David Jones CEO Scott Fyfe on transforming retail

Scott Fyfe has played a central role in transforming several iconic retail businesses, from Marks & Spencer in the UK to Country Road Group in Australia, as they’ve faced rapidly changing customer expectations and significant technological change. Now at the helm of Australia’s oldest department store, David Jones, he shares his leadership journey as he prepares the heritage brand for the future while maintaining the DNA that’s set the luxury department store apart throughout its history.

BRANDVOICE – SPECIAL FEATURE

For Scott Fyfe, taking on the role of CEO of David Jones in the middle of the COVID pandemic was, in his own words, “a very, very brave decision.”

“Day one was pretty alarming,” he says.

It was October 2020, and 80% of physical David Jones stores were closed due to a government-mandated lockdown.

Hired to turn around the 186-year-old luxury department store after a series of profit declines, Fyfe had only 20% of stores and the online business to run in his first few months.

The upside was that the health crisis served as a stress test highlighting cracks that needed fixing.

“It gave me a very good opportunity to see where the pressure points of the business were and where the opportunities existed,” Fyfe says.

What he learnt during those early months at the helm would inform a transformation strategy that would refocus on the core strengths of the brand’s heritage while preparing it for the future with a modern approach to omnichannel retailing.

But the seeds of his leadership style were sown two decades earlier in another iconic department store 17,000 kilometres away.

Power of purpose

Born in Scotland to a mother who worked in fashion retail and a father who was a banker (“I guess I have both in my DNA,” he says), Fyfe graduated with a marketing degree, started as a graduate and then progressed to land a rare job opportunity working as executive assistant to the then executive chairman of UK retail group Marks & Spencer, Sir Stuart Rose, who would become his long-time mentor. Here, he learnt the nuts and bolts of retail and witnessed how a leading retailer successfully navigated a period of change.

“I was privileged to sit beside Sir Stuart Rose for two years and watch and learn as he led the business through significant transformation. He was highly inspiring, setting the pace of the business and keeping everyone focused on the strategic pillars,” says Fyfe.

“What I learnt very quickly was you need a clear purpose, strategy, and set of values through which you can lead teams of people. I still remember that quality, service, innovation and trust were the values of Marks & Spencer. What that allowed the business to do was to really focus on the customer.”

Fyfe’s marketing degree taught him that the customer is at the heart of everything, and on the job, he learnt the importance of surrounding himself with a great team. “Don’t try to be an expert in everything,” he says. “I also learnt the power of partnerships because Marks & Spencer was a retailer with a very strong brand presence but was only successful because its partnerships were solid.”

As the shockwave of the GFC tore through consumer confidence and weighed on spending, the retail industry was moving from a physical model to an omnichannel approach. Marks & Spencer invested in its online presence, customer service journeys, and financial services, as well as rebuilding its supply chain.

Rose gave Fyfe, at 32, the opportunity to become director of trading, a role in which he oversaw a supply chain transformation. When he joined the company, 99% of product was sourced in the UK. By the time he left, it had been driven down to less than 5%. He also worked closely with Rose to develop the company’s sustainability strategy, which was market-leading at the time.

After a successful career at Marks & Spencer, Fyfe wanted to build international experience and was eager to see his family experience living overseas. “I had aspirations for a C-suite role and wanted to lead a business, lead people, and innovate brands.”

An international career

In 2016, South Africa’s Woolworths Holdings Ltd (unrelated to the Australian supermarket chain) asked Fyfe to take on the CEO role at its Australian subsidiary Country Road Group, which then owned a stable of established Australian fashion brands, including the Country Road label, Trenery, Mimco, and Witchery.

“This was a fantastic opportunity for me to work with some of the most iconic brands in Australia. The transformation challenge was significant across all the brands in the Country Road Group. The group needed a new focus, a new direction, and to become an omnichannel business. They were just focused on the physical and not on the online experience.”

On his first day in the role, he spoke to the team at a town hall meeting and said, “We’re going to be 20% online by 2020.”

“This was in 2017, and they all just looked in amazement and said, ‘How’s this guy going to do this?’” he recalls. “We took some risks and some opportunities. We had an online business of 7% of the total business, and by 2020, we were well over the 20%.”

