MA Financial Group’s joint CEO and one of the company’s founders, Julian Biggins, argues we’re looking at a “once in a cycle” opportunity in terms of investing in commercial real estate and alternative assets. In an environment with rates uncertainty, a cost-of-living crisis, and shaky geo-politics, Stewart Hawkins explores the logic behind his seemingly contrarian position.

This article featured in Issue 14 of Forbes Australia, out now. Tap here to secure your copy.

Where have you got your money right now?

Asset management now has about $10 billion under management and really, we’ve honed our focus to be around real estate and private credit – the growth comes out of those two channels. We’ve also got a lending business – we’re basically a home loan provider in Australia, a non-bank lender, as well as the quickest growing broker aggregator in the country, which is called Finsure. We’re not really a trader of assets. We’re more a builder of businesses and a builder of annuity income streams.

What’s your definition of an alternative asset?

It is one that’s not liquid. It’s a private asset. Familiar things like listed equities and listed bonds are not alternative assets. Whether we’re in private credit or private real estate or any real estate investment, [it] is really an alternative asset. Real estate can be either core real estate – people normally talk about retail, industrial or office – and it can be non-core, which is everything else. Whether I’ve got a Four Seasons Hotel, a pub, or a marina, they all have underlying real estate traits. It’s a very big world, that world of non-core real estate.

There’s another layer to this. If I’ve got a pub, I can either have [someone else] operate the pub and [I] own the land, or I can own the land and operate the pub. In the marinas [for example], we operate everything, so we capture both the land value and also the operating value, but the devil is in the details because if you haven’t got the capability to operate it, you shouldn’t be operating it.

If you can capture a good business on top of that land, you can capture both sides of the economic [advantage]. We have a lot of retail shopping centres. Suppose you’ve got a shopping centre with a hundred tenants – you [need] active management. Some people will outsource that, but we have it internally. We do the same for the pubs [and] for the marinas. It’s not just capturing the value but also capturing the alignment. When we went through COVID-19 and the pubs got shut, we had to quickly decide on staffing and how we would deal with the situation. You don’t want to outsource that decision to someone not fully aligned with your outcomes.

COVID-19 woke us up to how the world can change in a heartbeat. Now, we’re possibly facing the most dangerous geopolitical situation since the end of the Cold War. We have rates uncertainty and a cost of living and housing affordability crises. As an investor, what are the fundamentals for you?

You’ve got to stick to what you understand, and we understand real estate. If you’re borrowing [for] real estate, you’re making a five or a 10-year investment – not a two-or-three months trade. In the past two years, there’s been a very significant premium put on liquidity. As interest rates moved up 400 points, asset valuations became very uncertain in some asset classes, especially in real estate [some people] said: “The uncertainty makes me very worried.” There was a flight to liquids and cash. Now, when you think about real estate deals, when you read about, say the office market conditions, valuations are down, people are locked up in funds, these decisions were made three or five years ago, when people bought those assets. Not today. Those sorts of examples are all a reflection of last cycle decisions, not decisions being made today.

I think about [the] cost of debt. What if I go and buy this building and put 50% leverage on it? What’s the bank going to charge me? That’s probably gone from maybe 1.8% to 2% as a cost of debt to today being 6% to 6.5%, and that impairs asset values. You’ve got a fear of losing money in real estate because asset values from the peak three or four years ago are coming down, and then you’ve also got this uncertainty around the demand.

So why real estate, and why now?

