Taking a company global can be challenging, but Anteris Technologies boss Wayne Paterson knows how.

Key Takeaways

- Be better than what is on the market already

- Understand that Wall Street is a complicated beast

- Be realistic with shareholders

Wayne Paterson is the managing director and CEO of ASX-listed Anteris Technologies (ASX: AVR). He’s lived and worked in seven countries, launched drugs for global pharmaceutical and healthcare conglomerates Merck and Roche, and now has 3D heart valve technology that could revolutionise the treatment of aortic stenosis, a disease that occurs when the heart’s aortic valve narrows, limiting blood flow to the body. It can be fatal if not treated.

Paterson is based in Minneapolis, in the US, and says taking a company global takes hard work, great relationships and realistic shareholder expectations.

“A lot of Aussies in small cap healthcare on the ASX have a reputation on Wall Street for making stuff up. They’ll come in, all guns blazing, saying they just cured AIDS and saved a billion people and Wall Street will turn to them and say, ‘Sure, like we haven’t heard that before’.

“We [Anteris] are in the 1% where the clinical data is so significantly superior that it’s almost too good to believe. I’ve launched 36 drugs in my career around the world. I’ve got context. I would put this in the top two to three products I have launched in my career. The data is about 50% better than the market leader right now and it’s a US$10 billion space,” he says.

Paterson says he has seen patients near death, and the morning after the surgery they are smiling and hugging everyone in the room.

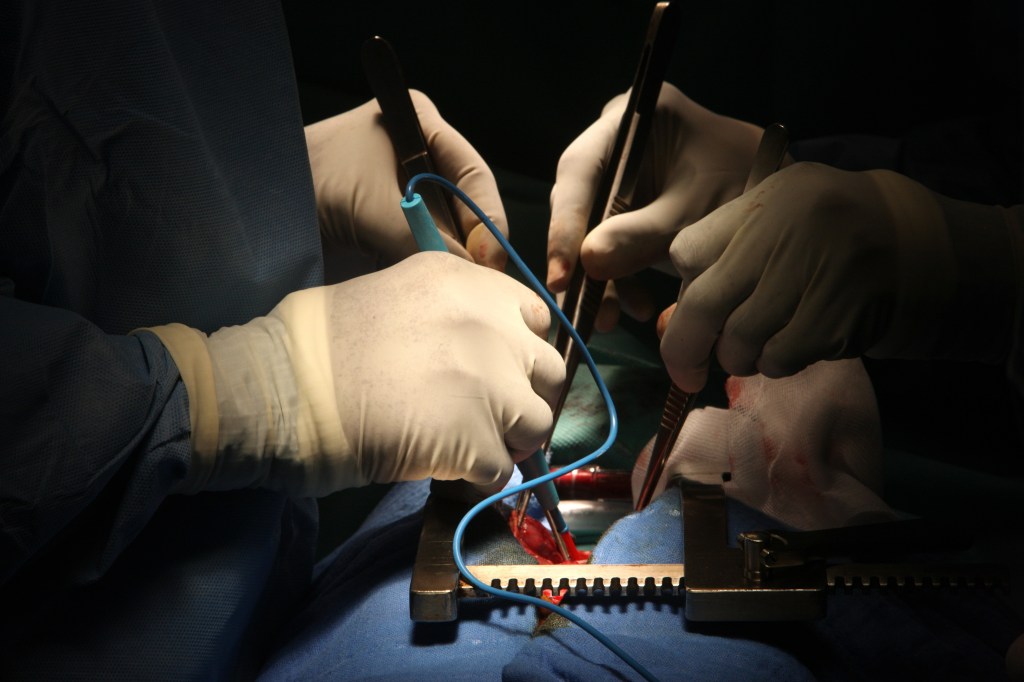

“Once the product goes into the patient, we can measure within about three minutes if they are better off,” he says. “It is that quick. It’s a physical function, not a drug where you have to wait for results. Once that valve goes in, it is either working or it isn’t.”

Patient response to the insertion of the valve is measured before they leave the operating theatre.

Watch Live in the OR on the Anteris Technologies website

Anteris was originally a drugs company, but Paterson realised that investors were never going to make money, so he shut down the drug program and pivoted to medical technology.

