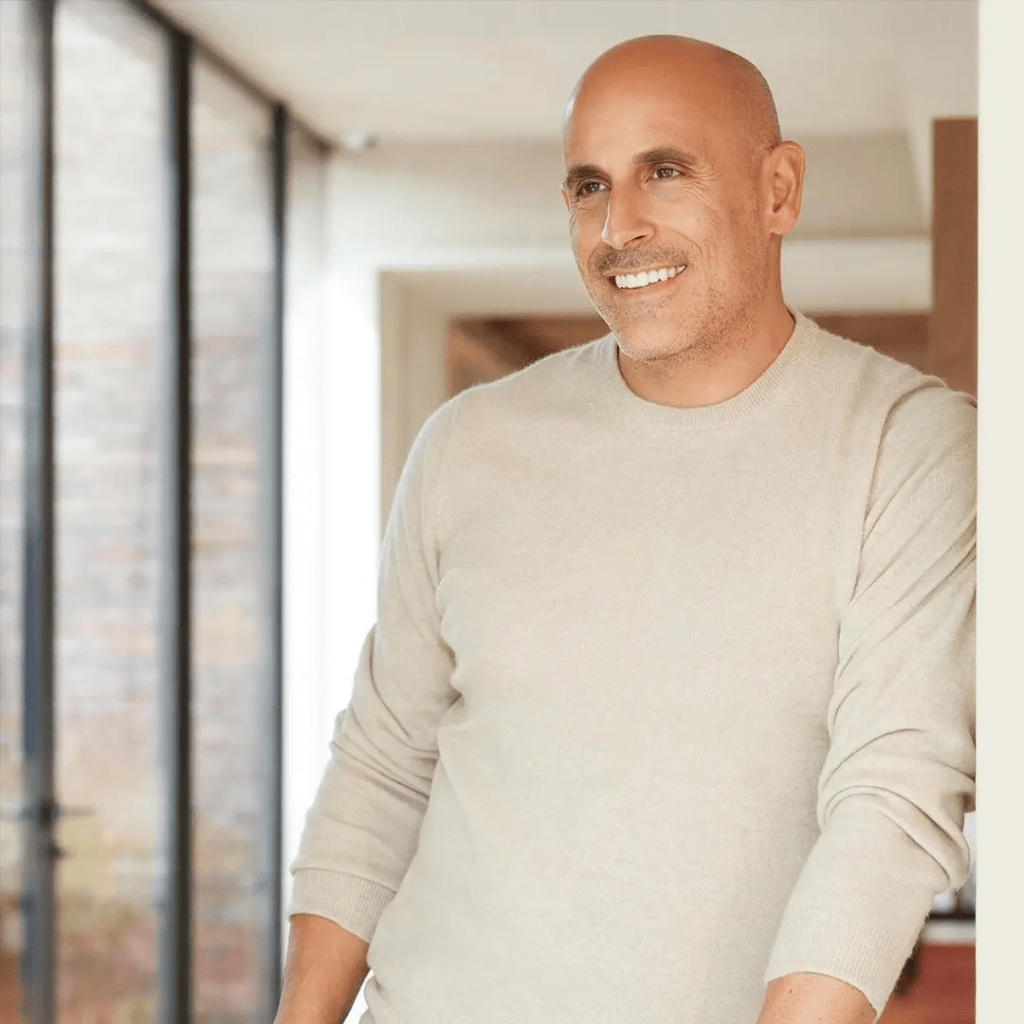

Marc Lore became a billionaire by refusing to stick to one thing for too long. The Diapers.com cofounder and Minnesota Timberwolves co-owner is now betting heavily on his latest startup Wonder, which has big plans to upend takeout and delivery.

Put the cart before the horse.” “Count your chickens before they hatch.” Marc Lore, 53, loves to invert old adages, dismissing the originals as anti-entrepreneurial. It’s hokey, sure—but telling of a restless mind. The questing has paid off: The serial entrepreneur, who has dabbled in everything from e-commerce to baseball cards, is now worth $2.8 billion, Forbes estimates.