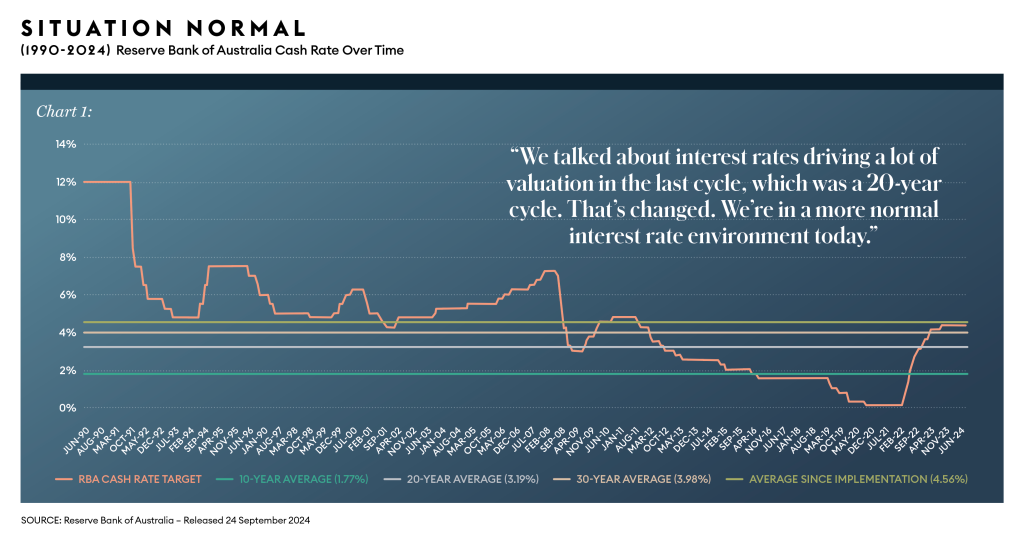

This goes back to my earlier comments about a five-to-10-year outlook for what I’m buying. I’m not buying for rates going down 25 points in the next six weeks; I’m buying for five or 10 years. Do I think that this is going to be a good investment? We talked about interest rates driving a lot of valuation in the last cycle, which was a 20-year cycle. That’s changed. We’re in a more normal interest rate environment today. (See Chart 1). They might not go down much at all, but you’ve got to buy assets that you can sweat – that you can operate, that you can increase the value of by increasing the earnings.

For example, half of a marina’s revenue comes from berthing boats. How do I find a way to charge you more in rent for your wet berth each month? [Now] try to get a [new] marina approved in Sydney – you just can’t. Anyone with a marina in the harbour is pretty set, and we’ve got three of them. Boats keep getting bigger, and there’s a trait going on where the wealthier, 45 years plus, don’t have a mortgage; they have cash, and there’s been a real splurge on boat sales since COVID-19. Most of the Sydney marinas are running at 100% occupancy.

Suppose you look at the other side of the coin. The person who invested their hard-earned money and bought a lifestyle asset in a boat, are they that price sensitive over berthing fees? Or are they [ok] to see the rents go up because they’ve got their boat, and they’re enjoying it? Sydney Harbour’s a beautiful place, and I’ll tell you, berthing fees in the last two and a half to three years have increased by 25% in the harbour. And they’re probably going up again. These are the sort of dynamics you’re trying to find.

Think about the broad-brush strokes here – [there’s] a lack of capital in the market looking to invest in this [kind of] sector. International capital has retreated to [its] home. You’ve seen interest rates go up materially. You’ve seen [some] banking covenants come under distress, so there are people that are motivated sellers of assets, but there are very few buyers. So, it’s a buyer’s market.

What kind of assets are you looking for?

