Flowcarbon secured millions of dollars in funding from investors like Andreessen Horowitz to merge carbon credits with the blockchain, but its “Goddess Nature Token” never launched.

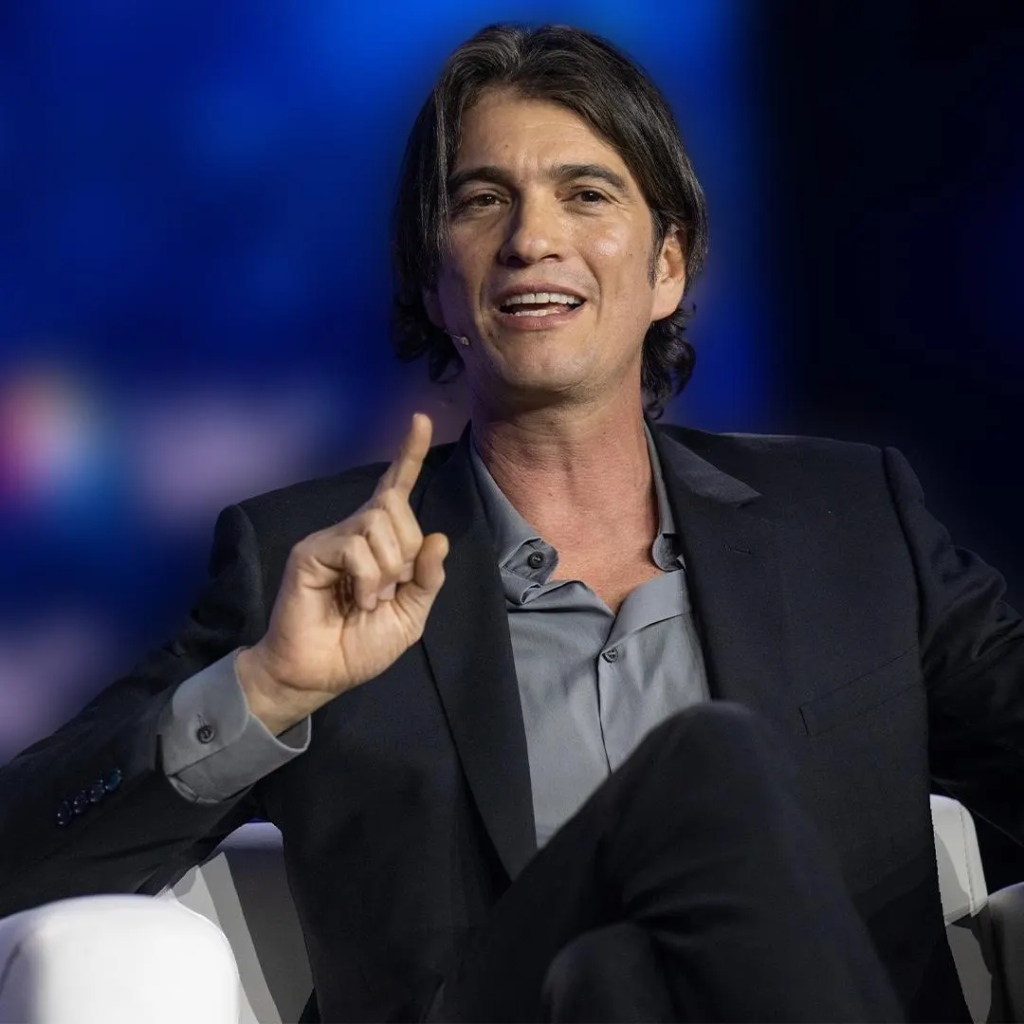

Flowcarbon, the climate tech startup cofounded by WeWork’s Adam Neumann, has been quietly refunding investors after failing for years to launch its “Goddess Nature Token,” Forbes learned.

Since debuting more than two years ago, the startup has struggled to realize its mission of bringing carbon credits onto the blockchain. In 2022, Flowcarbon announced it had raised $70 million in funding from investors like Andreessen Horowitz to create a new token backed 1:1 by carbon credits, certificates that companies typically buy en masse to offset their greenhouse gas emissions. Each credit represents a metric ton of carbon dioxide that has been removed or prevented from entering the atmosphere. Tokenizing them would, in theory, make it easier for anyone to participate in the carbon market, a system that some reports have claimed can do more harm than good.

But in recent weeks, Flowcarbon has been issuing refunds to people who purchased its “Goddess Nature Token” and waited years for a launch that never happened. According to sources who were contacted by the company last month, Flowcarbon cited market conditions and resistance from carbon registries as the reason for returning buyers’ funds instead of continuing to hold them indefinitely. These individuals told Forbes that the company relayed this information over Zoom calls.

As part of the refund process, Goddess Nature Token purchasers were asked to sign a release including a broad waiver of claims against Flowcarbon and its affiliates, as well as confidentiality terms, according to a contract viewed by Forbes.

“There was so much demand for the presale that everyone was asked to help.”

Former Flowcarbon employee

Flowcarbon did not address a list of questions about the refund. It told Forbes, “It’s well known that since last year we have been offering refunds to retail GNT buyers due to the industry delays, with standard and customary terms, as we continue to grow Flowcarbon as a leader in carbon finance.”

