Never mind the recent rally, for a decade the crypto industry has been selling the promise of decentralisation, a new financial system without middlemen, but many blockchain projects have recreated the very elements they tried to overthrow, and regulators are adamant about keeping the status quo.

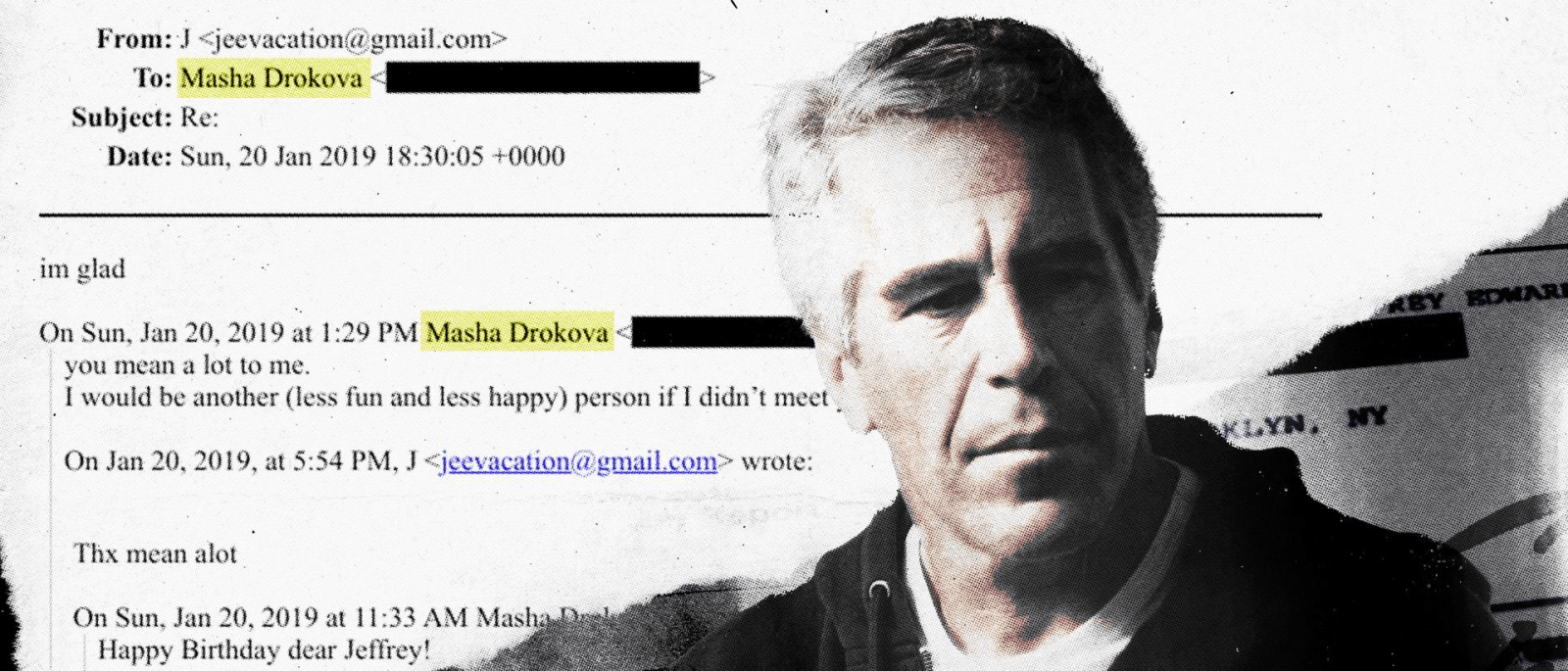

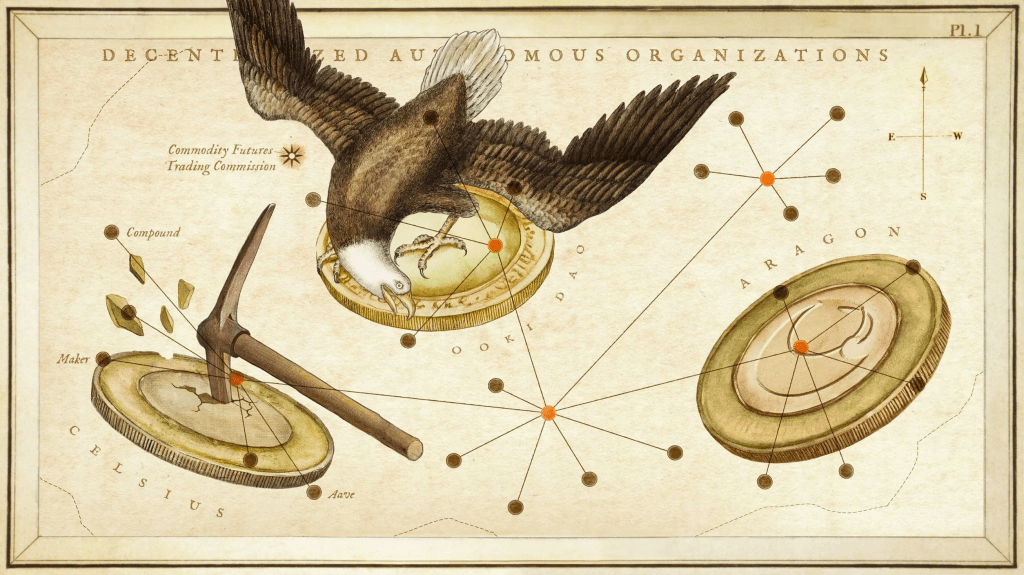

On November 2, holders of a cryptocurrency called the Aragon network token were told they were being cashed out of their investments, like it or not. The tokens were issued by the Aragon Association, a Zug, Switzerland-based non-profit entity that writes software that helps run 7,500 decentralised autonomous organizations (DAOs) managing a staggering $25 billion in crypto assets.

Aragon also started a DAO of its own with the lofty if quixotic goal of creating a court system to settle disputes in the online world, and holders of ANT, as the token is known, would be eligible to be the jurors.

The concept caught the eye of crypto-friendly venture-capitalist Tim Draper, whose Draper Associates bought $1 million worth of the tokens in February 2020 but has since cashed out.

Tim Draper said on Twitter at the time that this “new form of governing from Aragon” was “very exciting.”

It still may be, but the ANT holders are not going to be part of it. They’re getting kicked to the curb as the Aragon Association, a standard-bearer for decentralised finance, did a very centralised thing: it unilaterally decided to put its assets beyond the reach of corporate activists.

A group that included hedge fund Arca Investments wanted to close the gap between the approximately $200 million that Aragon had in assets in early May and the $123 million market value of ANT, trading at just over $3 a token at the time and $2 just two months prior.