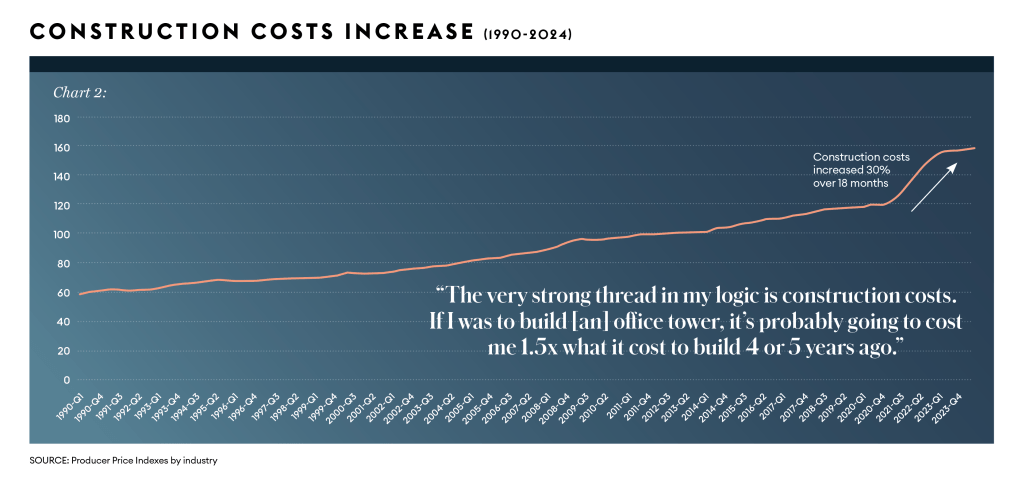

If you’re a private developer who’s developed a hotel and you’ve got other things that you need to develop, or you’ve got other uses for your cash, you’re not so worried about taking a mark on your asset. I’ll give you a live example. We bought something in Melbourne that I think would cost $130 million to build [today], and we bought it for $90 million. If you were a patient investor, there’s no way you’d sell that asset. The person had taken all their money out of another part of the development, so they weren’t too focused. They were an offshore investor who took their money home and did something else with it. That opens up another important thread that I haven’t seen before: the significant increase in construction costs. And when you think about even your home, which is residential housing, when you think about anything hard asset-backed, if you can buy something at a deep discount to replacement cost, it underpins the downside for your investment return.

One of the reasons we like to look at other asset classes and [not] just the core asset classes is you bring a lot more potential vendors into the funnel. When looking at accommodation hotels, pubs, marinas, and other alternative real estate, we can broaden the funnel to look at other places where we might find a motivated vendor. If there were a lot of people chasing the same asset classes, you wouldn’t be buying them cheap.

Where do you see the nuances in this space, though?

I’m apprehensive about commercial offices [because] it’s a lot harder to underwrite the demand side. I’m avoiding it – I think there are easier ways to make money, but I don’t think the office market is dead. With people working from home, what is the demand for commercial offices in three years? I’m a big believer in “the cities” and the need to have an office to be a successful business. We tend to get probably 90% of our people in the business [in] five days a week. I believe that for training young people within the business, it is very important to work in communities, to work in groups and to learn. I learned as a junior by listening to the guy on the phone next to me. He wasn’t even talking to me. I also believe that people are generally social and want to belong to something. And if that is exciting, they want to be there. They actually want to be there. It’s not a chore to come in. But if you’ve got a sleepy old giant of a business that is a chore, it’s not because the office is a problem.

But I’d rather go back into more visible things. The demand you’re seeing for offices right now is actually hard to predict, but I do think that these buildings have a place in the market. We need to chew through the new regime or environment around working from home and the flexible work environment. Over time, the office buildings will fill up again because the backstop here, which is really the very strong thread in my logic, is construction costs. If I were to build this office tower here, it would probably cost me one and a half times what it cost four or five years ago.

What about retail and pubs?

Inflationary pressures aren’t bad for retail. If you’ve got wage growth, they’re spending money on retail sales, which is not bad. It’s a scarce asset. So the revenue is keeping up with inflation. They’re a bit of an inflation hedge, to be honest. As long as interest rates don’t blow out and the forward curve is looking at 100 points of interest rates decline over the next 12 to 18 months. (At time of interview). That’s not a bad setup. If you’ve got population growth, a bit of wage growth and interest rates rolling over [and] if developers aren’t developing shopping centres or they’re not developing hotels, how are people who need this real estate to expand their sales, grow their businesses? That will cause an increase in demand for these assets to help them grow as well. Buying something that’s [at] a significant discount to replacement cost is always a good idea, assuming there is demand for the asset.

