Start-up funding has hit a six-quarter high thanks to a surge in mega-deals, but AI is not attracting as many investors as the hype would have you believe, Cut Through Venture’s latest report shows.

Key facts

- Start-up funding for Q2 hit $1.5 billion for the first time since 2022 with the surge being driven by the return of mega-deals. (Six start-ups raised $100+ million fundiing rounds).

- Overall, investor sentiment has improved, with 46% of investors describing the funding market as more favourable compared to last quarter.

- Funding for female-founded start-ups slumped to its lowest level since 2019, with later-stage participation dropping significantly.

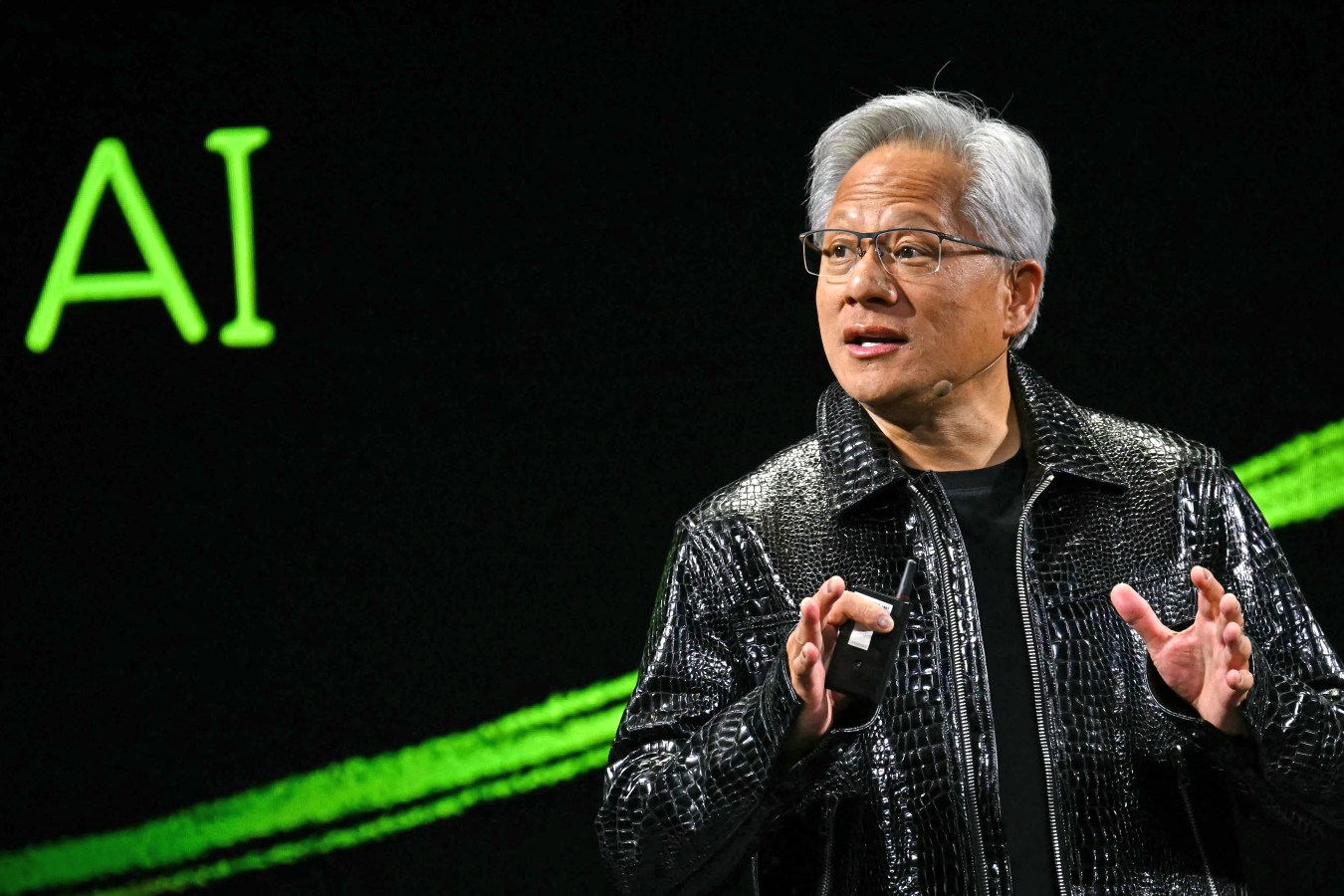

- The AI sector achieved the highest deal count for the first time in Q2 thanks to some large rounds, but most AI companies will struggle to secure funding as 57% of investors say their firms haven’t invested in any AI-first start-ups in 2024. Just 19% showed ‘strong interest’ in the sector.

Big numbers

A total of 99 deals closed through Q2, with funding totalling $1.5 billion, according to Cut Through Venture’s Australian Venture Capital Report for Q2, 2024. Artificial intelligence and big data led in deal count, with 16 announcements from start-ups considered ‘AI-first’ – those primarily focused on developing, implementing and leveraging AI technologies to drive innovation, solve problems and create value.

Fintech topped the total funding table for the first time in over a year with $546 million raised, thanks to three $100+ million deals from Betashares, CoverGenius and HoneyInsurance.

Climate-tech followed, with $344 million raised, followed by food and beverage ($142 million) and biotech ($92 million).

What to watch for

Investors say their top priority for the quarter ahead is to invest in new start-ups, with 39% of investors hoping to close more deals than last year. Cut Through suggests a backlog of start-ups that raised $20+ million in 2021-2022 without recent rounds means larger deal announcements could follow later this year, pointing to a robust second half.

But it’s the female-founded start-ups to look out for, after funding slumped in this sector to its lowest level since 2019 with just 11% of total capital raised going to start-ups with at least one female – and 4% to female-only. Across 2024, just three female-led start-ups have raised rounds greater than $20 million.

