Amid changes in climate, Australian agricultural revenue is projected to fall by $13 billion next year. Agtech – the intersection of technology and agriculture – is one solution that could replenish the ditch.

Matthew Pryor, co-founder and managing partner of Tenacious Ventures, sees immense opportunity in agtech.

“We actually have a world-class innovation ecosystem here,” Pryor tells Forbes Australia in an exclusive interview at the Global Entrepreneurship Congress in Melbourne. He believes that agricultural ecosystem, coupled with emerging technology, gives Australia a natural advantage to lead the world in agricultural technology.

“Agtech actually was just ‘agriculture’ in Australia,” says Pryor. “For three decades, we have invested in a lot of research and development.”

It paid off. “In most of the major crops, most of the major production systems, most of the major innovation areas, we’re a podium finisher.”

All of that agricultural innovation contributes more to the Australian economy than just accolades. Agricultural, fishery, and forestry production reeled in $93 billion in 2022, contributing 2.4% to GDP and making up 2.5% of employment.

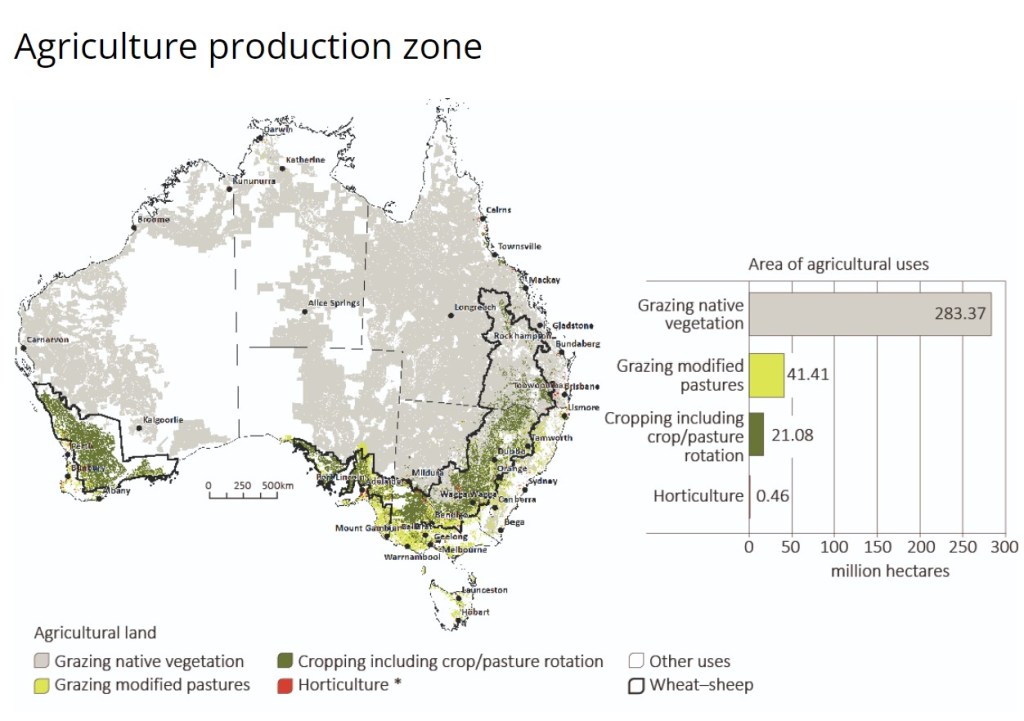

In 2020, 55% of Australian land was used for agricultural purposes. No small feat for a country that has an inconsistent climate, and topography that is almost 20% desert, and 81% rangeland – otherwise known as the outback.

“Australia is a decently lousy place to grow food,” says Pryor. “It’s dry, it’s hot, it has always had variable weather. So historically we’ve always had to be very efficient and innovate.”

Despite historical success in the sector, it is now anticipated that agricultural revenue will go through a downturn. The Department of Agriculture, Fisheries and Forestry forecasts a 14% dip to $80 billion in 2023-2024. It attributes the decline to El Nino and the Indian Ocean Dipole, which will likely result in lower crop yields.

Adding to the agricultural woes, are falling prices of agricultural commodities across the globe. Accordingly, agricultural exports are anticipated to decline 17% next year.

Given the lull in projected revenue, Pryor wants the federal government to put agtech centerstage to facilitate growth in the agricultural sector, both on the farm and off.

“Innovation has to span the entire AgriFood value chain,” says Pryor. “We have these amazing digital technologies, we have artificial intelligence. The tool set is very different today.”

The Australian Farm Institute is also looking to emerging technology to provide a potential revenue bump for the industry. It projects Aussie agricultural revenue could grow by $20-billion – around 25% – each year if digital tools are adopted widely.

“Digital agriculture will deliver growth and employment opportunities across the sector and into the heart of our regional economies,” the Department of Agriculture website states. “Digital technologies will be the foundation of the next major wave of agricultural productivity.”

