Radiopharma therapies targeting prostate cancer are driving a new gold rush in biotech—and Australia is leading the charge with technology so advanced, even the former US President might want in.

“The best treatment you can get for prostate cancer in the world right now is probably in Brisbane,” says Andrew Adamovich, CEO and co-founder of radiopharma startup AdvanCell, when asked about former US president Joe Biden’s prostate cancer diagnosis last week.

“I’m quite serious.”

Adamovich might be biased. AdvanCell is one of numerous Australian startups that have followed in the wake of Telix’s success [ASX: TLX, market cap $8.5b] in “theranostics” – the precision medicine field in which radioactive material is attached to molecules that carry radiation direct to cancer cells, for diagnoses and treatment.

On the back of promising early trial data, Adamovich’s phone got a lot pings last week when news of former US president Joe Biden’s metastasised prostate cancer broke. “He doesn’t have a Medicare card, but I’m sure we can figure something out,” Adamovich quipped to Forbes Australia.

Oh my god, these are beautiful pictures and this is quite magical.

Andrew Adamovich

While AdvanCell is dosing men this week in Brisbane as part of its Phase1-2 trial, the only precision radiation therapies approved for sale anywhere in the world are Novartis’s prostate cancer drug Pluvicto and its neuroendocrine tumor treatment Lutathera.

Pluvicto brought in sales revenue of US$1.4 billion last year, and in March, its potential market was effectively tripled when it won US FDA approval to go into patients before they receive chemotherapy.

AdvanCell is one of at least three Australian companies that say they can do it better and are gunning for a piece of Novartis’s action. The field is being hotly contested. In the past decade, Big Pharma has spent US$15 billion on radiopharmaceutical acquisitions with billions more coming from venture capital.

And in March, Novartis launched legal action in the Australian Federal Court to stop Australia’s largest cancer-care provider, GenesisCare, from using its prostate therapy, alleging the Australian company’s lutetium product – allowed by Australia’s Therapeutic Goods Administration under a special access scheme – infringed the Swiss giant’s patent for Pluvicto. This is despite the fact the technology was pioneered in Australia and was in use here before Novartis took out its patent, according to Professor Sze Ting Lee, chair of the Australasian Association of Nuclear Medicine Specialists theranostics committee.

“The Australian-led trials led to the evidence that was used to take out the patent,” she told ABC radio.

While Australia has been ahead of the game for decades in theranostics, Telix was the first to break out into mass-market profitability with its prostate diagnostic Illuccix. And while Telix has a thick pipeline of diagnostic and therapeutic cancer candidates, there’s a pack of competitors coming.

AdvanCell

AdvanCell made headlines in February this year when it announced a $178 million raise to fund ongoing clinical trials for its prostate therapy. “We’re now running a Phase 1-2 clinical trial treating men with metastatic prostate cancer at two public hospitals in Brisbane, Royal Brisbane and the Princess Alexandra Hospital,” Adamovich says.

“We’ve treated 16 men so far. We’ll treat four men this week. We treated three last week. The results are looking unbelievably good. Really tolerable… and also looking like they’re very, very effective.”

Okay now let’s deliver a payload and blow these cancers up.

Brandon Capital founding partner Chris Nave

Four weeks after dosing, patients return for testing. “We’re getting the feedback radiographically – we can see tumors shrinking, or in some cases you can’t see them anymore. We’re getting biochemical information – so we’re seeing PSA [prostate specific antigen markers in the blood] reductions – and then we get the feedback from the patients who say, ‘I feel great’. This is not something that a man with metastatic prostate cancer usually says. It’s a painful disease.”

Adamovich is hoping to release the results at the European Society of Medical Oncology annual meeting in Berlin in October 2025.

Adamovich says that the reason his company is persisting in prostate cancer – a field already dominated by Novartis’s Pluvicto, and possibly to be followed by Telix – is that AdvanCell will be attaching a different type of radioactive material, an “alpha-emitting isotope”, lead-212, that delivers more “killing power” to the cancer cell than the lutetium used by Novartis and Telix.

