From alerts to action: PagerDuty keeps business continuity strong during downtime

Customer-impacting outages and cyberattacks have plagued top companies, severely affecting profits and eroding trust. PagerDuty’s innovative digital operations management platform empowers organisations to strengthen business resilience, reduce downtime, and streamline incident response, ensuring they are prepared for disruptions in an increasingly complex digital landscape.

BRANDVOICE

In 2024, “disruption” became synonymous with operational chaos, impacting industries from airlines and banking to retail and healthcare. Widespread outages disrupted banks, retailers, and hospital systems, resulting in significant financial losses and eroding consumer trust.

According to PagerDuty’s Automation Downtime Research, there was a 41% increase in customer-facing software incidents, with 71% of Australian IT leaders reporting declining customer confidence. Most critically, the average downtime per incident lasted 148 minutes, costing $7,011 per minute, equating to more than $1 million per event. These figures underscore the urgency for robust, proactive incident management.

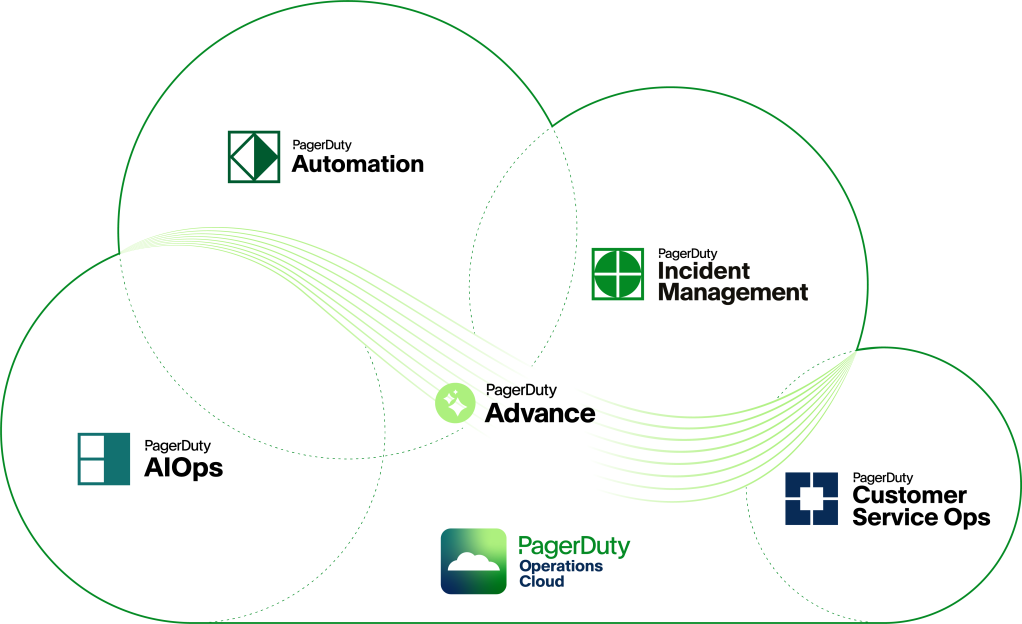

Over the last 16 years, PagerDuty has evolved from a single product into a comprehensive digital operations platform designed to support businesses at every stage of incident management.

“We aim to help organisations effectively handle unplanned, mission-critical work,” says Natalie Fair, Regional Vice President for Asia Pacific, Japan at PagerDuty.

“Our platform equips businesses with the tools and insights needed to navigate crises swiftly, minimising impact and restoring services quickly.”

Real-time collaboration: A unified approach

PagerDuty’s Operations Cloud integrates AI and automation to enhance response times and streamline critical processes across IT, operations, and customer support teams. Leveraging advanced machine learning, the platform provides a comprehensive view of ongoing operations, ensuring transparency and rapid identification of issues.

“Any service disruption is a race against time,” Fair says. “PagerDuty’s platform, backed by a dedicated team of local experts, enables organisations to act decisively, reducing the time needed to resolve complex issues.”

Combining automation workflows, incident response, and post-incident analysis offers a unified approach to managing disruptions and continuously improving performance.

The human element is a critical differentiator for PagerDuty. “Our local experts bring deep technical knowledge and a relentless focus on customer success,” Fair says.

“We collaborate closely with our clients, providing support during incidents, training their teams, and offering guidance on operational continuity.