The risks included bringing a new brand into the portfolio by acquiring the Politix menswear label early in his tenure. “I wanted to bring in a truly vertical business. It was sourcing its own product, and it worked at pace. It was very much a bricks-and-mortar business, and I wanted to take a brand that didn’t really have an online presence and go from there.”

Another risk was implementing a fully integrated loyalty system “because we wanted to connect more meaningfully with the customer.”

“These projects are always time-consuming,” he says. “They always involve capital expenditure, but getting the roots to the customer and owning the customer is absolutely key across the brands. Sharing that expertise across the brand led to some of the successes we managed to deliver.”

Reorienting an iconic brand that had lost its way

After four years in Australia, Woolworths asked him to take the helm of Australia’s oldest department store, David Jones, which the South African firm had acquired in 2014. The acquisition hadn’t been as successful as Woolworths had hoped, and David Jones had lost half its value after several write-downs. It was a challenge Fyfe was eager to take on.

“David Jones is an iconic brand that resonates very well with Australian and New Zealand customers, but I felt it needed a new direction. It had lost its identity and was responding rather than being proactive. I wanted to set myself the challenge of turning around and transforming an iconic 186-year-old brand that I didn’t feel was positioned in the right place from a consumer point of view. It hadn’t been focused on the right priorities.”

Under the pressure cooker of the pandemic and associated lockdown during his early days as CEO, he could see the problems in 3D.

“What I picked up pretty quickly was the business was trading on its reputation rather than its customer promise and delivery. The balance sheet was extremely challenged. I also managed to understand where the true passion in the business lay – luckily, I knew the people were very committed – and we started working on the strategy.”

Fyfe said Woolworths had lost faith in the David Jones business, and he knew there would be a change of ownership in the future. “Meanwhile, my job was to stabilise the business and provide a trajectory as to how we would get out of the challenging COVID-19 period and develop a forward-thinking strategy that could be globally benchmarked and make a difference for consumers.”

Through hundreds of hours of customer and staff feedback, he identified that the team worked in different directions and lacked a clear, unifying purpose. “There was no vision or strategy, and the brand wasn’t adapting to the customer’s changing needs.”

“It was a great opportunity during COVID-19 because the only way people could connect with brands they loved was through digital. The customer pain points were quite obvious to me: we weren’t getting the right assortment and certainly weren’t giving the right service to customers from a digital point of view.”

Fyfe led the development of a strategy called Vision 2025+, which sought to make David Jones a more integrated omnichannel retailer. “Our vision was to be the destination that inspires with experiences and services like no other and the ‘like no other’ was a nod to the heritage of David Jones. Everyone kept saying to me and the team, ‘David Jones differentiates; no one else can do this in the Australian market’.”

The four key objectives in Vision 2025+ were to know and grow the customer base, be an omnichannel curator of world-class brands, deliver seamless service and experiences, and leverage the skill and experience of David Jones’ talented team.

“I’d learned this from experience, especially at Marks & Spencer – lead the business on key objectives. Don’t have too many. Have enough that people can remember them and be consistent in our delivery.”

