Data from the research firm reveals that a Hermes Birkin in black togo leather might be the best luxury investment you can make. Ultra high-end handbags are up 2.8 per cent on 2024.

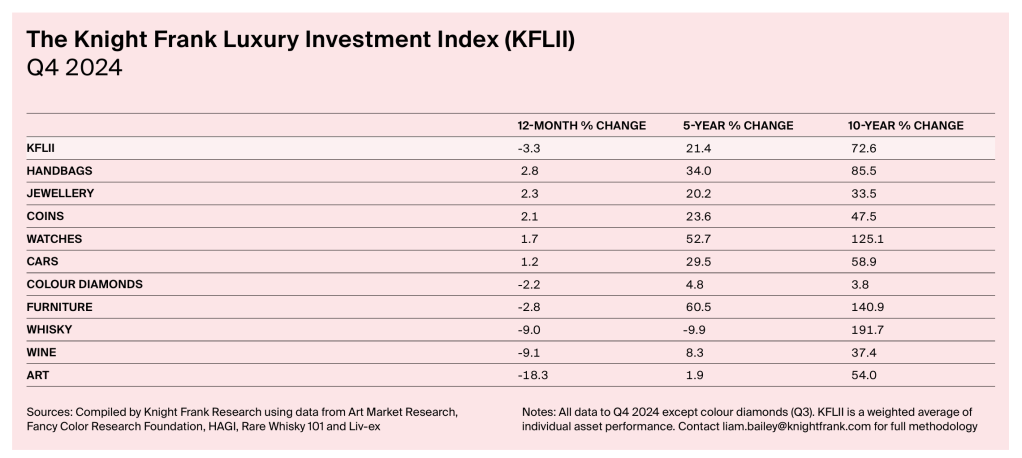

The global Luxury Items Index compiled by Knight Frank fell by more than 3 per cent in 2024. There were a couple of bright spots, however. Handbags were the best performing luxury asset class last year, rising by 2.8 per cent. Jewellery assets also got a bump, as did coins, watches and cars.

Those figures are year-over-year, says Liam Bailey, Knight Frank’s global head of research, who oversees the Knight Frank Luxury Items Index (KFLII.) Zooming out to look at growth over the last 20 years shows more significant expansion.

“Luxury collectibles have delivered for investors over the long term. If you had invested US$1 million in 2005 and tracked KFLII, your investment would now be worth US$5.4 million,” says Bailey. “The same amount invested in the S&P 500 would have been worth US$5 million by the end of 2024.”

Sebastian Duthy of Art Market Research says that the Hermes Birkin in black Togo leather, is now more valuable than ever.

Why? Auction house Sotheby’s states that Birkins hold their value because of five factors: craftsmanship; limited supply; a quota system; market demand; and a secondary market premium.

“There are over 1.3 million monthly searches for the Birkin every month. The Birkin remains an icon in the fashion world, highly sought-after by celebrities, top luxury buyers and the bag-obsessed,” Sotheby’s claims.

“While the retail price of the most popular Birkin 30 in Togo leather – $12,500 – is at the high end of luxury bags, the secondary market premium is the highest of any brand. A pristine Togo leather Birkin 30 sells for between $25,000 to $30,000 at Sotheby’s.”

The definition of ‘luxury collectibles’ is expanding

For many people, the first thing that comes to mind when they think of the luxury asset class, is art, jewellery, and fine wine. That definition is expanding, according to Knight Frank.

“The rise of online marketplaces has significantly altered the luxury landscape. For established sectors, like art, it has aided transparency and given new buyers confidence to enter the market,” says Bailey

“At the same time, online has encouraged the expansion of the definition of luxury collectibles to include NFTs, rare sneakers, and Pokémon cards. Social media has amplified these trends, fuelling demand but also intensifying competition for investment.”

One sector that has not seen an increase in competition or value throughout 2024 – a departure from the dream run it has had over the last five years – is fine wine.

“A correction was needed,” says Tom Burchfield who works for Liv-ex, a wine exchange. “The wine market enjoyed a bull run inspired by low interest rates during Covid. This resulted in a lot more speculation and prices rose across the board, with Champagne and Burgundy in particular surging in price.”

Last year, those fortunes reversed, as fine wine saw a decline of 9.1 per cent in value. Burchfield attributes that to market saturation, a weaker Chinese economy, and changing demographics.

“There is a significant stock overhang,” says Burchfield. “The Chinese market has not returned in force, many traditional fine wine collectors now have enough in their cellars, and the next generation is not yet picking up the slack.”

Why buy luxury? The joy of ownership, research states

Given those fluctuations, the drawcard for buying luxury items goes beyond a return on investment. The Knight Frank 2025 Wealth Report reiterates 2024 research that wealthy people invest in luxury largely, for the ‘joy of ownership.’

“In many cases these reasons come down to the pleasure of investing. As we noted in last year’s edition of The Wealth Report, the biggest driver for purchasing luxury collectibles was “joy of ownership”, which was ahead of “investment” in every world region in our Attitudes Survey – except for Asia,” the report states.

That premise may be little consolation to art investors, the sector that performed worst over the last 12 months.

“Art was down 18.3%, with the market seeing a total reversal from the double-digit growth of 2023, and a worse performance than during the Covid-19 crisis when values fell 17%,” the report reads.

Looking holistically at the luxury sector, investors may need to grapple with the reality that a shift in the value of scarcity is underway.

“As financial markets soared in 2024, the KFLI fell by 3.3%, leaving collectors and investors to

navigate a changing landscape where scarcity no longer guarantees returns,” Knight Frank states.