Solving the lithium problem

Lithium is widely considered the key to a low-carbon, green future for the world. However, the industry faces a bottleneck over the longer term, with the production of lithium chemicals set to sharply lag mining capability. Sydney-based start-up Novalith has emerged with a potential solution to this vexed problem through a process that can produce battery-grade lithium from ores faster, cheaper and greener than existing techniques.

BRANDVOICE – SPECIAL FEATURE

Lithium mining has boomed over the past decade, led by the rapid adoption of lithium-ion batteries in vehicles and grid energy storage. Australia’s huge hard rock deposits account for almost half of the world’s lithium production.

However, the industry faces a bottleneck over the longer term, with the production of lithium chemicals set to sharply lag mining capability because processing has been limited by current production methods that are expensive, environmentally harmful and take years to bring online.

Sydney-based start-up Novalith has emerged with a potential solution to this vexed problem through a process that can produce battery-grade lithium from ores faster, cheaper and greener than existing techniques. It is now looking to transform the production process by setting up its own commercial-scale plants.

“The big problem with lithium is that we need a lot of it,” says Novalith CEO and founder Steven Vassiloudis.

“The challenge is that the way in which lithium is currently refined is not particularly cost-effective or sustainable, and so it doesn’t meet the needs of this massive demand moving forward.”

Process improvement

The conventional extraction process uses sulphuric acid to leach lithium from the ore, forming an intermediate product, lithium sulphate, which must be further refined to turn it into lithium carbonate or lithium hydroxide, the chemicals used in lithium-ion batteries. The process results in high operating costs and produces a host of harmful chemical by-products and wastes.

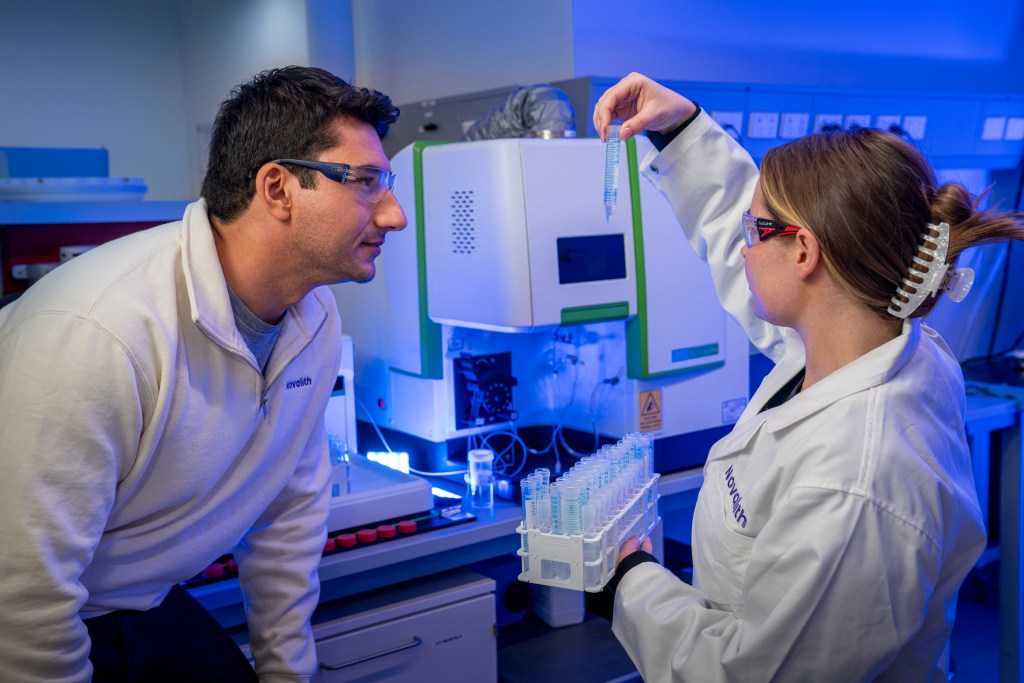

By comparison, Novalith’s patented LiCAL® technology extracts lithium from hard rock and other lithium ores and turns it directly into lithium chemicals, and it does this by using carbon dioxide.

The company says its process reduces the plant costs by up to 50% and production costs by up to 60%. It also uses significantly less water, does not generate harmful industrial wastes and emits less than half the carbon dioxide per tonne of lithium chemical produced.

