CEO Phillippa Watson has been at the helm of ubank for three years. Forbes Australia sits down with the banking dynamo to find out what Gen Z banking customers are looking for, and what she is doing to give it to them.

When Phillippa Watson joined ubank in June 2020, the Canberra-born CEO saw an opportunity to innovate and appeal to the coveted digital-native demographic.

“Ubank was operating on the technology that it had been built on in 2008. The first iPhone was launched in 2008,” Watson says with a laugh.

“Our challenge was that the technology fit for an established bank, but not at all fit for a bank that was going to want to grow and innovate and change quite quickly.”

Watson enlisted the help of Andrew Morrison, whom she had worked with at CBA, and is now ubank’s Chief Product and Growth Officer. Not only did they team up to bring ubank’s technology into the smartphone era, they also set their sights on the acquisition of one of the four neobanks that were around at the time.

“86 400 was the most mature of the neobanks,” Watson explains from ubank’s headquarters in Sydney’s CBD.

“It had fantastic technology, with both a mortgage and a deposit business. Which meant that ubank could migrate onto the 86 400 cloud-based modular very-up-to-date technology, and move off the legacy environment that we had been operating on.”

Ubank had 600,000 customers at the time, and the financial backing of parent company NAB. The neobank had 85,000 customers, held $375 million in deposits and $270 million in residential mortgages, according to company documentation. Discussions between the two digitally focused banks started in late 2020, and NAB acquired 18% of 86 400 to support its growth.

By 2021, the remainder of the deal was done. Ubank, via NAB, purchased the remaining 82% of 86 400 for approximately $220 million.

From positive 4 to positive 41

The improvement in technology had the intended effect with the target demographic. Ubank’s advocacy net promotor score, a measure of company growth and customer lifetime value developed by Bain and Company, has grown from 4 to 41 in the 18-34 year old demographic, according to the company.

“We’ve been growing really strongly,” says Watson. “We’ve taken our net promoter score, which is the same objective measure that all of the banks use, to become the second ranked bank in the country – including the majors, the minors, the neobanks.”

That progress sets ubank up to continue to grow with its customers.

“We’ve got a particular passion about 18 to 35 year olds, because if we can serve that market really well it will allow us to grow a customer base that will stay with us.”

Phillipa Watson, ubank CEO

That demographic enables ubank to ‘move fast and break things,’ in Silicon Valley parlance. To push the edges of what is expected from a bank, and to simultaneously reduce the expensive brick and mortar overhead that traditional banks have endured.

“Our strategy for ubank is to be a very fast-paced, innovative challenger within the NAB environment. We are aiming at acquiring and serving customers who are happy to be in a fully digital branchless environment.”

The power of rates, no monthly fees, and an app

Founded within NAB in 2008 as a digital-only bank, ubank started by accepting customer deposits. It soon began providing other financial products.

“Three years later in 2011, ubank launched a direct-to-consumer mortgage business,” says Watson.

Sixteen-years after inception, ubank is releasing research on what Gen Z and millennial customers are looking for now. Thirty-nine per cent of respondents to a recent survey say they are looking for strong interest rates.

