Sacrificing a percentage of your post-tax income for long-term goals can have immense impact on your long-range financial security. Is saving 20 per cent of each paycheque too much or not enough?

Almost 20 years ago, US Senator Elizabeth Warren wrote a book titled All Your Worth: The Ultimate Lifetime Money Plan. In it, Warren advises to use the ‘Balanced Money Formula,’ also known as the ’50/30/20′ plan. The budgeting tool is broken down as follows.

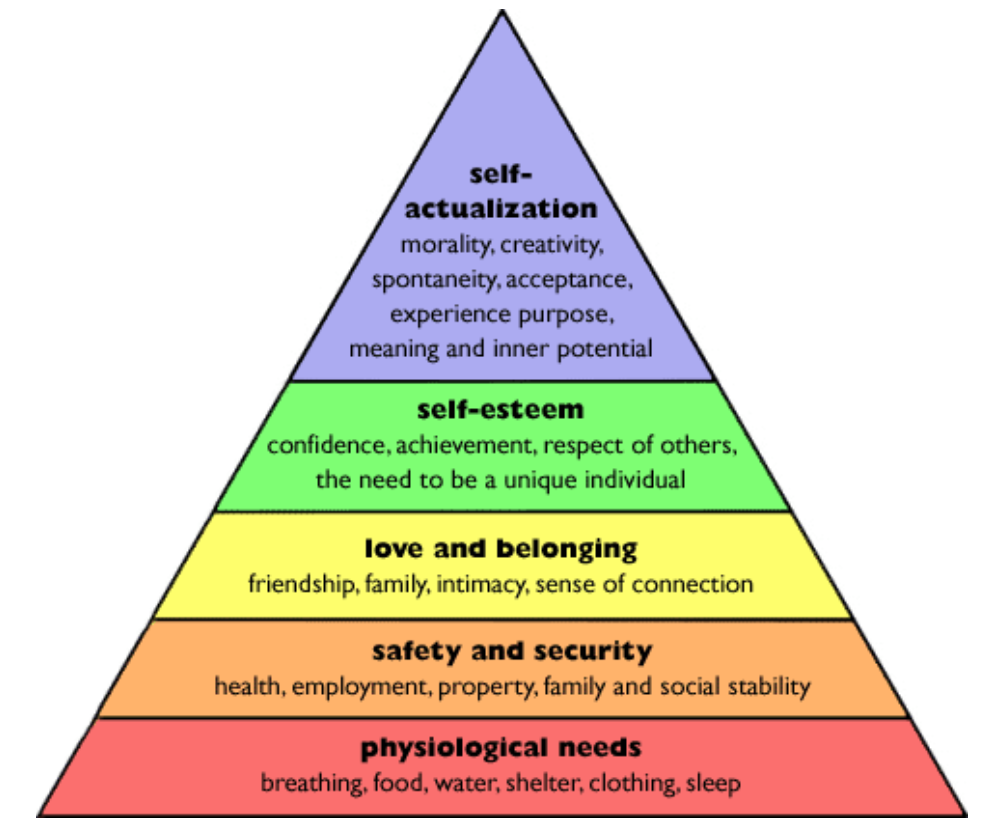

50 per cent of your post-tax income should go to ‘must haves‘ – ie, rent or a mortgage, transportation costs, food. Think the bottom two levels in Maslow’s Hierarchy of Needs: must haves are the things that you need for safety, security, and to meet your physiological needs for example shelter and sustenance.

30 per cent of your income should go to ‘wants‘ – the things in life that are not absolutely necessary, but are important (in moderation) for happiness and enjoyment. This category aligns with the middle category of Maslow’s hierarchy of needs: friendship, family, sense of connection. It also dips into the second highest level of the pyramid; self-esteem. The things you want can build confidence, and your hobbies and social time can fulfil the desire to be a unique individual.

20 per cent of the funds you bring home from work should go directly to ‘savings,’ according to Warren and co-author Amelia Warren Tyagi. Putting this aside enables a “simple automatic plan for saving a certain portion of your paycheque, every single month,” the authors state. Over time, monthly savings grow and you may be able to make investments that will benefit you in the long term.

The online training platform Upskilled advises that the 20 per cent you contribute to savings each pay check could result in a house deposit, financial investments, topping up your superannuation or making extra payments on existing debts. Savings can also be used as an emergency fund.

The advice from Australian banks and financial planners

The 50/30/20 plan is also endorsed by Australian banks ANZ, NAB, CBA, and Vanguard Australia.

CBA, Australia’s largest bank, also recommends techniques such as zero-based budgeting, to provide detailed control over your finances and the envelope system whereby cash for must-haves, wants, and savings is put into separate envelopes to prevent overspending.

Once you have saved enough to invest, first create a rainy-day fund to cover 3-6 months of living expenses, advises CBA. “This fund should cover essential costs like your mortgage, utilities, and food. Keep this fund in a high interest saving account to benefit from higher interest rates,” according to CBA.

Australia’s oldest bank, Westpac, advises that “budgeting isn’t something you do once and never visit it again. Perhaps you’ve found areas where you’re able to cut back more on expenses, allowing you to increase what you save or to pay off debt quicker.”