Pryor notes that it is important that the federal government helps financially to facilitate the digital transformation of farms, but he also wants to see policy and administrative change take place at a federal level.

“It is funds, but in the end it’s also the Prime Minister of a country creating a portfolio, integrating a set of ministries into a mandate that’s legislated. Its that level of commitment [that’s needed].”

Pryor looks to the structure of agriculture in New Zealand as a model of what can be instituted in Australia to successfully drive the industry forward. He says that attitudes towards sustainability are shifting around the world, providing additional opportunities for Australia to spearhead global innovation in this sector for which we are already known.

“Agriculture contributes in the order of 25% of global emissions,” says Pryor. “Because of the focus on ecological sustainability, decarbonization and increasingly climate adaptation and resilience, the transition of the AgriFood system is an area where solutions are needed.”

Pryor pioneered agtech when he founded Australian-based company Observant, which he sold to Jain – an agricultural conglomerate headquarted in India – in 2017. He now runs VC firm Tenacious Ventures with co-founder Sarah Nolet in Melbourne.

“We are a sector-specific, early-stage investor that does nothing but look for research in, and look for highly impactful, really early-stage companies,” says Pryor. “And if we do our job right, then having a government fund ready to co-invest alongside us, is a really good model.”

He is encouraged by the recent news that Victoria is investing further in the category, with a view to attracting agtech entrepreneurs to the state and maintaining its status as the heart of the agtech ecosystem in Australia. Pryor is on the Investment Committee for LaunchVic’s recently announced Hugh Victor McKay Fund, which is investing up to $200,000 in agtech startups.

“Co-investment funds are a really good model,” says Pryor. “A decently self-sufficient professionalized ecosystem, to work out which fires to pour a bit of extra fuel on, is a pretty effective model. It’s cost effective, it’s highly leveraged. And so yeah, I think it’s great to see the Victorian government out there doubling down in that way.”

Why Victoria?

The Australian mainland’s smallest state already punches above its weight when it comes to agriculture. Victoria produces a quarter of Australia’s agricultural output, from just 3 per cent of its landmass, according to Invest Victoria. There are around 20,000 farms in the state, and 31 per cent of Australia’s food manufacturing jobs are in Victoria.

“[The] industry is a major contributor to the state economy and has been a national source of high-quality produce, particularly in wool, meat, grains, dairy, fruit and vegetables, since the 1800s,” according to the Invest Victoria website.

The state’s history in innovating in less than ideal circumstances to provide food to the nation puts it in an ideal position to lead the agtech charge forward.

“Victoria has the perfect blend of agricultural and technology capability,” according to the state’s investment body. ”With a technology base that is contributing to a 20 per cent year-on-year growth in smart farming devices, Victoria’s leading advances in digital agriculture innovations make it the perfect destination for the development of new and integrated systems.”

Victoria’s agtech ecosystem also includes an innovation hub. SproutX is based in Melbourne and is the largest agtech incubator in Australia.

Lay of the land

Despite the projected downturn in agricultural revenue this year, farmers are hoping the value of the industry will exceed $100 billion by 2030. The National Farmers Federation released a report called Delivering Ag2030, providing a framework for how a $100 billion bounty for farmers can be brought to fruition.

The Australian government also issued a report setting out a pathway to achieving a $100 billion in agricultural revenue. In it, it stated it would facilitate policy and funds to support growth in the sector. The federal government says it has invested more than $6 billion to fund Delivering Ag2030 initiatives so far, to ‘set the foundations for industry to not only achieve its goal, but to help farmers build resilience and access new markets across the world.’

Ruralbank, the nation’s largest lender to farmers, agrees that there is enormous potential at the cross-section of technology and agriculture, not just for farmers, but for entrepreneurs and VC.

“There’s massive growth potential for Australia to capitalize on. It’s the fastest growing industry,” Ruralbank states. “Investors love big markets, and entrepreneurs are drawn to the opportunity to build companies that can do good and do well. Today, the global market for agtech products and services is estimated at $500B. It’s expected to grow to $730B in the next three years.”

A part of the ‘doing good’ piece, is tapping into the growing global desire toward sustainability. Ruralbank attributes the projected industry growth in part to changing consumer sentiment around the production of food. The evolution toward subsistence that is organic and sustainably produced, is fueling enormous opportunity for agtech entrepreneurs.

“Shifting consumer preferences are putting new pressures on our food and fibre system. In addition to healthy, safe, affordable food, consumers now also want convenience, premium eating experiences, and confidence that the produce they’re purchasing is good for their families and the planet. These trends may seem niche, but they are growing at an astounding pace and are impacting the bottom lines of companies globally. The traditional big players in food and agriculture are now scrambling to partner with agtech startups to complement their traditional R&D activities,” Ruralbank states on its website.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.