The billionaires behind Tesla, Alphabet, Meta, LVMH and more saw their fortunes plunge in the billions on Wednesday following a rash of earnings reports that disappointed investors.

Sliding stocks on Wednesday took a huge divot out of the fortunes of the world’s ultra-rich. Altogether, the planet’s ten wealthiest people lost nearly $66 billion in a day, as shares of Tesla, Alphabet, Meta and more tumbled.

Big tech stocks were hit particularly hard following the release of second quarter earnings reports late Tuesday by Tesla and Alphabet, both of which disappointed investors.

The biggest loser of the day was Tesla CEO Elon Musk. His fortune fell by $17.1 billion to $231 billion as the result of a 12% decline in shares of the electric vehicle manufacturer. Despite the big loss, Musk still holds onto his title as the world’s richest person, maintaining a $33 billion lead over number two richest, Amazon chairman Jeff Bezos, who lost $5.2 billion as Amazon shares fell nearly 3%.

Industries beyond tech were not immune to the downturn. Shares of French luxury goods behemoth LVMH dropped 4.6% following the release of its second quarter earnings, which missed analysts revenue estimates. That led to an $8.4 billion loss for LVMH Chairman and CEO Bernard Arnault, the world’s third richest person.

Here’s how much each of the world’s ten richest people lost on Wednesday:

Elon Musk

- Company: Tesla

- Drop: $17.1 Billion

- Net Worth: $231.6 Billion

Musk, who spent part of Wednesday at the U.S. Capitol listening to Israeli Prime Minister Benjamin Netanyahu’s address to Congress, led the individual losses with a net worth drop of $17.1 billion. Late Tuesday, Tesla reported a 45% drop in profits in the second quarter, more than analysts had expected. More than half of Musk’s fortune lies in his Tesla stake.

Jeff Bezos

- Company: Amazon

- Drop: $5.2 Billion

- Net Worth: $198.6 Billion

Amazon’s stock seems to have been swept up in a bigger tech downdraft on Wednesday. The e-commerce giant will release its second quarter earnings next week, on August 1. The 2.99% drop in Amazon stock resulted in a $5.2 billion loss on the day for the Amazon founder and chairman. Bezos is still the world’s second richest person, according to Forbes. The 2.5% decline in his fortune isn’t likely to dent his lifestyle.

Bernard Arnault

- Company: LVMH

- Drop: $8.4 Billion

- Net Worth: $181.8 Billion

Second quarter results for French luxury goods group LVMH, which were released on Tuesday, missed analysts’ expectations for sales growth. Revenue for the group rose 1% in the quarter to 20.98 billion Euro, below estimates of 21.6 billion Euro. Shares of LVMH fell as much as 6% on Wednesday but ended the day down nearly 4.7% on the Paris stock exchange, shaving $8.4 billion off the fortune of Arnault, who serves as Chairman and CEO. The luxury group’s 75 brands include Louis Vuitton, Dior, Bulgari, Sephora and Tiffany & Co. Arnault, whose net worth is largely tied up in LVMH stock, was the third biggest loser of the day.

Larry Ellison

- Company: Oracle

- Drop: $6 Billion

- Net Worth: $171.2 Billion

Ellison, the chief technology officer and cofounder of software giant Oracle, is still the world’s fourth richest person despite a $6 billion decline in his fortune on Wednesday. Oracle announced its fiscal fourth quarter earnings last month; its stock dropped 3% amid a downdraft in the tech sector.

Mark Zuckerberg

- Company: Meta

- Drop: $9.5 Billion

- Net Worth: $161.9 Billion

If losing money was an Olympic sport, Meta CEO Mark Zuckerberg would win silver today after a 5.6% drop in Meta shares left him down $9.5 billion at the market close. Despite the drop, he held onto his spot as the world’s fifth richest person. Zuckerberg, whose 13% ownership of Meta (parent of Facebook, Instagram and WhatsApp) accounts for the vast majority of his net worth, is at age 40 the youngest among the world’s ten richest people.