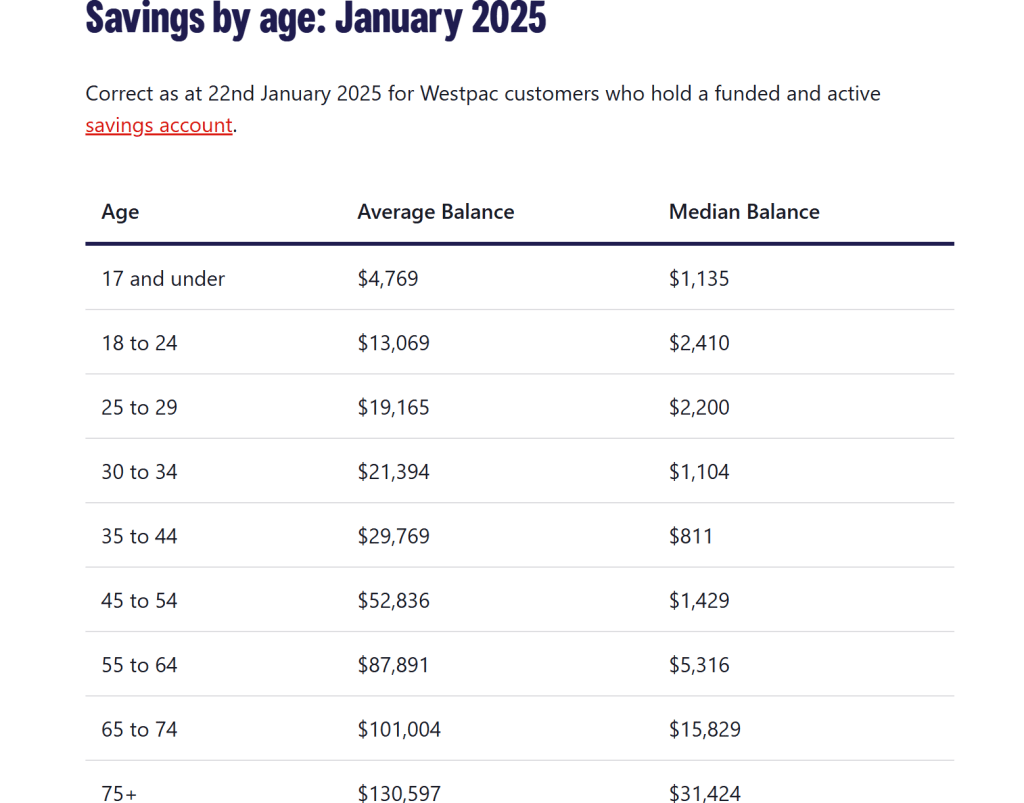

Westpac provides a breakdown of the average balance in its customers’ savings accounts, categorised by age. While this paints a picture of the savings held at Westpac, it doesn’t look at savings that Westpac customers hold at other banks.

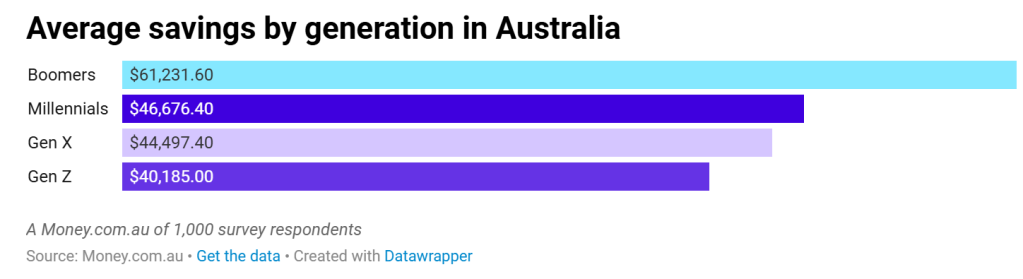

Money.com.au provides a more holistic picture and breaks data down by generation. Unsurprisingly, baby boomers have the highest average savings, given they have been earning money for the longest time, according to Money.com.au.

Millennials- currently aged 26 – 41- come in second, with an average of $46,676.40 in savings, beating their elder peers, Gen X, who have just under $45,000 on average.

