The soaring price of Solana has increased the value of visible assets held by FTX to the point where they seem able to satisfy all of the claims that small investors have filed against the failed cryptocurrency exchange.

Solana’s price has nearly doubled in recent weeks

getty

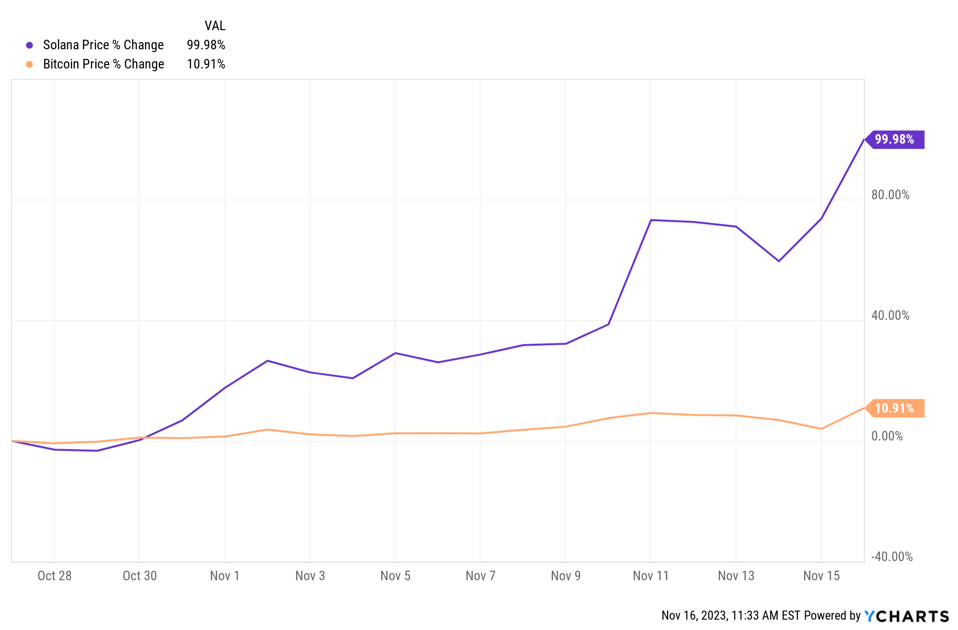

SolanaSOL has nearly doubled since Forbes calculated on October 27 that FTX had assets worth about $12.6 billion that could be used to finance the $14.8 billion of net customer claims. Along with an 11% rise in bitcoin, there is now approximately $1.8 billion more in the exchange’s coffers from those two tokens alone. FTX held about 59 million solana tokens and 21,482 bitcoins on August 31, according to data in a presentation filed as part of its bankruptcy case.

Solana Shines On FTX Customers

Rising cryptocurrency prices could aid clients whose funds are tied up in bankruptcy proceedings

Changes in prices of bitcoin and solana since October 27

YCharts

It also held $1.6 billion worth of other major cryptos, which if they rose in line with the rest of the market’s 27% rally added about $460 million more likely providing enough money to make small FTX customers whole. Investors who pulled out more than $250,000 in the days leading up to the exchange’s failure last year are subject to a 15% clawback of those funds.

Even if there are enough assets to pay back investors, a looming question is whether the U.S. Internal Revenue Service will spirit away the exchange’s assets. The IRS has asserted that FTX owes it $44 billion in a way that would give the agency precedence over other creditors, but the number seems to be inflated and secondary-market prices for customer claims indicate investors do not think they will be preempted.

A second issue is where the Securities and Exchange Commission stands on FTX sales of cryptocurrencies, many of which it considers to be unregistered securities. The agency previously sought to halt similar transactions by Voyager Digital and was overruled by the judge in the failed brokerage’s bankruptcy case, though the sales were eventually canceled for other reasons. It is possible the agency will attempt to intervene in the higher-profile FTX case.

FTX amassed its solana holdings under founder and former CEO Sam Bankman-Fried, who saw the currency as a faster rival to ether in processing transactions.

Rising prices for digital assets since the depths of the Crypto Winter decline last year are also complicating the Genesis bankruptcy case. As part of a joint program called Earn, Genesis posted collateral to protect customers of the Gemini exchange who were paid as much as 8% on capital used to make loans. The collateral was in the form of shares in the Grayscale BitcoinBTC Trust, some of which Gemini foreclosed upon last year and the rest of which it is trying to obtain in a messy court battle.

Because of bitcoin’s rally and the narrowing of a discount to the bitcoin price, the trust shares have risen 223%. Genesis and Gemini are battling over whether the collateral should be valued at last year’s depressed price or the current value, with the outcome potentially affecting recoveries for other creditors.

This article was first published on forbes.com and all figures are in USD.