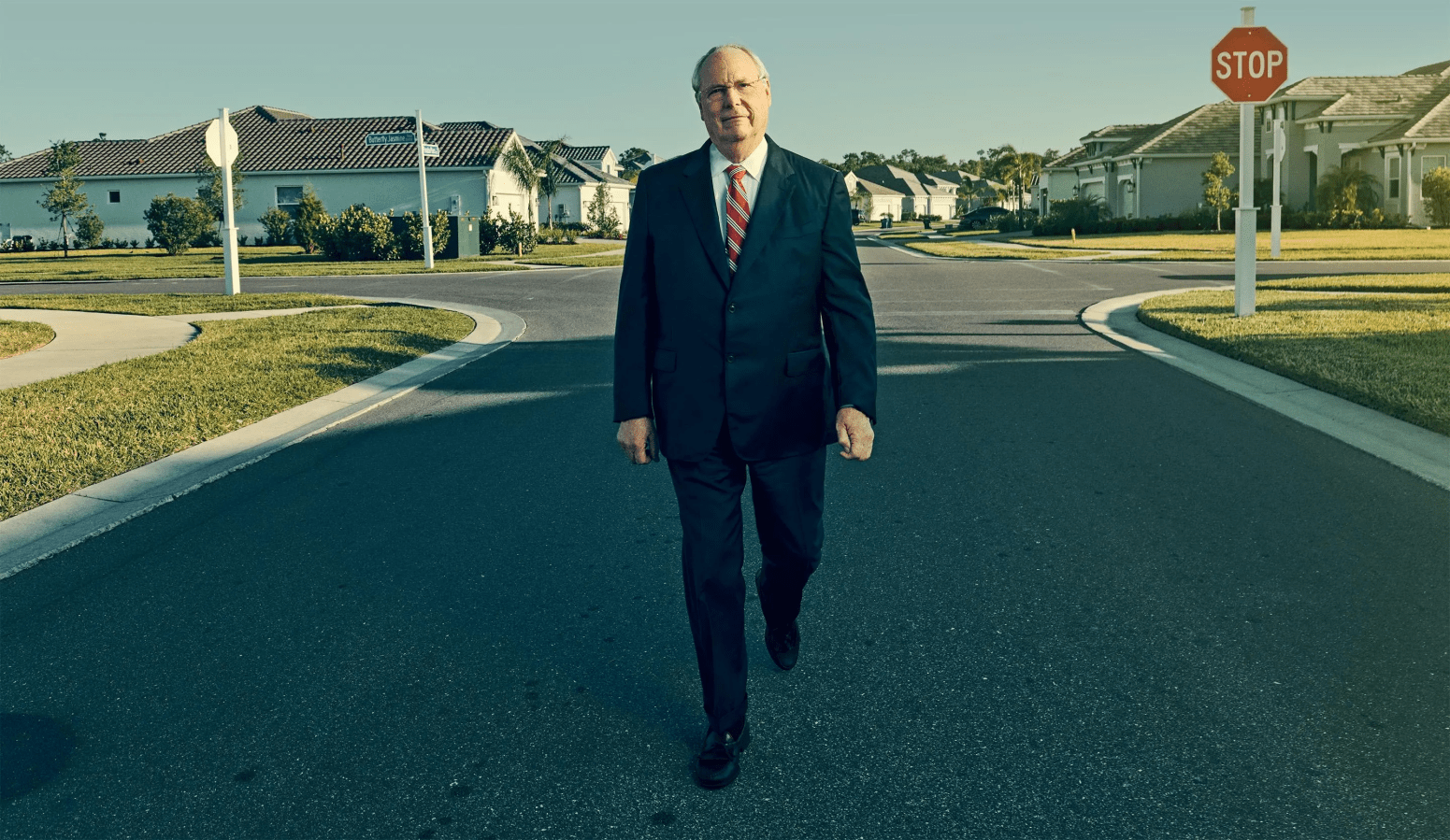

Scott Fyfe, David Jones CEO

The firm’s investment in digital is paying dividends, with 110 million people visiting the website every year, and conversion rates, sales, and profitability are consistently improving and there is more to do. When he first came on board, he was shocked that David Jones only “knew” 16% of customers. That’s now risen to nearly 70%.

David Jones focused on looking after its team through COVID-19 and to retrain all of its 7,000 staff who are passionate about fashion trends and services.

Fyfe is “super proud” of the team’s work in building its net promotor score. Over the past two years, NPS has risen 35%. Every trading meeting, every day, starts with customer insights to keep service front of mind.

One of the things he’s most encouraged by is the 70% engagement rate of team members across the business, a significant improvement of 10% over the last three years. Staff feedback attributes the engagement boost to having a stronger sense of purpose, a clear strategy, clear objectives, everyone working in the same direction, and clear incentives linked to KPIs.

“In retail, when you’re hitting new KPIs and earning incentives, it’s a very positive place to be. And I’m very proud about what we’ve achieved in the past three years together, which was a very, very challenging start when I started at David Jones to where we are now.”

Changing of the guard

In March 2023, the expected change of ownership came to pass, with Anchorage Capital Partners acquiring the business. The private equity firm were experts in carving out businesses to maximise their potential. The new owners quickly announced their intention to retain Fyfe, noting that David Jones was now profitable, cash-generative, and self-funding under his leadership.