Arca did not respond to a request for comment sent via its website.

Fearing investors could eventually control more than 50% of the votes, the association offered a take-it-or-leave it buyout of 0.0025376 ether, about $5.76, and holders have 12 months–until November of this year–to cash in.

The deal will see at least $11 million and possibly much more go to a successor not-for-profit company set up by Aragon. The Aragon Association did not respond to requests for comment.

There may yet be more to the story. Disgruntled ANT holders managed to get hold of $300,000 in the DAO and have used it to retain a law firm to potentially oppose Aragon’s strategy.

‘Decentralisation is a means to an end, not the end itself.’

Anthony Leutenegger, CEO of Aragon X

If all of this seems like the height of 1980 corporate raider culture on Wall Street, that’s because it is.

Aragon’s story illustrates that decentralisation of finance and governance, where decisions are made by large numbers of individuals instead of a handful of large organizations, might be nothing more than a utopian pipe dream.

Decentralisation is “what you have to do if you are in crypto to attract new investors and get more legitimacy,” says Camila Russo, founder of decentralised finance-focused publication The Defiant.

Much of the crypto business just mimics what already exists in traditional finance but with an alluring high-tech narrative.

Founded in 2016, the Aragon Association was meant to be a “token-governed digital jurisdiction,” according to its white paper, a kind of constitution for crypto projects.

