Lazard Asset Management Pacific’s portfolio manager and analyst, Warryn Robertson, has worked in the investment field for more than 30 years and specialises in global listed infrastructure and equities. He explains the advantages of being heavily weighted offshore, when to be brave and when to be cautious (particularly now with tech) and ultimately, why boring can be quite beautiful.

This story featured in Issue 12 of Forbes Australia. Tap here to secure your copy.

As an investor, what are your fundamentals?

We are value-focused and seek to invest in undervalued companies but with a longer-term view. We are happy owning companies for years [if] the investment thesis remains consistent. There’s a focus on quality, which [speaks] to predictability. My job is to predict earnings and put a multiple on them, and that’s how I come up with a valuation.

Suppose you find a group of businesses where the earnings and cash flows are more predictable. In that case, you are more likely to get that valuation problem correct because you’ve got fewer variables around the volatility, earnings and cash flows. That gives you more confidence to make big bets in portfolios [and] run concentrated portfolios. That sounds boring, but the beauty of that is because you’ve got a longer-term view, and the [rest of the] market is fixated on next quarter’s earnings, not what will happen in five to 10 years. You can make pretty decent money investing in these dull, predictable businesses.

When you think about our definition of infrastructure and those monopoly-like essential service assets with regulated or concessioned, long-term contracts, high margins, and good debt structures in OECD countries, out of roughly 400 infrastructure assets listed around the world today, less than 90, we consider for investment, and we own 26. We are very selective because of the criteria and importance of getting the characteristics right.

Why is the broader market so short-term driven?

The news-flow cycle has become even more ingrained in [our] lives, particularly in financial markets. So, [it’s] what happened yesterday? Why has the share price moved in this given month [or] quarter because of what happened? Occasionally, that’ll be based on genuine information against the value of that company, but in most cases, it’s kind of irrelevant. The path to get there may be slightly jagged, but the result is what we’re talking about. What does this business look like in five to 10 years? When you think about infrastructure [companies], that’s a much simpler problem to solve. You’re talking about regulated utilities, toll roads, airports, railways, communication towers or satellites – businesses with a physical presence and typically enshrined regulation or government contracts or concessions that underlie their earnings and revenues. That makes them very predictable. They’re also essential services, and they’re [generally] monopolies. So unless you get lockdowns, people go about their daily lives. Turn on the tap, brush [their] teeth, turn on the light, hop in a car, drive to work. We are very rhythmical, repetitive creatures, and you make money from that repetition.

How do you deal with the noise and volatility in the market?

Noise and volatility [are] good things because you can use the noise to trade around long-term value and generate excess returns for clients. Let’s say you’ve got a view that a stock’s worth $5 in five years, and it’s trading today at $2, so you want to own it. [The] market will bid the stock up, and you’ll think it’s gone slightly above where it should be on that trajectory. Then, you’ll be able to trim it. Likewise, if the market gets disappointed because some esoteric thing happens in some part of the world that means they decided to sell that particular stock, you can buy it at a slightly lower price. You constantly trade around intrinsic value, and [that] gives you the opportunity to buy and sell. I might own the same name for a decade, but I might own different weights in the portfolio.

What is the noise in the market now?

You’ve got a perfect storm for UK water companies. Under Jeremy Corbyn, one of the policies of the Labour Party manifesto was to nationalise UK water. That is not part of the current Labour plan, but it still gets brought up when people do Google searches around ‘water company Labour Party policy’, and then they don’t backcheck it. At the same time, they undergo a regulatory reset every five years. You’ve had a situation where some UK water companies have been poorly managed for the better part of a decade or more. The common feature of those companies is that they were owned by private equity firms and used aggressive gearing and tax structures.

We own three UK-listed water companies that have been caught up with the contagion effect of how badly the private equity guys have been managed. Our three companies have essentially the gold star from the regulator, and the Office of Water says it is happy with our plans. We will allow you to enact [it] without double-checking every line item. For the private equity guys, they scrutinise every single line item. And if you’ve read stuff in the local press, [they] talked about, ‘Oh, the political risk in the UK is high, the regulatory risk for UK water is high.’ This is all the private equity guys feeding the press like pigeons with seed, telling them, ‘The UK regulator is bad, and this is terrible.’ It’s not bad.

The UK regulator is doing their job properly. It probably needed to clip these guys a little more over the past 10 years, but they haven’t. And the truth is, virtually the entire national press lives in London – that is serviced by one UK water company. A series of private equity funds own it. The simple story is for every 100 litres of water that leaves the reservoir, 20 litres end up at the tap. They have an 80% leakage rate. Now, some of these pipes were built during Queen Victoria’s reign, fair enough, okay. So they’re old.

[Therefore], that noise means we’re suddenly getting to buy well-managed, well-run, well-financed, well-resourced UK water stocks at what we think are giveaway prices. And here’s the killer: they make up less than 1% of household budgets. In the cost-of-living crisis, these businesses are in a great place, and the regulator allows them to grow their asset base appreciably. You’ve got good growth in a boring business.

