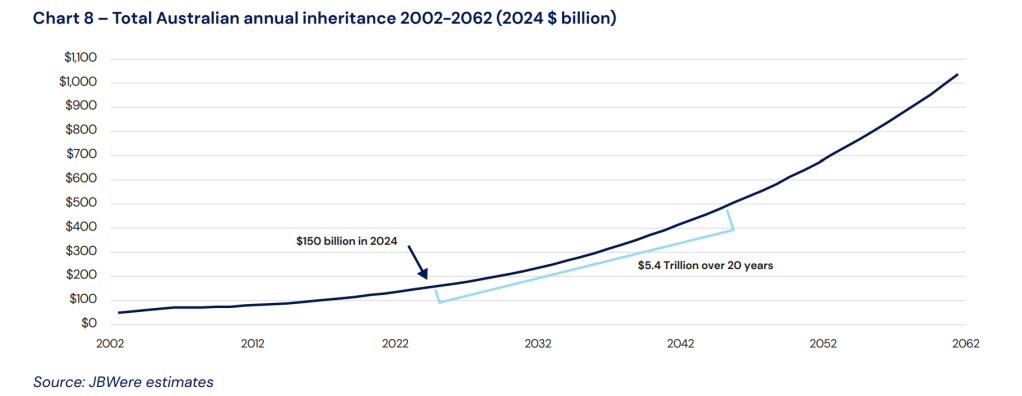

Bequests to philanthropic organisations are expected to double over the next decade, growing from $1.3 billion in 2024 to $2.6 billion in 2034, according to a new report from JBWere. Meanwhile, inheritance to family, friends and charity is expected to reach $5.4 trillion by 2044.

Key Takeaways

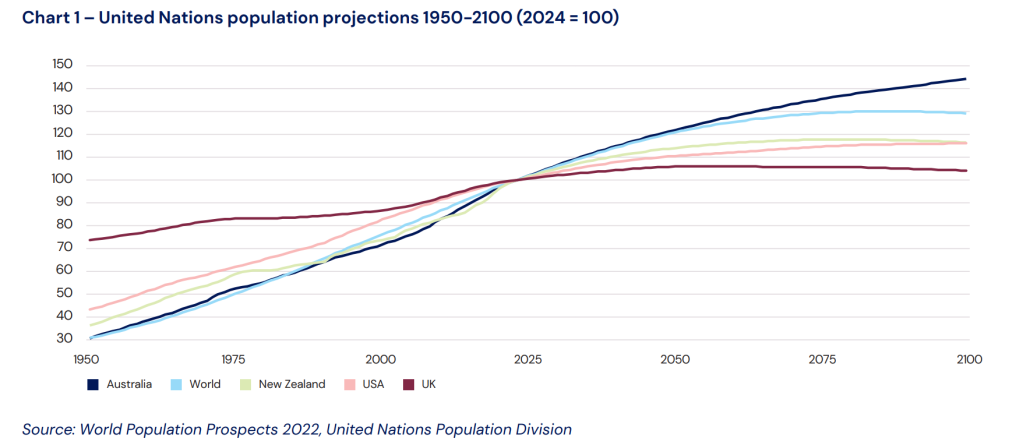

- Australia’s population growth is slowing and the annual number of deaths is expected to accelerate to 330,000 annually by 2064.

- Over the next 20-years $5.4-trillion will change hands from deceased estates.

- The partner of the deceased will inherit wealth in 38% of cases. In 51% of deceased estates the next generation will be the beneficiaries.

- Currently around 6.5% of Australian wills make provisions for charity, according to JBWere.

- $1.3 billion that will be bequeathed to philanthropic organisations in 2024

A new report from NAB’s private wealth company JBWere estimates that $150 billion will be bequeathed from Australia’s aging population to their beneficiaries over the next year.

“Australia’s population growth is slowing and while positive net migration sees our peak later than global totals, we will still experience a dramatic increase in the number of older age people in the population. This contributes to an acceleration in the number of annual deaths from around 180,000 currently to over 330,000 within 40 years,” the Bequest Report states.

While $150-billion changing hands between 2024 and 2025 may seem like a large number, JBWere projects that over the next 20-years inheritance figures in Australia will continue to escalate, and reach $5.4-trillion by 2044.