The largest rounds this quarter went to Liquid Instruments ($15 million), Orygen ($6 million), Sumday ($5 million), Great Wrap ($5 million) and Unseen ($4 million).

Cut Through says the share of funding received by female founders will remain low until these start-ups are supported with large capital rounds at Series B and beyond.

Key quote

“There’s huge potential for technology to be a growth engine for jobs in the Australian economy, and we’re already seeing a flywheel of talent coming from this generation’s success stories like Canva, Go1, Employment Hero, Linktree and Immutable.” – Craig Blair, co-founder and partner, Airtree.

Key background

It’s a step up from total funding across Q1, which reached $703 million across 66 deals. Then, two companies (Bugcrowd and Deputy) hit unicorn status (achieved a valuation of $1 billion or more), becoming the first new additions since 2022.

In terms of sectors, cybersecurity took out the largest share of funding last quarter, but didn’t make the top 5 this time around. But the big highlight across Q1 was that funding for female-only founder teams reached its highest-ever percentage. Across the first quarter, 21% of funding flowed to female-only founder teams, while 30% flowed to start-ups with at least one female founder.

Tangent

Just last month, Elon Musk’s xAI raised US$6 billion in funding from the likes of Andreessen Horowitz and Sequoia Capital, claiming the company’s “pre-money valuation” was US$18 billion.

And the AI sector has never been more competitive, with Forbes receiving nearly 2,000 submissions – more than double 2023’s count – for its Top 50 AI companies list. The companies featured had raised a total of US$34.7 billion – with nearly a third of that total stemming from OpenAI, thanks to a US$10 billion capital injection from Microsoft.

The 10 largest deals of Q2

- Betashares: $300 million

- Hysata: $172 million

- Guzman y Gomez: $135 million

- CoverGenius: $120 million

- HoneyInsurance: $108 million

- Samsara Eco: $100 million

- Omniscient Neurotechnology: $60 million

- RayGen: $51 million

- DataZoo: $35 million

- Ofload: $31 million

Are you – or is someone you know -creating the next Afterpay or Canva? Nominations are open for Forbes Australia’s first 30 under 30 list. Entries close midnight, July 31, 2024.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.