Resolve cofounder and CEO Jason Gammack

Resolve Biosciences

Spatial biology company Resolve Biosciences is building up capital to accelerate its development of “Genomics 3.0.”

It was in 1973 that the first animal gene was ever cloned. Researchers at Stanford and the University of California at San Francisco accomplished this by taking a gene from a tree frog and fusing it with the genome of a bacteria. This, says Jason Gammack, cofounder and CEO of Resolve Biosciences, was the beginning of “Genomics 1.0.”

Then in 1995, he says, came “Genomics 2.0,” which is when technology made it possible to sequence massive numbers of genes in a short amount of time. This is the technology that powered the Human Genome Project, as well as private companies such as Illumina, he says. At the time, there was a great amount of promise that the ability to find the genetic sequences of diseases such as cancer or viruses or the pancreas could lead to curing fundamental diseases. While better sequencing has definitely led to better treatments across the board, Gammack argues that its promise is only partially fulfilled. That’s because, he says, “we believe and our investors believe it’s because this process was fundamentally broken. And what’s broken in this process is Genomics. 2.0 relies on the analysis of the disease outside of the natural disease state.”

For example, he says, in a patient with cancer, a tissue sample is taken and the genetic material is extracted from it outside the body—which causes researchers to miss the important context of what’s happening inside the body. That’s where his company, Resolve Biosciences, comes in. Its technology is in the field of “spatial biology” or what Gammack calls “Genomics 3.0,” which uses a combination of digital technology and biotechnology to see the forest for the trees by better understanding what’s going on inside a patient.

“What Genomics 3.0 does is we bring the analysis directly to the disease,” says Gammack, 51. “So we keep the context of what’s happening within the disease. So we no longer have this inefficiency.”

On Monday, the German-based company announced that it has raised a $71 million (€70 million) series B round led by Patient Square Capital and including participation from NRW.BANK, Alafi Capital, EDBI (the venture arm of Singapore’s sovereign wealth fund) and PS Capital. This new financing brings the company’s total backing to over $100 million. That’s a larger round than usual for the spatial biology industry—a report from Outcome Capital found that the average investment in this space is only around $33 million.

Laura Furmanski, a partner at Patient Square Capital, says Resolve caught her eye because her firm was interested in making an investment in the spatial biology industry and that the company has developed technology she thinks makes them contenders in the growing space. “I think this type of spatial biology has the potential to really give much greater insight, and as a result, really start to personalize the treatment that’s delivered to patients,” she says. Furmanski was also familiar with the founding team, having worked with two of its cofounders, including Gammack, at molecular diagnostics company Qiagen.

Right now, the market for spatial biology is still fairly small: An article earlier this year in European Biotechnology estimated the global market size to be around $250 million, with a projection of close to $500 million by 2028. That’s in part because right now, most adopters of this technology are basic researchers like universities and similar academic institutions. Growing the market, suggests the Outcome Capital report, means getting into providing technologies to the broader clinical industry, which will require “significant time and cost.”

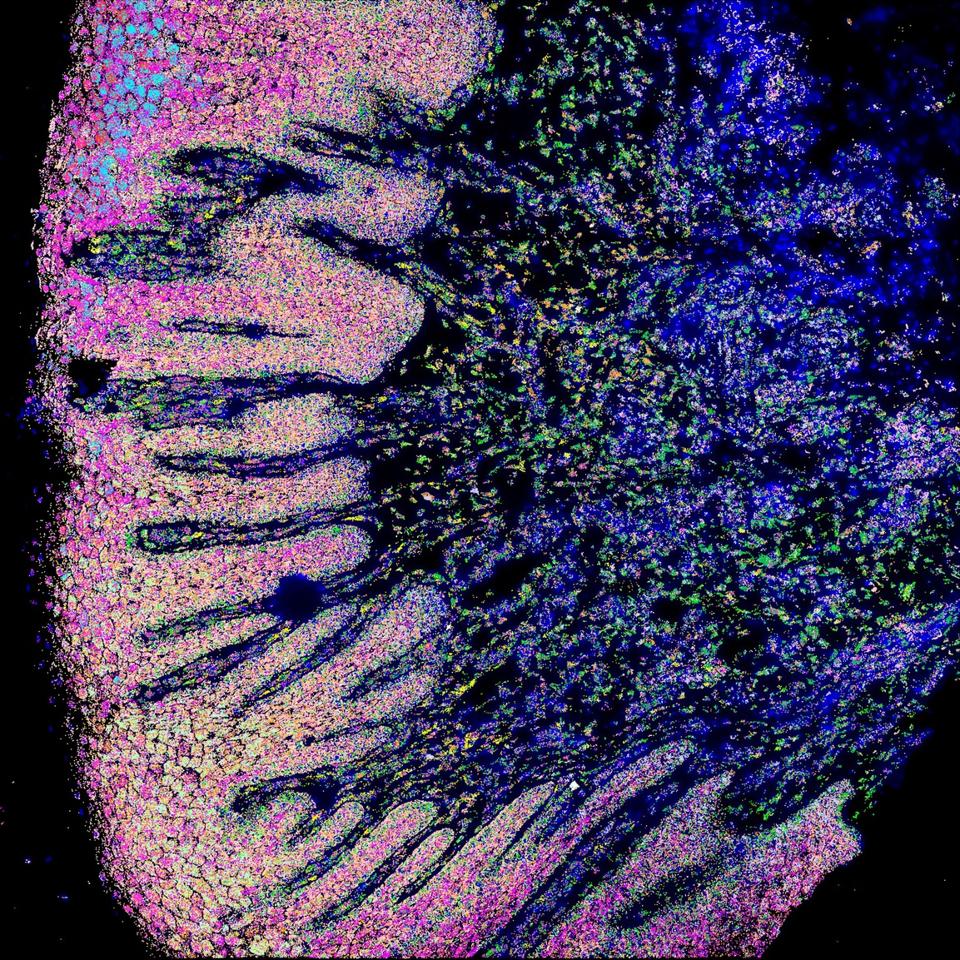

Researchers used Resolve’s technology to create this image of healthy and diseased gum tissue in a dental patient.

Resolve Biosciences

Founded in 2020 by Gammack, Axel Heinemann, 57 and Peer Schatz, 57, Resolve Biosciences aims to close that gap quickly with what it calls its “Molecular Cartography” technology. This enables researchers, Gammack says, to understand not only the genetic structure of, say, a tumor cell, but also a stronger understanding of what’s happening in that cell’s environment. “Scientists can now get a view of individual cells and their interactions within the tissue in the three dimensional space,” he says.

For its customers, which include the Novo Nordisk Foundation Center, the Stanford Medicine Department of Genetics and the European Spatial Biology Center, Resolve’s technology provides high-resolution images of gene expression at the subcellular level. For example, a recent experiment using Resolve’s technology was used to create an atlas of healthy and obese liver cells. Those results were published in the journal Cell.

For these institutional customers, Resolve has been selling instruments and the consumables that go with it, a model common in life sciences. But for other researchers who either lack the capital or need for their own equipment, Resolve also has two professional services labs in Europe and the United States providing “data-as-a-service” by analyzing samples using its spatial biology technology.

With the new capital from its series B round, Gammack says that his company plans to scale the commercialization of its technology. Additionally, he says, Resolve will also focus on increasing its own product development capabilities to advance its existing technologies.

“Similar to sequencing, spatial biology will also have unique needs for certain applications in the marketplace,” Gammack says. “And so we see us developing multiple instruments and to do that we need a lot of resources from an R&D engineering perspective and biology perspective to continue to stay ahead of that innovative curve.”

This article was first published on forbes.com