It aimed to create a “decentralised court” to manage user conflicts beyond what is programmable into smart contracts, the self-executing agreements that are the basis for decentralised finance.

Clients for its management software included Lido, the dominant crypto-staking service, and metaverse provider Decentraland.

The association raised $25 million through the sale of the ANT token in May 2017, followed by a manifesto that declared it would create free, open-source technology to allow the management of DAOs as part of its “fight for freedom.”

But it wasn’t until January 2023 that the Aragon DAO was launched, with the intention that it become the organization’s governing body and keeper of its funds–including the proceeds of the ANT sale, which still were held by the association.

Throughout that year, the goal was to slowly move the assets to the DAO, says a source familiar with the inner workings of the organization. “There was pressure both internally and externally to be a DAO building technology for DAOs.”

Ironically, the provider of voting technology for decentralised organizations found that complete decentralisation was not necessarily efficient.

“We’re so fixated on this one avenue of trying to decentralise,” says Anthony Leutenegger, CEO of Aragon X, a new company made up of the DAO’s development team. “Decentralisation is a means to an end, not the end itself.”

Leutenegger says Aragon X will be restructuring into a traditional Switzerland-based not-for-profit company in November when the redemption period for the ANT tokens ends.

He said his team was not part of the Aragon Association board and could not address the legalities of the DAO dissolution.

The company’s rationale for forcing out the ANT holders was that Swiss law required it.

Describing the activists as “a coordinated group,” the association said in a May 9 blog post, “Evidence indicates that their involvement is aimed at extracting value from Aragon for financial profit. The Aragon treasury was established with the explicit mission of supporting builders to advance decentralised governance infrastructure.”

The intention was to make ANT a utility token under Swiss regulations, with the stated purpose of “providing holders of the token permissionless, trustless, and censorship-resistant decentralised governance participation in working towards the mission of the Aragon project.”

Turn the social mission into a profit-making enterprise, Aragon contends, and that could “result in regulatory enforcement actions.”

For its part, Arca said in an open letter that while Aragon’s goals are “ambitious and noble” that “in order to unlock future utility and governance value, there must be recognition of the financial value or risk dissolution.”

It proposed Aragon buy ANT tokens to drive up their price, similar to a stock repurchase in the equity market.

Arca ended up getting the buyback it sought but found the terms “bittersweet.” The deal provides $11 million to fund a new not-for-profit that will take over the DAO’s intended position, but if any ANT is not tendered by November, it becomes worthless and Aragon keeps the funds.

Arca reckoned in a November posting on its website that 25-35 percent of the outstanding tokens would not be redeemed, leaving $43.5 million to $61.4 million of assets for the new company.

Over half of the ANT tokens, about 17.4 million, had been handed in so far, according to data from DuneAnalytics.

The dustup with Arca came just after the Aragon Association transferred the first funds to the Aragon DAO, totaling $300,000.

Remaining ANT holders opted to engage Patagon Management, an investment firm with a track record of litigating against DAO founding teams and grant it the $300,000, with an eye to undertaking negotiations with or legal action against Aragon.

ANT tokens taken from the DAO were “being taken at the direct expense of investors with no legal basis,” Patagon, which did not respond to requests for comment, posted on X. “It is in our opinion papered over, beautified theft.”

Decentralisation has been the driving philosophy for thousands of entrepreneurs and developers since the introduction of bitcoin, the first cryptocurrency, in 2008.

Satoshi Nakamoto, its mysterious creator whose identity is disputed, envisioned a peer-to-peer payment system that would rely on cryptographic proofs to validate transactions, replacing intermediaries like banks and brokers.

That concept gave rise to an entire industry, with crypto now worth almost $1.7 trillion, that relies on distributed ledgers to exchange, trace and establish ownership of assets including everything from physical assets like precious metals and real estate to digital money itself.

Companies like JPMorgan, Samsung and Tencent use the underlying blockchain technology in supply-chain management, data security and digital-identity verification.

As recently as 2021 and 2022, at the peak of crypto’s latest bull run, venture-capital investors poured nearly $50 billion into the blockchain-based economy, according to PitchBook.

