The luxury conglomerate behind Coach, Kate Spade and Stuart Weitzman is growing by three more brands with the US$8.5 billion purchase of Michael Kors-founded Capri Holdings Limited, merging two American fashion groups amid news that U.S. luxury spending has slowed in favour of growth in Europe and Asia.

Key Takeaways

- Tapestry, Inc. the holding company created after Coach bought Stuart Weitzman and Kate Spade New York in 2015 and 2017, respectively, said Wednesday it will buy Capri—owner of Versace, Jimmy Choo, and Michael Kors—to create a single conglomerate that combined generates US$12 billion in annual sales.

- Capri Holdings shareholders will receive US$57 per share in cash in the deal, which Tapestry CEO Joanne Crevoiserat said will create a “powerful global luxury house” in the vein of luxury giant LVMH, owned by Europe’s richest person Bernard Arnault, and Kering, which owns Gucci, Balenciaga and Yves Saint Laurent.

- Capri shares surged 58% ahead of open Thursday while Tapestry shares were flat.

- Tapestry, Inc. reported a record first quarter revenue of US$1.5 billion this year; Capri is expected to share its results in a joint call with Tapestry Thursday morning.

- Capri, formerly called Michael Kors Holdings, was founded in 1981 and has a US$4 billion market cap and Tapestry, originally named Coach, Inc., has a US$9.5 billion valuation.

Key Background

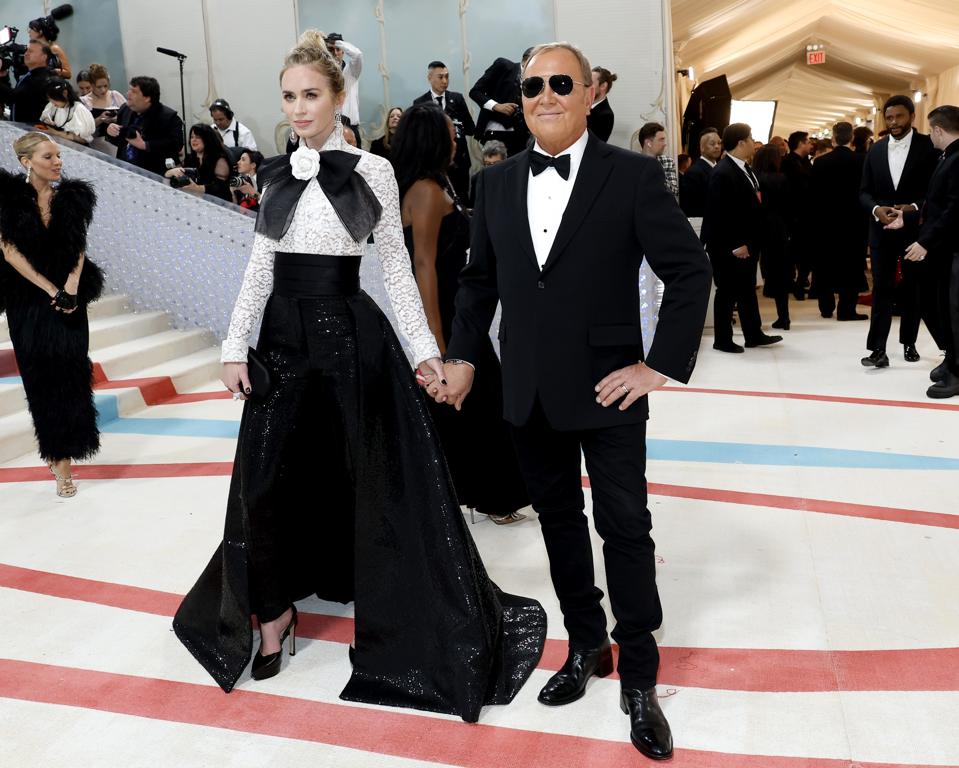

Coach and Michael Kors are both known as fashion brands that run the gamut—their bags can be bought at department stores for relatively affordable luxury prices but they also have a foothold in the high-fashion world. Michael Kors fashion shows are often attended by stars like Kate Husdon and Ellen Pompeo—Emily Blunt attended this year’s Met Gala with the designer in a custom look—and Coach can count famous fans like Jennifer Lopez, Kaia Gerber and Megan Thee Stallion. Tapestry’s expansion will significantly up its market share but likely still puts it out of reach of conglomerates LVMH, which reported an annual revenue of US$79.2 billion last year, and Kering, which reported US$20.3 billion in 2022 sales. News of the merger comes at a time other luxury conglomerates are reporting slowing American business.

LVMH said last month that sales slid 1% in the second quarter from the same period last year due to falling sales in the U.S. while experiencing double-digit sales growth in all other markets — with an 18% increase in Europe and 34% increase in Asia (excluding Japan). Kering reported a 2% overall growth in the first half of 2023 but saw falling sales in North America, as did Richemont, which owns Cartier, Chloé and Montblanc, and Prada, which saw a 25% growth in Asia Pacific in the first half of 2023 compared to a 1% drop in year-over-year sales in the Americas.

Forbes Valuation

Michael Kors hit the US$1 billion net worth mark in 2014 but dropped off the Forbes billionaires list in 2015. LVMH is owned by Bernard Arnault, the second-richest man in the world with a US$227.7 billion net worth Thursday, and François Pinault, founder and honorary chairman of Kering, is worth an estimated US$38.8 billion and is the world’s 30th richest person.

Crucial Quote

“They don’t want to wear your product as a badge,” Joanne Crevoiserat told Forbes of luxury fashion shoppers last week. “They want to wear your product to express their own individuality.”

This post originally appeared on Forbes.com.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.