WeWork co-founder Adam Neumann is aiming to buy back his now-bankrupt former company alongside billionaire Dan Loeb’s hedge fund Third Point, according to a letter sent to WeWork’s lawyers obtained by the New York Times and Wall Street Journal—plotting a return to the coworking company after his tumultuous departure in 2019.

The former WeWork CEO previously resigned after the company valued at $47 billion failed to produce a successful IPO.

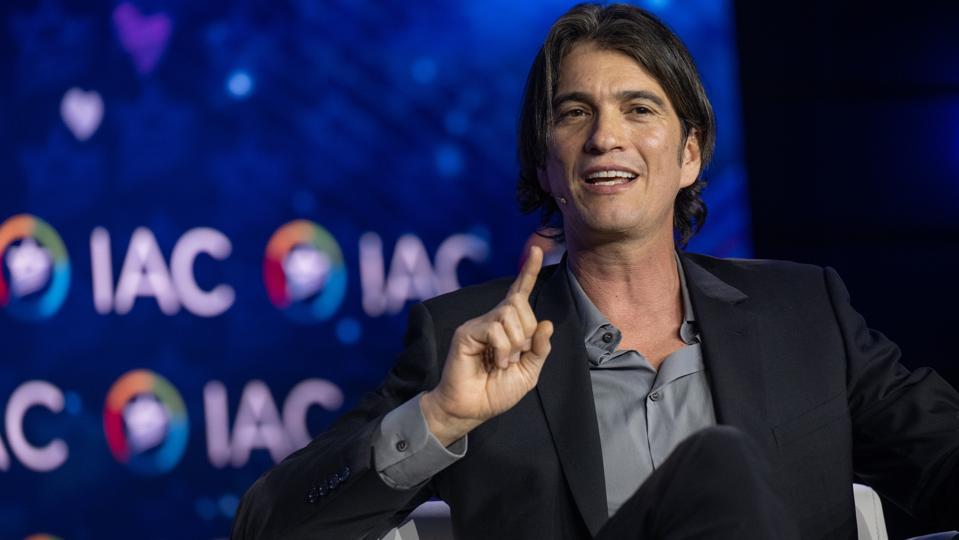

Getty Images

Key Takeaways

- Neumann, who now runs the real estate firm Flow, and Loeb began exploring options to purchase WeWork or its assets in December, after the company filed for bankruptcy in November, according to the letter published by the Times on Tuesday.

- Attorneys for the billionaires said the company has to find additional financing, and claimed the company managed to negotiate lease amendments with seven landlords (the company operates 777 coworking spaces, according to securities filings).

- Neumann, who remains a billionaire and has since founded other real estate ventures since leaving WeWork, did not disclose how much money he would put up for the company.

- According to the letter, Neumann had attempted to re-invest in his old company once before—offering $1 billion to the struggling company in 2022.

- Neumann’s lawyers also said that they have faced resistance from WeWork, which has refused to provide the billionaires with necessary information to create an offer, and accused the company of failing to “maximize value for all stakeholders.”

- WeWork declined to comment on the planned purchase.

Key Background

Neumann and co-founder Miguel McKelvey founded WeWork in 2008 as a coworking space in Brooklyn. The company rapidly expanded, purchasing more real estate and opening more coworking spaces across the U.S., eventually leading to an initial valuation of $20 billion. The company continued to grow quickly in the following years, with its valuation peaking at $47 billion in January 2019.

Related

However, WeWork’s planned IPO the same year ultimately failed, after public filings revealed troubling finances and expensive lease agreements—and criticism swirled about Neumann’s unconventional management style and possible conflicts of interest. In 2018, the company reported a loss of $1.9 billion with only $1.8 billion in revenue, CNBC reported.

The IPO was eventually canceled, and Neumann stepped down as CEO in September. The company did eventually go public in October 2021 with a $9 billion valuation, closing at $11.78 per share. After years of further problems, some of which were linked to the Covid-19 pandemic, the company declared bankruptcy last year.

Forbes Valuation

We value Adam Neumann’s net worth at $2.2 billion. Loeb’s net worth is estimated at $3.3 billion.

This article was first published on forbes.com and all figures are in USD.