Stewart Investors’ senior portfolio specialist Pablo Berrutti maintains the key to sustainable investing is taking the longer-term view and being very mindful of the people his firm entrusts its clients’ money with. With $28 billion under management, his company has decades of experience in sustainable investing. He spoke with Stewart Hawkins about the imperfect realities of making sure money is put to the best possible use, why investing responsibly can oftentimes mitigate risk and his source of hope for the future.

This story was featured in Issue 15 of Forbes Autralia. Tap here to secure your copy.

There’s been talk for decades about sustainable, environmental, ethical, and impactful investing, much of it meaningful, but there’s plenty of chat that’s not. How do you define this kind of investment?

There’s been talk for decades about sustainable, environmental, ethical, and impactful investing, much of it meaningful, but there’s plenty of chat that’s not. How do you define this kind of investment?

This is part of the challenge because all those terms are used, and some relate to specific things. We talk about ourselves as sustainable investors. What the industry has never done well and is a great disservice to itself – to all of us – is to explain things clearly and well.

Whether you go back to the global financial crisis or the Banking Royal Commission, we clearly have a communication problem and sustainable, responsible, ethical investing, whatever you want to call it, has suffered from that same set of problems. In this case, people have different objectives and things they’re trying to achieve. Most broadly, it’s considering environmental, social, and corporate governance issues when you’re making investment decisions, but for some people, that’s purely because we believe it’ll help us deliver better returns, help us manage risk better because those issues are going to impact companies and impact assets. For other people, they’re really trying to invest in line with their values and are still looking to achieve a return. It’s not philanthropy, but they’re less concerned about the return impacts because they’re determined not to invest in certain areas that they have an ethical concern with.

Often, those financial and non-financial concerns overlap because [for instance] slavery in the supply chain of a consumer goods company can impact its brand and reduce its sales, cause it to be sued and have regulatory and other issues.

What’s your firm’s investment philosophy?

It’s great that you use the term philosophy because that’s what it has to come back down to for all investors. We’ve been investing in different markets for 30 years and investing with a focus on sustainable development for the past 20 years. We’re looking for high-quality companies contributing to or benefiting from sustainable development. What we mean by that is that there are tremendous human needs in a lot of parts of the world, and even in developed countries like Australia where people don’t have access to basic needs like healthcare, healthy foods, education, infrastructure, transport, which need to be provided for.

We [also] face tremendous environmental challenges and companies play an important role in delivering some of the solutions. It’s through that lens that we think about what sustainability ESG means for us. For some companies well-placed to deliver solutions into those areas, they’re going to have a tailwind that will help them grow and deliver better returns for investors over the long run. In contrast, some companies that are actually contributing to the problems and making them worse and aren’t able to change are going to have headwinds, whether it is regulation, reputation or consumer boycotts.

It’s not a thematic thing where we go, “Okay, well, solar panels are good, so we should invest in all solar panel companies.” You have to have the right management teams in place. You have to have the right business models. You have to have a healthy balance sheet because without those things, and solar is an area where often those quality dimensions are [often] missing, then you’re not going to be able to capture those opportunities.

Where do you draw the lines in the sand? How do you judge a company’s suitability to invest in? What are your parentheses?

We would rather not invest in certain product types industries because we think they pose unmeasurable and unmanageable risks from our standpoint. Basic things like tobacco, gambling, and fossil fuels are areas where we believe the future of those industries is at risk. It’s important [also] to talk about patterns of behaviour across businesses and how they respond to issues when they arise.

If we see a pattern of behaviour that points to a company that isn’t taking responsibility for issues and addressing them and then looking to put in place systems and processes to fix them, then that would be a no-go area for us.

In the case of Techtronic, [for instance] … they have quite a long-term view. Take Covid. [Other companies were] more ruthless and cutthroat during the pandemic. They cut a lot of their staff and research and development budgets to try and maintain margins, whereas Techtronic took the longer-term view that they want to keep their people. They wanted to continue to invest through the health crisis because they could see that that would be in their business’s long-term interest. They’ve done a lot of fantastic work regarding battery technologies and recycling programs. We look at how they’re transitioning their business to fit what a more sustainable economy might look like, as well as the types of products that they produce that are helping to maintain and build things safely. That doesn’t mean that they’re not going to make mistakes and there aren’t going to be issues, but then it’s how they front up and address those issues and make sure that they don’t happen again. If we’re looking for perfection, we wouldn’t invest in anything.

People [are] critical because we’re trying to get comfortable with the company’s stewardship. We expect that when incidents or mistakes happen, we’ve got the right type of people with the integrity to take responsibility and address them appropriately.

