Australian venture capital firm Foxglove Capital says nuclear fusion is the “ultimate energy source” – and has backed US fusion energy company Type One to prove it.

Fusion energy is a hot topic – and not just because of the extremely high temperatures required to spark a fusion reaction (100 times hotter than the sun).

Fusion happens when two atoms are smashed together to produce a bigger one, while releasing massive amounts of energy in the process. This kind of reaction happens in the sun and other stars. Scientists believe that, if they can harness its power, it could provide virtually limitless clean, safe and affordable energy. The problem is, no-one’s been that successful – yet. In fact, the long-standing joke in the field is: “fusion energy is always 50 years away“.

But Australian venture capital firm out of WA, Foxglove Capital, believes it is the ultimate energy source – and it’s backed US stellarator fusion energy company, Type One, in its recent seed round to prove it.

“The commercialisation of fusion energy is the game changer when it comes to meeting net-zero targets in a way that offers ubiquitous, low-cost, reliable energy globally,” Foxglove Capital founder, Matt Bungey, says.

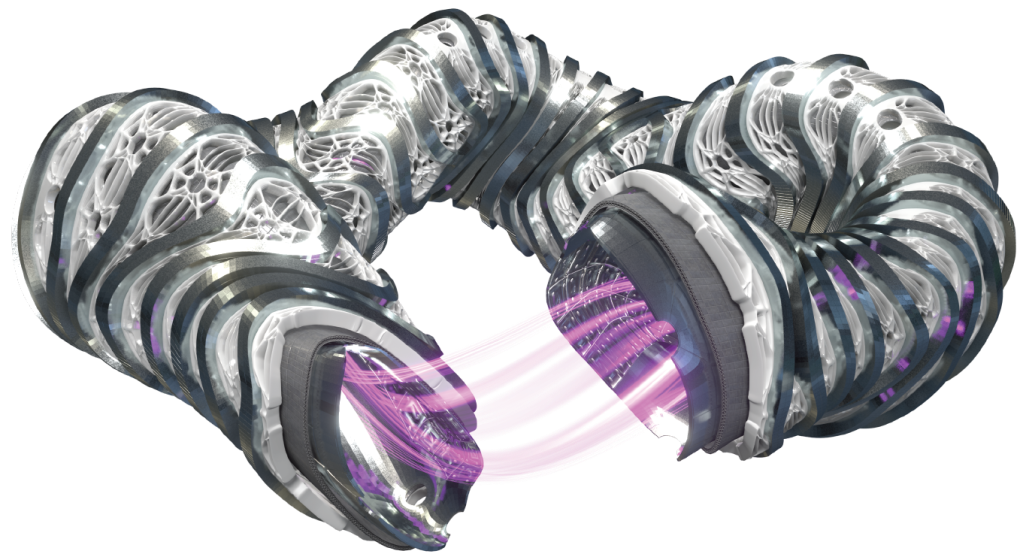

And Bungey claims Type One’s stellarator technology represents the most robust pathway to achieving fusion energy at costs below US$50/MWh. (According to the US Department of Energy, a stellarator is a machine that uses magnetic fields to confine plasma in the shape of a donut, called a torus. These magnetic fields allow scientists to control the plasma particles and create the right conditions for fusion).

About half of the world’s population probably lives within a 3,000-mile radius of Singapore, so if we don’t get Southeast Asia and APAC to net zero, it doesn’t matter what the rest of us do.

Chris Mowry – CEO, Type One Energy

Type One Energy just closed an oversubscribed US$82.5 million seed round (AU$126.4 million) led by Bill Gates’ Breakthrough Energy Ventures, bringing its total capital raised to US$82.5 million (AU$126.6 million) since its inception in 2019. Prior to VC funding, the company secured US$3.2 million in government support from the US Department of Energy. The company, based out of Oak Ridge, Tennessee and led by CEO Chris Mowry, says it will use the cash to fund its FusionDirect program – its path to commercialising fusion energy.

In the last 18 months, the company has grown to 120 full-time staff members, and it aims to double that by the end of 2025. Perhaps its biggest milestone is just around the corner: in February, the company earmarked the Bull Run Fossil Plant in Tennessee, US, as the construction site for its engineering testbed, Infinity One. Type One claims it will be the world’s most advanced stellarator. InfinityOne is scheduled for commissioning and testing in 2029.

Foxglove’s particularly hot on Type One because of its stellarator technology, and the fact that there have been significant developments in the field.

“Breakthrough Energy Ventures has often used the analogy to the space industry’s rapid reduction of part counts, complexity and timelines for challenging hardware to outline their vision for Type One Energy,” Bungey says. And then there’s the team, which includes key members from the HSX and W7-X stellarator experiments. Mowry echoes the sentiment.

“On top of having some of the brightest and most hardworking minds out there, the diversity of our team continues to be our greatest asset, driving the innovation we need to create a more sustainable future of energy,” Mowry says.

Related

But the APAC region featured heavily in Type One’s seed financing, with contributions from New Zealand’s GD1 fund alongside Foxglove Capital. Mowry says that’s no accident.

“I consider APAC and Southeast Asia as ground zero for climate change,” he says.

“About half of the world’s population probably lives within a 3,000-mile radius of Singapore, so if we don’t get Southeast Asia and APAC to net zero, it doesn’t matter what the rest of us do. That’s why this region is so incredibly important in terms of mitigating climate change and basically decarbonising the energy cycle world’s energy system.

“Australia and New Zealand are really leaning forward on climate policy and environmental policy. They’ve got a great innovation ecosystem and those are things that make those locations great places for us to launch our focus on Southeast Asia and APAC.”

Australia’s fusion opportunity

Australia is already home to fusion energy company HB11, founded by German-Australian theoretical physicist, Heinrich Hora, and material scientist, Warren McKenzie, in 2019. This duo spoke to Forbes in 2022, and at the time, claimed they had the world’s cheapest, simplest and most scalable fusion solution. But their approach to fusion energy uses high-powered lasers to compress and ignite a fusion fuel pellet. Energy from the reaction is converted into electricity.

There will be disappointments along the way, but this must not lead to a lack of funding – the prize is too large.

Matt Bungey, co-founder, Foxglove Capital

“Australia has a huge fusion opportunity given our depth of engineering expertise, significant pool of capital and proximity to Asia,” Bungey says. “Entirely new supply chains will need to be developed and there will be multiple huge winners (both in terms of technology and valuation) from advances in fusion technology. We have followed HB11 from afar, which is following a different pathway to commercialisation of fusion.”

The fusion energy industry – as a whole – is expected to reach US$840 billion (AU$1.28 trillion) by 2040, growing at a compound annual growth rate of 6.9% between (from 2030), according to Allied Market Research. And its supersized market is largely due to the fact that it can solve many of the baseload power challenges imposed by renewable energy, and can plug into existing infrastructure without the need for grid restructuring, Bungey says.

“There are multiple technologies being developed as solutions for the commercialisation of fusion energy,” he says. “We believe there will be multiple winners, however it will take time for opinions to coalesce as to the most promising solutions. A key challenge will be that significant government and private funding is needed for the commercialisation of fusion. There will be disappointments along the way, but this must not lead to a lack of funding – the prize is too large.”

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.