Studies a decade ago showed that an alpha-emitting isoptope, actinium, is very effective against cancer, Adamovich says, but sourcing it is impractical – relying on leftovers from a type of nuclear weapon that is no longer being made.

“When I and a number of people got together, we said, ‘okay, if you can do this, you really will change the world’. So we focused very much on that challenge: How do you make alpha-emitting isotopes at scale?” All the answers seemed to involved cyclotrons and reactors and hundreds of millions of dollars.

Then Julian Kelly, a former Australian Nuclear Science and Technology Organisation and CSIRO scientist, introduced the idea of using lead-212, another alpha-emitting isotope that they could make themselves. “It wouldn’t require a reactor or a big cyclotron … We could just buy a small amount of thorium-228 from the US Department of Energy and rent some lab space.”

AdvanCell started small-scale research production at various university and research institute sites until it was presented with an opportunity to secure a large facility that had been previously leased to Ellume – a COVID-era RAT test manufacturer that had fallen into administration. And that’s how a 4,000 sq m lab in the southwestern Brisbane suburb of Richlands came to be producing “targeted alpha therapies” – radioactive materials – at a scale unparalleled globally.

AdvanCell raised $2.3 million and got a $2.1 million government grant in 2021. It raised another $18 million in 2022, led by Boston-based Morningside Venture Capital, to fund the current trials.

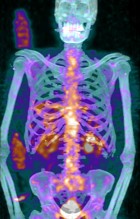

Even though the AdvanCell treatment is not designed as an imaging agent, when they dosed their first patient in 2023, the scans showed starkly where the radiation was. “We were amazed at the quality of the images. We scanned the patient at various time points and we saw the sustained tumour uptake, the very low negligible uptake in salivary glands, which is a problem for lutetium therapies and actinium therapies.

“And the rapid excretion from the kidney. We were blown away,” says Adamovich. “We said, ‘Oh my god, these are beautiful pictures and this is quite magical’. So we submitted it to The Journal of Nuclear Medicine and we got the cover in April last year. It’s the most famous periodical in the field.”

Australia’s largest med-tech venture fund, Brandon Capital, invested in this year’s $178 million round. Brandon founding partner Chris Nave had been talking to AdvanCell for years,” he tells Forbes Australia, but what led Brandon to jump on board was the hardware.

“One of the big challenges of radio pharmaceuticals is the radioisotope, which has a very short half-life … somewhere between 10 and 20 hours. So while there was an industry-wide race to find great targets, flags, for these isotopes, there’s also a race on to make the radioisotopes without needing some nuclear reactor in the snow somewhere in the Arctic.

“AdvanCell has come up with a really clever generator that sits on a bench and makes these isotopes. In our mind, they were the picks and the shovels to this industry that’s exploding. No one had come up with a picks and shovels solution.”

And AdvanCell’s lead-212 product has a shelf life of 24 hours. That it now also has its own patented targeting molecule, makes it all the more attractive, Nave says.

Why this men-only cancer gets so much attention?

The reason why prostate cancer has had so much focus in radiopharmaceuticals is because of the discovery of prostate specific membrane antigen [PSMA], Nave says.

“It is a really well-validated flag for that disease. So there’s been quite a number of products that have targeted it, trying to deliver drugs against that PSMA. Some have worked, which has demonstrated that you can deliver and have an impact, but none of them have been perfect. Some of them have had bad side effects, some haven’t been as efficacious as you’d like. So what a lot of the radiopharmaceutical companies have done is they’ve said, ‘We’re going to prove our radioisotope against PSMA, because that’s a proven target.’

“If you have a really good efficacy in treating prostate, it validates that radioisotope, so the industry will say, ‘That will work in other cancers as well’.”