“The Anchorage team and I have a strong collaboration, a very strong trust, and we’ve worked very well as a collaborative management team,” says Fyfe. “What we’ve done very well together is to take the 2025 Vision strategy and accelerate it. Over the past 18 months, we’ve significantly invested in our stores. We’ll further invest in our online experience, we are investing in our value chain – which will include new warehousing facilities – and we’re going to invest in a new loyalty scheme which will make us more connected to our customers.”

Having separated the David Jones technology stack from the Country Road Group, “we’re also investing in technology, which is going to be a key driver of the business going forward to underpin and ensure that we can connect with customers in a more personalized way, both from a store perspective and online perspective using technology like AI.”

Tech that connects

As it looks to connect with more customers in a more personalised and intimate way, David Jones has been looking at some of its peers in retail and other industries to see what they are doing.

One example is NAB. Fyfe, a client of NAB Private Wealth, was particularly impressed with the customer experience provided by the bank through their app. David Jones has hired new capability to help its digital strategy employing some technical experts from NAB.

Under Anchorage ownership, David Jones has also set up a retail media business called David Jones AmplifyTM. “It is a game changer for brands wanting to engage with Australia’s most affluent consumers. Nordstrom has set the benchmark internationally and our offer will showcase the power of our media assets, both in our physical and digital stores.” Designed to be Australia’s number one media ecosystem targeting the premium shopper, it connects the products and services of brand partners as well as other brands of interest to customers across 500 instore formats, 102 digital formats and can be tailored to personal preferences.

Unleashing potential

On the bricks and mortar side of the business, David Jones has been investing in its flagship stores in Elizabeth Street, Sydney and Bourke Street Mall, Melbourne, over the past few years and is now starting to invest in major developments of other top stores as it seeks to elevate the customer experience. In Chatswood, we are developing a “future concept store” that’s set to open in 2025.

“Our store network has been under-invested in, and since the change of ownership, we’ve really allowed ourselves to unleash the true potential of David Jones. Elizabeth Street benchmarks one of the best global experiences for a department store. We are investing in many more store to improve customer experiences, and that’s what we’re striving to do as part of our strategy.”

Fyfe also has big ambitions regarding David Jones’ sustainability and ESG strategy.

“We want to be, by 2030, the pioneers of future responsible retailing.”

Scott Fyfe

To this end, David Jones has been partnering across recycling, reuse, and rental.

“We want to start to think about how we work with the next innovators. David Jones has always been an innovator. It has always been a creative thinker. So, we want to make sure that sustainability is key to our future strategy and offering more sustainable products than ever.”

“We’ve always been an influential innovator and I believe we can help influence sustainable and profitable retailing for Australia and New Zealand.”

Curators of memories

While looking to the future, Fyfe is conscious of heritage and retaining the brand’s unique DNA.

David Jones is the oldest department store in the world still trading under its original name. Founded in 1838, it’s older than Harrods or Selfridges in London.

“We’ve been the authors of memories; we’ve been the curators of some of the best fashion in the world. We’ve been underpinned by services, and it’s ensuring that we keep that DNA at the forefront of everything we do,” he says.

Soon after he started in the CEO role, he was told the story of a David Jones buyer who travelled to Europe in 1948 and convinced Christian Dior to sell his brand outside Paris. “David Jones was the first store in the world to sell Dior outside Paris. And what is beautiful for us to celebrate is that we still sell this amazing brand today. We treat it with respect, as heritage, and we love it. And that is how we’ve created some of the worldwide partnerships that make David Jones so special.”

Under its legacy strategy, David Jones recently announced a partnership with the Powerhouse Museum. This includes the donation of its archives, the most significant of its kind in Australia to the care and preservation of the Powerhouse Museum and the creation of a $100,000 Australian design commission. Artefacts include programs from Christian Dior shows that were presented at David Jones in the 1940s and the official program and menu for the State Dinner for Her Majesty the Queen and His Royal Highness the Duke of Edinburgh hosted by David Jones in 1954.

