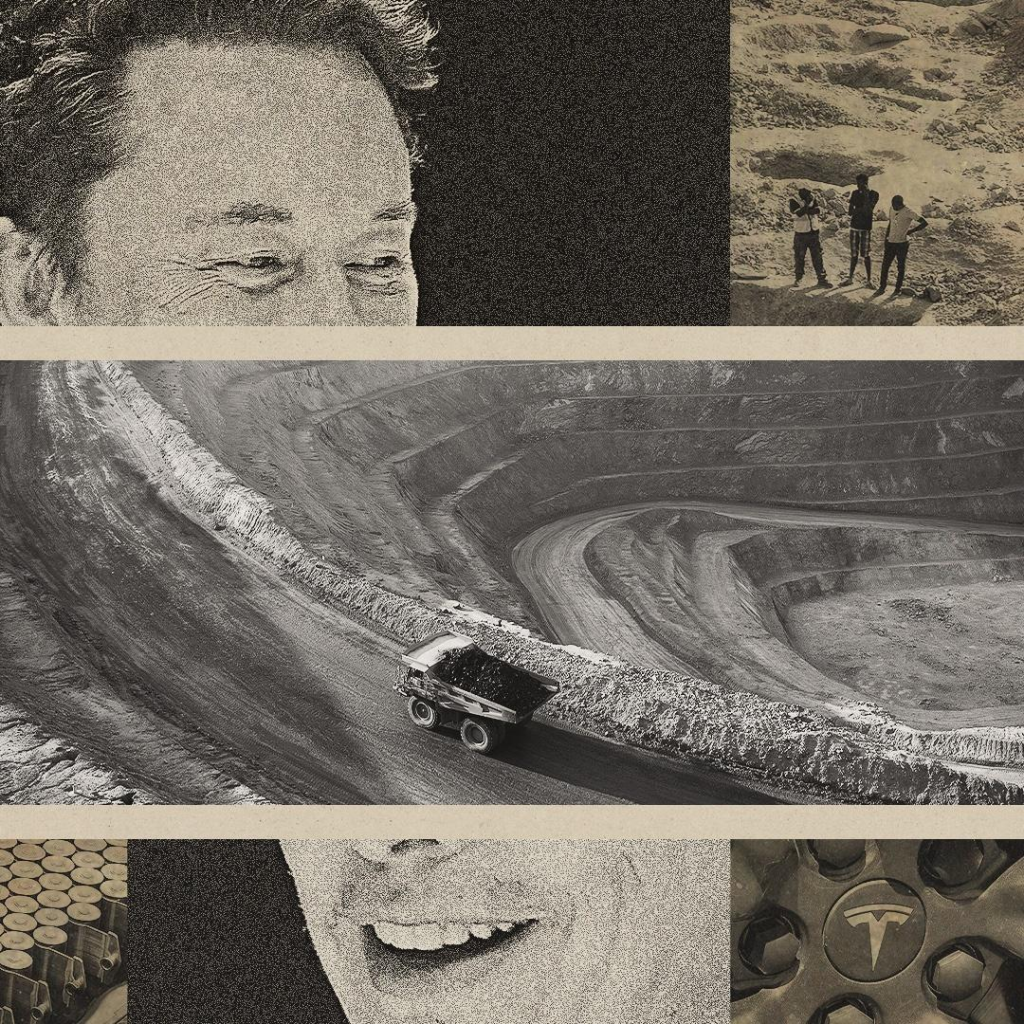

Tesla’s CEO Elon Musk said he would address the company’s challenges with child labor in its supply chain. But his high-tech solution doesn’t cut it.

Last year, just after Tesla’s board and investors voted down a proposal to hire an outside monitor to ensure the electric vehicle maker’s cobalt suppliers weren’t using child or forced labor at mines in the Democratic Republic of Congo, Elon Musk pledged to do exactly that – and more.

“I heard a question raised about cobalt mining and you know what? We will do a third-party audit,” the world’s wealthiest person told a raucous, adoring crowd of shareholders at Tesla’s annual meeting in May 2023. “In fact, we’ll put a webcam on the mine. If anybody sees any children, please let us know,” he said, giggling.

But Forbes has learned that a year later, Musk’s promised webcam hasn’t materialised as expected. Rather than a live camera feed, the Kamoto Copper Co. that’s Tesla’s main cobalt source instead posts a single photo of the sprawling mine complex in southern Congo every month, taken by an Airbus satellite orbiting far above the Earth. There are no children to be seen, but that’s because the resolution isn’t nearly sufficient to reveal anything smaller than processing facilities and the scarred landscape of a highly industrialized open-pit mine.

Tesla also claims to have had multiple third-party reviews of working conditions at Kamoto, which is owned by the global mining giant Glencore, according to its latest environmental impact report. “Our direct suppliers undergo third-party audits to ensure no child labor happens at these mines and no material from unauthorised sources enters our supply chain,” the company said. “Four audits were conducted in 2023 and found no instances of child labor at our direct suppliers’ sites.”

But neither the monthly satellite image nor the third-party reviews address ongoing problems with cobalt and copper mining, according to Courtney Wicks, executive director of Investor Advocates for Social Justice. She represented the group of Tesla shareholders last year who tried to get the company to adopt more rigorous guidelines for cobalt sourcing in 2023.