Just how important are the people who run the companies?

The integrity of the people: can you trust them with your client’s capital? That’s the fundamental question we ask before we make any investment. You will get bad outcomes if you don’t have the right people. That may be through financial performance, but also through bad ethical outcomes, whether it’s bribery and corruption, not managing and dealing with incidents, or having a pattern of continuously poor performance in relation to different incidents. Those types of things are bad decisions that humans make.

What about environmental issues? One of the companies you invest in produces soda ash – a process that can produce toxic effluent.

[That company] manages the effluents as best as it can, and it’s continually looking to improve how it is managed. Soda ash plays a critical role across several industries. You cannot make solar panels without soda ash, for example. It is a key component for delivering many solutions the world needs. Suppose you’re going to have something for which there isn’t already an alternative available. In that case, you’d want to have the type of stewardship within an organisation like [that company] to manage those issues that inevitably occur as well as they can be. The case for investing in them really comes from the fact that soda ash is essential in so many key components that are needed for the energy transition.

All companies and all processes have negative environmental impacts as they stand today because it’s the nature of the way the economy operates. For many companies, the need is to transition their businesses to ways that don’t have those impacts and, in fact, are net positive in all respects. However, we’re not there today, and the needs of that transition also involve some products that have negative impacts. We try to weigh how well the company does compared to others in producing [them] to try and mitigate those impacts.

What are the real-world effects of your investment philosophy, given the weight of the global investment market as a whole? What are you achieving?

I think what we bring, and what is the importance of investors that have a long-term view and a focus on trying to build relationships with companies, is to provide a voice that encourages better practices in the areas of continuous improvement, encourage more conservative management of balance sheets rather than gearing up and being racier in the way that companies operate, which is often what they’re encouraged to do by more short-term members in the market.

To think 10 years out and longer [is what] companies need to hear more from their shareholders. There are a lot of free-float companies out there who [would] benefit from hearing that message. It’s around being good stewards and trying to encourage the right types of long-term behaviour from companies, as well as a multi-stakeholder approach to the way they manage things.

We think that if shareholders are going to benefit financially from a company’s success, it’s because the company has managed the relationships with all of its stakeholders, whether it’s employees, the communities that they operate in [or] their customers.

How do returns stack up against market benchmarks?

Over the shorter term, it’s been difficult the past couple of years, but over the long run, our returns in our longest-running strategies, Asia Pacific, global emerging markets, have well outperformed [benchmarks]. The way that our investment process manifests in terms of returns is that when markets are falling, we tend to hold up and not lose as much as the market does. Then, when markets are rising rapidly, we won’t keep up. We’re still delivering positive returns when markets rise, but not as much as the broader market. The net effect of that over time is that the compounding of the terms allows us to deliver better returns than the market, but there will be periods where we underperform, and the most recent period is one of those to date.

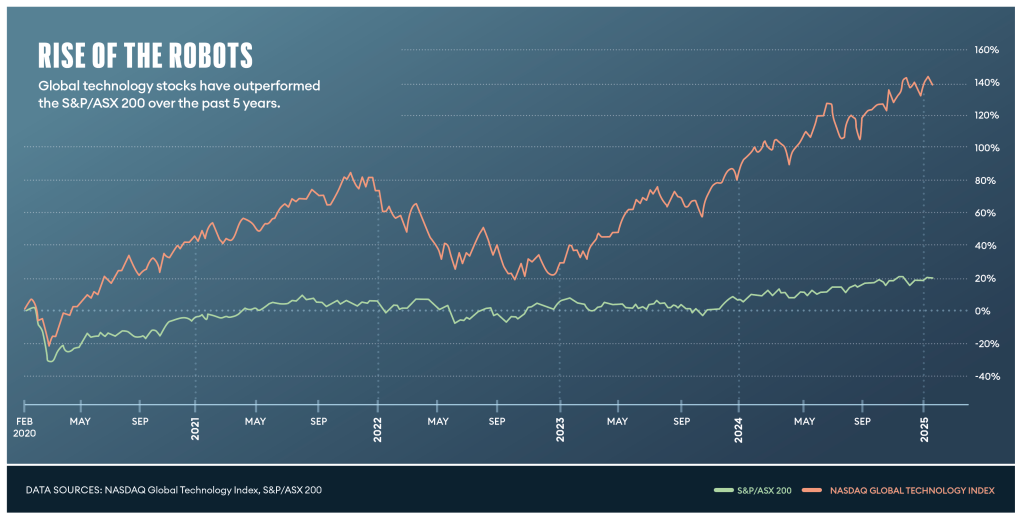

We try to focus on the process and the philosophy because you can get carried away with different themes and trends that are happening within the market. We’re seeing that with artificial intelligence and the IT sector, but we want to invest bottom-up. We think about companies, not sectors and countries. We want to be long-term, 10-years-plus out when we’re at the point of valuation, at the point of investment. Some companies we’ve held for much longer. Sometimes things change, and we can’t hold them as long, but that’s the goal. We want to try and preserve capital, so we’re looking for resilient companies.

