Opinion

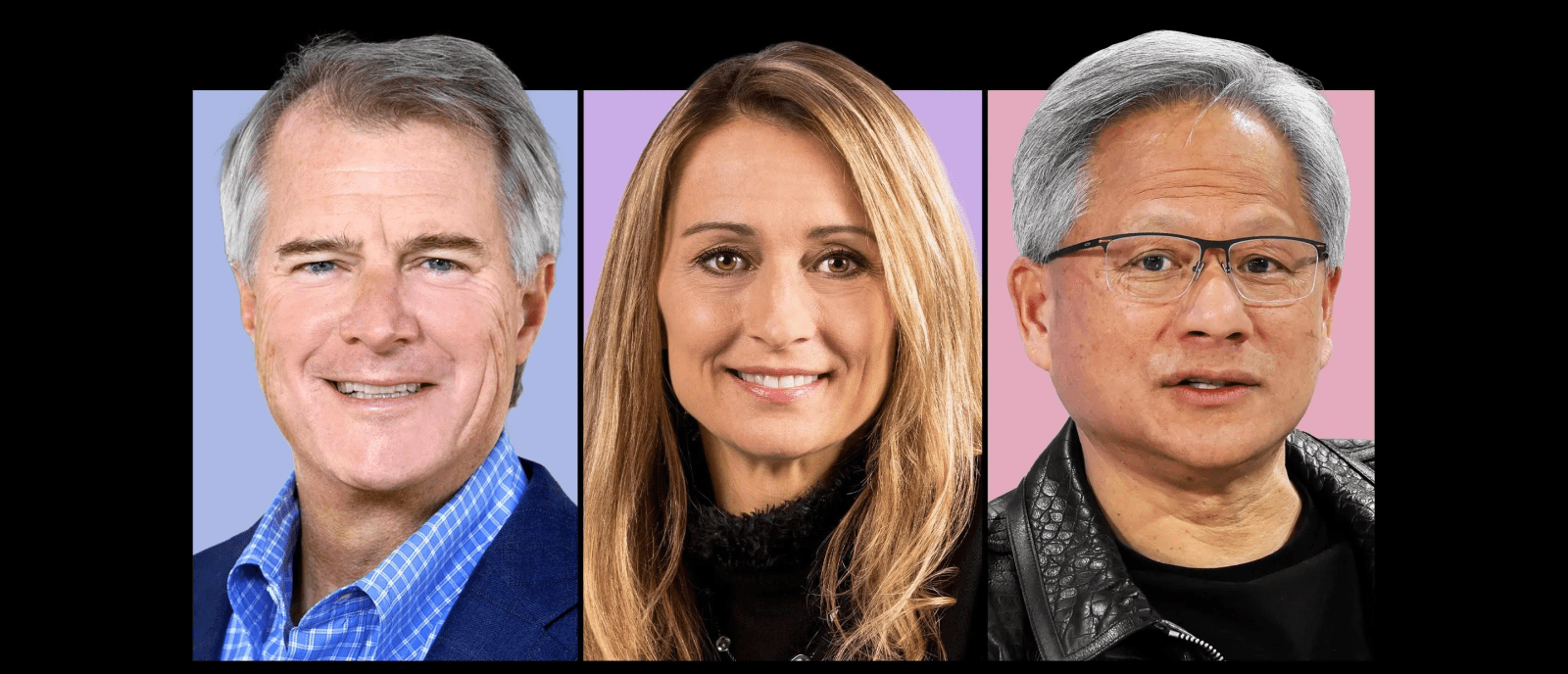

“Last year, at Cannes, Jensen Huang (Nvidia CEO) introduced himself to me and said, ‘I love your videos’. Not recognising him, I asked if he’d like a photo. He said yes, we took the snap, and I kept walking. Since then, his company has added $1.3 trillion in value. I did Ketamine therapy, stopped drinking for 17 days, and installed a router with only the help of YouTube. It’s been a big year for both of us” said Scott Galloway, a professor of marketing at the New York University Stern School of Business at New York University and a podcaster.

Let’s talk about Nvidia, the most celebrated company in the world of AI right now.

Not long ago, Nvidia was a company known for providing gamers with better resolution for their games. Today it’s the most valuable company on Earth, bigger than the economy of the UK.

Nvidia is worth $3+ trillion — larger than two and a half Metas, five Tesla, seven Samsung and 12 times the market cap of Salesforce.

Over the past 12 months, at the peak of their market cap, Nvidia’s market capitalisation had grown by an amount equivalent to the entire value of Amazon. Amazon!