Earlier this year, Flowcarbon stopped using Discord as a communications channel, telling Forbes that “anonymous users [were] increasingly posting inappropriate content, sometimes of a graphic nature.” Spokesperson Jennifer Owens added that “Email, phone and Zoom are all much more effective for communicating directly and regularly with our audiences, as is X and LinkedIn where we are very active.” Flowcarbon does not appear to have disclosed the recent refunds on any public platform.

Flowcarbon isn’t the only crypto-carbon project but its profile was arguably the highest, thanks to Neumann’s WeWork renown and a lineup of major backers. “Adam and Rebekah’s vision is a key part of the story and that is really what gave birth to the company,” Andreessen Horowitz general partner Arianna Simpson enthused during the $70 million Series A she led, touting Flowcarbon as “best in breed.” Also on the cap table are General Catalyst, Samsung Next, Hollywood producers Sam and Ashley Levinson and Euphoria producer Kevin Turen, who passed away last November. “There was so much demand for the presale that everyone was asked to help,” a former Flowcarbon employee told Forbes. Andreessen Horowitz did not respond to a comment request.

At least $38 million of that $70 million round was raised through the sale of Flowcarbon’s token, though it’s unclear if that figure includes retail buyers. Venture capital firm Fifth Wall bought $4 million worth, and did not respond to questions about whether it has also been refunded. At one point, Flowcarbon had a “requested minimum purchase amount” of $25,000 for presale participants, it told Forbes earlier this year, but insisted it was “never intended as a floor” and that many purchases were for less.

Crypto’s heyday gave rise to a number of startups looking to tokenize carbon credits: The idea was that the blockchain could make them easier to buy and sell. In traditional carbon marketplaces, credits are typically retired after purchase to redeem their emissions benefits and remove them from circulation. But in 2021, millions of retired carbon credits were tokenized by projects like Toucan and KlimaDAO, causing some of the world’s largest carbon registries — standards bodies that oversee massive offset databases — to worry their value was being counted twice. In November 2021, before Flowcarbon had even publicly launched, the prominent registry Verra cautioned against the practice.

The voluntary carbon market, which purportedly allows companies and individuals to cancel out their emissions footprints, grew to roughly $2 billion in 2021. But over the past few years, a series of investigations found that some of the projects supplying credits to registries like Verra had exaggerated their benefits, failed to actually remove carbon dioxide from the atmosphere or been linked to alleged human rights violations. A marketplace report found the value of carbon credits fell dramatically last year as a result of these claims. In May, the Biden administration announced a set of federal guidelines intended to steer buyers toward higher quality offsets.

“For pre-salers, are we looking at our money being locked up for another year?”

Goddess Nature Token investor

While Flowcarbon has stated that only unretired, certified credits would back its token, meaning only token holders could claim their offsets, Verra’s announcement had a chilling effect on its launch. According to staff updates posted to Discord throughout 2022, the launch was bumped from January to February to March of that year. In May, Verra announced that it had banned the tokenization of retired credits entirely so it could explore a solution that “prevents fraud and upholds environmental integrity.” Two months later, Flowcarbon CEO Dana Gibber told the Wall Street Journal that the launch had ultimately been paused to “wait for markets to stabilize.”

Buyers were frustrated. “For pre-salers, are we looking at our money being locked up for another year?” one asked on Discord in September 2022. Earlier this year, Flowcarbon told Forbes that its policy since 2023 has been to honor all refund requests.

“Verra stands by its decision made in May 2022 to prohibit the practice of creating instruments or tokens based on retired credits,” registry spokesperson Lara Kennedy told Forbes. While it continues to have internal discussions about potential blockchain applications, “there is no forecast date as to when Verra will make its next announcement on this subject.” Flowcarbon has said it “maintained a very close and collaborative relationship with Verra and Gold Standard,” another major registry.

While Flowcarbon’s daily management falls to Gibber and COO Caroline Klatt, who are sisters, the idea behind the company originated with Neumann and his wife, Rebekah Neumann. During WeWork’s scrapped public offering in 2019, the Neumanns revealed they were pledging $1 billion to charitable causes, and claimed to have funded efforts to conserve “over 20 million acres of intact tropical forest,” though they did not say where.

Gibber and Klatt have said that Flowcarbon was incubated by Neumann’s family office, 166 2nd Financial Services, which invested an undisclosed amount in the company. After the two cofounded and sold a chatbot marketing platform to a private equity firm in 2020, Gibber and Klatt, “got a call from a close person in our network who was working at a family office,” Gibber said on a podcast in 2022. They were asked if they could research the ins and outs of the carbon market, she added. “What evolved from that is Flowcarbon.”

That “close person” may be Ilan Stern, chief investment officer of Neumann’s family office, who is also the sisters’ cousin, according to public records and two former Flowcarbon employees, who claimed that Gibber and Klatt’s brother also works at Flowcarbon. The company confirmed these family relationships to Forbes.

In 2022, Neumann founded the similarly named real estate startup, Flow, causing some Flowcarbon staff to wonder whether the companies would eventually partner, former employees told Forbes. Flowcarbon has maintained there are no plans for the companies to collaborate.

This article was originally published on forbes.com.

Don’t miss the opportunity to gain exclusive insights that could shape your financial future. Join us at the Forbes Australia Icons & Investors Summit to hear directly from Australia’s top business and wealth experts. Tap here to secure your ticket.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.