John McLeod is a senior research consultant with JBWere Australia. He co-founded JBWere’s Philanthropic Services team and authored the report.

“Australia is indeed a fortunate country, with great wealth and a relatively small population to divide it amongst. How that is handled in the next few decades, as record levels of accumulated wealth and family values changes hands, can reshape our country,” says McLeod.

The report reveals that the partner of the deceased will inherit wealth in 38% of cases. In 51% of deceased estates the next generation will be the beneficiaries. Family and friends will make up 10% of bequests, and for-purpose organisations will receive around 1% of the wealth transfer.

Today, approximately 6.5% of Australian wills make provisions for charity, according to JBWere. That equates to around $1.3 billion that will transfer hands from the estates of individuals to philanthropic organisations.

“The majority of dollars goes to a concentrated group, and it comes from a smaller cohort of large donors,” the report states.

The international comparison

Australia’s current rate of 1% inheritance that goes to charity is on par with New Zealand. It is considerably less than the UK however, where 3.7% of inheritance is channelled into philanthropy, and the US which achieves 4.4%.

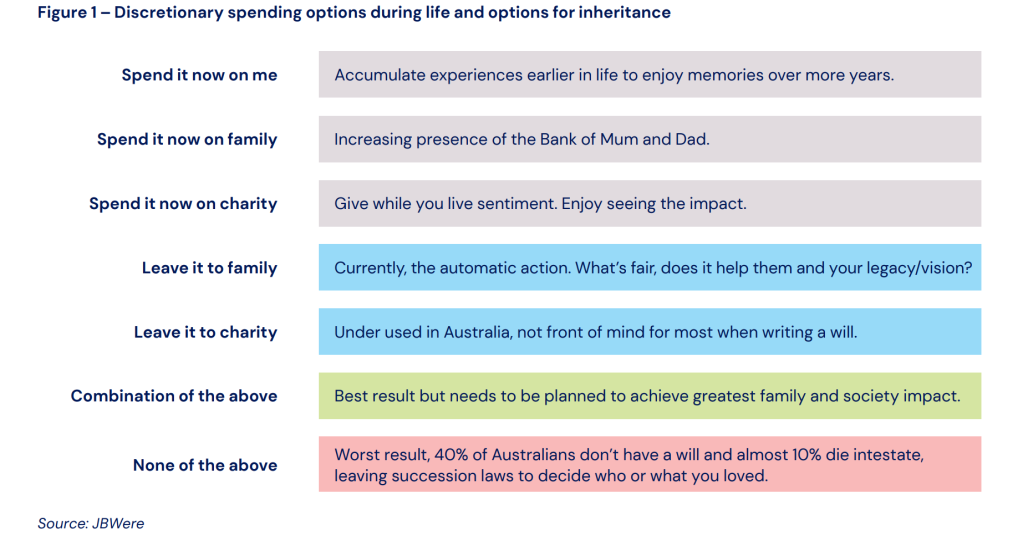

The JBWere report highlights the differing perspectives of Australians when making choices about to whom they will leave their wealth.

“Both during life and after passing, there are a limited number of broad choices for discretionary spending (ignoring tax and non-discretionary living expenses). Yourself, family and friends or community/charity. Admittedly, many are seeing far less in available discretionary funds currently, but a significant cohort have the benefit of choice and even more so after passing as

one of those spending options no longer exists,” the report states.

The ‘spend it now’ categories are no longer relevant, meaning leaving it to family/friends or charity are the two choices. The report notes that the worst case scenario is not having a will at all, a reality in around 10% of estates currently.

It also mentions the perspective of billionaire philanthropist Warren Buffet on how to decide how much inheritance to leave family.

“There has been increasing commentary on the best way to divide spending and inheritance from the well-used (for good reason) Warren Buffett line of “I want to leave my children

enough so they can do anything, but not so much that they can do nothing” to the sentiment expressed by Bill Perkins in his book ‘Die with Zero, Getting all you can from your money and your life’,” the Bequest report states.

The argument that hedge fund manager Perkins makes is not to leave the enjoyment of the capital you have built up, until it is too late.

“A combination of enjoying your life and spending in earlier years and building memories for a longer period, helping family earlier when they need it and supporting charity during your lifetime to see the impact, provides a better outcome than passing with a still large financial balance sheet,” JBWere states.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.