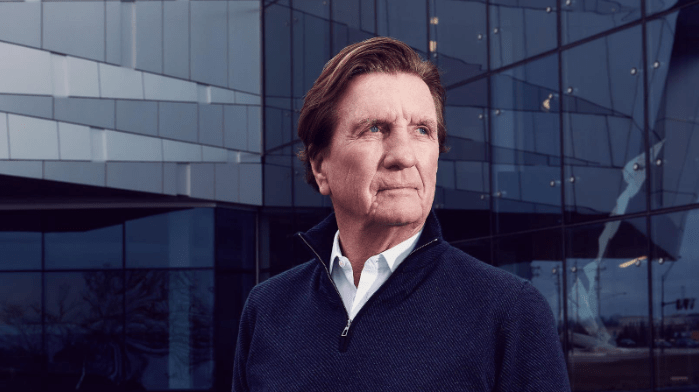

Thrill-seeking Larry Connor has notched astronomical real estate returns while flying a fighter jet, travelling into space and plunging to the depths of the ocean.

This article is featured in Issue 11 of Forbes Australia, on stands Monday, 17th June. Tap here to secure your copy.

It’s a cloudy day in late January in Dayton, Ohio, and Larry Connor is rifling through a stack of property reports in his office, which overlooks Wright Brothers Airport’s runway and a hangar that houses a replica of the Model B, one of the first aeroplanes.

The walls are lined with framed mementos of his own firsts: a skydive out of a balloon at a record-breaking 38,139 feet; a mission to the International Space Station as one of the world’s first private astronauts; and a pioneering plunge to the bottom of the Mariana Trench, at 35,876 feet below sea level the deepest point on Earth.

“You’ve got to be willing to take calculated risk, not stupid risk,” Connor says. That has been a winning strategy for him and his real estate firm, the Connor Group, which has led to three decades of astronomical returns and a $2 billion personal fortune.

Since he cofounded the business in 1991, its investments in luxury apartments have generated an annual rate of return of 30.4%. That’s almost unheard of in an industry in which titans such as Blackstone and Brookfield have posted returns of 16% and 18% in real estate, respectively, since inception.

He has achieved this by seeking quick returns in an illiquid market. “I’m going to maximize value in the shortest period of time,” says Connor, who tries to profitably sell properties as quickly as possible. On average, he keeps a property for five and a half years, compared to 10 years for publicly traded REITs. He once flipped a building in Charlotte, North Carolina, in just over a year, netting a 75% return.

He calls this the “transactional model,” in which every property is constantly analyzed to juice income and minimize costs, all while monitoring the local market. Flipping through a report for a Connor-owned apartment building in Fort Lauderdale, Florida, he rattles off measurements including capital expenditures and revenue improvements as well as how easy a property is to run. One metric is simply called “instincts.” Everything is assessed with an eye to sell. “Every property, twice a year,” he says. “Eighty-five percent of the time, we meet or exceed our forecast.”

Every sale is memorialized in a meeting room off the lobby of the firm’s headquarters. There, past the glass-encased spacesuit Connor wore in orbit and behind a table made of used airplane parts, are 135 plaques marking every deal since 1995, worth more than $6 billion in aggregate.

“Obviously he’s got a significant ego and really believes in his own abilities,” says Roger Lipson, an executive coach and the only non-employee partner in the Connor Group, who has known Connor for three decades. “But he’s measured enough and has that internal risk calculator that’s kept him on the planet.”

The Connor Group currently owns and operates a $5 billion portfolio of 51 apartment buildings across 12 states from Colorado to Florida. Between 2020 and 2022, as the post-pandemic boom sent rents and property values soaring, the firm’s funds generated a 42.5% return. Many buildings were sold less than three years after they were acquired, with returns ranging from 17% to 159%.

How did a self-described C student build one of the best-performing real estate companies in the country? “They’re all real estate guys,” Connor says of the competition. “We’re not real estate guys. We’re investors that just happen to invest in apartments.”

At the Connor Group everything must be maximized, from time to money. Meetings start at odd times to be as short and efficient as possible (during Forbes’ visit, one began at 12:37 p.m.). Every dollar spent must be justified. One example, lionized in the firm’s glossy culture book, recounts how associates checked every dumpster at an apartment complex in Dayton one night and recorded how full each one was. Since many were nearly empty, the next day the team reduced the number of weekly collections and saved the company $27,000 a year in trash bills.

