She’s not there yet but iron ore billionaire Gina Rinehart is on her way to being crowned the world’s first lithium queen.

Already ranked as Australia’s richest person with a fortune Forbes estimates at US$26 billion, Rinehart has plunged into lithium, a key metal in the batteries used to power electric vehicles.

A pair of daring stock market raids over the past two months expanded her stake in the lithium industry, while also forcing one takeover bid to be abandoned and another to be unsettled.

Snapping up a 19.9% stake in an emerging Australian lithium miner, Liontown Resources, forced U.S.-based Albemarle Corporation to drop its US$4.2 billion takeover offer, while buying a 15.4% interest in Azure Minerals has upset a move on that company by Chile’s lithium leader, Sociedad Quimica y Minera (SQM).

Those moves on the Australian stock market follow an earlier investment in Vulcan Energy Resources, which is developing a lithium and geothermal energy project in Germany’s Rhine Valley.

Funding From Iron Ore Profits

Funding for her lithium investments, which are believed to have cost US$1.5 billion so far, is coming from her iron ore interests which last financial year made the biggest contribution to a US$3.3 billion profit by her master company, Hancock Prospecting.

Another feature of her addition of lithium to a portfolio which already includes agricultural assets along with oil and gas, is that the bulk of lithium investments have been made as the price of the metal has been falling.

A glut of lithium, especially in China, has seen the price of material in its pre-battery form as lithium carbonate or lithium hydroxide fall by more than 70% over the past 12-months from around US$82,000 a tonne to US$22,000/t forcing some producers to withhold deliveries until prices improve.

The steep fall, which mirrors what happened in 2017, the last time lithium supply overpowered demand, has hit the share prices of most lithium exploration and mining companies as most investors trim their exposure.

Buy When Others Are Fearful

Not Rinehart, she is putting into practice the advice of legendary investor Warren Buffet who has said that one of his investing maxims is “to buy when others are fearful.”

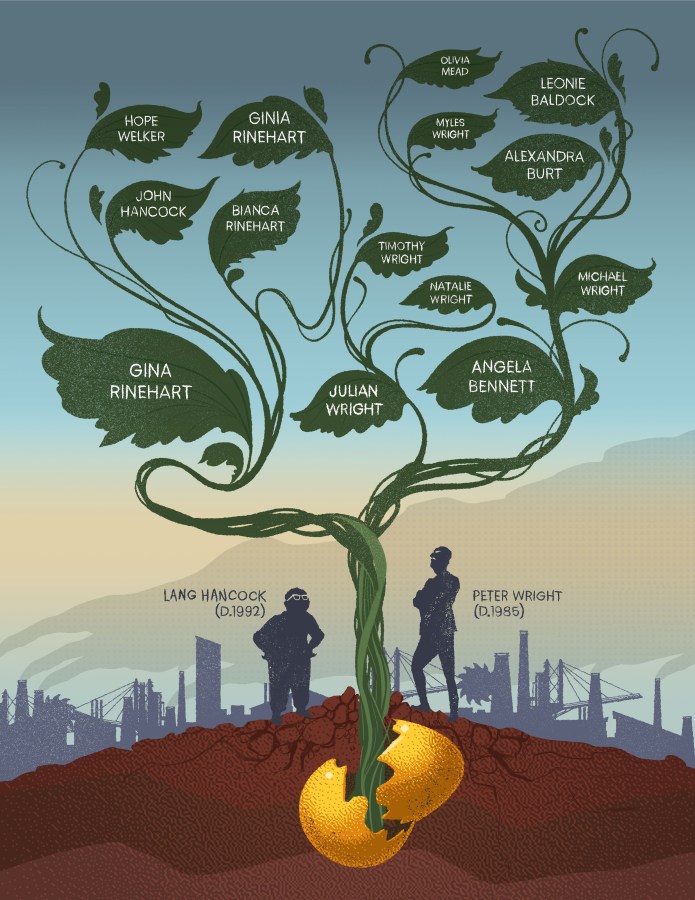

The lithium business Rinehart appears to be creating will probably need fine-tuning because while she understands mining better than most thanks to the pioneering work of her late father, Lang Hancock, she will need to bring in processing expertise to capture the full value of the metal.

Albemarle, a chemical specialist, could provide that skill if it remains exposed to Liontown after dropping its takeover bid, as could SQM, which is building a processing business in Australia with a local partner, the diversified industrial company, Wesfarmers.

The Korean Connection

A third, and most likely lithium processing partner for Rinehart is Korea’s big steel and industrial materials company, Posco, which is already developing a business making lithium cathode material for batteries in the U.S. as well as investing in a lithium mine in Argentina and a new lithium processing plant in Korea.

Posco is also a shareholder in Rinehart’s most profitable business, the Roy Hill iron ore mine, along with shared ownership of the Senex gas business in eastern Australia.

Clear signals have been sent by Posco that it wants exposure to Australian lithium, including those in a statement issued after a visit in June to Australia by the company’s chairman, Choi Jeong-Woo, after signing a “strategic cooperation” agreement with Rinehart.

The agreement, in the form of a memorandum of understanding specified interest in lithium, nickel and copper, as well as advanced forms of value-added iron ore processing.

With Rinehart assembling lithium assets in the ground and Posco having the technical skills to produce battery grade lithium chemicals, a perfect Australia/Korea partnership could be forming.

This article was first published on forbes.com.