Bitcoin last week surpassed $69,000 for the first time in its tortured 15-year history. The milestone comes 848 days after its previous peak on November 8, 2021. During the ensuing months and years, the industry dealt with a harsh bear market that caused the asset’s price to drop by more than 80%, leading to more than $2 trillion in value being wiped out from the total crypto market.

Bitcoin’s bull run has investors now looking further afield from greater gains

getty

Today, bitcoin’s price is being buffeted by ten spot exchange-traded funds (ETFs) offered by the likes of BlackRockBLK, Fidelity and InvescoIVZ, which have collectively brought in more than $7.5 billion in new money to crypto.

“BitcoinBTC has bear and bull cycles that are idiosyncratic with the rest of the market,” says Nathan McCauley, CEO and cofounder of crypto custodian Anchorage Digital. “Many people who may have been interested in taking a position in bitcoin over the last decade were unable to until the ETFs came out.”

Bitcoin poked its head above $69,000 for the first time this week

TradingView

Bitcoin’s surge begs an important question for investors: Will this remain a bitcoin story, or will other digital assets or so-called “use cases” rise to the forefront? The crypto bulls are hoping that the market will soon transition to another “alt-season.” This occurs when investors roll profits made from core crypto assets such as bitcoin and ethereum into more speculative tokens like solana, celestia and chainlink, with increased levels of volatility but potentially higher gains.

In 2017, funds moved from bitcoin into ethereum and other all-in-one blockchain platforms such as CardanoADA and PolkadotDOT. During the Covid surge in 2021 money moved into NFTs and even more speculative decentralized finance tokens such as uniswap, compound and aave. In fact, these DeFi tokens, rose by an average of almost 600% during the first stretch of the Covid bull run from August 2020-May 2021. Bitcoin increased by nearly 470% over the same period.

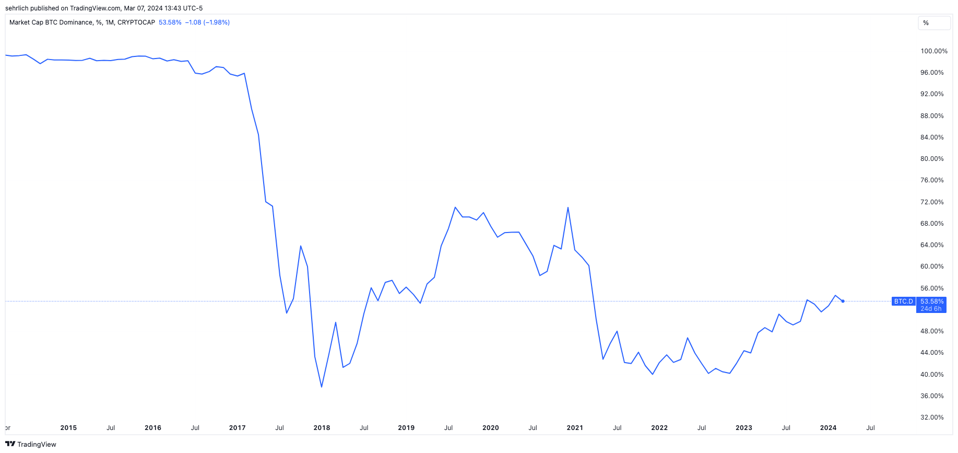

When crypto euphoria spreads beyond bitcoin, investors tend to pay attention to a metric known as bitcoin dominance, which measures the percentage of the total crypto market capitalization made up by bitcoin. This figure has hovered around 50% since the ICO boom of 2017, but when demand heats up for alternative tokens, it can fall to below 40% as it did in January 2022, a few months before the collapse of blockchain TerraLUNA and its stablecoin luna sparked a crypto crash. Currently, the bitcoin dominance level is holding steady at 53%.

