Jun Bei Liu took over Tribeca’s Alpha Plus Fund in 2019. Since taking on sole responsibility for the portfolio, she has quadrupled assets under management, now at around $1.35 billion. She talks to Stewart Hawkins about, the dangers of “thematic” investing, why tech stocks are too expensive and argues China will still need Australian iron ore for a surprising reason.

This article was featured in Issue 11 of Forbes Australia. Tap here to secure your copy.

What are the fundamentals for you as an investor?

I am focused on companies’ longer-term earnings potential and [their] strategic advantage compared to [their] competitors. When a company can grow its earnings and beat an analyst’s expectations year in and year out, the share price will go higher. Share price always follows where the earnings are going. In the shorter term, however, 50% of the share price is influenced by sentiment.

There’s a lot of noise in the market. One recent example [is] weight loss drugs [which] took the world by storm. The amazing result achieved by those drugs in terms of trial results created a lot of fear about anything to do with consumption like food, restaurants, and [even] sleep apnea – anything [associated with] weight gain. Share prices tanked significantly in the past 12 months.

Shorter-term investors [are] thinking, “Oh my god, in 10 years these companies won’t make as much money because we assume everyone will go on those drugs”, then we’ll eat less pizza and have fewer illnesses. It’s nothing to do with today’s earnings; it’s really about fear.

[You need] to work out whether market sentiment is fair or not. This is the mispriced value that we see. Suddenly, we have unrest in the Middle East [and] the market wants to sell everything.

The sentiment provides the opportunity to buy more or buy less. It is the shorter-term sentiment that gives you the chance to add or to take some profit.

What strategy would you avoid employing in the market?

There’s a lot of thematic investing now. Today’s very short-term in the share market, they focus on instant gratification, whether they’re focusing on next month’s result or focusing on this theme that sounds exciting [such as] AI or the like. They just buy regardless of valuation. There’s a lot more systematic, passive investing into those thematics. If you look at the ETFs, so many ETFs have been created that allow you to buy or sell the theme – not the company.

Themes don’t usually last very long. They usually last between six to 12 months or not even 12 months – it’s three to six months. And then these themes, when they fade, when [investors] move on to the next hot thing, you see a lot of opportunity. And the share price can react very quickly as the market rebalances itself.

I don’t do any ETF investing. For an active investor, it’s lazy investing. When the market goes up, it’s fine. Or when the market works in the [expected] direction, it’s fine. But when things go wrong, everything goes wrong. You really need to understand what companies sit within those ETFs.

What will the market look like in the second half of this year?

Pretty good, but we’ll talk about a couple of risks coming up as well. For the Australian market, we are now almost through the trough of the consumer slowdown. The six months until June will be pretty slow for consumers, and we’ve seen all the signs of that taking place. It’s not cratering but slower. From the middle of the year forward, we are going to cycle some easier numbers, and we also have stage-three tax cuts coming through on the first of July. That is going to be very supportive [and] help cushion the softening in the domestic economy.

But what about inflation?

I think inflation is slowly heading towards a lower level, not as fast as people hope.

Now, when we say the stage three tax cut, it is equivalent to 1.5% of GDP, so it’s quite meaningful. We do think [the] consumer [sector] will be helped somewhat. It’s a constant power balance between inflation and then the stimulation of the economy. I think the economy is slowing fast enough for us to have a reasonable inflation target, probably by the early part of next year.

Your outlook for the rest of the year is very positive, but what asset class are you concentrating on?

Given the repricing expectations of the rate cuts, I’m positive about the equity asset class and think fixed income has had a good rally. Most sectors in the share market haven’t done anything like it, so I believe equity [will do] well. Equity also reflects companies’ earnings power, and [they are] doing well. We’ve got population growth too. Compared to the rest of the OECD, we are doing well on that front. [But] I don’t think all of that will suddenly push the economy red-hot again.

I [also] think there will be many more mergers and acquisition activity coming back. Usually, these are excellent signs supporting the share market’s valuation.

Markets get driven higher by the excitement of these things. We have seen some M&A and takeover offers early this year, but I think the pipeline is large. Looking ahead for the next few years, companies will realize their earnings growth is too slow. They will try to deploy [their] strong balance sheets and cash. It is time to lock in some of the lower rates.

What about uncertainty driven by the US election?

