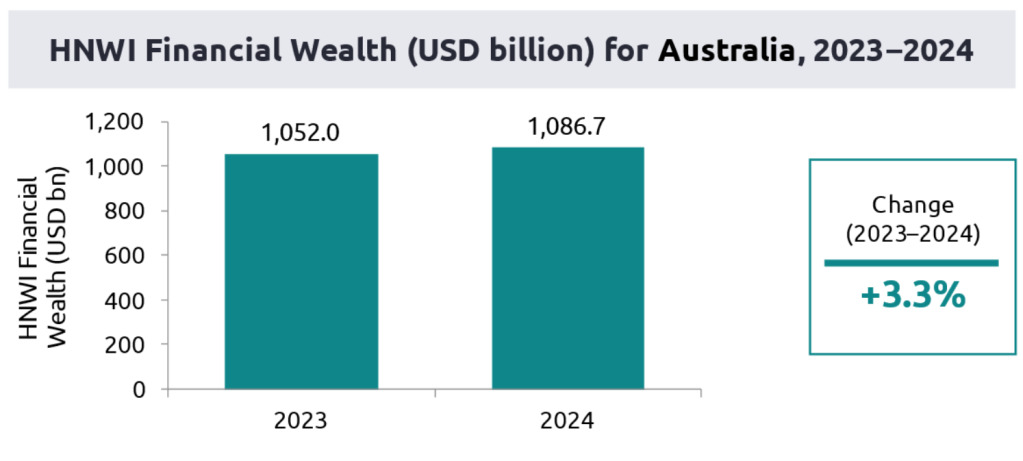

Australia’s richest collectively own 3.3 per cent more wealth than last year, with 22 per cent of it projected to be transferred to beneficiaries in five years, according to Capgemini’s annual report.

High net worth individuals (HNWI) in Australia are worth more than ever, according to Capgemini research, overseeing a pool of more than AUD$1.6 trillion in assets.

The firm defines HNWI as having ‘investable assets of USD1 million or more, excluding their primary residence, collectibles, and consumables.’

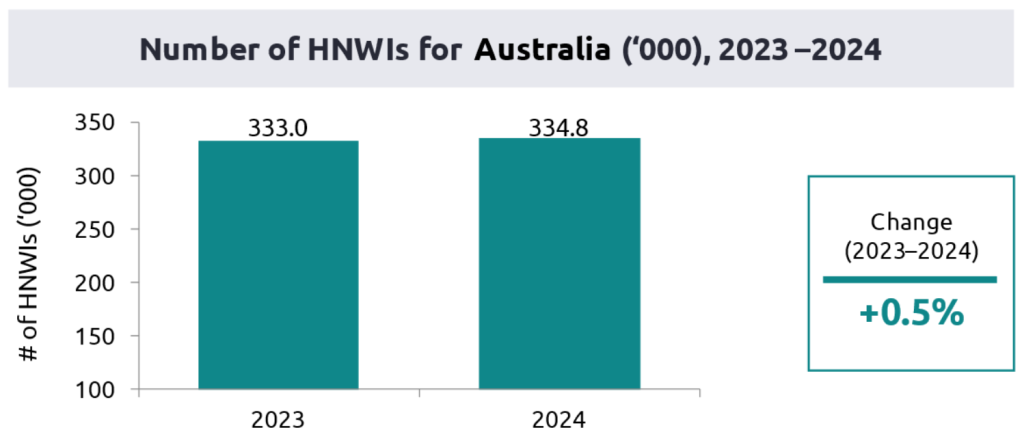

There are currently 334,800 Australians that meet that criteria, according to the 2025 report. Some 30,240 individuals have wealth above $7.7 million, and 2,450 have net worth of $46 million or more – making them Ultra High Net Worth (UHNW).

This year’s figures represent growth of just 0.5 per cent on last year. But soon, a much bigger shift is coming.

Eighty per cent of HNWI wealth will transfer into the hands of Gen X, millennials, and Gen Z within the next 15 years, the report states. And that transformation will drastically disrupt the status quo.

“The next generation of high-net-worth individuals arrive with vastly different expectations to their parents,” says Kartik Ramakrishnan, the CEO of Capgemini’s Financial Services Strategic Business Unit.

The expectations of the new HNWIs include financial services on their preferred digital channels, alternative investments including cryptocurrency and value-added services from wealth management firms.

“Globally, AUD$72 trillion will transfer into the hands of women over the next three decades.”

Capgemini 2025 ‘Sail the Great Wealth Transfer’ report

If those needs are not met, 81 per cent of inheritors intend to move the money away from the firms that served their parents within a year or two.

“Baby boomers (age 60 years+) focus primarily on preserving their wealth, ensuring it remains secure and stable for future generations,” Capgemini’s Sail the Great Wealth Transfer report reads. “In contrast, Next-gen HNWIs are willing to take more risks to expand their wealth – allocating capital to higher growth asset classes and demanding niche product offerings.”

$128 trillion to set sail globally

Around the world, the pool of money set to transfer from one family member to another, or their intended beneficiary, exceeds AUD$128 trillion. The majority of that – AUD$72 trillion – will end up in the hands of women, either female spouses, daughters, or other beneficiaries.

“The great wealth transfer will be a defining moment for the industry,” says Ramakrishnan.

As a consequence, firms like UBS have initiated programs designed to enable female financial decision makers.

“The Women’s Investment Circle Masterclass has empowered women to take an active role in managing family wealth,” UBS states. “Participants gained a robust understanding of financial markets, investment strategies, and wealth psychology, enabling them to confidently engage in wealth discussions and make informed decisions.”

The value of the global HNWI wealth pool grew 4.2 per cent over the last year, exceeding the rate at which Australian HNWI wealth grew. Similarly, there are 2.6 per cent more HNWI globally than there were in 2024. In Australia, the number of HNWI grew by just 0.5 per cent, to 334,800 people.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.