Top performers can earn a partnership stake with annual distributions. Sixty-six partners, including the chief mechanic and a groundskeeper, share a 7% stake in the firm (Connor and his family own 93%). Partners need to consistently earn an 8.25 on a 10-point performance scale to keep their share.

“You’ll feel very uncomfortable if you’re underperforming, and it won’t take very long for you to either get better or move on,” Lipson says. “If you’re elite and a high performer, then you have tremendous opportunities.”

The son of a World War II vet father and a mother who served in the Red Cross, Connor grew up in Dayton. He barely cleared high school, graduating in 1968 with a 2.0 GPA. But he was entrepreneurial, earning cash painting houses. After graduation he bought used cars, filling the trunks with cheap “damaged label” wines in Dayton, before selling both to college students in Athens, where he attended Ohio University. Also while at college, he’d pick up dead bodies on weekends and bring them to a local funeral home for $5 apiece.

After college came a sales gig at a Volkswagen dealership, followed by a stint as a travel advisor, which took him to Morocco, Mexico and Europe. Back in Dayton in 1977, he opened a bar, Newcom’s Tavern, with $52,500 cobbled together from 21 investors. “It was phenomenally successful,” he says. Backers got a 300% return when he sold it two and a half years later.

He took the proceeds and moved to Orlando, Florida, setting up a company that was reportedly once the second-largest reseller of IBM microcomputers in the state. That success didn’t last. “The margins got crushed,” he recalls. “We ended up going out of business after nine years. I got a Ph.D. in business failure.”

He returned to Dayton, jobless and $900,000 in debt. “It’s 1990. I’m worse than broke,” he says, pausing. “But I was determined I was going to pay every dime back.”

He turned to real estate, recruiting two partners and a single investor, and cut a deal with a Kansas City–based savings-and-loan institution to buy three apartment buildings in Dayton. Then the S&L crisis hit, upending the deal and crushing real estate values. “We were back to ground zero,” he says. But the tide soon turned in his favor, and a year later he bought the properties for $1 million less than the price to which he had originally agreed.

You’ve got to be willing to take calculated risk, not stupid risk.

Larry Connor

By 1994, he had repaid his debts. Nine years later, he bought out his partners and took over the firm. When the financial crisis struck in 2008, Connor’s obsession with cutting costs paid off as he went on a buying spree. “Late ’08, ’09 is probably the best buying opportunity I’ve ever seen,” he says. Adds Lipson: “When there’s blood in the streets and most people are running for the exits, he’s calculating.”

The firm was declared an essential business when the pandemic hit because it ran apartment buildings, and Connor took full advantage. Between 2020 and 2022, the Connor Group bought 32 properties for $2.5 billion, sold 28 for $2.7 billion and increased revenue by 26%.

In an industry as volatile as real estate, though, the risk of failure always looms. Delinquency rates for apartment buildings are projected to double in 2024, exceeding their pandemic peak, according to Fitch Ratings. And investments in apartment complexes fell by 61% to $119 billion last year, the lowest level since 2014. What happens if Connor wants to sell but no one wants to buy?

“They were crushing it, but going forward that’s completely changed,” says Michael Costantini, cofounder of Cincinnati-based brokerage 3CRE. “If you look at [Connor’s] big markets, you can ill afford to sell those assets now because you’ll be lucky if you get what you put in.”

Connor admits his strategy doesn’t always work. “We didn’t have a great year by our standards in 2023,” he says. But he doesn’t believe the conventional wisdom that prices will keep falling. “More buyers are going to come into the market,” he insists. “We’re going to start selling probably by the summertime.”

To underscore his argument, he points to the firm’s higher rents, which rose by 4% to 9% in 2023 compared to the national average of 0.5%. He’s not worried about debt—on average, 70% of value across the firm’s portfolio. He heavily refinanced when rates were low in 2021 and periodically stress-tests to ensure a margin of safety. And in the best-performing markets, like that property in Fort Lauderdale (“This thing’s a monster,” he says), he sees no reason to sell just yet: “We’re going to hold it.”

No matter what, Connor, 74, is not slowing down. A week after meeting Forbes, he jetted off to Florida and Indiana to inspect the firm’s properties there. He has some big adventures on the horizon, too. “If you think about land, sea and air, it’s not the land and it’s not the air,” he says, hinting at his next one, to be revealed later this year. “When this gets announced, you’ll chuckle.”

This article is featured in Issue 11 of Forbes Australia, on stands Monday, 17th June. Tap here to secure your copy.