Brighte founder and CEO Katherine McConnell is on a mission to increase the adoption of renewables on properties across Australia. The Sydney-born entrepreneur is fuelled by the idea that solar energy and savings should be accessible by everyone.

This story featured in Issue 14 of Forbes Australia. Tap here to secure your copy.

Katherine McConnell lives very differently today than she did growing up in Sydney’s outer Western suburbs. “My dad was a refugee who came here as a teenager; I’m from a Russian Ukrainian background; I didn’t have the lifestyle I have today,” says McConnell, the sole founder and CEO of Brighte.

Now living in Sydney’s Inner-West suburbs, McConnell is working hard to make sure her two children appreciate the little things – like the power of flicking on a light switch. “My kids have the experience of being on the grid in the city and on the farm with no energy support. We’re on spring water, we’re on rainwater. We got solar in 2010, and in 2015, we got our first battery – one of the first installations in New South Wales.”

The family farm is near Wollongong, an hour south of Sydney, where the Commerce major did her Bachelor’s degree. The property has been a personal test bed for McConnell and her husband Peter to experience renewables viscerally. “When our kids were five and seven, they saw how energy generated on the roof by the sun was stored in a battery. If they used too much energy at night, by the time they woke up, there’s nothing left in the battery; they saw that.”

Today, McConnell is on a mission to increase the adoption of renewables on properties across Australia. “From a cost of living and affordability standpoint, it can make a huge difference. Brighte removes the upfront cost, and we help the person buying the energy equipment align the savings on their energy bill with the finance repayments. When we got solar in 2010, we started saving money – energy equipment should be accessible to everyone,” says McConnell.

Since its inception in 2015, Brighte has financed 180,000 solar installations in Australia, avoiding 1.4 million metric tons of C02 emissions annually. Almost a decade later, the privately held company that was incubated at Macquarie Bank and has attracted capital from Mike Cannon-Brookes’ Grok, Scott Farquhar’s Skip Capital, and Australian VC Airtree is transitioning from solar panel financier to a platform for sustainable products and services.

When McConnell left her position as Senior Manager of Energy Leasing at Macquarie Bank she was 39. The executive had spent the previous year working to create a Macquarie product that would help to democratise the finance of solar panels so that all Australians could install them and bring down their energy costs.

“For regulatory reasons, Macquarie couldn’t do it themselves,” McConnell says. “And the reason why they couldn’t do it was validation of why I had to do it – and why it could be a big business.”

Why Australia’s fifth-largest bank couldn’t achieve what a start-up could came down to risk. McConnell’s company, Brighte, finances solar panels sold and installed in customers’ homes by tradespeople. In that model, the financier assumes the risk of lending money but traditionally has little oversight into the sales and installation process, creating uncertainty.

“We distribute credit through Australia’s biggest network of energy equipment retailers and installers – tradies,” says McConnell. “We work closely with them, accredit them, and train them about our finance products. There are a lot of risks in that situation for a bank with a financial services license. If something goes wrong in that communication, the bank’s business is much bigger than this energy financing business. It could have a far bigger consequence for the entire organization.”

Brighte, on the other hand, is singularly focused on energy.

“This is all we do – focus on the energy transition, on energy equipment, and we go deep in assessing the party selling that equipment – like their credit, finances and marketing claims. We do training. We do upfront checks. We do mystery shopper checks. We have people going out and visiting their warehouses. We call customers. We continually get customer feedback about their interaction with that retailer and installer,” says McConnell.

Brighte’s compliance framework mitigates risk that A+ Fitch-rated Macquarie and Australia’s other big banks are unlikely to take on directly. Government organisations looking to accelerate solar adoption within communities without taking on finance and installation credit risk can also benefit from Brighte.