In the math of the Motley Fool website, a $10,000 investment in Nvidia a decade ago would now be worth, last month, over $2.2 million. It seems sweet, doesn’t it? But it is not; let’s look under the hood.

The company has 40% of all their revenue tied up to just four clients. Amazon, Meta Platforms, Microsoft, and Alphabet are believed to be among Nvidia’s biggest customers, making up roughly 40% of its revenue. And the same companies are desperately developing GPUs to replace Nvidia.

The growth justification and share price keeping is a challenge. To maintain the relationship between the market value added (a full Amazon!) and the expected revenue, Nvidia would have to keep dominating the AI market and very likely will create or move on into a whole new market and dominate it, too.

The Dot-Com bubble

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late 1990s and peaked in March 2000. The signs of the past are eerily similar to the present, with rapid valuation increases, concentrated revenue sources, heavy speculative investment, lack of profitability and rapid rise followed by dramatic fall of stocks.

Most importantly, bubbles occur when pure perception overlaps and overtakes real economic potential.

Related

“Bubbles emerge in unexpected ways, for unpredictable reasons. Big bubbles inflate in similar ways. A transformative innovation emerges, capital rushes in, valuations increase, speculators add fuel, the atmosphere heats, the bubble grows, the cheap capital supercharges growth, and the wheel turns,” says Scott Galloway

So, what’s going on beyond Nvidia? AI Funding and Growth

In the first quarter of 2024, global AI funding surged to a staggering $13.1 billion. This is a 24% increase from the previous quarter and the highest quarterly level since early 2023.

You got this right. It’s a record investment. Or, as the Economist paper puts it: “AI Gold Rush”.

The increase in funding is a clear indication of the growing recognition of AI’s potential to transform industries or just the perception of the potential to transform industries, and for investors, the constant stream of AI-related news makes it challenging to distinguish which businesses are truly thriving in the AI boom and which will ultimately succeed.

The Rise of AI Unicorns and New Monopolies

Technological advancements have consistently redefined industry leadership. In the 1980s and 1990s, the PC boom elevated Microsoft and Intel to the top, capturing four-fifths of the PC industry’s operating profits by the 2000s. Similarly, the smartphone revolution got Apple into dominance; after the 2007 iPhone launch, Apple commanded over half of the global handset profits. Today, we are at the onset of the generative AI era, poised for similar transformative impacts. However, what we are seeing is more concentration, with a few dominating all layers of the generative AI tech stack.

Just on the Cloud layer (the other two layers are “Models”, and “Software”), the combined market value of Alphabet, Amazon and Microsoft has jumped by $2.5 trillion during the AI boom (another Canada). This implies that investors believe that the cloud giants will be the biggest winners in the long run.

In the 1st quarter of 2024 alone, six new unicorns (private companies valued at over $1 billion) emerged. Notably, three of these new unicorns are generative AI model developers: Moonshot AI, Together AI, and Krutrim.

Geographically, the United States leads the way in AI funding, accounting for $9.3 billion of the global total in Q1 2024, a 52% increase from the previous quarter. Asia was the only other major region to see a funding increase, rising by 6% to $1.9 billion. These figures highlight the regional disparities in AI investment and the strategic importance of the US and Asian markets in the AI landscape.

The concentration of AI funding in the US and Asia reflects the strong innovation ecosystems in these regions. Silicon Valley, for instance, continues to be a hotbed of AI activity, attracting top talent and significant investment. Similarly, China’s robust AI initiatives and government support have positioned it as a global leader in AI development. Understanding these geographic trends is crucial for businesses looking to tap into the latest AI advancements and establish a presence in key markets.

Where to from here?

There’s an AI for That is a website that calls itself the largest database of AI applications on the web. By the time I’m writing this column, it lists 12,565 AI applications for over 15,000 tasks. A check on the web archive showed the website listed 10,000 earlier in the year. It’s growing on average by 1,000 applications a month. I can’t help but see the similarity in this rapid growth in AI applications with the expansion seen during the dot-com boom. The sheer volume of new AI tools being developed is staggering, and it seems that the money is following.

I was 26 when the internet crashed in 2000. The AI boom undoubtedly resembles the dot-com bubble but with a difference. Back then, most startups carried the risks, while now, giant AI pioneers are unlikely to go broke. Rather, investors will suffer.

Lucio Ribeiro is a pioneer in the field of artificial intelligence applied to marketing, advertising and business.

Are you – or is someone you know -creating the next Afterpay or Canva? Nominations are open for Forbes Australia’s first 30 under 30 list. Entries close midnight, July 15, 2024.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.