How did these companies end up with more liabilities or debt than they could handle in the first place? The simple answer is they offered enticingly high yields.

“Parties agreeing to conduct transactions openly and transparently on the blockchain, as opposed to backroom deals by opaque, human, potentially-conflicted financial actors, is the vision we should be striving for, rather than clinging on to inefficient centralised financial systems,” wrote Dan Morehead, founder and managing partner of blockchain-focused hedge fund Pantera Capital, in a July 2022 letter, contending that decentralised finance, or DeFi, offered better protections to investors than centrally managed companies.

At about the same time, however, crypto brokerage Voyager and digital-loan company Celsius, filed for bankruptcy amid the collapse in cryptocurrency prices that disrupted their business models.

Morehead considers the failures to be a strength of DeFi–in the case of Celsius, for example, the business was forced by smart contracts to pay down loans to lenders to preserve collateral–but an opposing view would be that inflexible automated agreements that do not allow for changing conditions are no way to run an industry.

How did these companies end up with more liabilities or debt than they could handle in the first place? The simple answer is they offered enticingly high yields.

At the time when banks and their newfangled neobank rivals offered 4-5% rates on high-yield savings accounts, DeFi lenders paid as much as 20%.

But a series of hacks and crises in both DeFi and the broader industry, culminating in the collapse of Sam Bankman-Fried’s FTX in November 2023, rattled investors.

The amount of crypto held in DeFi projects now rests at $54.7 billion—below that of a mid-sized regional bank—compared with a peak of about $179 billion in November 2021, according to data aggregator DeFi Llama.

While the decline can be mainly ascribed to the drop in crypto prices, it also is the true that increased interest rates on low-risk assets such as Treasuries as governments withdraw pandemic-related support to their markets are diminishing the appeal of DeFi.

A bigger issue is that the decentralisation concept seems better in theory than practice. One reason is that blockchain projects can be hijacked if a single entity or a group of allies controls more than half of the computing power or rights to validate network transactions.

In this scenario, known as a 51 percent attack, bad actors could prevent new transactions or reverse settled ones, or they could send the same tokens to multiple recipients, which potentially would be fatal to the entire blockchain.

Aragon suggested that something similar occurred when it transferred its first batch of ANT tokens to its DAO, saying in its May 9 blog post that it had suffered a “coordinated social engineering and 51% attack.”

This is not exactly the same as such an attack on a blockchain because DAOs are meant to be governed by their token holders, but Aragon’s decision to take matters into its own hands to satisfy what it sees as legal requirements shows how real-world concerns can limit pure decentralisation.

“Full decentralisation in DeFi is illusory,” wrote economists at the Bank for International Settlements (BIS) in a 2021 review of the industry. “DeFi platforms have an element of centralisation, which typically revolves around holders of ‘governance tokens’ (often platform developers) who vote on proposals, not unlike corporate shareholders.”

Decisions on major DeFi projects typically do not pass without support from their founders and financial backers, Andre Cronje, founder of Yearn.Finance, a yield farming robo-advisor, told Forbes in 2022. “As much as there is talk of decentralisation, unless it is back-channeled there will be no approval.”

That year, researchers from the University of Luxembourg did a study on tokenised voting at nine big DeFi projects and discovered that rights “are highly concentrated,” and their exercise “is very low.”

Unlike voting for common stocks, there is no mandate to notify token holders of upcoming votes, and for those who store their DeFi tokens on exchanges like Coinbase there isn’t even a mechanism to allow voting.

“DeFi has evolved in a much more centralised way than expected,” says The Defiant’s Russo. “You see this centralisation in governance (usually a small team making most of the decisions), in the distribution of token ownership—most tokens are owned by teams and a few VCs. Then there’s kind of a technical centralisation, like the presence of backdoors in smart contracts.”

But “this theater of decentralisation is not necessary,” she adds. “I think everyone can understand that there’s a progression towards this decentralisation ideal” and that “you can’t be fully decentralised from the start. I would just push for all of these protocols to be more upfront about their degree of centralisation. There’s a way to grow in a more transparent way.”