“Taking one picture a month — it’s not really a comprehensive plan,” Wicks told Forbes. Steps Tesla has taken “are not worth even mentioning. The effectiveness is just not sufficient at this stage.”

“Taking one picture a month — it’s not really a comprehensive plan.”

That’s because the issue isn’t mainly what’s happening at the Kamoto mine complex, but in neighboring unregulated mines, said Michael Posner, a professor at New York University’s Stern School of Business and director of NYU’s Center for Business and Human Rights.

Artisanal miners carry sacks of ore at an artisanal mine near Kolwezi in the Democratic Republic of Congo in 2022.

JUNIOR KANNAH/AFP/GETTY IMAGES

A new study he worked on with the Geneva Center for Business and Human Rights estimates that about 40,000 people under 18 work or are present at artisanal small-scale mining (ASM) operations in Congo. Children are often there “because their families do not have access to childcare. Older children also work in ASM because families need additional income,” according to the study.

“Monitoring what goes on in a mechanized mine site ignores the central problem, which is that a significant percentage of cobalt is coming from artisanal mines,” Posner said. Cobalt from these smaller-scale mines is sold to traders and mixed in with metal coming from industrial mines like Kamoto. But Tesla’s not monitoring them at all “and that’s the problem,” he said.

A further complicating factor: cobalt from Congo is shipped to China for refining, making it even harder to ensure that it’s not sourced from an artisanal mine. “By the time it’s put inside of a battery in the United States or Europe it’s all been commingled somewhere in China,” Posner said.

Neither Musk nor Tesla responded to requests for comment on the matter. Glencore declined to comment.

“Monitoring what goes on in a mechanized mine site ignores the central problem, which is that a significant percentage of cobalt is coming from artisanal mines”

Michael Posner, NYU’s Center for Business and Human Rights

The discrepancy between Musk’s promised action on cobalt and the reality of what the company is doing isn’t unusual for a billionaire entrepreneur with a history of bold promises on which he’s failed to deliver (everything from the safety of Tesla’s plants and automated driving features to plans to create an “ecological paradise” at the company’s Austin plant.)

Cobalt is a crucial component of the batteries Tesla builds for its electric vehicles. Found in combination with copper, the material acts as a stabilizing ingredient in the cathodes of lithium-ion batteries that improves energy density. Congo is the leading source, with about 70% of the world’s cobalt. While cobalt currently goes for about $28,000 per metric ton — less than half the price it was two years ago — it’s still lucrative to mine. Batteries using it go into everything from iPhones to laptops to electric cars. While Musk’s company isn’t the single biggest consumer of cobalt, its leading position in the EV space has made it a focus of child labor and human rights activists.

The third-party audits Tesla said it’s doing at the Kamoto mine complex also don’t resolve concerns about the use of child and forced labor, Wicks said. That’s because such inspections appear to be scheduled, not surprise events, and don’t occur at night when problems are more likely to be found.

“The lack of standards and lack of transparency around how they’re executed, that was our main concern,” she said. “It sounds good in a sustainability report but for investors that care about this issue and see this as a significant risk, what’s the effectiveness of these audits?”

Trucks load sacks containing cobalt at an industrial mine in the Democratic Republic of Congo.

ARLETTE BASHIZI/THE WASHINGTON POST/GETTY IMAGES

Cutting Cobalt Use

Tesla claims it is working to reduce the amount of cobalt it uses by shifting to new battery chemistries over time. It’s also recovering and recycling more of the metal for use in new battery packs. In 2023, the company said it recycled 117 metric tons of cobalt. Musk has said cobalt represented just 3% of a Tesla battery by weight and that his goal was to eventually stop using it. The lithium iron phosphate chemistry Tesla has started employing in its batteries contains no cobalt.

Tesla hasn’t provided recent details on how much cobalt it uses annually. But Benchmark Mineral Intelligence, which tracks demand for metals used in battery production, thinks the 3% figure remains essentially accurate, largely because the material’s commodity price has fallen by more than half in the past two years.

“Despite cobalt consumption trending down slowly on a per unit basis, overall consumption is rising due to increasing vehicle sales”

Caspar Rawles, Benchmark Mineral Intelligence

“The move to reduce cobalt in cells has broadly become less of a priority for many cell and auto manufacturers due to the lower price environment linked to the current period of oversupply the cobalt market is experiencing,” said Caspar Rawles, Benchmark’s chief data officer. “Despite cobalt consumption trending down slowly on a per unit basis, overall consumption is rising due to increasing vehicle sales, which far outweighs any reduction at the cell level.”

In a study on cobalt mining coauthored with the Geneva Center for Business and Human Rights, Posner and his co-authors argue that the best way to curb labor problems at artisanal mines is to officially acknowledge the role those operations play in the supply chain and work to improve their conditions.

“Rather than ignore it and pretend that’s not their problem, they have to say this is also part of our supply chain and we’re going to do what we need to do to make sure that there’s a process of formalizing these sites so that kids are not on it and people work in safe conditions,” Posner said.

This article was first published on forbes.com and all figures are in USD.

Are you – or is someone you know -creating the next Afterpay or Canva? Nominations are open for Forbes Australia’s first 30 under 30 list. Entries close midnight, July 15, 2024.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.