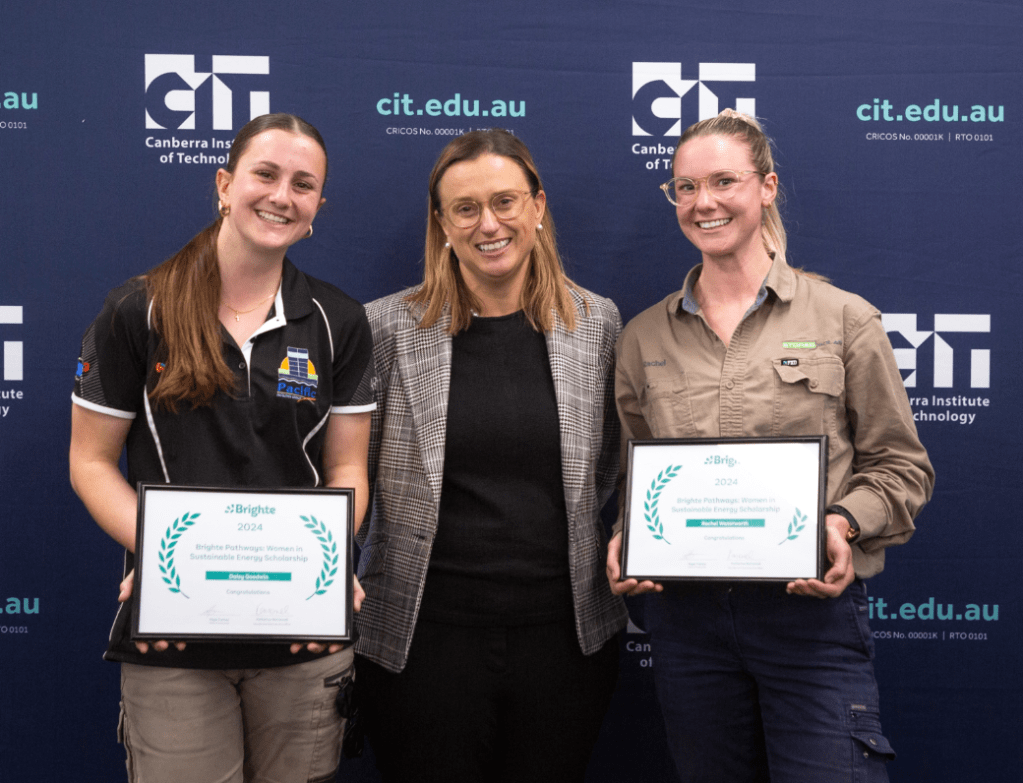

“Our compliance framework is a big part of the IP that we have in our business. We won programs with the ACT and Tasmanian governments, where the governments have had subsidies and schemes in the past and were exposed to the energy equipment installers and retailers. They need someone to disintermediate that risk,” says McConnell.

Twenty-two thousand solar installation applications have been processed under Brighte’s exclusive partnership with the ACT government’s Sustainable Household Scheme. That program was expanded in April to allow apartment building body corporates to apply for $100,000 for rooftop solar. Brighte administers half as a Commonwealth grant/rebate and half as an interest-free loan. It is an initiative that Chris Bowen, Australia’s Minister for Climate Change and Energy, says would not be possible without the Brighte Marketplace platform.

“We want all Canberrans to have access to cheaper, cleaner, reliable renewables – our Solar for Apartments Program is doing just that,” says Bowen.

From solar panels to a platform for sustainability

McConnell says that the success of ACT’s solar program with Brighte is a model for other states and territories and can be expanded beyond solar panels. “The program is scalable, and it can be deployed everywhere. The vision is to help households everywhere get solar, batteries, electric cooktops, EV chargers, EVs,” says McConnell.

Brighte’s work has also made it the central platform in a pilot study to electrify a postcode. The Electrify 2515 project aims to make 500 households in NSW’s Wollongong district – postcode 2515 – fully electric. Brighte administers the pilot with Australia’s Renewable Energy Agency (ARENA), Rewiring Australia, and Endeavour Energy. The $12 million program will run between December 2024 and April 2027 and is partly funded by a $5.4 million ARENA grant.