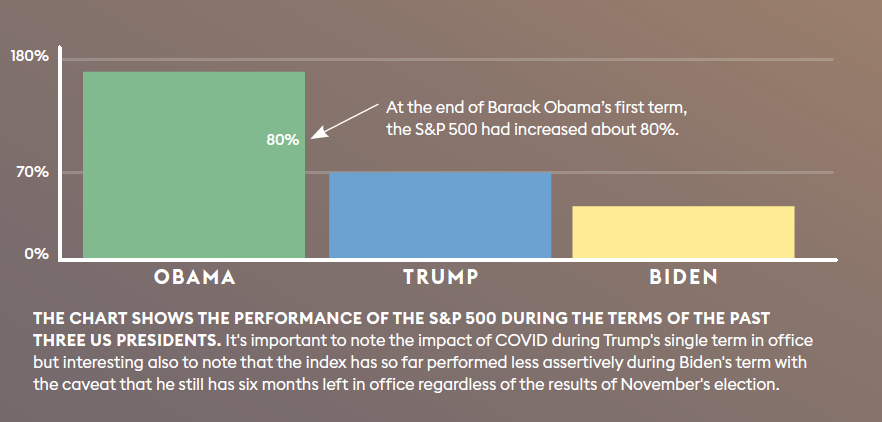

The election will probably become more prominent by July-August this year because we saw the previous Trump election and the drastic policy changes. They were quite volatile drivers of the

share market. Ultimately, if you look through that whole Trump administration period, the share market did go higher, but there was so much volatility.

He didn’t just put tariffs on Chinese businesses; he did it in Europe and everywhere. Investors are a bit cautious about what that might mean about how you position yourself because if Trump wins the election, is he going to undo many of those renewable investments [for example]? A lot of renewable prices have already fallen in recent months. If he does win the election, that will just mean that these prices could crater for the time being. And then, does that mean your dirty coal suddenly becomes much more valuable?

How do you price in this kind of uncertainty – or is it a known unknown?

[The] market has taken the view that Trump is actually good for shares – as in he’s stimulatory, he’ll spend, he’ll provide protectionism. The market is trying to draw the same playbook.

If Trump takes over, that’s not really uncertainty. We know what he’s going to do. It’s probably going to be tough for Chinese [companies] listed in the US – it might be really tough.

At the moment, there has been zero policy that’s been announced that we haven’t seen before. Uncertainty will come when one of them announces some extraordinary policy we haven’t considered before, and then it looks like the poll’s too close.

That’s when you have uncertainty. So far, it’s really about Trump’s old playbook.

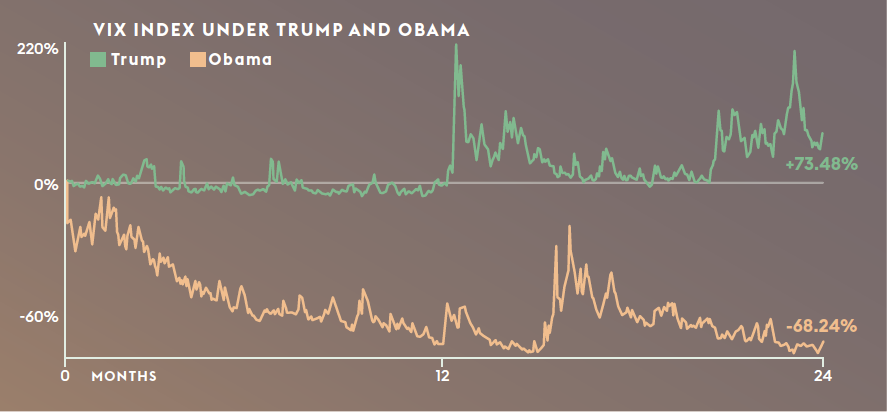

US PRESIDENTS and Stocks: A Nuanced Relationship: The Cboe Volatility Index, provides a measure of how much the market thinks the S&P 500 Index will fluctuate, reflected in its common name “the fear gauge”. When analysing the VIX over the terms of Obama and Trump, we used the first two years to mitigate the influence of the COVID pandemic. While it is an imperfect comparison, it’s worth noting the VIX during Obama’s first two years was, on average, 12 points higher than during Trump’s, but by the end of that period it had fallen by 68%. By contrast, during Trump’s equivalent term it experienced an increase of 73%. – James McCreery. [Data souces: Cboe/S&P Global/tradingview.com]

What about economic growth in Australia? It’s not good.

No, it’s not good. It will continue to slow. [But] if you look at [the] parts [that are] driven by export to Asia, China particularly, given [it’s] our biggest trading partner, China is doing a little bit better now.

It’s the second-largest economy [in the world], and that’s real growth. There’s not much inflation in there if not deflation. So that real growth is pretty good, and their export growth has just started to pick up recently. Asia trade is very strong. The Chinese consumer is looking okay. Their confidence is slightly dented, and their biggest asset, housing, is under pressure. But net-net things are on the way up.

What are the knock-on effects for our biggest exports to China?

