The EV company’s sales are tanking in all major markets as its Chinese rivals are surging. But Tesla’s problems are just beginning.

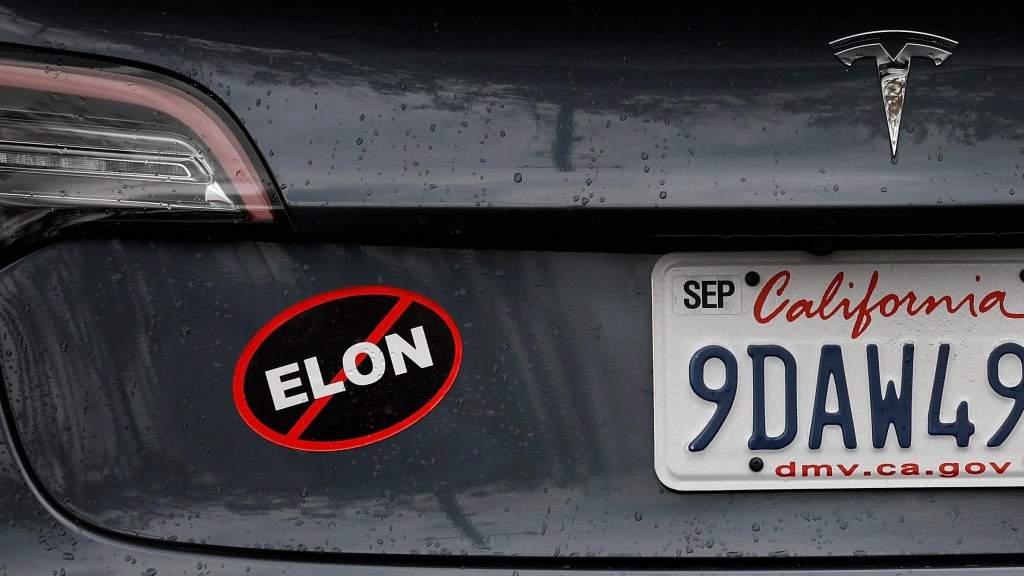

Tesla is in a world of hurt. Sales in California, its main market in the U.S., plummeted 31% in January from a year ago. European numbers are even worse, dropping 43% in the year’s first two months. And in China, by far its most important market for profitability, Tesla sales crashed 29% through February. Its stock has tanked, dropping 34% this year. A backlash has grown against part-time CEO Elon Musk–who also leads five other companies–with protests at Tesla stores and the torching of vehicles as he carries out a clumsy attempt to slash government workers and spending as Trump’s DOGE master.

But things are about to get worse.

Falling sales indicate that the company’s financial health is fundamentally faltering as competitors are surging, particularly rival BYD. The Chinese EV and battery maker for the first time topped Tesla in revenue in 2024 and is on pace to leave it in the dust as the global leader in electric vehicle sales this year. Tesla’s brand is becoming toxic in California, which has nurtured it since the Roadster arrived in 2008. It’s even failing on the technology front, with BYD outpacing it with a super-fast charging battery system and Waymo dominating in self-driving cars, which Musk has bet the company on.

“Many have out-Tesla-ed Tesla in software, range and in intelligent driving and are making Tesla look like the laggard.”

Tu Le, Sino Auto Insights

The worst by far, though, is what’s happening to Tesla in China, where it opened its Shanghai plant in 2019. That plant, the first in China wholly owned by a foreign carmaker, marked a turning point for Tesla, fueling a massive sales spike and pushing it into the black consistently thanks to low-cost Chinese labor, parts and logistics. But a decline in that market, where Tesla has seen consistent growth up until this year, threatens to narrow its already shrinking profit margins. A big reason for slower sales: China’s domestic EV companies are starting to beat Tesla on, well, everything.

“China had a plan when they let Tesla have a fully owned factory. They wanted the technology and the knowledge and experience. With that came a risk China would take that technology and build better stuff,” said shareholder Ross Gerber, CEO of Gerber Kawasaki Wealth and Investment Management. “That’s exactly what they’re doing. Now they’ve got really competitive vehicles, really competitive technology and the vehicles are cheaper.”

Tesla didn’t respond to a request for comment.

Model Y remained the top-selling EV in China last year, but BYD, the country’s biggest carmaker, sold far more EVs combined with a number of models ranging from its $10,000 Seagull hatchback to its Yuan Plus compact SUV, starting at $16,000. Those are less than half the cost of a Tesla, which positions itself as a more premium brand: A Model Y base price starts at $34,500, and the Model 3 sells for about $32,000 and up. BYD’s low prices are also helping it grow global sales in Latin America, Australia and Europe (high tariffs so far have blocked it from exporting to the U.S.).

BYD also just unveiled a new five-minute battery charging system–four times faster than Tesla’s Superchargers. CATL, the world’s largest battery maker and a Tesla supplier, is now dismissive of Musk’s battery ambitions, including a newly launched lithium cell designed for heavier vehicles. CEO and founder Robin Zeng said in a Reuters interview late last year that he’d flat-out told the billionaire that Tesla’s new battery cell “is going to fail and never be successful.”

A BYD Seal electric car on display in Warsaw, Poland.