Start-up in stealth

Brandon has also invested in a Sydney-based radiopharma start-up that is targeting cell death, Nave says. Still in stealth mode, it has discovered a marker specific to dead cancer cells. “When you have a tumour, you have constant turnover, death and growth of cells. And there’s a way that cancer cells are dying that’s creating a particular flag that doesn’t happen in healthy cells.

“They’ve done the human studies to show that it’s a really important marker that is specific only to cancer. The next stage is to say, okay now let’s deliver a payload and blow these cancers up.”

What makes investors and investigators keen on this dead-cell target is that when the toxic payload is delivered to it, it kills more cancer cells, giving the next dose a bigger target. “So you can see how it snowballs itself as a therapy.”

Because there has been so much merger and acquisition activity in the last few years, Nave says AdvanCell is “one of the few independent companies still around that’s getting really exciting data, so we’ve got high hopes for what the future looks like.”

Big Pharma’s big buys

| Acquirer | Target | Deal Value (USD) | Year | Notes |

|---|---|---|---|---|

| Eli Lilly | POINT Biopharma | $1.4 billion | 2023 | Expanded into radioligand therapies with late-stage assets focussed on prostate |

| Bristol Myers Squibb | RayzeBio | $4.1 billion | 2024 | Added actinium-based radiopharmaceutical platform, most advanced in pancreatic cancer |

| AstraZeneca | Fusion Pharmaceuticals | Up to $2.4 billion | 2024 | Next-gen radioconjugates, including Phase 2 prostate cancer candidate |

| Novartis | Mariana Oncology | Up to $1.75 billion | 2024 | Strengthened radioligand therapy pipeline with preclinical assets, leading with lung cancer |

Nave also likes the look of Clarity Pharmaceuticals. “We keep an eye on it. We think the current change in valuation has made it a rather interesting company.”

Clarity

Clarity Pharmaceuticals [ASX: CU6, market cap $695m] came out of the University of Melbourne and the work of co-founder Professor Paul Donnolly, in 2010. Donnolly developed a “cage” that could hold radioactive isotopes of copper.

Clarity co-founder Matt Harris brought the copper cage technology and eventually convinced investment banker Dr Alan Taylor to come on board as executive chair in 2013.

Taylor is a former reserve grade rugby league player and gym owner who took himself to university to study exercise science but ended up going on to do his PhD in biochemistry and molecular biology, before adding post-grad finance to his qualifications. He raised $1 million, including some of his own money, and began recruiting. They raised $2 million, then $4 million, then $10 million, including $5 million from Australian cancer-care provider GenesisCare. It culminated in a $25 million pre-IPO round in 2020.

“A group of investors had margin loaned against us because they’d made so much money on us. They got smashed by the market.”

Clarity Pharmaceuticals executive chair Alan Taylor

Taylor wanted in-human trials before listing. Clarity’s most advanced product, SAR-bisPSMA, is an imaging product that takes radioactive copper to prostate cancer cells using PSMA as its target.

Dr Louise Emmett of St Vincent’s hospital in Sydney ran a head-to-head comparison with a gallium imaging agent like the one Telix uses. Emmett told the UroToday podcast that Clarity’s agent was more than twice as bright as the competition. “Cancer doesn’t guarantee to be a particular size,” Emmett said. “So when you look at the median node size in prostate cancer, it’s sub five millimetres, and that’s a real struggle for PET cameras.”

The big money in “theranostics”, however, is the therapy side in which various molecules carry larger doses of radiation to cancer cells to kill them.

Telix is already close to having such a treatment approved for prostate cancer and Pluvicto is well established in the market. So what is Clarity doing differently?

Clarity’s point of difference is Paul Donnolly’s copper cage technology, says Taylor. More copper attaches to the cancer cell and it stays there longer. “And instead of a one-hour half-life like Telix has in their molecule, we have a 12.7-hour half-life. So we can centrally manufacture, broadly distribute and image not only at one hour, but at later time points.”

“I got off a call this morning from a clinician: ‘My PSA’s rising. They can’t find my lesion. Can you help?’”

Clarity’s Alan Taylor

He says the strongest resolutions are 24 hours after the solution is injected.

