Stripe processed $200 billion in local payments over the last decade. That’s less than 7% of the payments opportunity that will be on the table in Australia by 2029, according to industry research. Yet, billionaire co-founder Patrick Collison has his sights set on a much larger goal: growing the GDP of the internet.

Irish-born brothers Patrick and John Collison founded Stripe in the Bay Area in 2010. Four years later Stripe launched in Australia.

Over the last decade, the company has handled over $200 billion in transactions on behalf of 500,000 Australian businesses. It’s a drop in the bucket compared to the US$1 trillion that Stripe oversaw in global payments last year. And yet Australia is an important growth region for the company, according to co-founder and CEO Patrick Collison.

“Market response has been quite a bit stronger than we expected,” Collison says, talking to reporters in Sydney’s convention centre during the Stripe Tour conference. “ANZ is now our third largest market globally.”

Traction

One of the Australian organisations that uses Stripe to process payments from subscribers is content-streaming platform Stan. Homegrown unicorn Canva also uses Stripe, as does Westfield, Atlassian, Shopify, Amazon, Leonardo.ai, Instacart, Microsoft, Uber, and Zara, among many others.

The company already has an impressive roster of customers under its belt. But Collison remains laser-focused on a bigger, loftier goal.

“Our mission is to grow the GDP of the internet and that’s kind of an abstract idea, and certainly not the world’s catchiest slogan. But we do think that there’s not enough prosperity in the world. The average global income is on the order of $10,000 a year.”

Encouraging and supporting entrepreneurialism is something the County Tipperary-born 36-year-old takes to heart. In part, because of his journey as a founder, but also because it is good for business. Stripe’s business model includes taking a cut of each payment transaction. So the more startups and founders that are building and selling, the more that ends up in Stripe’s coffers.

It’s a playbook that has worked out quite nicely so far.

The company was valued at USD$70 billion in April of this year. An enormous figure, no doubt, and yet considerably less than its peak valuation of USD$95 billion in 2021, and far below what the company can achieve moving forward, according to investors.

Celebrating entrepreneurship, and revenue

In addition to the obvious financial upside to Stripe of growing the global entrepreneurial pie, Collison says his upbringing in rural Ireland has given him great respect for company founders being able to trade across borders. He witnessed the country he grew up in transform from collective pulling up of bootstraps.

“We grew up in Ireland, I didn’t move to the US until I was going to university,” says Collison. “Back in the 50s and 60s, Ireland was the poor man of Europe. Through the 80s, 90s, 2000s, we saw the Celtic Tiger and a complete transformation in Irish livelihoods. Ireland became one of the most prosperous countries in Europe. You can’t help but internalise the importance of that when you grew up in the midst of it.”

The brothers’ Irish heritage inspired a desire to connect people and companies across borders. Born in 1988, he recalls not having internet as a boy and instead reading magazines from the UK.

“You’re an eight-year-old kid reading this magazine with all these cool offers, thinking ‘I want to order the such and such.’ But in the small print it says ‘offer not valid in the Republic of Ireland,'” says Collison. “It gave us some sense of the value of that last mile.”

Connecting company founders to markets beyond their geographical boundaries has been a consistent theme throughout the brothers’ careers. Their first startup, Auctomatic, provided tools for eBay sellers. The brothers built the company in San Francisco in 2007 with co-founders Harj and Kulveer Taggar who they met through YCombinator. They sold Auctomatic to a Canadian company for $5 million the year after.

Collison was an undergraduate at MIT at the time, and younger brother John was still in high school. Two years later, the Collison brothers had developed a ‘behind-the-scenes snippet of code called an API‘ that could make it easy to add credit card functionality to a website, according to a 2022 Forbes profile on the company.

That product was the genesis for Stripe. By 2010, the elder Collison had dropped out of MIT and John left Harvard where he had begun studying. The brothers launched the company in a cafe while on a trip to Buenos Aires, promising to “pick up where PayPal left off.”

In 2011, Stripe launched publicly in the US. By 2013 it had expanded into the UK and Canada. The launch into Australia came the year after.

The company got its name in part because the domain name was available, and because it had a positive association to racing stripes, according to former CTO Greg Brockman – now a co-founder of OpenAI. The name is also reminiscent of the magnetic stripe on a credit or debit card, the physical manifestation of payments in a bygone era, that Stripe has helped to upend.

In 2016, six years after Stripe’s inception, the company launched its Atlas product, reaffirming the brothers’ commitment to encouraging entrepreneurship to sprout from all corners of the globe.