“We’ve built the tech platform that will facilitate the community electrifying. Rewiring Australia is our research partner collecting the data, and Endeavor Energy is the network that will be looking at consumer behaviour, grid usage and tariffs,” says McConnell.

The project transitions Brighte from a financier of solar panels to a platform Australians can use to integrate renewables in their home. “It’s the first time we’re not there to provide finance but to facilitate the journey. We want to be the platform that enables the acceleration, deployment, and installation of sustainable equipment in Australia.”

Brighte’s funding journey

McConnell closed Brighte’s seed round with high-net-worth angels and investors in 2016. The year after, Brighte’s Series A fundraise was led by Mike and Annie Cannon-Brookes’ investment vehicle, Grok Ventures. McConnell didn’t know Cannon-Brookes personally, but she was familiar with the team in his family office.

“Grok’s Chief Investment Officer Jeremy Kwong-Law used to work with Macquarie. When he started at Grok, he reached out to me and said, thematically, I think what you’re doing would be right for us. Let’s talk,” says McConnell.

The entrepreneur believes Cannon-Brookes’ took a big swing in Brighte’s direction because there is a direct correlation between its thesis of making finance for renewable solutions accessible and removing the friction at the point of sale and Cannon-Brooke’s sustainably focused worldview.

“It is very capital intensive to build a platform and a loan book, and he had capital to deploy,” says McConnell. “He has a clear, strong belief in what he thinks energy looks like in 20, 30, 50 years. Some people invest in green because it’s trending. Mike invests in it because he truly believes in it – that it is an economic decision for the user and creates value for them, but also it is the way society needs to go forward.”

Grok has participated in every fundraise Brighte has done since and contributed $78.8 million to the $100 million Series C that closed in 2021. Leading Australian VC Airtree also participated in Series B and C fundraises. Partner Craig Blair led Airtree’s investments and sees an enormous opportunity for Brighte to expand beyond solar financing. “The market for home energy and home improvements is $33bn annually in Australia alone and over $100bn when considering adjacent markets. We are hugely excited about the size of the opportunity.”

Blair is optimistic about what Brighte can achieve internationally. “Their bold mission doesn’t stop at home energy or Australia – they plan to use their strategic position and partner relationships in home energy to expand into new categories,” says Blair.

Brighte differentiators: Raising debt and establishing Australia’s first green bond

McConnell has also innovated with Brighte’s financial instruments. Not only has she raised $150 million in equity, but she has also raised almost a billion dollars in debt.

“I learned working at Macquarie that they have deposits and securities through the public debt market. For Brighte to compete with the banks and get cost-effective interest rates, I had to be able not to use private credit and equity,” says McConnell.

In 2020, McConnell issued Australia’s first 100% rated green bond. That first public market issuance has been followed by four more, with one or two more next year.

McConnell is also innovating the terms of the credit it issues to consumers. “We started with only three-year terms to repay the equipment. Now, we’re at 10-year repayment terms. Solar has a 25-year useful life. I’m going to continue changing the credit products to make them more flexible. The more friction you can remove in paying for it, the fewer barriers to people buying renewable equipment.”

McConnell says she is open to a potential Brighte IPO in the future but has no immediate plans to pursue a public offering. For now, she has her sights set on replicating the significant uptake of solar in Australian households with batteries.

“We have the world’s highest solar penetration, but we don’t have the world’s highest battery penetration. Government support is what ignited the solar uptake. Now we need a consistent battery policy to help households understand they can store their energy.”

Almost a decade into her journey to democratise access to renewables, and with 2030 and 2050 energy targets creeping closer toward us, 48-year-old McConnell wants Australians to benefit from being able to store and monetise renewable energy. “We have problems with transmission and grid reliability, and we don’t have enough generation to support our country. As we turn the coal off, we need to get extra energy on the grid.”

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.