What about the AI space? Is it a bubble?

There are some differences with the .com bubble in that there were no earnings, whereas when looking at some large tech companies, they make money in other areas and reinvest it in AI. It’s having enormous impacts, some positive and some negative. I think if you look back to [the growth of] social media where, and again, this goes back to people and stewardship, where the companies had a product that could deliver many benefits. Still, because of how they were operated, they delivered a lot of harm as well, and some would argue greater harm than benefit. Hopefully, from the macro societal perspective, those companies and the regulators learn some lessons from social media and apply those lessons to the risks posed by AI.

Can you explain your interpretation of “bottom-up” investing?

It’s taking [a] company as the centre view rather than investing behind a particular theme or saying the interest rates are going down in this country and they’re going up in that other country and therefore I should move capital from banks in this country to that country. We’re not looking at that as a direction of capital or wanting to invest that way. What we’re trying to do is find great quality companies. We consider how those macroeconomic, environmental, and social factors will impact the company, [also] the geopolitical factors. We try to manage those risks as best we can, but we are thinking of it from the company’s perspective instead of taking that top-down view. In practice, we don’t have a target for investing a certain amount in a certain sector or a target for investing a certain amount in a certain country.

You’ve said you invest in companies “contributing to a better world”. Can we look at what that statement means in real-world terms for you? You could argue that defence companies protect vulnerable communities, for example.

There are companies in the portfolio [for instance] Texas Instruments [which] operates out of the US. They make chips, and some of those chips would go into drones, no doubt. They had one of their chips found in a bomb that was dropped by Russia, but that’s a chip that you could find in a toaster or a washing machine, so they’re ubiquitous. Those technologies have then been readapted, so sometimes it’s hard to avoid altogether those incidents.

You can make arguments around most things. We’re looking for things that promote sustainable human development. While you can make a defence argument for it, [defence is] not promoting human development given the way that weapons are used in conflict, how the weapons industry operates with governments and the sales of weapons [and] how weapons leak into the wrong hands. We’re looking for the positive side of where a company is supporting and promoting human development.

What are the macro navigational challenges for you at this point?

I think they’re manifestations of things that we’ve been seeing coming for a very long time. We are seeing democratic norms being eroded in different countries. We’re seeing climate impacts increase and become more devastating for people and companies. We’re seeing the polarisation and misinformation become challenges. How we manage that, again, goes back to the companies that we’re investing in and the types of roles that they play in the world, whether that’s in their specific countries and what they’re able to deliver there, but then also more broadly in terms of these big global challenges that the world faces. India is an interesting example of this. For instance, where in China and the United States, more than 95% plus of households have a fridge, they have a washing machine, they have air conditioning, whereas, in India, it’s 40% or less [that] all households have any have those things.

Air conditioning will become a life-or-death consideration for people in India in the years ahead. The companies that can produce those products in a way that’s affordable and accessible but also recognise the environmental impacts are going to be vital to how India can build a more prosperous economy and society more sustainably.

It’s also increasing inequality, which is happening all around the world. These are the types of issues that individually can cause significant disruptions but also collectively are going to combine to create entirely unpredictable things. They’re not new concerns. You’ve got things that are novel now in the discourse around AI and whatnot, but there are these fundamental ongoing challenges that we’ve not dealt with very well globally as a society, as a country or as individuals. If we don’t, those issues will get worse, to the point where we’ll have very, very significant problems.

What’s your most important piece of advice?

If you can achieve as good or better returns by investing in companies helping to deliver better outcomes, then why wouldn’t you? It’s not easy or straightforward – you need to have the right type of information, and a set of investment principles [that] are aligned with doing that and doing it over the long run. It is a very rewarding way to be able to invest from a financial standpoint, but ultimately, we are sharing the profits of companies that have real world impacts. Why wouldn’t we want those impacts to be good ones?

The beauty of investing in sustainability is that you see companies around the world that can do things in ways that we wouldn’t think are normal but yet are still delivering good financial and good social and environmental outcomes. That’s a source of hope.

This article represents the views only of the subject and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.

More from Forbes Australia