Form Energy, led by a former Tesla executive and backed by Bill Gates’s Breakthrough Energy Ventures and TPG, sees iron and rust as a low-cost solution to storing surplus energy for more than four days.

Iron and rust could be used in the fight to kill planet-cooking carbon emissions. Rechargeable lithium-ion batteries have become a core technology in the clean energy space.

They can power electric cars that get more than 480 kilometres per charge. They can store enough electricity to support millions of homes for hours. And they’re a central part of power plants’ ability to store ever greater amounts of renewable energy.

But if poorly made, they can also overheat into toxic chemical fires. They’re not always reliable, and in electric cars have failed to deliver the driving range certain companies claim.

They’re also expensive: battery-grade lithium carbonate costs more than US$37,600 per metric ton, according to Trading Economics. Plus, they only hold energy for hours, not days.

And in the race to scale up renewable energy, that’s a big problem during periods of cloudy or windless days.

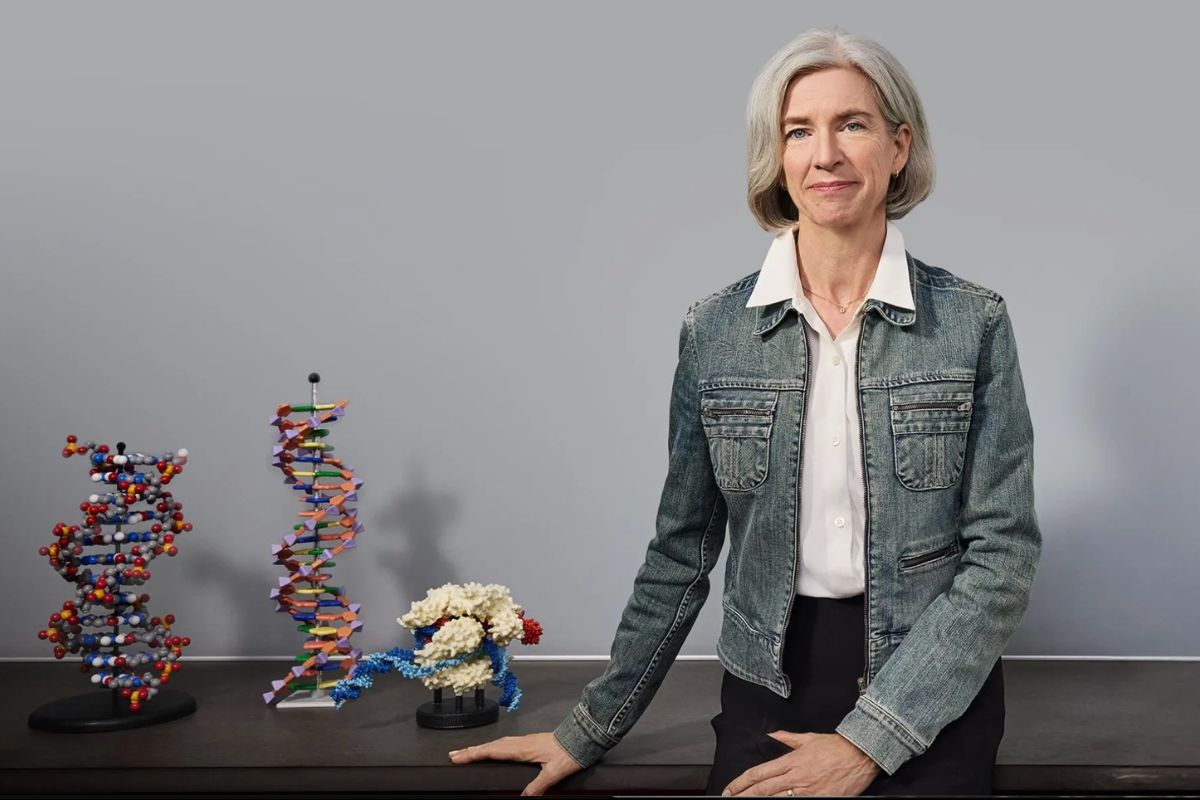

That’s why the former vice president of Tesla’s stationary power business, Mateo Jaramillo, focuses on building batteries made with iron, an abundant and cheap material that only costs $115 per ton.

“Having a battery that’s based on iron means you can scale it as much as you possibly want to. There’s no raw material limitation.”

Mateo Jaramillo, Form Energy CEO

He says that his start-up, Form Energy, has created iron-air batteries that can store electricity for at least 100 hours — far longer than the four to six hours large-scale lithium-ion packs provide.

“On the globe, there’s iron and then everything else — by orders of magnitude,” Jaramillo, 46, told Forbes. “Having a battery that’s based on iron means you can scale it as much as you possibly want to. There’s no raw material limitation.”

To commercialize its battery technology, Boston-based Form has raised more than US$810 million from backers, including Bill Gates’s Breakthrough Energy Ventures, TPG and Energy Impact Partners.