This partnership approach equips businesses to handle crises confidently and effectively.”

Learning from every incident

Post-incident analysis is a cornerstone of PagerDuty’s value proposition. After each incident, the platform delivers detailed insights and actionable recommendations, helping organisations pinpoint root causes and implement mitigative measures.

“We focus on forward-looking solutions rather than blame,” Fair says. “Our analytics provide the data needed to make informed decisions and enhance resilience.”

For instance, PagerDuty’s prescriptive analytics include “team health” metrics, which offer visibility into how well teams perform and adapt to crises. By identifying patterns in response times and collaboration efficiency, businesses can fine-tune their processes and improve overall operational maturity.

Success stories: Transforming operations at scale

Specsavers, a global retailer managing IT operations across more than 2000 stores, faced significant challenges in streamlining support and maintaining service levels.

By implementing PagerDuty’s Automation, they centralised their IT support, resulting in the execution of over 120,000 tasks monthly. This automation saved an equivalent of 225 days of manual effort, matching the productivity of 30 full-time employees, and reduced the training time for new Service Analysts by 75%. The enhanced efficiency has allowed Specsavers to maintain high service standards while scaling its operations seamlessly.

Similarly, Zendesk faced delays in incident analysis, with post-incident retrospectives taking up to 5-6 hours due to manual processes. By integrating PagerDuty’s Jeli tool, Zendesk reduced analysis time by 80%, enabling teams to complete thorough reviews in 90 minutes or less. This shift improved engagement during retrospectives, provided clearer insights, and led to faster resolution times.

“The integration of Jeli has transformed our incident analysis,” a Zendesk representative said. “We now have concrete, actionable data in a fraction of the time, directly impacting our service quality.”

Machine learning and AIOPS: Leading the way in incident response

In July, a software malfunction triggered one of the most severe outages in recent history, causing estimated financial losses of over US$10 billion globally. While many companies struggled to respond, PagerDuty clients detected issues hours before their customers experienced any impact. “Our operationally mature clients recovered faster and faced 60% less business impact than their peers,” says Fair. “This proactive approach saved millions and protected customer trust.”

PagerDuty’s AIOps (Artificial intelligence for IT operations) engine is at the heart of this capability. The platform aggregates data from diverse sources – including monitoring tools and user inputs – and applies machine learning to filter noise and identify critical signals. PagerDuty enables faster, more accurate incident resolution by providing automated triage and suggesting optimal responses. In some cases, the platform can even automate responses, initiating self-healing actions for common, well-understood issues before they escalate.

“In today’s digital environment, the volume of data generated is overwhelming,” Fair says. “Manual analysis is no longer viable. Our machine learning solutions sift through millions of data points, highlighting what matters most and empowering teams to act swiftly.”

Preparing for the future: Regulatory demands and resilience

As digital services expand, regulatory bodies are increasing their focus on operational resilience. The Australian Prudential Regulation Authority (APRA), which oversees the Banking, Financial Services, and Insurance (BFSI) sectors,

has introduced stringent requirements, effective July 2025, to ensure businesses have robust systems in place to handle outages. These regulations mirror broader trends across Asia-Pacific, where markets like Singapore have already imposed strict measures to safeguard financial services.

“The regulatory landscape is evolving rapidly, and companies must adapt to meet these heightened expectations,” Fair says. “APRA’s guidelines are a clear signal that digital resilience is non-negotiable. Businesses need to invest in reliable systems to guarantee service availability for their customers.”

PagerDuty’s platform, enhanced by the expertise of its local team, is designed to meet these regulatory requirements.

By providing a scalable, always-on solution, The platform helps businesses maintain compliance and operational excellence. “Our enterprise platform never sleeps, ensuring that while your teams rest, your services remain up and running,” Fair says.

Looking ahead: Building a resilient future with PagerDuty

PagerDuty’s commitment to innovation and customer success is evident across its extensive service offerings. From real-time incident response and machine learning enhancements to detailed analytics and comprehensive post-incident reviews, the platform equips businesses with the tools needed to thrive in an unpredictable digital landscape.

By blending cutting-edge technology with the expertise of a dedicated local team, PagerDuty delivers a holistic approach to digital operations management. As organisations face increasingly complex challenges, PagerDuty remains a trusted partner, helping them stay agile, minimise downtime, and build lasting customer trust.

For more information, visit pagerduty.com