“If you make a radiopharmaceutical product, you want to increase the amount of radiation in the lesion and maximise how long it stays there and we achieve that with this pharmaceutical.”

While the competition has few false positive tests, Taylor says, it also has many false negatives – failing to see small tumours. Men who get a high PSA [prostate-specific antigen] reading often get a negative scan result, Taylor says.

A common scenario is that men who’ve had their prostate removed often continue to get high PSA readings, indicating that there’s a strong chance the cancer has spread to other parts of the body. “People who know they might have some metastasis, rising PSA, they’re calling me freaking out. I got off a call this morning from a clinician here in Sydney, exactly the same thing: ‘My PSA’s rising. They can’t find my lesion. Can you help?’”

Clarity’s phase-2 trial, COBRA, published last year, looked at suspected prostate cancer cases where standard-of-care imaging was unable to detect any lesions, but Clarity’s Cu-SAR-bisPSMA imaging found lesions in 80%.

Taylor says they picked up lesions as small as two millimetres. “When we did the comparison to [Massachusetts-based Lantheus Holdings’] Pylarify and gallium PSMA we would find some lesions with next-day imaging that gallium couldn’t find six months later. We actually had that lesion excised and proven as cancer.”

Market darling

Clarity Pharmaceuticals listed on August 25, 2021, during the “COVID halo” with an initial price of $1.40 raising $92 million. They ran into the post COVID-19 slump in 2022, bottoming with a share price under $0.40. “We said, ‘Let’s stick to our knitting, continue to deliver on our milestones.’”

By late April 2024, Clarity’s share price had risen to $2.50 before beginning a remarkable rise to $8.98 in the five months to September. It was the biggest star on the ASX in early October 2024 – a pre-revenue biotech suddenly in the ASX 200.

“But that brings exchange-traded funds, that brings short sellers, that brings a whole myriad of other things,” Taylor says.

The downside started when Robert F Kennedy Jr began to be talked about as the US’s next “health czar” ahead of the November US presidential election, says Taylor. With Kennedy’s anti-big pharma views, biotechs suddenly looked riskier – especially those still needing FDA approvals to get to market.

“If someone comes along with a large cheque and offers a great return to investors then we’ll take it.”

Brandon Capital founding partner Chris Nave

“Then people are taking profits. A group of investors had margin loaned against us because they’d made so much money on us,” says Taylor. “They got smashed by the market.”

The slide became reinforcing, such that Clarity’s value is less now than it was before it read out its series of remarkable milestones like the COBRA study – about a quarter of its October 2024 highs.

Taylor remains upbeat and says the company is coming to eat Telix’s lunch. “It’s a market we want … We have a hundred-odd million dollars in the bank. We’re just going to continue doing our job. Now we are in a strategically hot area. There’s been a number of transactions, but we would just want to keep doing great work.”

Clarity is currently recruiting for a 34-person Phase-2a trial, SECuRE, for therapeutic use and for a 383-person Phase-3 trial in the diagnostic use that will get that product to market. The company also has a potential pan-cancer diagnostic and therapeutic, Bombesin, in a Phase-2 trial for breast cancer, and another molecule in Phase-2 trials for neuroendocrine tumours. But Taylor sees perhaps greater promise in other areas of breast cancer focussing on Herceptin receptors.

Taylor says there has been merger-and-acquisition interest. “It’s a crazy time out there and it would be crazy not to have suitors because the companies most at risk right now are Lantheus and Telix. Both of them only have the diagnostic generating revenue and we’re coming in to take that market.”

Asked about Taylor’s comment, a Telix spokeswoman said: “It’s our policy not to comment on competition.”

Telix

Telix began dosing prostate cancer patients in February for its Phase-3 trial of a therapeutic dose of its TLX591, a combination of the radioactive material lutetium-177 with a PSMA targeting antibody.