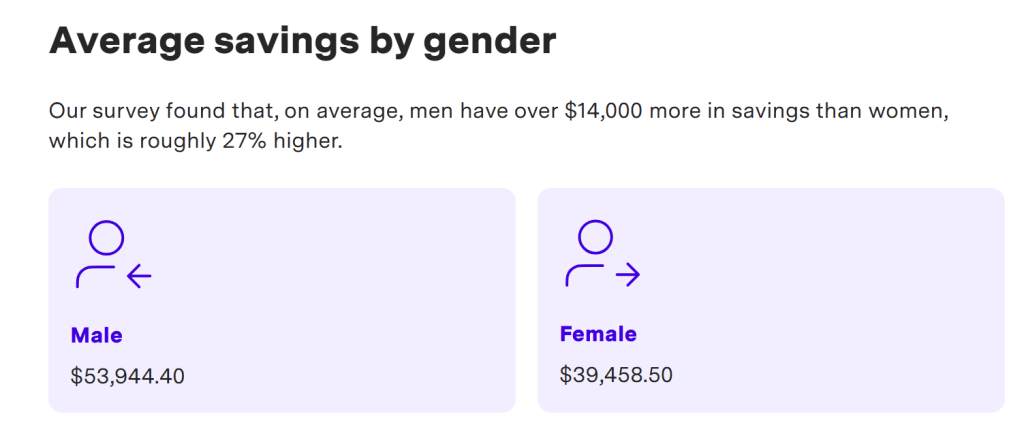

Other revelations from the Money.com.au survey show that men typically hold higher savings than women, and homeowners without a mortgage have the highest amount of savings, when compared to renters (the lowest amount of savings) and mortgage-holders.

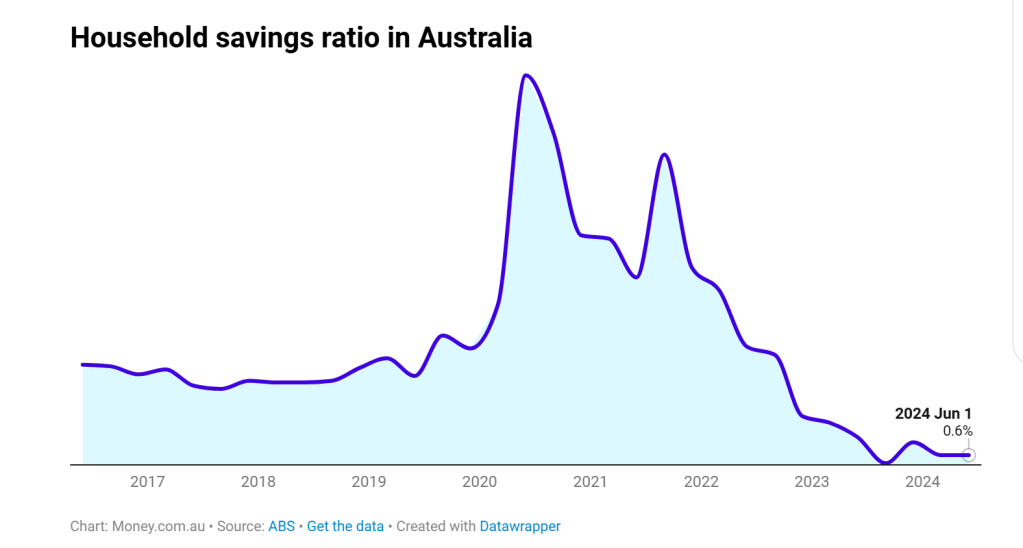

The data also shows that the savings levels of Australians have dropped considerably since Q4 2021 – a period of significant inflation and elevated cost of living.

All of this goes to show the necessity of saving to achieve long-range goals, and have something put aside for the inevitable rainy day.

Budgeting expert Jackie Matjasec, who founded The SImple Budget, agrees that setting aside 20 per cent of post-tax income will have long-term benefits.

“If someone has the capacity to save 20% of their income, it can absolutely lead to long-term financial stability,” Matjasec tells Forbes Australia. “But beyond just saving, I encourage people to think strategically—whether it’s offsetting mortgage interest, investing in index funds, or retraining for a higher-paying job.”

Rather than the 50/30/20 rule, Matajesec recommends that her clients who have low income or are unemployed use the zero-based budgeting approach.

“Many clients don’t have a consistent 20 per cent to put toward savings. Instead, I teach zero-based budgeting, where every dollar is assigned a job—whether for bills, lifestyle expenses, debt repayment, emergency funds, or savings goals. This ensures my clients make the most of their income, no matter how much they earn,” says Matajesec.

The benefit of having saved in retirement

Building wealth and paying off your home loan puts you in the best financial position for retirement, Australia financial planner Benjamin Brett tells Money.com.au. For those that can afford it, putting aside more than 20 per cent is advised.

“Like all things in finance, it depends on your personal circumstances. For lower income earners, 20% may be too much,” says Brett. “On the flip side, for higher income earners, you may be able to save a lot more. If your goal in life is to retire at a reasonable time and not be stuck with a mortgage forever, 20% may be a good starting point.”

Like Maslow’s hierarchy of needs, once the fundamentals of putting a roof over your head, and feeding and clothing yourself have been met, it leaves room to focus on other financial and non-financial needs.

“For some, the best investment isn’t just in a savings account—it’s in themselves,” says Matajesec. “Learning new skills or even starting a small business can increase earning potential and financial autonomy, allowing them to build a career they enjoy while securing their future.”

The top two tiers of Maslow’s hierarchy of needs are Self-actualisation and Self-esteem. The latter speaks to the benefit and confidence that an individual experiences from achieving goals. Many goals in life can only be achieved by forsaking short-term wants and instead investing in long-range, big-picture goals. The same is true when it comes to budgeting and personal finance.

Forbes Women is mobilising a network of female business owners, entrepreneurs and changemakers who support and empower each other. Become a member here.