“Atlas enables founders anywhere in the world to establish a US business and get a US Corporation, a US bank account, and to start operating,” says Collison. “We built Atlas because we kept meeting these founders who had terrific ideas, but found it very hard to get them off the ground.”

Going public?

It has long been rumoured the company will IPO on the US public markets, though its founders have denied it is imminent. Collison confirmed as much in Sydney, stating that Stripe is very happy with the current status of the business.

“If at some point we think that IPOing would help us build better products for our customers or serve them more effectively, then we’ll consider it, but we’re very much optimising for them, and not for corporate structure or shareholder returns,” says Collison.

The last raise the company completed was a USD$6.5 billion series I in 2023, led by existing investors Andreessen Horowitz, Founders Fund, and Thrive Capital, as well as new investors including Goldman Sachs and Temasek, Singapore’s sovereign wealth fund.

Stripe’s first investors included three of Silicon Valley’s most notorious gang of investors, the PayPal mafia. Peter Thiel, Max Levchin and Elon Musk chipped in on the $2 million seed raise in 2011. Not only did Thiel and Musk contribute capital, but also a wealth of knowledge from their days running the world’s first digital payment platform.

Prolific Silicon Valley investor Sequoia Capital also went in on the seed round. The firm has continued to fund Stripe throughout its meteoric 14-year rise, investing a total of $517 million. Today, Sequoia reportedly holds a position valued at almost USD$10 billion.

“When we first partnered with Stripe in 2010, it was a scrappy payments innovator,” says Roelof Botha, Sequoia Capital’s managing partner. “More than a decade later, Stripe has evolved beyond payments to set a new standard for financial infrastructure—driving significant revenue growth for its users.”

In April of this year, Stripe raised almost USD$700 million on the secondary market to provide liquidity to employees, a further sign that it is looking to give early investors an exit without having to immediately take the company public.

Stripe in Australia

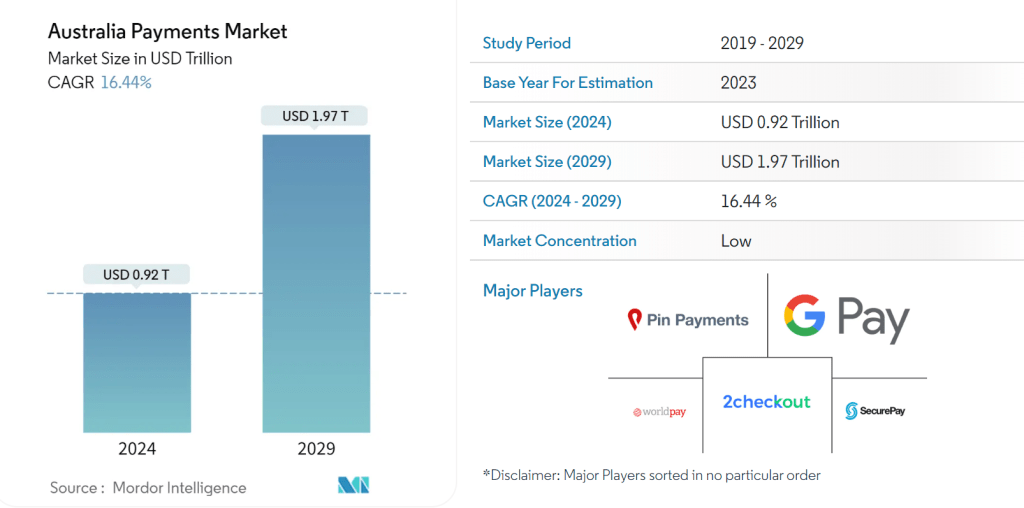

Locally, there is still significant room for Stripe and other payment processors to grow. Research from Mordor Intelligence projects that the Australian payments market will more than double from this year’s total of USD$920 billion to reach USD$1.97 trillion in five years.

In August, the company launched new features in the Australian market. Stripe now offers PayTo and Instant Payouts to Stripe customers. While Collison was in Sydney for the launch he sat down with fellow unicorn founder and Canva chief product officer Cam Adams. The two billionaires discussed how their approaches to building company products differ.

“At Stripe we try to be quite cautious in forming our conceptions and visions as things are rapidly changing. We try to go out with something that is directionally correct and hopefully useful, then get a round of feedback and iterate,” Collison told Adams on stage at Sydney’s ICC.

Daniel Miller, Stripe’s head of solutions architecture for ANZ, is based in Melbourne and tasked with creating products for the unique Australian marketplace.

“What started as a really foundationally great card payments product has now evolved to include other things that we call Connect, RFA (revenue and finance automation) card-present payments, and Terminal. And we’re not going to stop here, there’s lots more for us to do,” Miller tells Forbes Australia in an exclusive interview.