The dosing began two weeks after it announced a 10-fold increase in annual profits to $49.9 million on revenue of $783 million – predicted to grow to $1 billion in 2025 – which comes almost entirely from its radioactive prostate cancer diagnostic tool, Illuccix.

UBS healthcare analyst Laura Sutcliffe said in April that she believed Telix’s prostate cancer therapy could reshape the market for late-stage prostate cancer treatments citing its shorter dosing period, lower toxicity, and promising early efficacy signals. Early data on the Phase-3 trial is due later this year.

Telix has leveraged its success to rapidly expand its pipeline portfolio and its infrastructure with a string of buyouts.

Telix’s strategic spree

| Target | Location | Deal Value | Date | Strategic Rationale |

|---|---|---|---|---|

| IsoTherapeutics Group | Texas, USA | US$13.6m | Feb 2024 | Enhanced U.S. radiochemistry and manufacturing capabilities |

| ARTMS Inc. | British Columbia, Canada | Up to US$82m | Mar 2024 | Acquired cyclotron-based isotope production platform and rare metal stockpile |

| RLS Radiopharmacies | Florida, USA | Up to US$250m | Sep 2024 | Gained a network of 31 radiopharmacies across the U.S., enhancing distribution |

| ImaginAb | California, USA | $45m | Jan 2025 | Acquired preclinical cancer antibody pipeline and research facility |

Telix’s senior vice president of investor relations and corporate communications, Kyahn Williamson, said that with the short shelf life of radiopharmaceuticals, companies could not rely only on third parties.

“All our acquisitions are aimed at strengthening global manufacturing, supply chain and technical capabilities to support faster product development, reliable delivery, and expansion into new markets.”

Telix Pharmaceuticals has 33 clinical studies underway worldwide, with targets including kidney, brain (glioblastoma), blood and bladder cancers. Its model has been to first produce diagnostic tools, for which approval is faster and cheaper. Then to use the cash generated by the diagnostic to develop the more profitable therapeutics which use the same targeting molecule, but with a higher dose of radiation.

Brandon’s Nave says that for all the advances in cancer treatment in recent years, “there is no technology yet that really deals with solid tumors except a knife”.

“The reason big companies are paying lots of money to buy early-stage clinical companies is the promise of having an approach that will treat solid tumours. That’s why AstraZeneca paid US$2.4 billion for Fusion Pharmaceuticals and Bristol Myers Squibb acquired RayzeBio for $US4.1 billion. And both of these companies are at very similar stages to where AdvanCell is going to be at the end of this year.”

Other Aussies in the pipeline

- OncoSil Medical, [ASX: OSL market cap $16.5 million] The Sydney-based company makes a device that takes radiation into the pancreas to treat pancreatic cancer. Approved in much of the world but not in the US, it announced a positive study early this month and was in a trading halt at the time of writing.

- Radiopharm Theranostics, [ASX: RAD market cap $54 million] The Melbourne-based company has ongoing trials on prostate, lung, kidney and brain cancers. It entered into an R&D partnership with Boston-based radiopharma Lantheus last year.

- GlyTherics, The Sydney-based startup has patented antibodies that target a protein – Glypican-1 – overexpressed in prostate, pancreatic, bladder, glioblastoma, esophageal and other solid tumors. In the case of prostate, it promises to find the 15% of tumours not found with PSA tests

Illustrating the risks of biotech investing, Eli Lilly bought Point Biopharma for $1.4 billion in 2023. Point’s lead product also targeted prostate cancer and PSMA, but Eli Lilly threw in the towel this month when the drug failed to show a positive result in Phase-3 trials.

Adamovich says the earliest he could hope AdvanCell’s therapeutic could be approved for sale would be 2030.

Nave says the plan is to build a “real business”. “You know the old saying: businesses get bought not sold. So we have built and continue to build serious manufacturing capabilities in Queensland and the aim is to build a satellite manufacturing facility in the US, and build a real business. But of course if someone comes along with a large cheque and offers a great return to investors then we’ll take it, but it’d be great to think that we could create a second Telix for Australia.”