So where else are you putting the money?

We like the UK and Europe; they are the two biggest geographical areas where we’ve put capital. They are definitely bigger than our Australian holdings. In fact, it is bigger than our US holdings, which is unusual for an infrastructure fund. Most infrastructure funds will have 50% of their portfolio in US utilities; we’ve got less than 20%. And that’s because we don’t see value in US utilities today. We only look to invest in developed market economies – not emerging markets. The key risks you bear investing in these types of assets are regulatory and political. We do not believe you are compensated appropriately for that level of risk in emerging markets. Even within the EU, [you’ve] got to be careful about the regulatory nuances – very few are in South America, and none are in Africa. We stick to OECD countries, good regulatory regimes tested over multiple decades, and most importantly, [have] recourse to an independent legal system. Mainland China is definitely out. We have an investment in Hong Kong because almost all their assets are offshore, and the holding company sits in Hong Kong.

Why are you so heavily weighted offshore?

It’s just valuation. In Australia, two significant trends have been going on in the past 30 years. You’ve had governments seeking to privatise [infrastructure] assets. Depending on the political swings of the day. Then, there are the sovereign wealth funds, the big pension plans, and private equity that want to buy them. And what’s happened in Australia is we’ve had privatisation, and the private equity/sovereign wealth/big pension plans take big stakes in them.

What they do is they have a checklist, which is very similar to ours. They look at the market and say, if I can buy a stock that’s listed because the market’s short-term noise is missing the long-term value, then I’ll bid for it. [Pushing the equity prices up.] You’ve got governments with fiscally constrained budgets looking at assets to sell and private equity with a pot of money looking for assets to buy.

How does the FX market play into your offshore positioning?

Our infrastructure strategy [is] fully hedged. That’s not a tactical decision; it’s a strategic investment decision. The reason for that is we want to remove the vagaries of currency movement to reduce volatility. The second reason is that we are buying inflation-protected assets. If I hedge the currency, I import that inflation protection. That said, in terms of currency, the Australian dollar does look underpriced – relative to fair value [now]. And we do consider fair value. Punting on currency

is very hard in the short term.

Does that come back to “noise” in the market?

The US dollar looks expensive against most currencies. And the rationale for that is that the US dollar is seen as a haven, and we think the market is almost bipolar in what it’s doing now. It’s not looking at equities, not infrastructure. Because what it’s saying is, ‘I’m cautious about something, so I want to be long for the US dollar’. The other currency that’s weird at the moment is

the Japanese yen. The point I would make about that is for the past decade or more, currency has not been a major risk for portfolios because central banks moved in lockstep with the Fed [US Federal Reserve Bank]. [When] the Fed dropped rates, they dropped rates. The Fed talked about raising rates, they talked about raising rates, apart from the Japanese.

We’ve all got the Japanese disease now. We think the risk around currency is greater, and it’s not the only risk, but it’s undoubtedly one of the macro risks you must conider because we don’t believe that the central banks will be moving in lockstep with the Fed. We don’t think inflation will come down as fast as everyone anticipates.

What risks are looming?

Populist governments will be a big risk because they will probably be less fiscally constrained, and the [US] Republicans aren’t talking about fiscal constraints. Democrats aren’t either. The US is likely to continue to run budget deficits. That is inflationary, and we think [central banks] will struggle to return to their target ranges.

[Also], the one surety in life, is demographics. Old people are getting older in the Western world, and death rates are falling. Despite COVID-19’s best efforts, which have trimmed life expectancy, you are still seeing a lot more of those baby boomers come through. That is inflationary because they spend more on healthcare. And, of course, there’s the cost of climate change.

[But] volatility creates opportunity. You asked about one of my fundamentals as an investor. Patience is one, but always being cautious when others are careless and brave when others are frightened. So, you’re contrary. We are certainly cautious today because we think the world is quite careless [in] the way it’s thinking about risk.

Why are people being careless?

Free money.

The whole petri-dish experiment of modern monetary theory worked as long as the government, banks and central banks kept it all together. As soon as COVID-19 happened, we did [former Federal Reserve Chair Ben] Bernanke’s helicopter, we gave [money] to everybody, and that became inflationary. They got the other thing wrong, which is that the pandemic was not a typical recession. Central banks globally mucked that up. The boring thing they got wrong was that in a [typical] recession, aggregate demand falls, people consume less, but productive resources and the supply curve remain fixed. If you just think of supply and demand, demand falls, that’s deflationary. You can throw money at it, and it’s no problem. What we did was we had demand destruction, but we also had supply. Suddenly, both curves moved [and], you’re unsure if it’s inflationary, deflationary, or neutral. What they should have done was not to throw money at it. They should have waited and watched. They threw fuel on the fire.