Bitcoin’s dominance is staying above 50% for now

TradingView

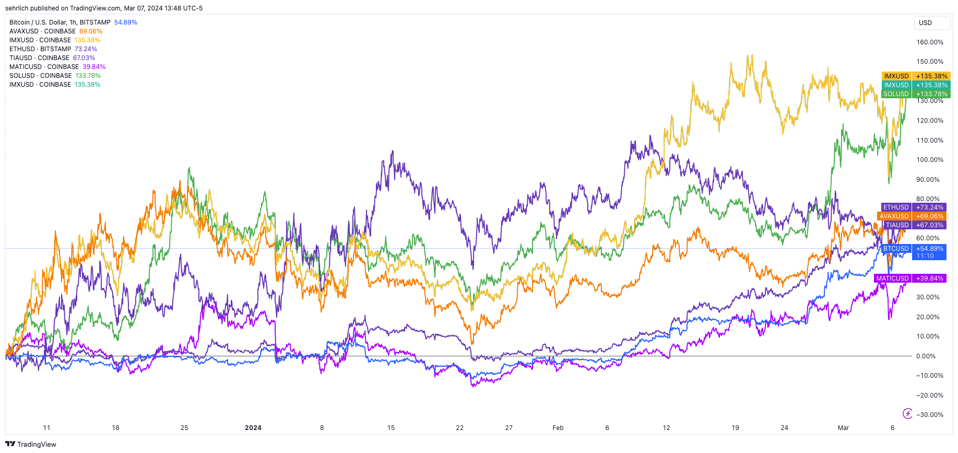

“The technology tokens are underappreciated right now,” says Kavita Gupta, founder of the $120 million Delta Blockchain Fund, which invests in early-stage crypto companies. “EthereumETHETH, solanaSOL and polygonMATIC have rallied some, but they are nowhere near their all-time highs.” In the last three months, ethereum is up 60%, while ethereum blockchain clone solana has nearly doubled in price. Polygon, which allows developers to build multiple blockchains from ethereum, has gained about 33%. Other altcoins that have rallied include, immutableX, a blockchain platform focused on gaming applications, which is up 118% since late December, and avalanche, an ethereum competitor that is making strong inroads in putting real world assets on blockchain. This token is up 63% in the last three months.

Altcoins are starting to move past bitcoin

TradingView

Despite these gains, overall crypto valuations are still below 2021’s euphoric highs. For comparison, in November 2021 the entire crypto token ecosystem was worth $3 trillion, today it is less than $2.5 trillion. And despite crypto’s drubbing since early 2022, the number of digital assets has expanded. Today there are 13,000 tokens trading compared to 5,600 at the peak of the market.

Nico Cordeiro, chief investment officer at the $50 million crypto hedge fund Strix Leviathan, is sitting on a portfolio brimming with speculative altcoins. “We expect to see another big alt-run,” enthuses Cordeiro. “Bitcoin ETFs are a big driver of this price movement, but crypto is much wider than just bitcoin and ether.” One area Cordeiro finds particularly interesting is platforms that let users move tokens between blockchains. This is especially useful for developers who do not want to be siloed into one specific chain. It is far more efficient to build one application that can run on multiple blockchain platforms simultaneously. Interoperability protocols provide that connective tissue. For example, decentralized exchange UniswapUNI uses these tools to branch its platform from Ethereum to other chains such as Binance’s BNBBNB chain. Leaders in this specialty include celestiaTIA, which is up 70% in the last three months, and thorchain, which is trading nearly 50% higher than it was one month ago, according to CoinGecko.

There is an army of speculators like Cordeiro eager to see a reinflation of the crypto bubble, but some smart industry veterans believe that the recent introduction of fully registered and regulated exchange-traded funds has changed the game. “I believe that bitcoin ETFs will dampen this trend [rolling profits into altcoins] over time because bitcoin is in an ETF,” says Alex Thorn, head of research at Galaxy Digital, the $4.6 billion firm headed by billionaire Mike Novogratz. “This is particularly true if it’s an advisor-managed account, which is likely to be much stickier than bitcoin on an exchange and not easily rotatable into other coins.”

In other words, as Main Street investors and institutions move into bitcoin, and eventually ether, via ETFs, they will do so via traditional intermediaries, like financial advisors. That creates more friction when it comes to speculative crypto trading. “If an ether ETF is approved, the funds would still be stuck in client accounts. This development might even be a bigger detriment to the remaining liquid crypto coins,” says Thorn.

Molly White, crypto critic and proprietor of the website “Web3 Is Going Just Great,” is even more adamant in her warning to investors considering trading into risky altcoins. “I don’t think much has changed since the last [time cryptos were at] all-time highs that would prevent the same sorts of crises from happening again,” says White. “In 2021, there was all this talk about NFTs, how Web3 would be the future of the web, and all of these narratives about how there was so much potential in blockchains and the associated technology. That’s missing this time, but once the new money coming into bitcoin dries up, I think the crypto industry will try to come up with those narratives as best they can to bring in retail investors.”

With a potential ether ETF not expected until late May, all eyes remain on Satoshi Nakamoto’s brainchild, bitcoin. The next key event for traders and bitcoin miners will be bitcoin’s halving next month, a once-in-every-four-year occurrence when the issuance rate of bitcoin is reduced by 50%. This process will continue until the year 2140, when the 21 millionth and final bitcoin is mined. At the same time, more wealth management firms are starting to put the new bitcoin ETFs onto their platforms. Recently Wells FargoWFC and Bank of America’sBAC Merrill Lynch began allowing clients to invest in these products. Morgan StanleyMS is reported also to be evaluating bitcoin ETFs for its clients.

Technology analyst and newsletter editor Jon Markman of Seattle’s Markman Capital Insight thinks bitcoin could enjoy a surge of interest from institutional investors with lagging portfolio performance in the current market. “Professionals are going to be itching to catch up. Those who have been in cash did not expect the market to go up, and bitcoin is a good way to get that added exposure,” says Markman.

Another crypto bull, Cathie Wood of $13 billion Ark Invest, believes that each new investment will have a disproportionate impact on the price of bitcoin. “There are 19.6 million bitcoins, and the highest that they will ever go is 21 million,” said Wood during her recent podcast. “There is a real scarcity value. This price increase for every institutional dollar coming in now is much higher than a year or two ago.”

This article was first published on forbes.com and all figures are in USD.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.