“All of the mums and dads investing had seen the share price slide 70% and they were raising capital for something that would never come to market. There’s a lot of companies like that. There’s a lot of spruikers, a lot of snake oil merchants. It takes US$1 billion to bring a drug to market and it can take 10 years. Your chance of failure at the beginning is 95%. Investors don’t understand that,” says Paterson.

“We have some great healthcare companies in Australia. We just don’t have enough of them. It’s important to me to keep this company Australian. The companies that have quality science we want to keep as Australian, but that is not easy. If people want to go global it’s because they want to raise capital.”

Be better than what’s already out there

He said the first consideration when taking a company to global markets is to make sure the technology is legitimate and better than what’s already out there.

“Companies like mine don’t make revenue. You have to invest knowing you are going to come out the other side making revenue, but if you spring a product that’s the same as everything else out there, you are not going to get there. You have to be significantly better,” he says.

Wall Street is a complicated animal

“The second thing is the US, the Nasdaq. People want to be there, but don’t really understand what that means. Wall Street is a complicated animal. It takes time to build relationships.”

He says in the US, “they invest in leadership first and the product second”.

“You can’t roll the dice in Sydney and expect Wall Street to trust you and invest in your company if they don’t know you, or you don’t have a presence in the US. This is money and money matters and there are millions of opportunities for funds to invest in legitimate healthcare companies if we just take that sector.”

“Your shareholders will appreciate it much more if you have a gradual increase in your stock price rather than a quick spike and a drop. There’s often no recovery from that.”

– Wayne Paterson, Anteris Technologies

He advises that companies and entrepreneurs should look at their industry, and the sector, and find the best environment for the company globally.

“I have dozens of employees in the US and Minneapolis is the centre of the med tech universe. All the companies have their headquarters there. For pharma, it’s New Jersey. In Minneapolis, the environment and infrastructure around you is full of med tech people. They know what they are doing. There is no shortage of very smart people right there. That’s a huge plus.”

Be realistic with shareholders

The third thing is to be realistic with your shareholders. If you are going global, just be honest, Paterson says. It might not drive your share price up in the next minute, but think about the next five years.

“It may sound like a long time, but in the sharemarket it is not. Your shareholders will appreciate it much more if you have a gradual increase in your stock price rather than a quick spike and a drop. There’s often no recovery from that. Then they’ll hate you, and want to do a first strike at the AGM,” he says.

“Don’t just jump and say – I’m going to be in the US tomorrow – and get your shareholders all excited by that. You need to establish a presence. You are going to need global staff. Know where your gaps are. The capital markets are geared toward resources. There are a couple of good healthcare funds, but you have to know who to talk to,” he says.

Paterson says that long before you tell the markets, building a presence in the country, in a city where it matters, can be crucial.

Do the simple things: Start the wheels rolling; make your networks; make sure you are showing up and talking to people.

“Most US funds prefer not to invest on the ASX because they see it as a commodities driven market. It’s not predictable. Healthcare is a very different animal to an iron ore company, in terms of the investor mindset. A lot of US funds are nervous that Aussie investors don’t understand healthcare companies.

“I’ve managed to get the biggest healthcare fund to invest on the ASX. They’ve never done that before. You need to spend that time and presence and build that credibility. Science talks and BS walks.”

He advises that any company wanting to make it in New York should seek out good investor relations, because building relationships is critical.

“They know the funds and the banks and you don’t. They can get the door opened. With a healthcare product like this or if you have a drug, they are going to want to see that you can do it, the team can do it, the technology is differentiated enough technically that there is a path to market.

People ask him how he did it.

“I tell them: ‘You have to work’. You’ll always have less staff than you need. You have to do six jobs. If you’re in a small cap and you want to develop a business and you want your staff to follow you and work hard, you need to know how to fill in the gaps globally. If you really want success for your company and your shareholders, you are going to have to do these things. Some of it you can’t teach, you have to experience it.

He says anything is possible.

“It’s all possible. It’s how you legitimately set yourself up. If you legitimately want your staff to develop, your company to develop and your shareholders to benefit you will put in the hours, develop the plan, set the right expectations in the stock market. You will get there.”