Blackstone confirms to Forbes Australia it sealed a deal today to acquire Australian unicorn AirTrunk. The Canada Pension Plan Investment Board also participated in the deal.

AirTrunk – the leading platform for data centres in Asia Pacific – founded by Australian Robin Khuda, is now a part of Blackstone.

“Digital infrastructure is experiencing unprecedented demand driven by the AI revolution as well as the broader digitisation of the economy,” Blackstone’s Sean Klimczak, the Global Head of Blackstone Infrastructure and Nadeem Meghji, Global Co-Head of Blackstone Real Estate, said in a joint statement.

The deal values AirTrunk at $24 billion, Blackstone confirms, and makes this the largest investment the New York-headquartered investment firm has made in the Asia Pacific region. It is not the first high-profile investment the firm has made in Australia, however. Blackstone purchased Crown Resorts for $8.9 billion in 2022.

Khuda founded AirTrunk in Australia in 2015. The company opened its Singapore headquarters in 2019. Macquarie invested in the company in 2020, valuing it at $3 billion. Four years later, it is valued at 8 times that.

“This transaction evidences the strength of the AirTrunk platform in a strong performing sector as we capture the next wave of growth from cloud services and AI and support the energy transition in Asia Pacific,” says Khuda.

The firm has a sizeable presence in Australia, Japan, Malaysia, Hong Kong, and Singapore and “owns land that can support over 1GW of future growth across the region,” according to AirTrunk documents. It currently facilitates more than 800MW of capacity to customers.

“We look forward to working with Blackstone and CPP Investments and benefitting from their scale capital, sector expertise and valuable network across the various local markets, which will help support the continued expansion of AirTrunk,” says Khuda.

Blackstone Inc trades on the NYSE and is worth AUD$251 billion today. The company advises that the AirTrunk transaction is ‘subject to approval from the Australian Foreign Investment Review Board.’

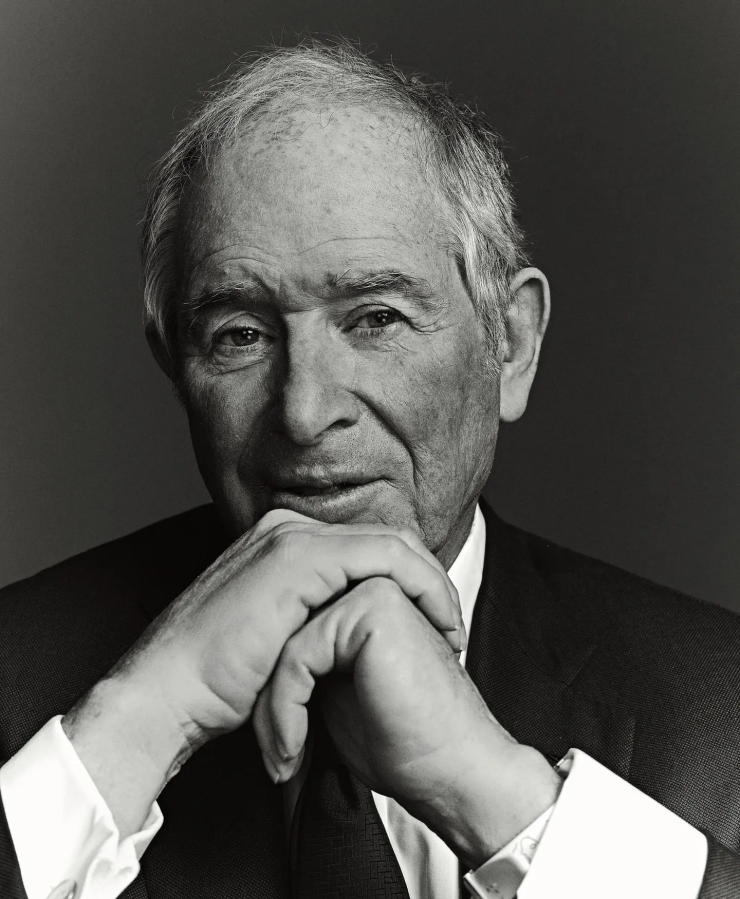

Jon Gray is Blackstone’s global President and Chief Operating Officer.

“This is Blackstone at its best – leveraging our global platform to capitalize on our highest conviction theme. AirTrunk is another vital step as Blackstone seeks to be the leading digital infrastructure investor in the world across the ecosystem, including data centres, power and related services,” says Gray.

The AirTrunk deal adds to Blackstone’s data centre portfolio valued at $55 billion prior to this transaction. A further $70 billion is in the pipeline, the company confirms.

Don’t miss the opportunity to gain exclusive insights that could shape your financial future. Join us at the Forbes Australia Icons & Investors Summit to hear directly from Australia’s top business and wealth experts. Tap here to secure your ticket.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.