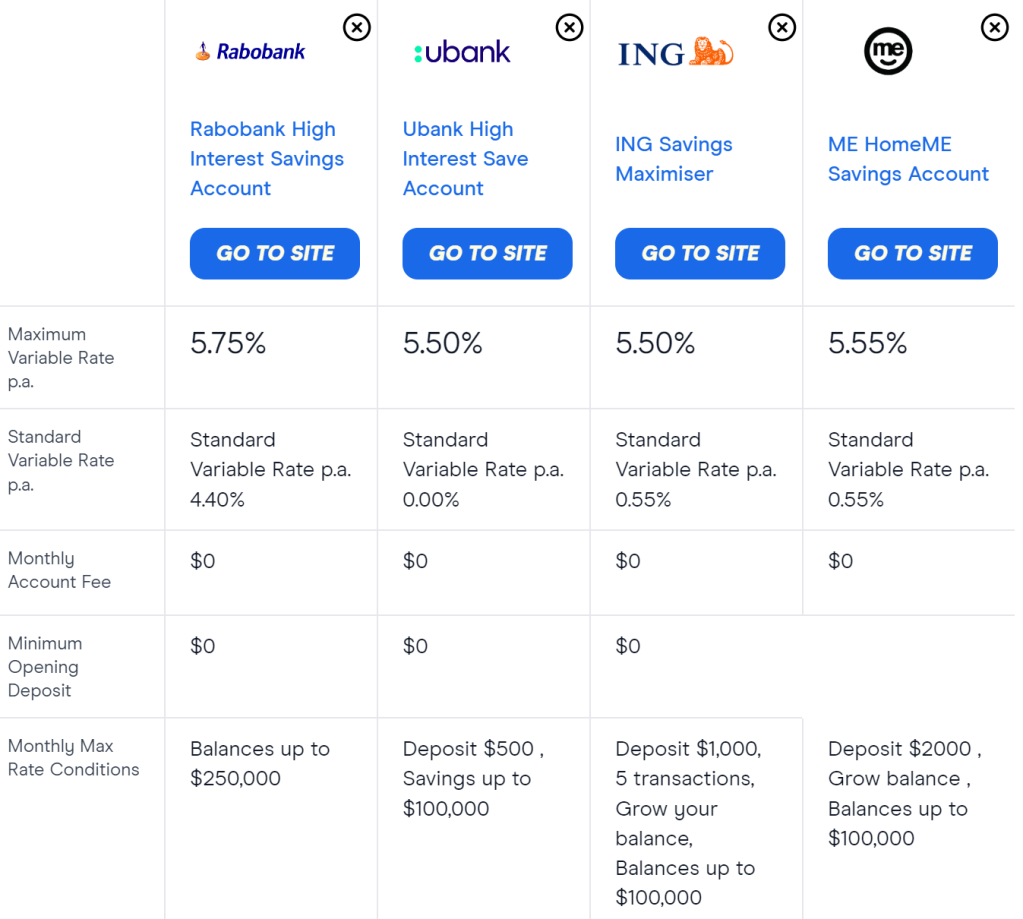

Accordingly, as of July, ubank offers a 5.5% rate on savings up to $100,000, as long as account holders make a $500 deposit each month. ING and ME have similar interest rates, but require account holders to deposit $1,000 and $2,000 each month respectively.

Source: Finder

“Among all respondents, one of the most important banking features to this generation of Australians are competitive interest rates,” a ubank statement reads.

Forty-nine per cent of respondents to Ubank’s survey say they want low-to-no monthly fees, and one third state they want an app that’s easy-to-use. A high inflationary environment is cited as a concern for customers too.

“Seventy-nine per cent reported the rising cost of living is making it increasingly difficult to manage their finances. Despite this, two thirds (66 per cent) remain optimistic, reporting they are confident in their saving and budgeting ability over the next 12 months,” ubank says in a statement.

The TikTok effect

Ubank states it is the most followed bank in Australia on TikTok, has over 190 thousand followers, and is also a leading Australian brand outside of the banking vertical. Much of the content on TikTok and Instagram is educational, warning users about scams.

Not only is the social media strategy effective in building awareness of the bank, but also in compiling a potential customer pool.

“We’re using these channels to build a Ubank community, brand awareness and acquire customers amongst the 18-35 age bracket,” the company states.

Being a part of the 18 – 35 year old conversation

Today, ubank has 800,000 customers, and has achieved 8% growth since 2023. The company says 60% of new onboarded customers are younger than 35.

Fifty-six per cent of ubank customers are 18-24, and 26% are 25-34. TikTok is not the only communication channel ubank uses to connect with them. Traditional email outreach is executed in keeping with the way generation Z chats too.

“Our brand, and our tone of voice is the starting point. We really try and talk the way our customers talk, we use language that they would use. Emojis are a great example of that. We use emojis in our monthly correspondence with customers giving them an update on what’s going on,” says Morrison.

The app is a central touchpoint for customers, as there are no branches. The tone on the app seeks to tap into a digital mindset, in a way that is much different from the NAB app.

“The ubank app changes every day, week, month. So you know, we will communicate that Wednesday is hump day. If the fourth of May is coming up, the app will say ‘May the Fourth be with you.’ Just little jokes, you know, cute sort of stuff,” Morrison says.

He says meeting the customer where they are in the physical world is vital.

“Our marketing growth acquisition strategy really emphasises being in areas like university campuses – bus shelters and billboards, and pubs – places where young people are and talking to them in the way that they’re used to. We’ve attended and participated in major gaming conventions too,” Morrison says.

Ubank campaigns are intentional about tapping into the zeitgeist of gaming, fashion, and music.

“Recent content include ‘Great Savers, Bad Gamers’, Feel-Good Fashion in Collaboration with Australian Designer Jordan Gogos, a student campaign across a number of Australian university campus’, which used talent like singer and previous Triple J unearthed winner KIAN,” a company spokesperson says.

Educating male and female 18-35 year olds about financial literacy is also handled with a distinctly Gen Z flavour, and leverages partnerships with personalities that the target demographic is open to hearing from.

“The latest is a nine-part content partnership that debunks the mysteries of the home buying journey with Ladies Finance Club,” ubank says in a statement.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter hereor become a member here.