Larry Page and Sergey Brin

- Company: Alphabet

- Drop: $7.2 Billion (Page) and $6.7 Billion (Brin)

- Net Worth: $143.1 Billion (Page) and $137.1 Billion (Brin)

The combination of slower ad-sales growth in the second quarter and billions of dollars in ongoing spending on AI led investors to sell shares of Alphabet on Wednesday, following the release of otherwise strong earnings on Tuesday. Page and Brin, the two Google cofounders, lost a combined $13.9 billion on Wednesday as Alphabet shares fell just over 5%.

Warren Buffett

- Company: Berkshire Hathaway

- Drop: $312 Million

- Net Worth: $136.4 Billion

Compared to the others in the top ten richest, Buffett had a pretty good day. Berkshire Hathaway’s Class A shares fell just 0.2% on Wednesday, shaving a bit more than $300 million off his fortune. For a guy worth more than $136 billion, that’s peanuts.

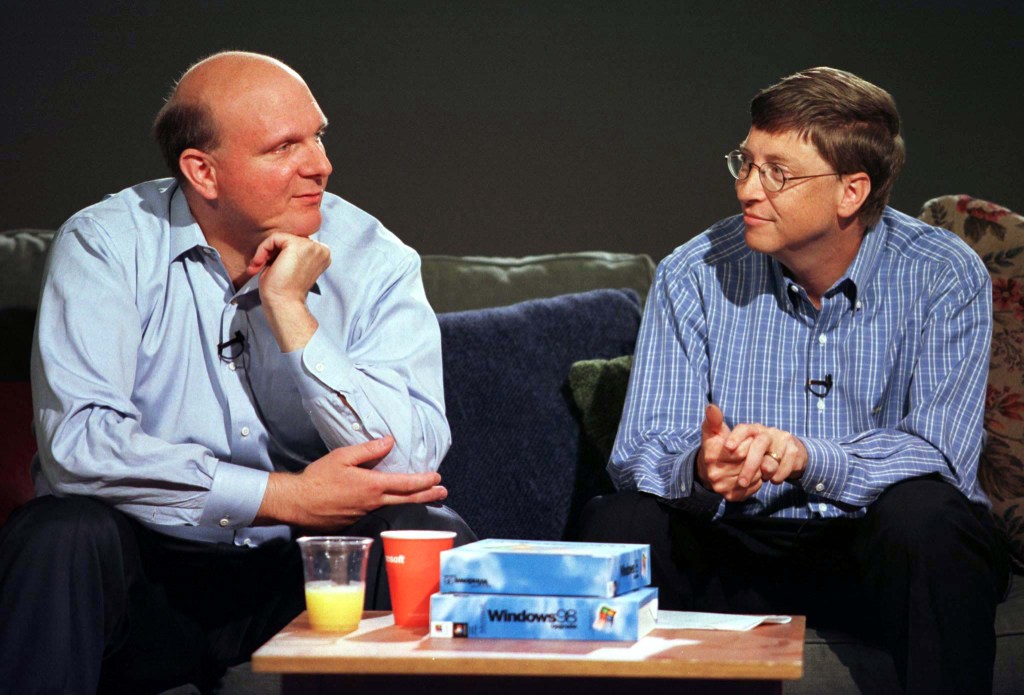

Bill Gates and Steve Ballmer

Company: Microsoft

Drop: $1.7 Billion (Gates) and $3.8 Billion (Ballmer)

Net Worth: $132.6 Billion (Gates) and $126.4 Billion (Balmer)

The fortunes of Microsoft cofounder Gates and its former CEO Ballmer got nicked by the nearly 3.6% drop in Microsoft shares on Wednesday. The software and computing giant is slated to report its quarterly earnings on July 30.

This article first appeared on forbes.com and all figures are in USD.

Are you – or is someone you know -creating the next Afterpay or Canva? Nominations are open for Forbes Australia’s first 30 under 30 list. Entries close midnight, July 31, 2024.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter hereor become a member here.