Funding for female founders rose from 11% of deals in Q2 to 13% in Q3. But it’s still down significantly from 2023. Techstars managing director Kirstin Hunter and Flying Fox Ventures’ Rachael Neumann say companies founded by women are not getting the resources they need to be successful.

Cut Through Venture’s Q3 funding report reveals that male founders have received 87% of fundraising cheques cut so far this year. The statistics paint a dismal picture of the funding landscape in which female founders find themselves.

“The Q3 report shows a slight increase in funding for teams with at least one female founder – 13% – up from the Q2 update which showed that this number had dropped to 11%, the lowest level since 2019. While 11% to 13% is directionally a good thing, it is still an appallingly low figure,” says Kirstin Hunter, the managing director of Sydney’s Techstars accelerator.

Flying Fox Ventures founder and prominent Australian VC Rachael Neumann has deep concerns about the gender funding gap.

“It’s emblematic of the “concrete boots“ we are giving our female founders and asking them to run the same race. We are holding them accountable to the same outcomes in the same time frames but starving them of sufficient resources to get there,” Neumann tells Forbes Australia.

In 2023, 23% of funding went to founding teams with at least one woman founder, significantly higher than 2024’s current statistic of 13%. Hunter says she would like to see significant increases in funding going to all-women teams. Only 5% of deals undertaken in 2023 went to companies without a male founder. So far this year it is even worse.

“The challenge in using raises by mixed-gender teams as the key measure – particularly where a small number of high-value raises can really move the dial – is that even this low number masks the true gender imbalance in the ecosystem,” says Hunter.

Finding the median: the size of the round matters too

Not only is there a disparity in the number of deals made to male and female founders, but there is also inconsistency in the value of the raises.

“When female founders do get funded, their round size is a fraction of what their male counterparts are raising,” says Neumann. “This year to date, the median round size for all-male teams is $3 million, it drops down to $2.7m for mixed teams, and $2m for all female teams.”

Last year, those statistics were lower: $3 million for all-male teams, $1.5 million for mixed teams, and $700,000 for all-female teams.

Flying Fox runs a female-focused founders program supported by LaunchVic, and currently invests 38% of its funds in female founders. The VC firm recently instituted an innovative additional funding method to combat lower round sizes.

“We have launched a female sidecar fund which acts as a ‘top-up’ to increase the cheque size we write into companies with a female founder, ideally giving them the fuel to go the distance,” says Neumann.

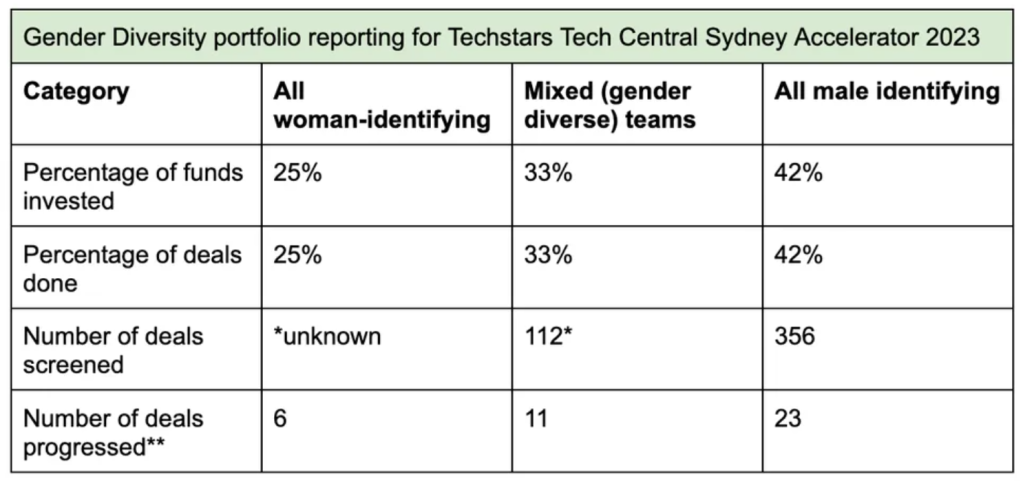

Techstars Sydney is also innovating to get more female founders into the funding pipeline.

“Ninety per cent of the companies we presented to our Screening Committee had at least one woman founder, which led to 10/12 of the companies that made the accelerator having at least one woman founder,” says Hunter.

“We have just completed Mentor Magic (in which we introduced our founders to 60 mentors who had 15 minutes with each of the 12 startups – 720 total meetings over 2 weeks) and the overwhelming feedback from mentors was a) they’d never seen an accelerator cohort of such high calibre and b) they’d never seen an accelerator cohort with so many women founders,” says Hunter.

The Cut Through perspective

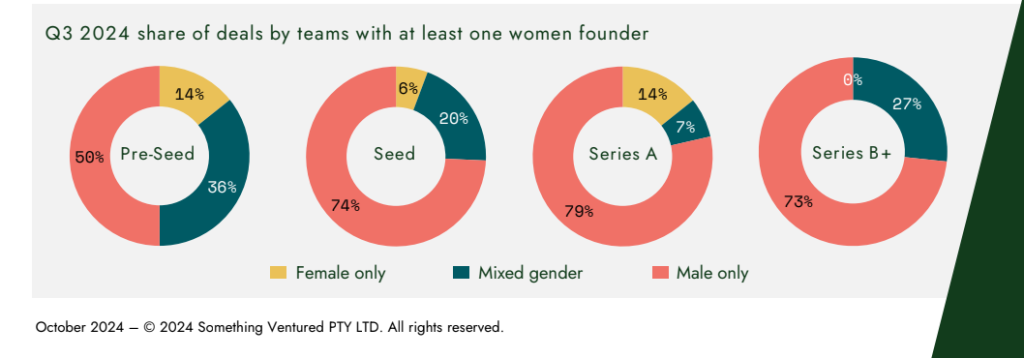

Cut Through’s Q3 report segments funding into pre-seed, seed, Series A and Series B.

“Outcomes for female founders at the Pre-Seed stage remained encouraging, with participation hitting a record level for the second consecutive quarter, making up 50% of reported deals. At the Seed stage, representation also reached a five-year high. Additionally, 54% of accelerator funding rounds included female founders,” the report reads.

Seventy-nine per cent of Series A funding went to teams with male-only founders. Interestingly, 14% of Series A funding went to female-only teams in Q3, a hopeful sign.

Yet there were no Series B+ raises that went to female-only teams. Twenty-seven per cent of Series B+ deals went to companies with mixed-gender teams over the last quarter.

The (current) benchmark: 27%

Twenty-seven per cent is a number Hunter keeps top of mind.

“The proportion of women founders in the Australian ecosystem was estimated to be 27% in last year’s Startup Muster report,” she says.

Hunter challenges the Australian VC community to rise to the 27% task, a benchmark Techstars far exceeds.

“Unless you believe that men are better entrepreneurs than women (despite the data saying otherwise) if a fund has less than 27% of women founders (i.e. not just businesses with at least one woman founder) in their portfolio, they are suffering from bias in their investment decisions. That bias will likely come at a cost to their Limited Partners in future returns.”

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.