“The cheaper we can make lithium, the cheaper we can make electric vehicles, lithium-ion batteries, etc. and the faster we can accelerate the world to a green future. If it’s too expensive, it’s not going to happen as fast as we need it to,”

Steven Vassiloudis

It is a dilemma the energy transition is already encountering. Lithium prices have slumped over the past year as global EV-driven demand has stalled for various reasons, including shrinking government subsidies, lagging charging infrastructure and consumer uncertainty amid cost-of-living pressures.

Still, analysts are confident lithium’s medium- and long-term fundamentals remain in place.

According to the International Energy Agency (IEA), global lithium demand is set to rise nearly threefold by the end of this decade and climb tenfold by 2050, primarily led by EV uptake but also supported by its increasing use in energy storage systems (ESS).

According to separate data from Benchmark Mineral Intelligence, mining capacity is expected to double in Australia by 2034 to service that demand. While lithium chemicals production will also scale up roughly 12 times over that period, production capacity will still only be about a quarter of the mining capacity.

Sustainable start-up

Vassiloudis says the speed and availability of new lithium processing coming online poses significant challenges for the industry because traditional lithium refineries are large, complicated plants that take several years from concept to operation.

Where Novalith differs is that it can move faster because its technology allows for a simpler process and a largely modular design. “Instead of building bespoke plants, we can modularise things, make them a bit more plug-and-play, which will allow us to scale up and bring plants online faster than conventionally and at lower cost,” he says.

Vassiloudis, a chemical engineer with a keen interest in sustainable engineering, founded Novalith in 2020 along with co-founders Dr Andrew Harris, a professor of chemical engineering at the University of Sydney, and Christiaan Jordaan, CEO of Sicona Battery Technologies.

Novalith acquired the intellectual property of the LiCAL technology – invented by Dr Brian Haynes at the University of Sydney – before raising a $2.5 million seed fund in 2021 to validate the research.

In 2023, it raised a Series A funding round of AU$23 million, using the funds to build and operate a pilot plant in Sydney’s Alexandria, which can produce several tonnes of lithium chemical per annum. Investors included the Clean Energy Finance Corporation, Lowercarbon Capital, Grantham Environmental Trusts’ Neglected Climate Opportunities Fund, TDK Ventures and Investible. In 2024, it raised an additional AU$16 million, led by TDK Ventures and existing investors, as part of a Series A extension round to accelerate the commercialisation and commence engineering on its first commercial-scale plant.

Backed by a recent $10 million federal government grant, Novalith is now developing a centre of excellence facility in Western Australia that will be able to produce hundreds of tons of lithium chemical per year, demonstrating its technology as well as pre-commercial scale qualification of the product and lithium feedstock.

Global play

Simultaneously, the Australian start-up is lining up more ambitious global plans to set up its first commercial refining plant in the US as it looks to rapidly scale up from a clean tech innovator into a large lithium chemicals company.

“We want to get as much low-cost lithium into the market as quickly as possible, and the way to do that most effectively is to build and operate our own refineries,” Vassiloudis says.

In line with that objective, it is looking to take advantage of the incentives available for Australian firms under the US’ Bipartisan Infrastructure Law and the Inflation Reduction Act to build a plant in the US supplying lithium chemicals to downstream consumers within the country.

It says it is considering the ‘battery belt’ in the south-central US for a facility that could produce tens of thousands of tonnes of lithium chemicals annually.

The move also comes when Western governments have been trying to secure supply chains for critical minerals and break their dependence on China to process battery minerals, driving the green energy transition.

While Australia offers similar incentives under its National Reconstruction Fund, Vassiloudis says Western Australia already has significant refining capacity in the works using conventional technology and prohibitive costs locally, making the US a more attractive destination.

Meanwhile, the company hopes to leverage on the current cyclical downturn in the industry that has seen lithium prices slump more than 80% and use this time to scale up while the established players are slowing down expansions.

“If the prices were as high as last year, there would be refineries popping up everywhere, but thankfully, they’re not,” Vassiloudis says.

“This gives us the opportunity to get our foot in the door, set up our first lithium production plant, and at the point when the market turns, we’ll have everything in place we need to allow us to grow rapidly and play a significant role in meeting the worlds lithium needs.”

For more information visit www.novalith.com.au