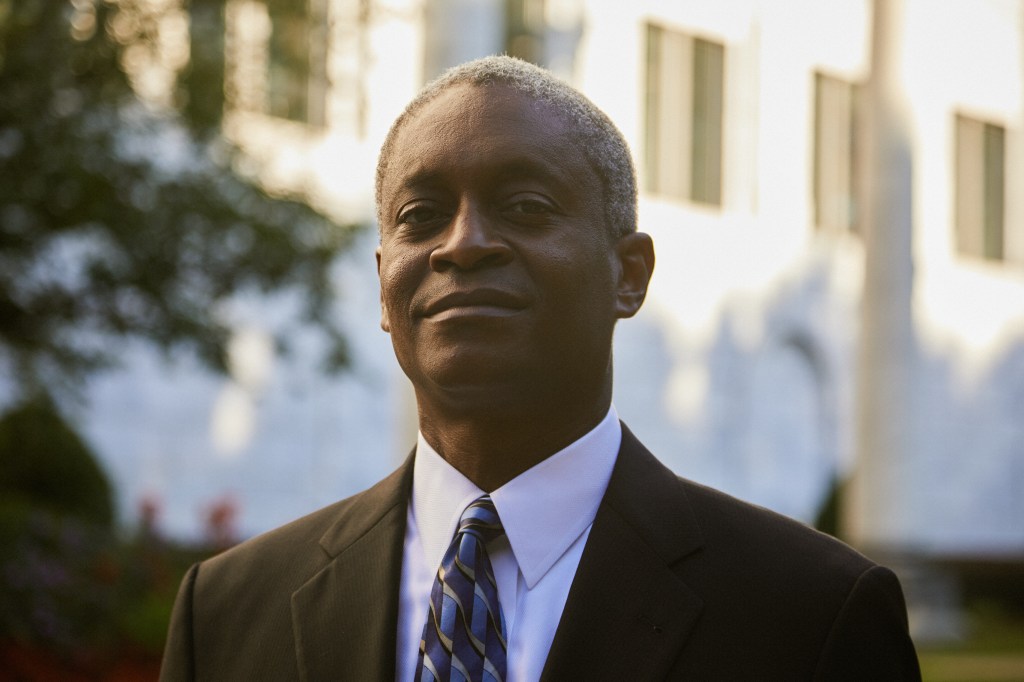

More than two years after the trading activity of Federal Reserve officials came under heavy scrutiny, Atlanta Fed President Raphael Bostic has come forth disclosing a series of transactions he made during periods in which officials were barred from trading—prompting the latest investigation into Fed officials’ trades.

Eric Rosengren and Robert Kaplan, the former presidents of the Federal Reserve Banks of Boston and Dallas, respectively, announced their retirements on the same day last year—just weeks after they came under scrutiny for trading individual stocks during the pandemic.

While Rosengren cited health issues for his early retirement, Kaplan acknowledged the “recent focus” on his financial disclosures risked “becoming a distraction” for the Fed. Trades made by Federal Reserve Vice Chair Richard Clarida in February 2020 have also faced criticism.

After the disclosures, Powell ordered a sweeping review of the rules governing Fed officials’ trades before coming up with the new trading rules that were implemented in May.

“I want to be clear: At no time did I knowingly authorize or complete a financial transaction based on nonpublic information or with any intent to conceal or sidestep my obligations of transparent and accountable reporting,” says Bostic.

This article first appeared on forbes.com

Elizabeth Warren Calls On SEC To Investigate Fed Officials’ ‘Ethically Questionable’ Trades (Forbes)