We bought $677 million [worth of pubs], 26 venues… back in 2017. We actually started back in 2014 [in Sydney’s] Western Corridor. [There] you get population growth, wage growth, and scarcity of assets, generally located around the transport nodes. It’s, therefore, a good real estate play as well as [the fact that] the operating venue is heavily regulated, [which] protects it as well. Today, we have about 30 venues, which might be valued at about $1.1 billion. They’ve been a very good return for investors. Sydney was the core. But we do like other markets. We like Queensland as well.

And the accommodation hotels?

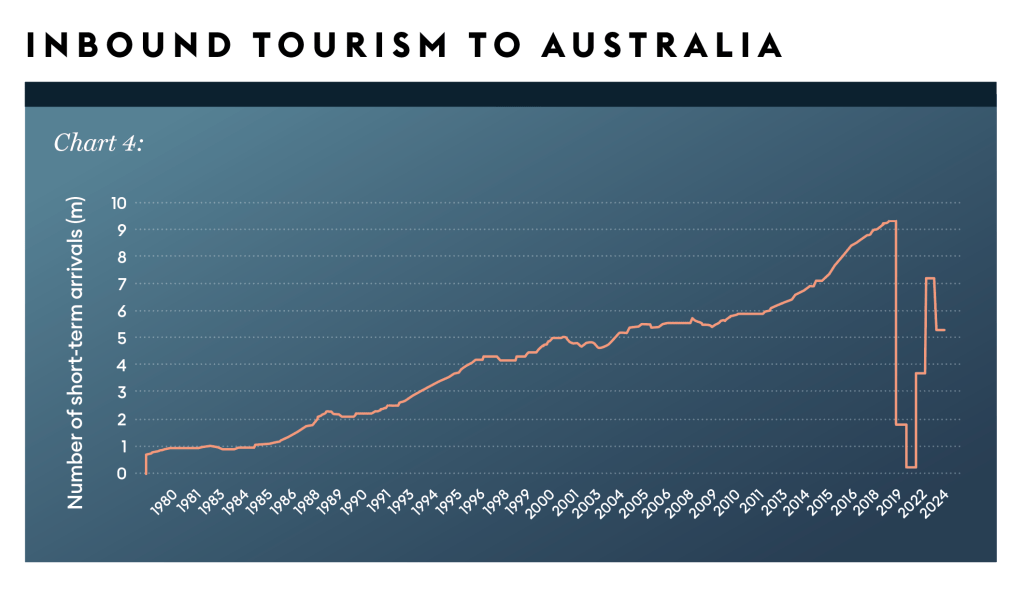

Same thesis. You’re buying well-located land. You’re creating cash flow out of the operations above it. Melbourne is the number one events market in Australia. The other thing from a demand side is that international tourism is still picking up and there were restrictions put on tourism out of China into Australia for a fair while, and that was lifted last year. You’ve got a very long runway of no new supply or competition coming to the market because the math just doesn’t make sense – and that protects you. (See Chart 4)

What makes you nervous? I want to know what keeps you awake at night.

Deficits. Who funds them all? Government deficit globally, really. It’s a bigger problem if interest rates are higher, and there seems to be [a low] political willpower to reduce indebtedness. I also couple that with the aging population and how we fund aged care and the health requirements. There’s a significant issue that will play out over the next two decades. Aged care’s a real pinch point. We’re only at the start of that ballooning of the numbers. These are all sorts of inflationary things too, to be honest – think about the transition to green power: inflationary. De-globalisation: and inflationary.

What would be your final word?

You should invest where you have real knowledge and capability and feel comfortable with the level of risk you’re taking. I think it’s a phenomenal time to buy hard assets at very deep discounts compared to what it would cost to replace them, but buy them in areas where you can generate significant cash. I think Australia is a great place to invest. I think we’re very lucky. It’s a very regulated, safe place to invest.

This article represents the views only of the subject and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicativeof future performance. You should seek independent Financial and tax advice before making any decision based on this information, the views or information expressed in this article.