What’s your position on AI and tech?

As a firm, we are seemingly not participating in the AI thematic, and I would make two points about that. One is we are a broad church – we don’t have a CIO who [maintains] investment dogma. Each team does what they think is the right solution for their particular clients. That said, as a firm, we are all looking at it from a similar lens because we are fundamental investors. From [that] perspective, AI is a complex problem to solve. One of the things is to understand the business you own. Try and predict earnings and cash flows for easy problems to solve.

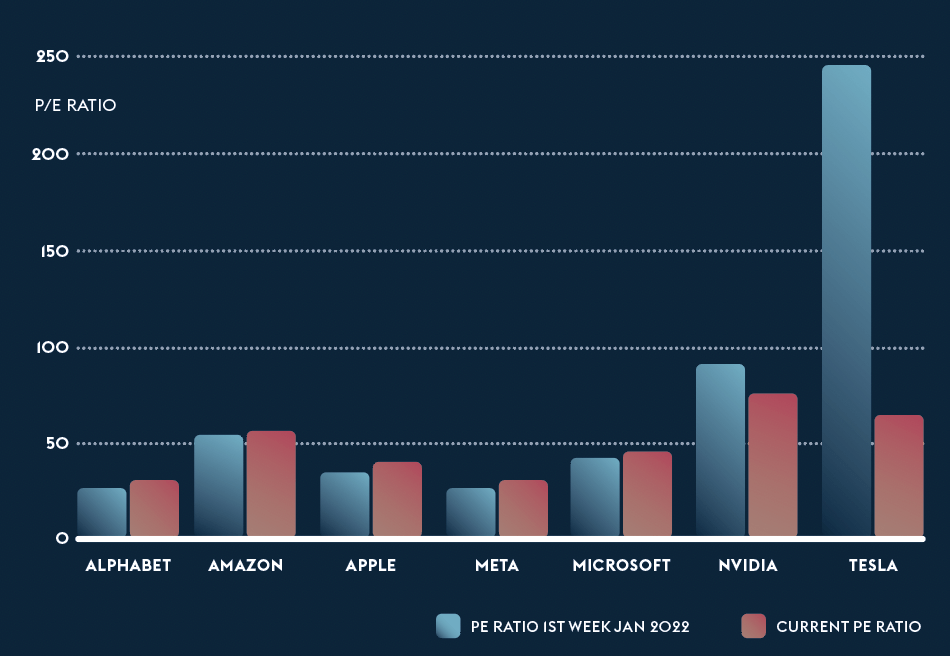

NVIDIA is an amazing company; it has done incredibly well. However, I have no idea what it’s going to earn in 10 years’ time. I don’t think anyone does. Tesla. What’s that company going to look like in 10 years? Solving those types of investment problems is really, hard. And the market is putting stratospheric-like valuations and expectations on them. So they have to continually meet these really difficult expectations year in and year out to justify the prices being paid for them today. Or they’re simply speculating [that] someone will pay more for this [than you paid for it today]. Justifying their valuations is hard.

Do you think we’re in a similar position as before the dot-com crash?

Picking short-term markets is nearly impossible. I couldn’t tell you what we’re going to look like in the next six months. What I have much more confidence about is a broad equity portfolio today that owns 100-odd stocks, supposedly well diversified, will struggle to achieve, in my view, a 10% per annum return over the next five years. The way you want to invest today is to know the companies you own really well. I reckon today you want to own 20 to 30 stocks max because there aren’t that many cheap stocks out there.

We know these [tech] stocks have collective earnings, which look good and have good earnings growth but are not stellar. If you look at the seven-odd AI [related] stocks, NVIDIA’s going off on its own tangent, but the other six are kind of… Yeah, they’re all right. But it’s all about what they will earn in the future. The future is uncertain for these companies because we just don’t know how they will monetise. Even though we’re on the sidelines, our question is, unlike the internet where you could see how monopoly positions could be built, it’s hard to see how monopolistic positions can be built with AI at this point. I could be wrong on that, but it’s not as obvious.

What would you tell investors at the moment?

Stick to good old-fashioned businesses that you understand. Valuation is critical. It’s the only thing that matters in the long run.

The Magnificent 7’s majestic rise

Asking if a stock is over-valued will often not recieve a definitive answer – particularly in tech’s brave new world. Looking at the so-called “Magnificent 7” tech stocks’ PE ratios, since the world emerged from COVID, shows valuations well above what is considered average. According to Forbes Advisor: “a PE below 15 has traditionally been seen as low… whereas some investors view anything above 20 as high (possibly overpriced). However, these are just rough guidelines and should always be contextualised.” The majority of the Magnificent 7 have seen small increases in PE ratios since January 2022. However, both NVIDIA and Tesla have seen dramatic declines. All of them though, particularly Nvidia and Tesla, still have ratios well above 20.

This article represents the views only of the subject and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.