Lawmakers and regulators are adding to DeFi’s woes.

In June, a U.S. judge granted a default judgment in favor of the Commodity Futures Trading Commission (CFTC) against the decentralised collective Ooki DAO, ruling that it was a “person” under the law and was therefore liable for illegally operating a trading platform and unlawfully acting as a futures dealer.

The organization was ordered to pay $643,542 and shut itself down.

“The founders created the Ooki DAO with an evasive purpose and with the explicit goal of operating an illegal trading platform without legal accountability,” said Ian McGinley, the CFTC’s enforcement director. “This decision should serve as a wake-up call to anyone who believes they can circumvent the law by adopting a DAO structure, intending to insulate themselves from law enforcement and ultimately putting the public at risk.”

None of the DAO members have responded to the summons nor appeared in court, and the founders of predecessor organization bZeroX–identified in a default judgment as Tom Bean and Kyle Kistner–have not responded to a request for comment.

Multiple friend-of-the-court briefs filed on Ooki’s behalf argued that DAOs should not be treated as a singular entity.

“The reason why the amicus effort was so important is that if a DAO member steps up and says ‘Hey, I’m a member of the DAO, I want to defend this,’ they’re putting themselves in the crosshairs,” says Gabriel Shapiro, a lawyer who was involved in filing one of the briefs in support of Ooki.

More importantly, he adds, “100% of DeFi would be illegal under CFTC’s reasoning. Why? Well, pretty much all of DeFi involves margin, financing or leverage.”

Beyond DAOs, authorities have also gone after open-source software like crypto mixer Tornado Cash, which enables users to conceal digital transactions.

In August 2022, the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) sanctioned the service, claiming that it had been used to launder more than $7 billion worth of virtual currency since its creation in 2019, including $455 million allegedly stolen by North Korean hackers.

A few days later, Dutch authorities arrested one of the alleged founders of Tornado, Alexey Pertsev, on money laundering charges. He remains in the Netherlands, where his trial is scheduled for March.

The following year, U.S. prosecutors charged two more Tornado developers, Roman Semenov and Roman Storm.

While Semenov is at large and believed to be in Dubai, according to blockchain analytics firm Elliptic, Storm is under house arrest at his Washington home, Coindesk has reported. His trial is set for September.

On January 22, Storm posted a video on X in which he asked for donations that would help fund his and Pertsev’s defense. “My legal team and I are going to put forth a strong defense at trial, not just for my family’s sake, but for the future software developers and financial privacy,” said Storm.

The campaign titled “Open Source Is Not A Crime” has already raised more than $500,000. Storm and Semenov have not responded to requests for comment.

Here too, the industry pushed back.

“OFAC’s action sets a dangerous new precedent that drastically exceeds their authority and jeopardizes law-abiding Americans’ right to privacy,” said Marisa Coppel, senior counsel at the non-profit Blockchain Association, in a statement accompanying the organization’s second amicus brief in support of Tornado Cash. “OFAC must see Tornado Cash for what it is: a tool that can be used by anyone. Rather than sanctioning a tool with a lawful purpose, OFAC should remain focused on the bad actors that misuse such tools.”

Despite the internal setbacks and regulatory pushback, decentralised systems remain popular in the crypto world.

Decentralisation has been more of “a means to an end—what can you do as a developer building on these new platforms that you couldn’t have done before?” asks Austin Green, cofounder of blockchain governance platform Llama.

After all, “the only way to arrive at the best organizational structures is to try a lot of different things and see what works and what doesn’t.”

Will Papper, cofounder of Syndicate, an infrastructure provider for blockchain-based internet products, says, “Looking at it over a very long-term timescale, the decentralised tech will always be less efficient and less usable than its centralised counterparts. At the end of the day, storing data on one system that is trusted, like the database, will always be more efficient than storing data on 10,000 nodes that are widely distributed.

“But if we harness the benefits of this, we will get to the point where I think the downsides become less noticeable and the upsides become much more present. If we do encode certain guarantees, like the ability to not change fees overnight, then we’ve created a better world.”

This article was first published on forbes.com and all figures are in USD.