The embattled special-purpose acquisition company seeking to merge with former President Donald Trump’s social media platform Truth Social has now lost most of its prior investment commitments, the latest issue for the years-old deal—though the two firms argued it was a positive development.

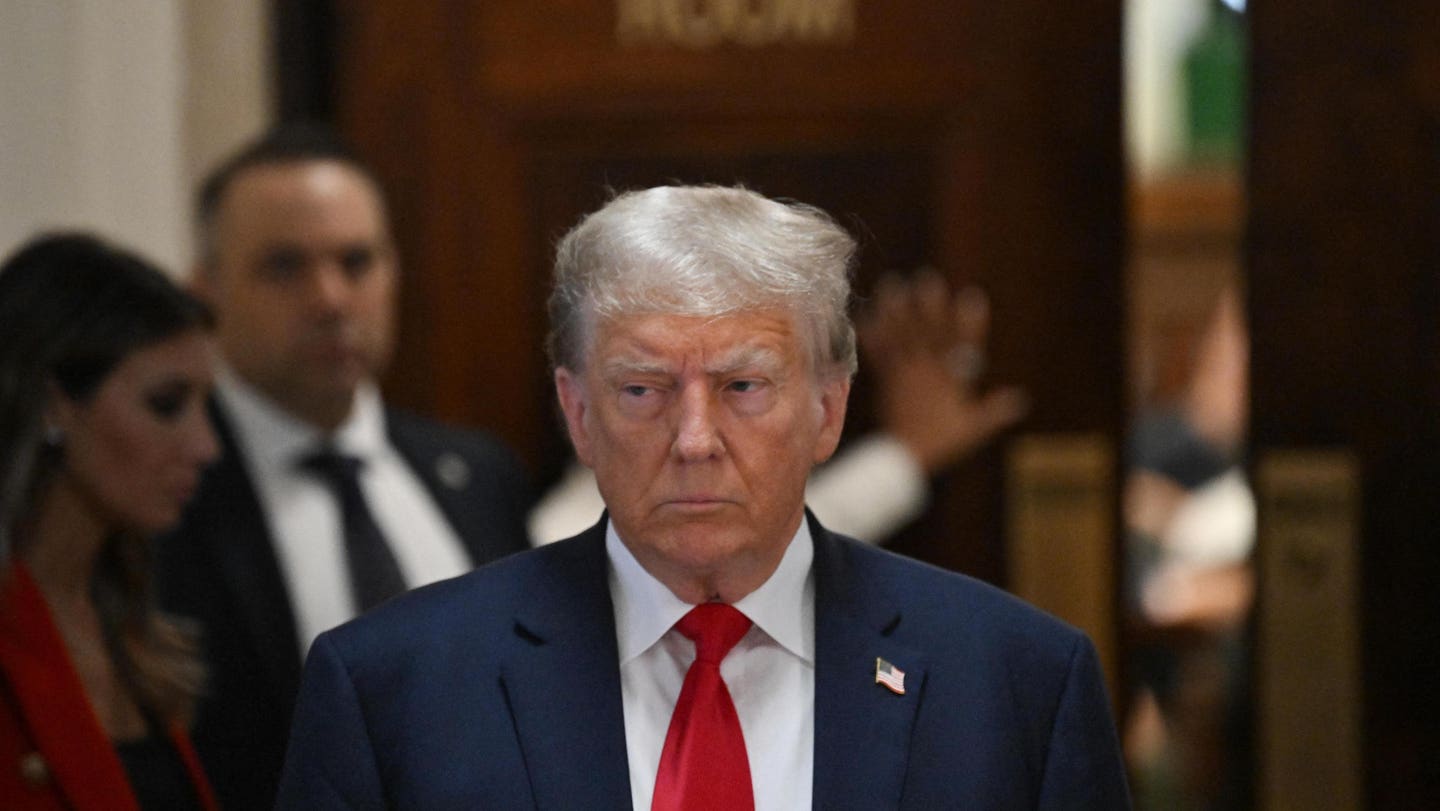

Donald Trump, center, is facing more headaches related to his social media company.

Getty Images

Key Facts

Investors who previously expressed interest in buying shares of Digital World Acquisition Corp. terminated $191.5 million in planned investments, bringing the total cancellation of such investments to $533 million out of a $1 billion original commitment, the firm revealed in Thursday filings with the Securities and Exchange Commission.

The company, which has pursued a merger with Truth Social parent Trump Media & Technology Group since October 2021, also said Thursday its unaudited quarterly financial statements from last year “should also no longer be relied upon” because of a “material weakness” in internal accounting practices, following a similar announcement in May about its audited 2022 quarterly reports.

In a statement, Devin Nunes, Trump Media’s CEO and former Republican member of the House, characterized the abandoned commitments as an “important step…in the “best interest” of shareholders designed to complete the merger “as soon as possible.”

Both companies expressed their desire to cancel all outstanding private investment in public equity (PIPE) investments.

Crucial Quote

“Despite how others may seek to characterize the PIPE commitment cancellations, we want our shareholders to understand that these cancellations are a positive development in our ability to consummate the business combination,” Digital World Acquisition Corp. CEO Eric Swider said in a statement.

Key Background

Shares of Digital World Acquisition Corp. were flat in Thursday trading but are down more than 80% since last March as the company faces an increasingly uphill battle to complete its merger with Trump’s firm. The blank check company’s $600 million market capitalization is a far cry from its peak valuation of nearly $4 billion. Beyond the typical headaches associated with reverse mergers, the two companies have also dealt with a variety of legal troubles, such as the arrest of a former Digital World Acquisition Corp. board member for insider trading ahead of the intended merger’s announcement and the arrest of Trump for a litany of charges related to election interference. Trump Media’s flagship product—the Truth Social app—launched early last year, but the company’s plans to merge with Digital World have faced repeated delays, with shareholders voting to extend the merger deadline by another year last month.

What To Watch For

Both Digital World Acquisition Corp. and Trump Media are able to back out of the merger between October 31 and November 21, according to a filing last month.

Tangent

Trump’s net worth declined from $3.2 billion to $2.6 billion over the last year largely due to the sinking value of Truth Social, according to Forbes’ calculations.

This post originally appeared on Forbes.com

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.