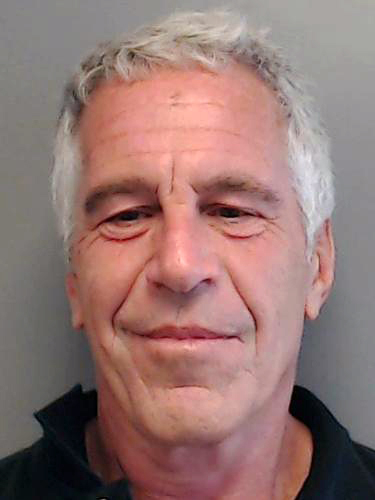

JPMorgan Chase CEO Jamie Dimon will sit for a deposition connected to two lawsuits over the bank’s ties to late convicted sex offender Jeffrey Epstein, according to multiple reports, though the billionaire executive’s connection to Epstein and his oversight of Epstein’s account at JPMorgan are unclear.

Key Facts

The deposition is reportedly related to lawsuits accusing JPMorgan of knowingly benefitting from Epstein’s sex trafficking operation, filed by an unnamed Epstein victim and the U.S. Virgin Islands, where Epstein owned an island and allegedly committed numerous sex crimes targeting underage girls.

JPMorgan has denied top figures like Dimon were aware of allegations against Epstein, instead placing the blame for its continued relationship and money lending to Epstein on a single former executive—Jes Staley—whom the bank sued earlier this month.

The Virgin Islands’ lawsuit claims a staffer’s 2008 internal email said the bank was expected to drop Epstein as a client and eliminate his $120 million portfolio “pending Dimon review” after Epstein pleaded guilty to soliciting prostitution from someone under the age of 18.

JPMorgan has insisted Dimon had no direct connection to Epstein or his account, but struck a deal for the CEO to appear under oath after the Virgin Islands asked a judge to order his deposition appearance, according to the Wall Street Journal.

The bank did not immediately respond to a request for comment from Forbes.

Tangent

Last week, a federal judge allowed the two lawsuits against JPMorgan to move forward, but dismissed several claims in the suits alleging JPMorgan participated in and facilitated Epstein’s abuse in addition to benefiting from it. The judge also greenlit a separate suit filed by the unnamed Epstein victim against Deutsche Bank, which worked with Epstein after he left JPMorgan.

Key Background

Epstein was a longtime JPMorgan client before parting with the bank in 2013—the same year Staley left the bank to become CEO of Barclays. In its suit against Staley, JPMorgan argued he was solely responsible for its continued relationship with Epstein and concealed a personal relationship the two had.

The bank also suggested Staley was aware of and perhaps even a participant in Epstein’s crimes, identifying him as the unnamed “powerful financial executive” and Epstein friend who was accused of sexual assault in the anonymous Epstein victim’s lawsuit against JPMorgan—a claim Staley denied. Speculation has persisted that other JPMorgan executives may have had more knowledge of allegations against Epstein than they have acknowledged, though.

A judge on March 9 ordered the bank to turn over a trove of documents connected to Dimon from 2015 to 2019 in response to the Virgin Islands’ lawsuit, though he did not state a reason for requesting the records—which came years after the relationship between Epstein and the bank ended.

The Virgin Islands has labeled Dimon “a likely source of relevant and unique information” about why Epstein remained a client after his first sex crimes conviction in 2008. Authorities said Epstein died of suicide in his jail cell in 2019 as he was awaiting trial for additional sex crimes in federal court.

Forbes Valuation

We estimate Dimon to be worth $1.6 billion. Dimon has run JPMorgan Chase—the nation’s largest bank—since 2005, leading it through the 2008 financial crisis.

This article was first published on forbes.com and all figures are in USD.