PayTo: The way forward

The launch of the PayTo product comes at a time when Australia’s regulators are demanding change and innovation.

“The old system, a bulk entry credit system called BECS is being retired by the end of the decade,” says Miller. “Eventually we’ll all be on PayTo and this is a good thing for businesses and good for consumers. We’ll have a lot more control on both sides [of a transaction], a lot more clarity, and instant verification of amounts which does not exist today.”

One of the criticisms of the current BECS direct debit system is delayed or non-existent notifications that make it difficult for companies to know if direct debits from customer’s accounts have gone through.

“It’s pretty terrible,” says Miller. “If you try to debit someone, you never hear if it was successful. You just don’t get your money, that’s how the system works. It’s pretty annoying for companies to deal with, frankly,” says Miller.

Australia is just one of many countries updating its archaic banking system to keep up with electronic banking and changing customer expectations.

“Many economies in the world are moving to a real-time payment system. They’re trying to get better. They know what expectations are and they want the ability to move money faster,” says Miller.

The power of revenue and finance automation (RFA)

Sharmeen Chapp heads up Product for Revenue and Financial Automation at Stripe’s headquarters in San Francisco. The Stripe Tour conference in Sydney is the first time she has had boots on the ground in Australia. She says that Australian startups are well aligned with Stripe’s product offerings.

“The people we can help the most are the users who are looking to innovate, who are ambitious and trying to grow quickly. They don’t want to repeat the same code for every point solution that they’re integrating with,” says Chapp.

“A consequence of being able to do business on the internet now is that companies can grow and expand across country borderlines much faster than they ever were able to before. Having to manage different regulations and tax jurisdictions is complicated.”

Stripe can oversee taxes in more than 50 countries and has products that assist with revenue reporting and recognition. In a market like Australia with many business owners selling internationally, Stripe’s product suite is invaluable, Chapp says, because it allows founders and teams to focus on creating their own products rather than worrying about payments and capturing revenue.

“To really grow, many businesses in Australia have to go overseas or sell to overseas customers. The revenue recognition product helps finance teams close their books faster,” says Chapp.

The AI effect

Like many companies, Stripe is using machine learning to tailor solutions specific to the customer. Its AI-driven product that helps companies capture failed payments is called Smart Retries.

“Let’s say your standard payment fails,” says Miller. “We have machine learning in place that effectively will say ‘this is the next optimal time based on that issue or that person’s spending habits.’ We found that on a fixed retry schedule, businesses have about 40% chance of recovering that in later attempts at collecting payment. But with Smart Retries, specifically in Australia, that jumped to around a 64% success rate.”

Chapp says that globally, Stripe’s Smart Retries product is helping to recover significant amounts of money for their customers.

“It’s so powerful that it helped our users save USD$3.4 billion last year. That is money that they would have lost to churn,” says Chapp.

The Australian market: research and culture

Stripe released research recently that found that 60% of Gen Z respondents in Australia don’t expect to use cash in 10 years. Sixty-seven per cent expect to rely solely on digital payment solutions for example smartphones/digital wallets. Twenty per cent expect that by 2034 biometrics and wearables will be used for payments.

The projections speak to the rapid adoption of digital payments. In 2023, Australian businesses using a software platform on Stripe increased by nearly 20% year over year. Payment volume grew 5x between 2019 and 2023. Asia Pacific is forecast to be the world’s fastest-growing region moving forward, according to the company.

Miller and Chapp partially attribute growth in the Australian market to Stripe being heavily focused on customer feedback. Each month the company holds a ‘voice of the user’ session where Stripe’s 100 Australian employees hear good, bad, and ugly feedback from a customer.

Transparency is a part of the Stripe culture that starts at the very top.

“Every Friday we have a ‘Friday fireside’ where Patrick or John, or other leaders at Stripe, will have a user come on and just have a nice chat with them. And there are no topics off limits. So Patrick will say, what can we be doing better? And that’s in front of the entire company,” says Chapp.

Another unique part of the Stripe culture is that the company is led by brothers. The elder Collison says knowing his co-founder all of his life has been beneficial.

“Before starting Stripe, we had decades of conflict-resolution experience and mostly that involved rolling on the floor, casting punches, but you have to start somewhere. And now we’ve really grown,” says Collison with a smile.

“The prevailing advice I think is wrong. People say, “You shouldn’t work with your best friends. You shouldn’t work with your brother, your sister, your wife.” It is among the most fulfilling things. We spend most of our daily lives working, building things, creating. And it’s awesome.”

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.