NurPhoto via Getty Images

Led by billionaire cofounder and CEO Wang Chuanfu who Forbes estimates is worth $28 billion, BYD is also coming after Tesla’s Full Self-Driving system (which, despite the name, still requires human monitoring). The Chinese company is making its “God’s Eye” automated driving a standard feature on new vehicles, competing directly with Tesla’s system for hands-free driving. Tesla is letting Chinese customers try out FSD for free, though it charges $8,000 for the feature in the U.S. and is expected to follow suit in China.

BYD’s system will be available in three versions, with the base system offering capabilities rivaling FSD, and a top-end version with laser lidar that Tesla doesn’t offer. It will also be connected to Chinese AI upstart Deepseek’s platform, the company that’s challenging OpenAI’s early lead in that space, to continuously improve its performance. The system looks to be “more advanced than Tesla‘s currently is, and maybe ever will be,” one reviewer wrote in automotive news site The Drive.

BYD is hardly the only player Musk–and all other global automakers–has to worry about. There’s also XPeng, Xiaomi, NIO, Geely, Zeekr, and battery giant CATL.

“They have IP the rest of the world hasn’t developed.”

Jim Farley, Ford

“People in the West are starting to pay attention to BYD, but there’s this whole gaggle of other [Chinese] EV makers they have no idea about,” Tu Le, managing director of consultancy Sino Auto Insights, told Forbes.

“Many have out-Tesla-ed Tesla in software, range and in intelligent driving and are making Tesla look like the laggard,” he said. “It’s in serious jeopardy of becoming an EV manufacturer that builds in the three largest passenger vehicle markets while simultaneously each market slowly slips out of its hands due in part to self-inflicted mistakes and laser-focused competition.”

China’s EV makers aren’t just matching Musk, they’re passing him–and the rest of the global auto industry.

“They have IP the rest of the world hasn’t developed,” Ford CEO Jim Farley said in October on a podcast, noting that he’d been driving a Xiaomi SU7 for six months and didn’t want to part with it. “It’s not the old days where someone would copy a Western technology. The opposite is true.”

Tesla is also struggling at home. While overall U.S. EV sales jumped 14% in January as consumers rushed to buy them before the Trump Administration eliminated a $7,500 federal tax credit, Tesla’s fell 11%, according to S&P Global. That’s due to the huge drop in California, which accounts for a third or more of its U.S. sales. S&P Global found that other EV makers like Hyundai, Kia and General Motors saw sales in left-leaning California rise in January by an average of 24%, while Tesla’s crashed by 31%. These numbers also pre-date the blowback Musk is facing for his DOGE duties and the big protests that have ensued at Tesla stores in California, across the U.S. and in Europe.

New numbers won’t be available until April, but they’re not going to be good. “Tesla sales are going to take a hit in Q1,” said Ed Kim, president and chief analyst for AutoPacific, an industry consulting firm in Long Beach, California.

Anger at Musk and the brand has led equity analysts to slash sales targets for the company, anticipating a second-consecutive year-over-year decline. “We struggle to think of anything analogous in the history of the automotive industry, in which a brand has lost so much value so quickly,” JP Morgan’s Ryan Brinkman said in a recent research note. He cut his annual delivery forecast for Tesla to 1.775 million vehicles this year, down from 1.789 million last year.

Overall U.S. EV sales should rise 12% this year, even as interest in the Tesla brand by carbuyers is dropping, according to Cox Automotive. It’s down 7% from a year ago, the most of any premium brand, the industry forecaster said.

“The most important company for climate and the environment in the world is now being treated like a pariah because of Elon. It’s crazy.”

Ross Gerber, investor

A lack of compelling new products is also a problem. Tesla’s most recent addition, Musk’s hard-edged Cybertruck that’s become a favorite target of anti-Elon vandals, has been a flop, selling about 40,000 units last year–a fifth of the annual volume Musk predicted. The vehicle has a shockingly bad record for quality, with eight recalls, including one this month to fix stainless steel body panels at risk of falling off.

Perhaps in recognition of Tesla’s problems, Musk for the past two years has touted plans to pivot into an AI and robotics company. Rather than just selling battery packs and EVs, which account for almost 90% of Tesla’s current revenue, he’s betting that AI, robotaxis and humanoid robots will add trillions of dollars to Tesla’s bottom line. Investments made in those areas “will bear immense fruit in the future. To such a scale that it is difficult to comprehend,” he said in a January results call.

There too Tesla faces disadvantages. Alphabet’s Waymo is light years ahead of Tesla in the robotaxi business and it’s unlikely that Tesla’s access to massive amounts of data collected by the cameras on millions of its cars on the road gives it an AI edge. The company’s Optimus, the humanoid robot regularly featured at Tesla events, has yet to show capabilities that match robots created years ago, like Boston Dynamics’s acrobatic creations or Honda’s child-size Asimo that climbed stairs, played soccer and opened bottles to serve drinks. (Honda retired Asimo in 2018.)

It’s clear the damage Musk has inflicted on the company is just beginning.

“The irony is that the most important company for climate and the environment in the world is now being treated like a pariah because of Elon. It’s crazy,” said Santa Monica, California-based Gerber. “The worst part is that in China they don’t care about the politics. In China, they’re down because of actual competition.”