This is interesting. Has the iron ore price peaked? Many people are still looking

at it, staying in the range of US$100-120. The thing is ‘steel intensity’. China is focusing on building power: the grids and renewables used to build energy. The Chinese can be quite strategic so they’re looking at ‘what do we need in the future’? The energy crisis is the biggest thing. Taking a step back, if you talk [about] all these large data centres and that trend to AI, all these companies will tell you they’re worried there’s not enough energy. The investment focus has changed in China. It’s no longer about building rail, building roads or building apartments. What’s important is they’re building the power grid. That’s why the first quarter bond issuance by local governments was a bit low – because they changed the mandate. They scrambled to find projects. The actual steel intensity for the power grid for these projects is far higher than [for] rail, roads or apartments. It is something like three to one in terms of intensity. Iron ore demand is coming.

What do you think about valuations?

If you look at the aggregate, it’s pretty much in line with historical averages.

But if you look at tech companies, they’re costly, and Australia has some of the most expensive tech companies in the world. It’s understandable and unlikely to change mainly because in Australia, growth is hard to come by, and with the large super funds as big investors, there’s just not that many growth companies [available]. Growth companies are looking very expensive. One of the reasons [the tech sector] has done well is because the interest rate outlook has moved from rate rise to rate cut. So, that has been a big delta for the tech companies in changing their valuation. To value the tech company, you must use a discounted cash flow model at the interest rate. A low-interest rate means a big valuation, and that’s been pretty much done now. The next way for this sector is potentially if the interest rate doesn’t get cut where the market thinks [it will]… they could fall because the valuation suddenly doesn’t quite get justified. So, this sector may face a bit of an issue regarding valuation when the rate cut gets priced out of the market.

I am buying tech, [but] I’m buying the cheaper tech.

Is AI snake oil?

We like the AI thematic, but [it’s] tough to find a pure exposure. Why do we like it? Because it is now being used. Every business, every board is asking the question, “What does that mean for our business?” How can we use that to improve efficiency?” It’s not about just a few companies making squillions, it’s about how that [technology] improves the rest of society.

It does not feel like a blip because not just a few companies use it; it’s everyone Like with everything, there’s usually an S-curve. When new technology suddenly comes through, everyone gets excited, and people buy anything that has the word AI in it. Everything goes up, and [no one] cares how much. Then, you go through the next phase when it goes down.

You see a lot of companies fail. A lot of them drop off, and then you come through the next wave, which is companies that have earnings and a competitive edge. We haven’t gone through that bust stage yet, but we will, and then we’ll see the big, top couple of market-share companies

will stay where they are. It’s very hard to call at this stage who’s going to win.

What do you see as the opportunities for the second half of 2024?

I think the cyclical companies are very well positioned for the uplift in the second half and for early next year into the rate cuts. I think the full-year results to August this year will mark the bottom of some of those earnings. Earnings will be a little bit lower than expected. I see that as an incredible opportunity to take a position in those companies because most retailers, particularly the good quality ones, have done very well working out efficiency because of all these supply chain shortages. These companies are not expensive, especially if the earnings are going higher.

Long/short investing essentially defines your investment strategy. Why do you believe that to be superior?

With traditional investing, you buy and hold a company, hoping the share price will increase. When market volatility picks up, you will have to figure out all of that when the market falls. All you can do to offset that risk is to hold more cash because your portfolio will become more volatile. You’re trying to time the market – holding a lot of cash. Hopefully, the market will come to me, and then I’ll go back in. You’ve started [trying] to time the market, which most

of the time doesn’t work.

The second component is that usually, when we research a company, you [sometimes] come away thinking, “Well, the company doesn’t look good.” If you can’t do anything about it, it’s like, well, okay, I won’t touch it. But as a short manager – I can short it! When it falls, great, I make money.

Taking these two positions will make my portfolio less risky. It’s great, particularly during times of volatility. When the pandemic took place, when things fell sharply like that, everything fell. Good company, bad company, they all fell together. So, what we could do during those times is that as a long/short manager, I can be very agile [and] net-net I’m cushioned somewhat. As a long-only manager, when things fall, what do you do? You must sell companies to [get] more cash because we don’t know what tomorrow looks like. So you have to sell more companies – the companies you love, which have already fallen. Cash is not an efficient asset.

I can buy growth companies when no one wants a growth company because I can do long/short, and I can buy a resource company when no one wants to.

What is the most important message you can give to investors now?

Stay invested [and] ignore the noise.

Addititional reporting by James McCreery

Are you – or is someone you know -creating the next Afterpay or Canva? Nominations are open for Forbes Australia’s first 30 under 30 list. Entries close midnight, July 15, 2024.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.