The Staten Island, New York, native studied business and economics at Bucknell, then spent six years at three banks before quitting to start a company—any company. He and two childhood friends came up with the Pit, an online trading card marketplace they sold in 2001 for $6 million. After becoming a new parent, Lore dropped out of Wharton to cofound Diapers.com; Amazon bought it in 2010 for $500 million in cash, then reportedly shut it down in 2017. Next was Jet.com, an e-commerce take on Costco that Walmart bought for $3.3 billion in 2016 and shuttered in 2020; Lore stayed on to run the retail giant’s online arm until 2021.

Later that year, he teamed up with retired New York Yankees star Alex Rodriguez on a deal to buy the Minnesota Timberwolves and the WNBA’s Minnesota Lynx for about $1.5 billion—to be paid in four installments through 2024. Lore and A-Rod completed the first two rounds, paying an estimated $550 million for roughly 40%. (Lore’s slice is about 25%.) The third installment ended up in arbitration amid a dispute over whether the duo met a March 2024 deadline; the decision is set to be announced by Monday, February 10. Forbes estimates the Wolves’ value has doubled since the deal was signed.

“He has a huge chip on his shoulder, and wants to build a big public company.”

Lore’s latest gamble? Wonder, which bills itself as “a new kind of food hall.” He founded it in 2018 and took the reins as CEO after he left Walmart. The original idea was to purchase recipes and branding from trendy restaurants and celebrity chefs. Wonder paid the chefs, including Bobby Flay and Wonder board member José Andrés, in cash and equity. Wonder then cooked meals in central kitchens and delivered them in oven-equipped vans.

In early 2023, shortly after raising $350 million at a $3.5 billion valuation, Lore swapped Wonder’s 450 vans for storefronts where customers could order takeout or delivery from a giant selection of 30 unique menus. Risky move. The company quickly rang up $80 million in losses tied to the switch. “We had to take revenue to virtually zero and start over,” says Lore, who owns about half of the company and has pumped $300 million of his own money into the venture to date, on top of raising about $1.5 billion more.

Wonder still cooks up its meals at three centralized kitchens but now ships them out to 37 locations across five states. The beauty of the model, according to Lore, includes that the stores don’t need to be equipped with full kitchens but get by just with rapid-cook ovens to finish cooking the food. For customers, especially families, each store offers a wide variety of options where, for example, one person can order pad thai and another a burger. To expand its coverage area, Wonder plans to add one new storefront a week, for a total of around 100 locations (mostly in New York and New Jersey) by the end of the year.

Although the company isn’t yet profitable, a source close to the company claims that Wonder brings in more revenue per unit than Chipotle or Cava, two highly regarded public companies.

Wonder is also making other moves. The startup acquired meal kit company Blue Apron in November 2023 for $100 million and delivery app Grubhub in January for $650 million (both at 90% discounts to their peak valuation). Plans for integration with Wonder’s main business remain unclear. “He’s trying to get additional sources of demand because the hardest thing to do is acquire customers and retain them,” speculates Matt Newberg, who is not involved in Wonder but follows it closely—he runs food tech media company HNGRY.

In 2024, Wonder pulled in $470 million in revenue, according to a source familiar with the company’s finances, up from $50 million in 2023. The more recent figure includes sales from Blue Apron, which had around $400 million in revenue in the year before Wonder acquired it, but not GrubHub. It also gets revenue from 29 businesses that have standing orders to buy meals in bulk including a coworking space, several office buildings and even an elementary school. Plus, Wonder’s subsidiary Wonder Works sells its kitchen equipment (like rapid-cook ovens) and cooking methodology to places like movie theaters, sports stadiums like Yankee Stadium and cruise ships to help them make food, mostly pizza, faster and cheaper. It could be a “massive business on that side as well,” says Wonder former chief engineering officer Stephen Toebes.

Still, Wonder remains a long way from Lore’s dreamy predictions of $2 billion in sales this year and a $40 billion IPO in 2028. Newberg is skeptical, and thinks Lore is “scaling [Wonder] before he has truly nailed the business model.” For context, it took 30 years for Chipotle to reach a $30 billion market valuation.

“He has a huge chip on his shoulder, and wants to build a big public company,” says Google Ventures managing partner Dave Munichiello of Lore, adding that GV’s $100-million-plus check for Wonder was its second-biggest ever, behind Uber. “He sees this as a market that has not yet been explored by an entrepreneur as fearless and fierce as he is.”

Given Lore’s track record, who would bet against him?

This article was originally published on forbes.com and all figures are in USD.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.