The partnership demonstrates the brands unique place in Australian culture and commitment to keeping Australian design history alive and connecting it for future generations. After a successful career in retail, what advice does Fyfe have for upcoming leaders in the industry?

“Keep your feet on the ground, build teams around you to do their best and empowering teams to move at pace is so important,” he says. “And be prepared to take risks because standing still in retail is not an option. If you’re standing still, you’re falling behind, and you’ve got to ensure that you’re moving at pace and moving in the same direction as the customer. And if you can move one step ahead of the customer, you will win more often than not.”

From C-suite execs to medical specialists: How profession impacts the financial needs of Australia’s wealthy

Australia’s high-net-worth individuals come from a range of professions, which can impact their financial circumstances and how they can be best managed.

Michael Saadie, who heads up NAB’s Private Wealth arm – which banks some of Australia’s wealthiest families and business owners – says NAB is committed to providing a holistic, integrated service to clients. “We are unique in the Australian market with our diverse offer supporting clients with their banking, investment and advice needs”.

“NAB’s clients can access bankers, specialist or advisers if they are looking for personalised support. However, we also know that there may be times when clients want to be self-directed in managing their investments and we also provide this option via our nabtrade platform”.

The profession of a client, whether they are C-suite executives, professional partners, or business owners, can make a significant difference to their wealth and investment needs.

C-suite executives, for instance, are very time-poor and tend to have most of their wealth tied up in the companies they lead as they receive a proportion of their remuneration in shares.

“What we try to do is clearly understand what that exposure is. How do we help them get a little bit more diversification? As their shares vest, how do we potentially give them some leverage to invest in other things?” Saadie explains.

“The other thing is understanding how busy our clients are and how we can find time to share proactive ideas with them. It’s about having a strong relationship with the team around the executive, knowing their availability and finding the right time and opportunity for us to have a conversation.”

NAB Private Wealth has specialist bankers catering to C-suite executives, medical practitioners, ultra-high-net-worth individuals, family offices, professional services firms, and business owners.

“Each of these client segments has different needs,” says Saadie. “We align our private bankers to the segments they look after so that they are experts in the field.”

Professional services partners of legal and accounting firms have distributions at certain times of the year and need to ensure their investments don’t conflict with their client obligations.

“We understand the way their distributions are paid, and we’ve built a portal on nabtrade.com.au for each company, so it excludes them from trading any of the conflicted stocks. It makes it simple.”

Michael Saadie

We also understand the unique needs of our professional specialist clients, for example, medical professionals, and we tailor solutions and insights to meet their needs, as part of the support we provide.

“Our experts ensure that they are available to meet at a time that is convenient for them. This could be early in the morning or late at night after they have finished in theatre, or through video conferencing.

We also work closely with our clients’ accountants and other advice partners because we know how time-poor they are, and it’s often easier for them to give us the mandate to talk to their advisers who have all the information.”

While the major banks in Australia have a private bank to serve their High-Net-Worth (HNW) clients, they predominantly focus on their clients’ banking needs, such as deposits and lending.

NAB Private Wealth’s holistic proposition has enabled NAB to provide a differentiated offer to meet a greater range of client needs. “We recognised that there was a gap in the Australian market in meeting HNW clients’ broad and unique needs. NAB Private Wealth brings together banking, investments and advice into a single, integrated offer, but also provides the opportunity for clients to self-direct their investments should they choose to do this. This means we are uniquely placed to deliver holistic, tailored solutions and insights with the depth and breadth that our clients want and deserve.”

For more information visit NAB Private Wealth.

BRANDVOICE – SPECIAL FEATURE

The information contained in this article is gathered from multiple sources believed to be reliable as at September 2024 and is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. National Australia Bank Limited ABN 12 004 044 937 AFSL and Australian Credit Licence 230686 (NAB) does not guarantee the accuracy or reliability of any information in this article which is stated or provided by a third party. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, property, financial and taxation advice before acting on any information in this article. Nabtrade, which is the information, trading and settlement service, is provided by WealthHub Securities Limited ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities). WealthHub Securities is a wholly owned subsidiary of NAB. WealthHub Securities’ obligations do not represent deposits or other liabilities of NAB. NAB does not guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. You may be exposed to investment risk, including loss of income and principal invested.