But Jaramillo is clear that he’s not trying to replace lithium-ion batteries, which he believes will continue to get cheaper through this decade.

Instead, Form’s rival is natural gas-powered generators that back up the power grid when energy demand spikes, such as during extended heat waves.

Jaramillo is targeting a chunk of the global energy storage market, worth US$430 billion last year and could top US$1.7 trillion in a decade, according to a Global Market Insights estimate, and includes batteries, pumped hydropower and other non-battery technologies.

Researchers put the cost of upgrading the US grid to handle much higher levels of renewable energy and adding far more power storage at US$5 trillion to US$21 trillion in the years and decades ahead.

To tap that prize, Form is building its first factory, a US$760 million facility, on the site of an old steel plant in Weirton, West Virginia. The state is providing an incentive package worth up to US$290 million.

Form aims to begin delivering its iron-air modules to utility customers, including Xcel Energy and Georgia Power, by 2025.

Storing for cloudy, windless days

To meet a national goal of 100% clean electricity production by 2035, solar power facilities and wind turbines are popping up all over the country.

But the sun doesn’t always shine, and the wind doesn’t always blow — thus the need to store energy when there’s an excess and continue to provide electricity when renewable power generation subsides. Here’s where iron and rust come in.

Batteries aren’t the sole choice, but they can be used anywhere, unlike relatively cheap alternatives such as pumped hydropower (in which water is pumped up to a reservoir at a higher elevation with surplus power and then released to spin turbines in a lower reservoir when needed) or compressed air storage (using surplus energy to compress air that’s held in empty natural gas reservoirs and other underground spaces that can be released later to power turbines).

And lithium-ion is the most popular option.

The Energy Information Administration estimates the US had 22.4-gigawatt hours of large-scale battery storage, almost entirely lithium-ion, at the end of 2022, led by big installations in California and Texas. That’s enough power for nearly 20 million homes.

The rapid addition of battery storage systems is one reason why the two big states are better able to weather this year’s heat waves.

“Lithium-ion batteries are just so easy to procure and install. That’s the solution today, but I’m not convinced it’ll be the solution for all storage needs going forward,” said energy expert Michael Webber, a professor at the University of Texas at Austin. “The problem we are bracing for is when it’s a windless, cloudy stretch of days” — what he calls “the five- to 11-day problem.”

Webber, who’s also CTO for Form investor Energy Impact Partners, says that most utilities have optimized batteries they use on the grid to kick in from 4 pm to 8 pm when customer demand rises and renewable power dips.

“Lithium-ion is sort of the fast twitch muscles; it’s great for rapid response, but at some point, you run out of juice and then have to switch to the marathon runner’s muscles, which will be something different.”

Michael Webber, University of Texas

Lithium-ion works well in this case, as it can send stored power to customers quickly. But the grid also needs a longer-term storage option.

“The way I think about it is that our body has fast twitch and slow twitch muscles, with some muscles for sprinting and some for endurance. Lithium-ion is sort of the fast twitch muscles; it’s great for rapid response, but at some point, you run out of juice and then have to switch to the marathon runner’s muscles, which will be something different,” he said.

Batteries vs. natural gas

Form’s system is intended to compete with natural gas power plants, which are good at scaling up electricity generation to meet volatile daily demand patterns and are the main go-to solution for this right now.

Need more power? Just burn more gas.

To succeed, Form has to offer a safe, cheap system that can compete on cost with natural gas plants, in addition to eliminating carbon emissions.

The company’s goal is to deliver battery modules that cost US$20/kilowatt hour, which approaches the price tag for operating these kinds of natural gas-based systems (on top of spending about US$300 million to build a plant).

By comparison, lithium-ion batteries currently cost about US$150/kilowatt hour, though that price could fall by 50% or more by the end of the decade.

A long-duration battery system that costs US$20/kilowatt hour would be attractive to utilities, said Halle Cheeseman, a program director at the Department of Energy’s Advanced Research Projects Agency-Energy, or ARPA-E, which provides federal grants to promising energy storage technologies. (Form won a US$2.9 million award in 2019 for an aqueous sulphur grid storage system, a technology it pivoted away from in 2021.)

But that also depends on how long Form’s batteries last. The company thinks they’ll be usable for ten years, and Jaramillo believes they could have a two-decade lifespan.

“Batteries, to a large extent, especially rechargeable batteries, are thermodynamically unstable systems. You put them together, and they start to degrade,” said battery scientist Robert Kostecki, director of Lawrence Berkeley National Laboratory’s energy storage division. “How well can you control this degradation phenomenon happening regardless of the specific chemistry they may have? You may have cheap components, but if they degrade too fast, the overall cost is going to kill you.”

Iron and air

What makes iron-air batteries so much cheaper is how they work and their reliance on low-cost materials.

“Basically, it’s a battery based on rust: iron for the anode and air for the cathode,” said the DOE’s Cheesman. “It’s difficult in terms of basic cost to imagine two materials cheaper than iron and air.”

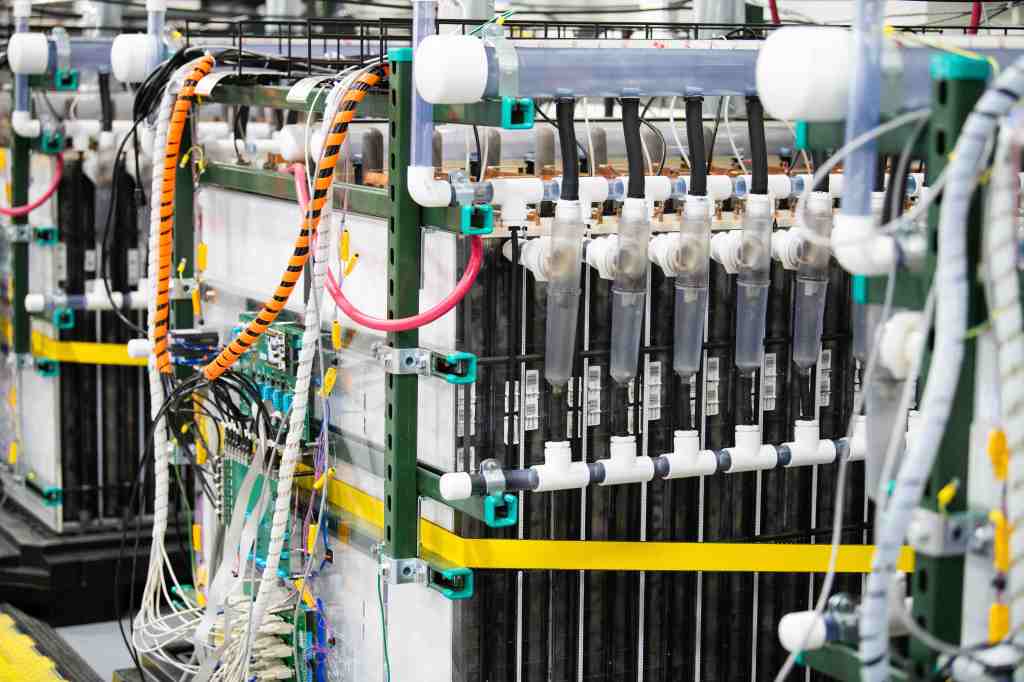

The way the battery works is that a porous iron plate is submerged in a water-based electrolyte solution. It generates an electrochemical cycle the company describes as “reversible” rusting.

“It’s difficult in terms of basic cost to imagine two materials cheaper than iron and air.”

Halle Cheeseman, DOE’s ARPA-E

As it discharges electricity, the battery absorbs oxygen from the air and converts iron metal to rust. When charging, the electrical current flowing in converts the rust back to iron, and the battery releases oxygen.

But the iron itself is never consumed, making the batteries very durable.

These iron-air batteries can’t be made nearly as small as lithium-ion batteries, but given that they’re designed for stationary applications, not cars, size is less of an issue.

Form’s battery pack, loaded with multiple individual cells, will be packaged in a 40-foot enclosure and hold 5 megawatts of electricity — enough to power 3,750 homes. There’s little fire risk, so that multiple packs can be placed side by side or stacked.

Iron air is just one of many possible chemistries that scientists and start-ups are readying to hold electricity for extended periods.

Technologies including flow batteries, in which chemical components dissolved in liquids are pumped through separate sides of a membrane, such as those using vanadium, are an option, as are iron flow batteries produced by Form’s rival ESS.

Sodium- and zinc-based batteries also show promise. Currently, developers of those chemistries say their grid packs can store power for about 12 hours — much less than the 100 hours Form aims to deliver.

But using iron and rust at a low cost looks challenging to Berkeley Lab’s Kostecki, given that the real-world usable life hasn’t been verified.

“The biggest concern of all the systems, regardless of whether you look at lithium-ion, vanadium, zinc or iron air, is that the cost is three times too high at best — the cost per kilowatt hour per cycle” compared with natural gas and traditional non-battery storage systems, he said.

Modified lithium-ion batteries may also be able to hold power longer than versions currently in the market, said Taylor Kelly, a senior technical leader with the Electric Power Research Institute, or EPRI.

“The use case for lithium-ion has historically been for four hours, and so they’ve been designed to do that,” she said. But in a recent call by the California Energy Commission for 10-hour energy storage systems, “lithium-ion batteries won those bids,” she said. “So, we see that it can be pushed to do longer duration.”

With its funding and shift to commercial production over the next 18 months, Jaramillo thinks Form Energy is positioned to enter the market ahead of competing long-duration batteries. But Kostecki can’t yet say which battery will prove to be the best option.

“We don’t know for sure, although it’s very encouraging that people are making progress and have started working on fixing issues related to chemistry and manufacturing,” he said. “But can it be realized on a terawatt scale? We don’t know yet.”

Forbes Australia Issue 7 is out now. Tap here to secure your copy.